DeFi pain points are rapidly shrinking as new protocols build on existing core primitives and offer new innovations, often in a more collaborative, protocol-centered, and long-term-focused manner. We review recent progress, examine examples, and ponder the future of what many are calling DeFi 2.0 in this week’s Chart of the Week.

Addressing Pain Points: Decentralized finance, or DeFi for short, is a form of finance that uses blockchain technology, smart contracts, and decentralized applications (dApps) to offer typical financial services such as lending, trading, and investment without intermediaries and in a transparent and open way. DeFi offers many benefits over traditional finance such as speed, cost, immutability, composability, and programmability, and ushers in new forms of governance, ownership, and incentive structures, to name a few. As a nascent technology, however, DeFi still has many challenges such as with liquidity, capital efficiency, and tokenomics. Fortunately, a new breed of innovative protocols have sprung up to address these improvement opportunities in what’s coming to be known as DeFi 2.0.

DeFi 2.0: While its definition is still fluid and it is better used as a mental model than a hard classification scheme, the notion of DeFi 2.0 seems to be congeling around building on top of existing DeFi primitives or creating new innovations to remedy pain points and offer new functionality. One key DeFi 2.0 construct, for example, is protocol controlled value (PCV); whereas many DeFi protocols are essentially two-sided marketplaces relying on rented, user-contributed funds commonly known as total value locked (TVL), a new crop of protocols have jettisoned this approach in favor of owning, rather than renting, their operating assets. In contrast to TVL, which requires ongoing compensation and has several undesirable characteristics discussed below, PCV is typically generated by a protocol selling its native tokens in exchange for an asset, enabling new mechanisms and a higher degree of protocol control that includes backing and managing a currency, owning one’s own liquidity, generating additional revenue streams, and providing insurance for users. DeFi 2.0 is also about building on existing primitives and creating new innovations to offer greater utility, such as improved capital efficiency, automation, and enhanced returns, and is often done in more collaborative, community-driven, and sustainability-focused ways. Not without its downsides, DeFi 2.0 has been criticized for compounding risk, a natural consequence of building on top of other protocols, and for having fewer checks and balances given its permissionless nature. In the following section, we offer more detail on various DeFi 2.0 innovations and present several projects as examples.

Protocol Owned Value/Liquidity: The importance of liquidity in crypto cannot be understated, at a high level to power the democratization of value exchange (similar to how bandwidth powers the democratization of information with the internet), and more practically to both to reduce price volatility/trading slippage and to enable the technology itself. Such liquidity is often generated in DeFi via liquidity mining, where protocols incentivize users to contribute their (redeemable) funds in exchange for the protocol’s native token. While liquidity mining can help distribute a token and successfully bootstrap liquidity and users for a time, user-contributed funds typically leave once the incentives end, and a falling TVL, high inflation, and the selling of liquidity mining rewards can cause the protocol’s token price to rapidly fall. New mechanisms, however, such as Olympus Dao’s bonding that results in protocol-owned liquidity, or Tokemak’s decentralized liquidity-as-a-service market making can alleviate the need for liquidity mining. Moreover, these innovations can offer deeper, less fragmented, and more consistent liquidity. To demonstrate, we provide the following two examples:

-

- Olympus Dao: With the goal of one day becoming a global unit of account and medium of exchange, Olympus is a decentralized reserve currency based on the OHM token. Olympus backs each OHM by assets in its treasury, which it receives mainly through an innovative bonding process where participants buy discounted OHM that vests over five days in exchange for cryptocurrency or LP tokens. By selling OHM via such a bonding mechanism, Olympus generates significant PCV, which it uses to control its own liquidity, generate additional revenue from liquidity provisioning rewards, and back its currency with treasury assets, creating a floor price. Moreover, bond buyers are further incentivized to lock up their OHM as Olympus shares much of the bond proceeds with OHM stakers, creating a game theory-driven virtuous bonding and staking cycle encapsulated by crypto Twitter’s (3,3) memes. Olympus has further introduced Olympus Pro, where it advises other protocols on setting up their own bonding mechanisms and offers said bonds in its bond marketplace. The end result is a protocol that owns nearly 100% of its own on-chain liquidity and a currency that’s backed by a rapidly growing $800m+ treasury that can be used to manage it similar to a central bank, but in a manner much further removed from fiat influence.

