Tokens play a vital role in decentralized entities by coordinating and incentivizing behavior, rewarding value contribution, and enabling exchange. Moreover, intelligent token design may not only help its price but more importantly, support and accelerate protocol objectives and create and enhance a sustainable economic model. We review tokenomics in the week’s Chart of the Week.

The Importance of Tokenomics

There are thousands of blockchain-based protocols, each with their own specific goals and objectives. These goals and objectives, however, may be difficult to achieve in part due to the protocols’ decentralized and open nature. Tokens play a central role in remedying this by coordinating and incentivizing behavior, rewarding value contribution, and facilitating exchange. To fulfill these duties, tokens often serve various functions, take on numerous designs, and employ diverse mechanisms. Such token design is referred to as tokenomics and concerns the systems, incentives, and math governing crypto assets. While one may assume tokenomics is about increasing token price, it is more about accomplishing the token’s intended function to support and accelerate protocol objectives. After all, a rising token price in the absence of protocol utility will not last, while an intelligent token design can add fuel to the fire, ensuring and accelerating long-term protocol growth, value creation, and a sustainable economic model.

The Token Design Process

The token design process revolves around design, validation, and optimization. It begins with assessing whether the protocol actually needs a token, which is determined by protocol objectives, and whether a token can further them. Next, one must internalize a deep understanding of the protocol itself, its goals and objectives, its various stakeholders and their motivations and interactions, system policies, the functions a token may perform, and how it will capture value created by the protocol. Unlike economics, which attempts to discern a future state from given inputs, tokenomics design works backward, starting with end goals in mind and weighing what design will help achieve such goals. Tokenomics design starts with the premise that all parties act in their own best interest, thus making it very much about incentives and the mechanisms enabling them. The process is quite iterative, examining the theoretical impact of a set of proposed mechanisms, often gleaned from studying their impact and effectiveness within other notable protocols, with constant tweaks and subsequent analyses during the design phase. Lastly, tokenomics is not only about creating and promoting value and utility, but also sustaining it, which safeguards against selling and creates a virtuous cycle.

Tokenomics Frameworks

Tokenomics frameworks are often used as thought templates during the design phase. For example, one popular framework looks at the token’s environment, the rules governing the system, and the incentives employed, zeroing in from big picture market design to mechanism design and to more focused token design. Others look to classify tokenomic models into categories, such as deflationary, inflationary, dual-token, and asset-backed models, while others look at value capture mechanisms, value distribution mechanisms, and the value creation pattern implementing them. Overall, we find examining supply and demand to be particularly insightful.

Token Supply

Token supply is more formulaic than token demand, and many of the variables impacting supply are often determined in advance and codified in smart contracts. There are various definitions of supply, including circulating supply, which is the approximate number of tokens currently circulating and readily available for sale, and is quite literally the amount of tokens that can immediately impact the price; total supply, which is the number of tokens that have been created so far minus those that have been knowingly burned, and includes tokens locked via staking and unvested tokens held by founders and investors; and, maximum supply, which is a hard-coded limit on the total number of tokens that will ever exist and is an indication of the amount of inflation remaining. With definitions in place, we can look at a number of factors to get a sense of a token’s current circulating supply and how it may evolve in the future. These include:

- Emissions Schedule: Many protocols have a built-in increase in their circulating supply, often referred to as inflation or emissions, to incentivize and reward activity, such as validation and liquidity provisioning. Emissions may be negative if, for example, the protocol employs token burning, or may be quite high to encourage activity, depending on the design. Additionally, the emissions rate may be fixed or may be variable, and protocols also employ mechanisms to counter emissions and reduce circulating supply. These include the aforementioned burning, which may be done based on fees, price, or timing, to name a few, and staking/bonding, which requires locking tokens in a smart contract to receive a benefit such as a share of protocol revenue or the ability to engage in community governance.

- Allocation: Tokens may be created and allocated via a fair launch or pre-mine. A fair launch is when a token starts with no initial supply, is brought into existence via mining or other community distribution methods, and often engenders strong community support, such as with Bitcoin, Dogecoin, and Yearn Finance. Pre-mined tokens, by contrast, are those where the team behind the project mints tokens prior to a public launch that are often retained by the team or sold to investors to raise funds for further development. While quite common these days, pre-mined tokens introduce risk that founders and investors may dump a large batch of tokens at once and depress the price.

