With the digital yuan set to be featured at next week’s Winter Olympics, we review CBDCs and their current status in this week’s Chart of the Week.

CBDC Motivations

Central banks are tasked with maintaining price stability, ensuring sound monetary and financial systems, and promoting access to safe and efficient payments. However, from changing behavioral patterns such as the declining use of cash to the rise of powerful fintechs like Alipay and Paypal and the growing use of private monies such as stablecoins, the way we pay and the forms of money we use is quickly evolving. Moreover, the provisioning of trusted money is a public good, and central banks must ensure credible, convenient, and accessible money in an increasingly digital world. As such, many central banks are studying whether to issue a Central Bank Digital Currency (CBDC), a widely-available digital form of a country’s fiat currency.

CBDCs Defined

CBDCs differ from other forms of money, namely commercial bank and nonbank money, in that they are a liability of the central bank itself, and thus have virtually no credit or liquidity risk. As a result, CBDCs do not require government deposit insurance to maintain public confidence and central banks do not need to back it with assets. CBDCs may be retail, used by the public for day-to-day payments, or wholesale, used as an instrument for settlement between financial institutions. According to the BIS, there are three foundational principles for any general-purpose CBDC: 1. Do no harm to monetary and financial stability; 2. Coexist and complement other payment mechanisms and forms of money; and, 3. Support efficiency and innovation. To bring about these three foundational principles, the CBDC itself should be convertible, convenient, accepted, available, and low cost. Its architecture should be secure, instant, resilient, available, scalable, interoperable, flexible, and have high throughput. And at the institutional level, there needs to be a robust legal framework in place with the central bank having clear authority to issue CBDC and the CBDC system conforming with appropriate regulations. Most central banks are considering a CBDC by weighing the pros and cons, studying whether risks can be managed, and engaging in ample discussions with key stakeholders. Below we discuss oft-cited benefits and risks of CBDCs before examining design choices and their current state.

Benefits of a CBDC

CBDCs bring about many benefits and can enhance economic growth, facilitate global commerce, improve remittances, and fight inequality. In more detail, these include:

- Faster, Cheaper, More Convenient Payments: The current payments system is built on financial rails created in the 70s, where transactions take 1-3 days to settle and where merchants are charged high fees that are ultimately passed on to the customer. CBDCs, by contrast, can offer safe, instant, low-cost, convenient payments 24/7/365. CBDCs allow central banks to meet the core needs of the financial system as technology advances and consumer behavior changes. And, CBDCs can improve upon existing payment mechanisms, such as cross-border payments where varying intermediaries, technology infrastructures, regulations, legal regimes, and time zones have led to slow settlement and high costs. CBDCs can also be programmable, and many central banks are studying how to make them work offline and without a smartphone.

- Greater Payment Competition: Payment service providers are often closed-loop systems benefiting from network effects. This can lead to high barriers to entry and a concentration of providers, potentially resulting in higher costs and worse performance. CBDCs can encourage innovation by acting as a platform for new financial products and services to be created upon. Moreover, such a platform could be utilized by companies of all sizes and would provide a safe foundation for new innovations that could include micropayments, improved access, programmable money, and many more.

- Financial Inclusion: 1.7b adults are unbanked globally, of which 1b have a mobile phone and 0.5b have internet access. As such, a CBDC has the potential to offer the unbanked greater access to financial products and services, particularly in emerging market economies. However, the cause of the inequality is often complex and varied, and a CBDC must address the main cause, ideally through a wider set of reforms, to be particularly effective in this area.

- Policy Support: CBDCs can help support central bank policy objectives. For example, CBDCs can improve payment system resilience, acting as an additional payment method should existing electronic payment networks function improperly. Moreover, CBDCs can ensure households and businesses will continue to have access to risk-free central bank money as digital payments rapidly supplant cash in many jurisdictions. CBDCs can also play an important role in protecting monetary sovereignty should significant adoption of stablecoins, cryptocurrencies, and foreign CBDCs otherwise occur. And for the US, a CBDC would help maintain the dollar’s reserve currency status, while it may help China challenge the dollar’s role in the global financial system, particularly given China’s first-mover advantage. CBDCs can also reduce government costs associated with issuing and administering physical currencies. Additionally, CBDCs can facilitate fiscal transfers especially if linked to a national identity scheme, could help with distributing government benefits and stimulus, and could be used to collect taxes. And stimulus payments could be programmed to expire to stimulate near-term demand or have benefits that vary based on real-time economic conditions. Lastly, there are even studies underway examining whether CBDCs can be used as an additional monetary policy tool.