- Vesting: Pre-mined tokens with large holder categories may not necessarily be bad if the team and venture investors have lengthy, gradual vesting schedules. However, short vesting schedules with large cliffs may cause a sudden increase in supply and a resulting decline in price, particularly if a token has performed well.

- Distribution: A token’s distribution examines who currently holds the token and in what amount to analyze how dispersed the token is. The presence of a few large holders brings about the risk that they could sell and depress the price. A single address holding a large percentage of tokens would not be risky, however, if it belongs to a large entity with granular constituents such as an exchange or smart contract. Protocols may use various tactics to encourage widespread token distribution, such as instituting a per person hard cap for an ICO, air dropping the token to ensure diffuse ownership, and enhancing marketing efforts to broaden the token’s appeal.

While a lower supply will support a token’s price, all else equal, supply-side tokenomics is not necessarily about removing circulating supply and should be more concerned with meeting demand to support and enhance protocol goals. For example, a protocol may wish to grow activity, however, a token with a rapidly deflating supply could cause holders to HODL in anticipation of the resulting price increase, incentivizing behavior detrimental to its goal. Moreover, many protocols such as proof-of-stake blockchains intentionally inflate their currencies in part to encourage token usage. This is why we contend the best supply-side tokenomics seek to match supply with demand. While there are no hard and fast rules, in general, a token with most of its max supply already out or with steady, predictable inflation encouraging its usage, that was fair launched or pre-mined with gradual, lengthy vesting schedules, with a high community token allocation, and with a well-diversified distribution with no overly large-holders is generally in a good place to steadily absorb demand as it develops over time.

Token Demand

Token demand is driven by the benefits the token provides. While the magnitude and timing of demand is less clear, there are nonetheless many factors/mechanisms that can give a token utility and entice demand. These include:

- Value Transfer/Exchange: Tokens play a key role as a store of value, unit of account, and medium of exchange. As a key function within an ecosystem, the ability to partake in these basic money functions adds value that increases as the ecosystem grows.

- Revenue Sharing: Protocols may distribute revenue back to token holders, offering a clear and tangible benefit to holding the token.

- Governance: Protocols may allow token holders to vote on key items concerning the future direction of the protocol, the utility of which is determined by the size/scope of addressable decisions, the amount of protocol resources being managed, and the ability to influence the outcome. The value of governance is hard to quantify, though is more straightforward for protocols with direct linkages to monetary gains such as with Curve.

- Reserves: Some tokens such as stablecoins are backed by and redeemable for other assets, giving the token value equal to the underlying.

- Boosts/Discounts/Penalties: Owning a token may lead to higher benefits, such as receiving boosted liquidity mining rewards. Alternatively, owning a token may offer discounted services, as is the case with many exchange tokens and associated trading fee discounts. Lastly, protocols may incorporate penalties for certain behaviors, such as a tax on selling to encourage buy and hold.

- Memes: Tokens may evoke certain emotional and psychological contexts, such as the ability to be part of a community or the belief that others will pay more for the token in the future. Such hedonic value is hard to quantify, though is more behavioral in nature and is important to consider.

Demand can increase over time both from the protocol gaining traction as well as the token utility increasing. Also note that token demand is based on fundamental as well as speculative components, the latter of which may be highly volatile and represent a material portion of token value/demand. Lastly, it is important to understand which parties impact demand (as well as supply), and it’s often preferable to have these be the same when possible. For instance, an AMM where token owners (LPs) are different from users (traders) or a protocol where users are not the ones participating in governance may lead to suboptimal outcomes.

Tokenomics Case Studies

We review several popular tokenomics models below, each of which employs various supply-side constructs to meet the demand generated by many of the value creation mechanisms discussed above.

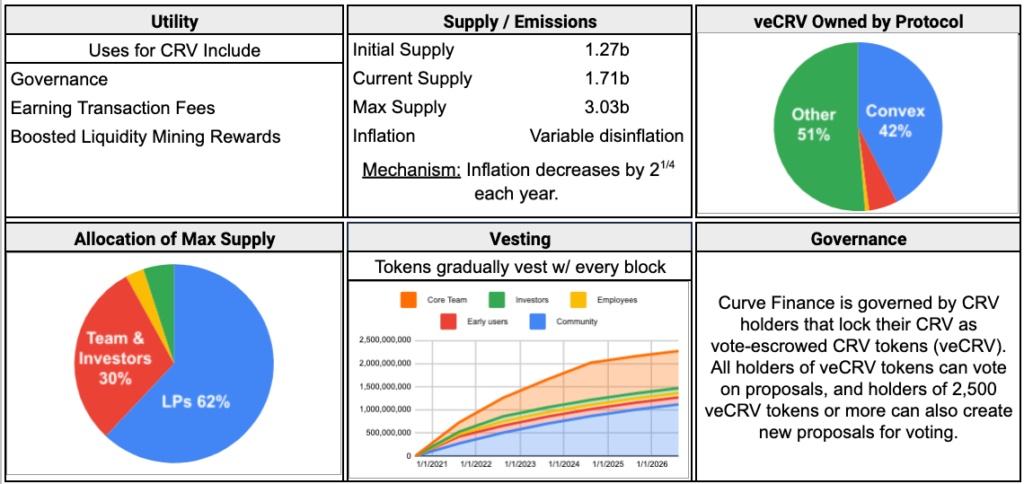

- Curve: Launched in January 2020, Curve is a popular automated market maker offering low-slippage, low-fee trading on Ethereum and other supported chains. To incentivize pool liquidity, Curve pays out a yield to LPs that comes from trading fees and CRV emissions, among others. Curve launched the Curve DAO and its native CRV token in August 2020, allowing holders to participate in governance. In order to vote, CRV holders must lock their CRV into non-transferable vote-escrowed CRV, known as veCRV, with voting power determined by the amount of CRV locked and how long the CRV is locked up for, ranging from one week to four years. Of note, veCRV holders may vote to direct CRV emissions to the pools of their choice via a weekly gauge vote. Additionally, locking up CRV allows holders to earn 50% of all trading fees on Curve proportional to their veCRV balance, as well as boosted LP rewards with the boost proportional to the time-lock, maxing out at 2.5x for a four-year lock. Such a vote-locking mechanism creates a flywheel where the more CRV one has, the more they can accumulate in the future. Additionally, this mechanism yields two important byproducts. First, vote-locking CRV removes it from the circulating supply and supports its price. Second, it allows those who control vote-escrowed tokens to direct liquidity, adding another source of CRV demand from external protocols and removing the need for them to engage in liquidity mining to generate liquidity for their pool (veCRV holders can incentivize liquidity using CRV rather than their native token, and the accumulated veCRV is an asset rather than an expense). Such a construct also encourages LPs to hold their tokens for boosted rewards and also helps prevent a vampire attack since large LPs are max locked. The CRV token exemplifies the nuance and lack of absolutes in tokenomics design. CRV’s total supply is currently only ~52% of its maximum supply, indicating material CRV emissions will occur in the future which some may perceive as a negative, all else equal. However, the ability for veCRV holders to direct future CRV emissions through the governance process provides utility and creates strong demand for CRV, and the process of locking CRV that is necessary to achieve this control reduces the circulating supply of CRV. Hence, CRV holders maximize the token’s utility when they continuously lock it for the maximum amount of time, which can potentially offset the incremental liquid supply created from future CRV emissions. To us, Curve is a great example of calibrating supply with demand to support the protocol’s objective of deep liquidity within a sustainable economic model. For more information on CRV and its tokenomics, see Curve Wars & The Battle For DeFi Liquidity.