Disadvantages of a CBDC

Despite the many benefits, CBDCs are not without risks, though many can be mitigated via the CBDC’s design. Nevertheless, disadvantages include:

- Financial System Stability: Central banks look to achieve financial and monetary stability, and as such, perhaps their top focus is making sure a CBDC doesn’t negatively impact either. As the safest form of money, a CBDC could cause a “digital run” on a financial institution if, for example, bank customers elect to convert their bank deposits to CBDC all at once during a period of stress. This risk exists now with physical cash, but a CBDC would make this much easier to effectuate. Even in normal times, disintermediation by CBDCs can dampen the money multiplier effect and may cause banks to rely on lower-quality funding sources such as borrowings. Lastly, there are significant risks with cybersecurity and other malicious attacks, and their consequences could be significantly worse relative to a breach of today’s segregated, smaller systems.

- Impact on Monetary Policy: CBDCs could impact monetary policy and the implementation of current policy tools by changing the number of reserves in the banking system. These would be further complicated should the CBDC be interest-bearing or there be significant foreign demand. Additionally, using CBDCs to enact policy such as with stimulus drops would blur the lines between monetary and fiscal policy, encroaching upon central bank independence.

- Cost and Availability of Credit: CBDCs are a substitute for bank deposits, particularly if interest-bearing, and could reduce the aggregate amount of deposits in the banking system. This in turn could increase the cost of credit or reduce credit availability. CBDCs could impact the cost and availability of credit for corporations too, as they would have implications for other short-term instruments such as money funds.

- Privacy: Any CBDC would be expected to adhere to anti-money laundering and terrorism financing rules and regulations, which require identifying those accessing CBDCs and collecting data to spot nefarious transactions. Particularly if connected to a digital identity, this could give governments significant power to, for example, freeze one’s money or track one’s location. Governments will need to implement strict user data storage and privacy policies and protections, and more generally, balance consumer privacy with prohibiting criminal activity.

Design Choices

Central banks have a multitude of design choices to consider when implementing a CBDC instrument and its infrastructure. Moreover, such choices have complex interactions and trade-offs, and ultimately determine where and how the central bank fits into the payments ecosystem. At the instrument level, examples of design choices include whether to make the CBDC interest-bearing, which could help control its demand and facilitate rates pass-through but could draw greater deposits out of the banking system. Additionally, a central bank could limit the amount of CBDC a household may hold, which could curb digital runs but cause potential demand to be unmet. At the system level, central banks must consider choices around its structure, payment authentication, functionality, access, and governance. For example, the architecture could be centralized or decentralized, transfers cold run through a central intermediary or be peer-to-peer, the system and payment access/authentication may be identity/account-based or token-based, the ledger could contain simple liability data or more sophisticated payment information, and ledger access can be relatively open or more restricted, to name a few. Moreover, central banks must determine which responsibilities they will provide in addition to issuance, such as distribution, system administration, and device management, and which they will rely upon the private sector to deliver. Note that most central banks are leaning towards handling issuance and partnering with the private sector for the remaining functions, as well as utilizing centralized infrastructure or permissioned distributed ledgers for greater control and throughput. To bring CBDC to fruition, a variety of technologies may be used which must undergo extensive testing and pilots prior to implementation. Lastly, central banks and governments must employ a well-thought-out governance process and implementation strategy.