- Olympus DAO: With the goal of one day becoming a global unit of account and medium of exchange, Olympus is a decentralized reserve currency based on the OHM token. Olympus backs each OHM by assets in its treasury, which it receives mainly through an innovative bonding process where participants buy discounted OHM that vests over five days in exchange for cryptocurrency or LP tokens. By selling OHM via such a bonding mechanism, Olympus generates significant protocol controlled value, which it uses to control its own liquidity, generate additional revenue from liquidity provisioning rewards, and back its currency with treasury assets to create a floor price for OHM. Moreover, bond buyers are further incentivized to lock up their OHM as Olympus shares much of the bond proceeds with OHM stakers, currently amounting to 900% APY and conceptually creating a game theory-driven virtuous bonding and staking cycle. Olympus also offers Olympus Pro, where it advises other protocols on setting up their own bonding mechanisms and offers said bonds for sale in its bond marketplace. The end result is a protocol that owns nearly 100% of its own on-chain liquidity and a currency that’s backed by a $400m+ treasury that can be used to manage it similar to a central bank. While OHM tokenomics are predicated on new bonders’ willingness to continue to pay a monetary premium for OHM – essentially the market price above its 1 DAI backing – Olympus effectively reduces its high emissions rate via its high-rewards staking mechanism, allowing it to become the de facto face of DeFi 2.0 and seeing myriad unaffiliated protocols adopt its core tokenomics elements for both decentralized reserve currency ambitions and beyond. For more information, see Innovations in Decentralized Finance with DeFi 2.0

- Axie Infinity: Axie Infinity is a blockchain-based, digital pet universe play-to-earn game created by Sky Mavis. With elements of Pokémon, Tamagochi, and CryptoKitties, Axie Infinity players collect, breed, and battle NFT-based fantasy Axie characters to earn tokens through their gameplay and contributions to the digital world. Players battle against other players or non-player characters in teams of three Axies to earn the in-game rewards token, with battle outcomes determined by energy/cards played and the category of the Axies fighting. Axie breeding produces offspring determined by a probabilistic genetic algorithm, requires AXS and SLP, and is limited in the number of times each Axie may be bred. Axie Infinity employs a dual-token system featuring a governance token with a fixed supply and an in-game token with an uncapped supply. The first is Axie Infinity Shards, or AXS, which is an ERC-20 governance token that allows holders to vote on proposals directly impacting the trajectory of the project. Holders can also stake their AXS to generate a yield that is derived from the transaction fees paid by players in the in-game marketplace. AXS is also used by players to purchase in-game items. The second token is Smooth Love Potion, or SLP, the native in-game currency which is minted through gameplay as a reward for winning battles. The price of SLP depends on the growth of Axie Infinity, with the supply of SLP and the demand for breeding being key factors. Additionally, the amount of SLP required to breed an Axie increases each time that an individual Axie is bred. Breeding Axies requires a fee to be paid in both AXS and SLP, but the SLP component of this fee is burned, reducing the net emissions of SLP when the demand for breeding is high. Axie Infinity earns revenue by collecting the AXS component of the breeding fee, as well as an Axie Marketplace fee for successful sales of Axie assets such as Axies, land, and land items. Revenue goes to the Community Treasury, which is governed by AXS holders. By utilizing a dual-token model, Axie minimizes the impact of AXS price fluctuations on the economic mechanism of the in-game token (SLP), in theory creating more stable in-game mechanics. Dual-token economic models have been increasingly adopted in Play-to-Earn gaming applications. For more information, see Axie Infinity Goes Parabolic.

- Algorithmic Stablecoins: Algorithmic stablecoins start with the objective of a pegged value to the reference asset, usually the US dollar, and vary circulating supply via various stabilization mechanisms to accomplish this goal. While a discussion of each of the various mechanisms is outside the scope of this short summary, their study can yield significant reports and understanding of supply and demand, mechanism design, and psychological factors. For a detailed discussion, please see Solving the Stablecoin Trilemma with Algorithmic Stablecoins.

Exhibit 1: Curve Sample Tokenomics

Source: Curve, Dune Analytics, Messari, GSR

Authors

- Brian Rudick, Senior Strategist

- Matt Kunke, Junior Strategist

Sources

Every: Tokenomics 101: The Basics of Evaluating Cryptocurrencies – DeFriday #19, Delphi Podcast: Jose & Yan discuss Delphi Labs, Incubating Mars/Astroport & Token Economic Design, Vasily Sumanov: A Hitchhikers Guide to Token Engineering, EP 11: Token Economist Explains How To Design Digital Economies with Tokens (Tokenomics), Longhash Ventures: How to Captuer Value, Time the Launch & Choose the Right Model, #DefiSummer: Designing Tokenomics, Token Engineering: Introduction to Token Engineering & Community Updates around the Globe – FullNode Berlin

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.

This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.