Where We Stand

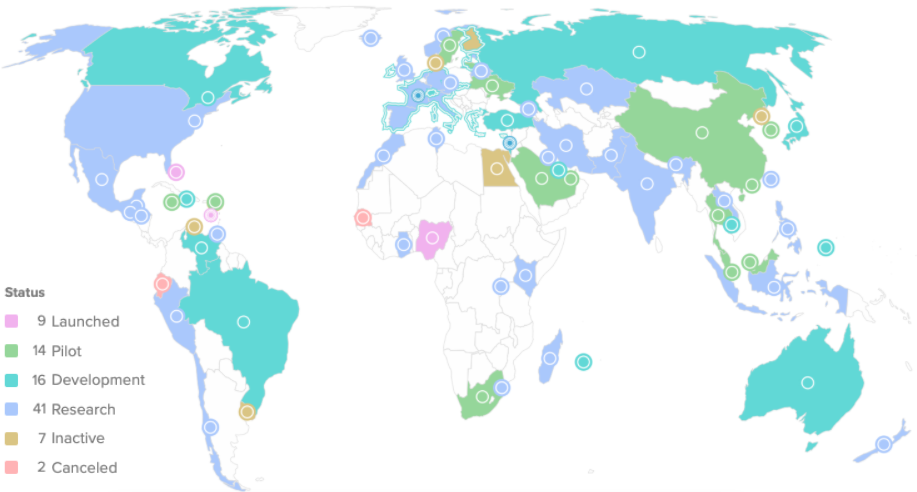

Central banks are in various stages of their CBDC journeys. As shown in Exhibit 1, of the 91 countries and currency unions tracked by the Atlantic Council, nine have launched a CBDC, 14 are in the pilot phase, 16 are in development, and 41 are actively researching the issue. Below we highlight select jurisdictions.

- The Bahamas: The Central Bank of the Bahamas officially launched the Sand Dollar in October 2020, making it the first nationwide CBDC in the world. Created to foster financial inclusion and fight illicit activity, one unique motivation was to lower cash distribution costs across the archipelago’s 700 islands. Sand Dollars are issued to digital wallets administered by licensed money transfer and payment firms, which have licenses to develop their own security-reviewed apps or use the central bank’s. Wallets contain different tiers of privacy, with lower balance wallets having the least strenuous KYC requirements. Additionally, the Sand Dollar does not pay interest and can only be held domestically. While it became available for use by all citizens upon release, it has only gradually been integrated into the banking system. Note that seven other Caribbean countries as well as Nigeria have launched their own CBDC as well.

- Europe: The ECB launched its digital euro project in mid-2021 and moved into a two-year investigation phase in October to examine its potential design, distribution, market impact, and required legislative changes. The investigation phase will inform the decision on whether to ultimately develop and launch a digital euro.

- US: Like the ECB, The Federal Reserve has been relatively slow-moving on the issue of a CBDC. The Fed has several efforts underway, such as the Federal Reserve Bank of Boston’s collaboration with MIT to design a CBDC prototype. Additionally, the Fed recently issued a discussion paper that did not take a policy stance, but examined the pros and cons of a potential CBDC and suggested that a US CBDC would likely be privacy-protected, intermediated, widely transferable, and identity-verified. The Fed has stated that the decision on a CBDC will ultimately be up to congress.

- China: China is the major economy furthest along in launching a CBDC, which is officially named the Digital Currency for Electronic Payments (DC/EP), but is more frequently referred to as digital yuan, e-CNY, or digital RMB. In addition to the benefits outlined above, motivations for its issuance also include helping to challenge the US’s role in the global financial system and reducing the country’s dependence on Alipay and WeChat which together account for 94% of online transactions. The People’s Bank of China first began researching digital currency in 2014, and in 2017 the State Council approved the development of the digital yuan. China began testing its CBDC in 2020, and in 2021 even tested its programmability, giving away CBDC that could only be used to pay for mass transportation. The PBoC operates a two-tier system, where digital yuan is issued by the PBoC to commercial banks and non-bank intermediaries, who then disperse it to the public. Detailed transaction information is captured in a centralized ledger managed and viewable by the central bank, but hidden from other financial firms. The digital yuan can earn interest only if moved to a deposit account and can be used with NFC-based technology to enable offline payments. The PBOC recently stated that over 260m users had activated digital yuan wallets at year-end 2021, though it has not revealed when a full national launch may occur. Nevertheless, China will meet its long-standing goal in just one week when it will showcase the digital yuan to the world during the Winter Olympics.

Exhibit 1: Central Bank Digital Currency Status

Source: Atlantic Council, Senior Strategist

Author: Brian Rudick, Senior Strategist

Sources

BIS: Central Bank Digital Currencies: Foundational Principles and Core Features, BIS: Central Bank Digital Currencies – Executive Summary, World Economic Forum: Central Bank Digital Currency Policy-Maker Toolkit, Federal Reserve: Money and Payments: The US Dollar and the Age of Digital Transformation, Harvard Business Review: What if Central Banks Issued Digital Currency

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.

This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.