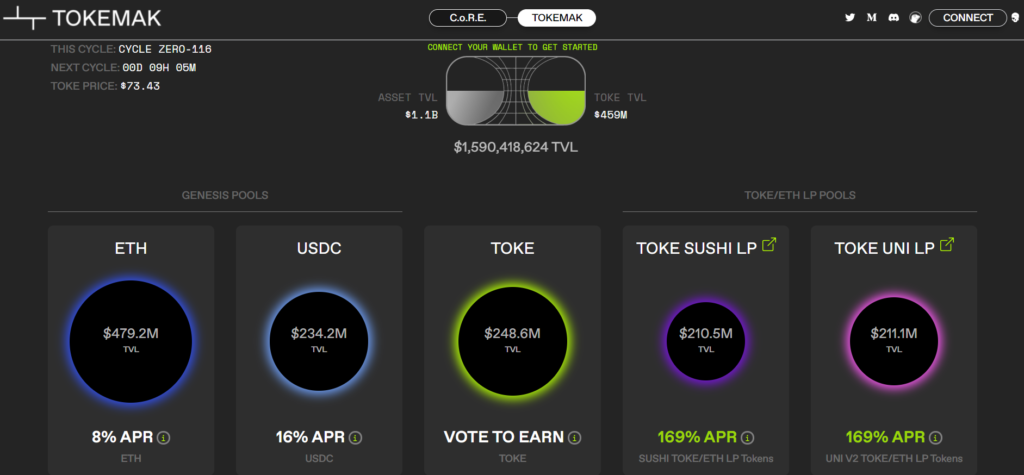

- Tokemak: Tokemak is a decentralized market making protocol used to create efficient markets and deep DeFi liquidity, and has been described as a liquidity utility, Liquidity-as-a-Service, and as an aggregator for exchange liquidity. Tokemak works by disaggregating the different pieces of a market maker, allowing for simple crowdsourced liquidity and democratized liquidity direction. Liquidity providers can deposit single reserve assets like ETH, USDC, DAI, and tokens from projects using Tokemak in exchange for high yields and impermanent loss protection, while TOKE holders such as exchanges can vote to direct the liquidity to AMM pools and other market making opportunities at a much lower cost compared to liquidity mining. Staking rewards and the ability to direct liquidity increases the demand for TOKE, and such directed liquidity also earns exchange trading fees for Tokemak, which are retained in the Tokemak treasury. Over time, Tokemak aims to accumulate enough protocol-controlled value to direct liquidity without the need for liquidity providers.

Adding Functionality: Many projects that exemplify DeFi 2.0 are also building on top of existing primitives or adding creative functionality to offer new products and services. Examples include:

-

- Abracadabra.Money: Abracadabra is a cross-chain stablecoin lending protocol that operates on Ethereum, Binance Smart Chain, Avalanche, and others. Abracadabra is similar to MakerDAO in that users deposit assets in return for a stablecoin, here called Magic Internet Money. However, Abracadabra lets users deposit yield-bearing assets such as yvYFI, yvUSDT, yvUSDC, and xSUSHI to mint MIM, allowing the collateral to accrue value, reducing the risk of liquidation and improving capital efficiency.

- Alchemix Finance: Alchemix is a future yield tokenization protocol. Alchemix offers loans backed by yield-bearing collateral allowing for self-repayment, and also issues loans as a synthetic version of the deposited collateral, removing the risk of liquidation. Alchemix’s yield advance expands the utility of existing yield-earning dApps and has many use cases in personal finance, capital efficiency, hedging, ect.

- Rari Capital: Rari is a suite of DeFi protocols that create and deliver aggregate yield. Rari’s Yield Aggregator is an autonomous algorithm that rebalances users’ funds into the highest-yield opportunities, while Fuse allows anyone to instantly create and deploy their own lending and borrowing pool. The latter in particular brings about many use cases with protocol treasury management, delta neutral strategies, leveraged yield farming, and borrowing against any asset like LP tokens, synthetic assets, staked assets, options, and NFTs.

The Future: DeFi 2.0 is already cutting edge, though we offer the following thoughts on what may lie ahead. Despite its drawbacks, liquidity mining is not going away and instead is likely to become more of a conscious choice. There will be less focus on TVL, and more focus on the efficiency of TVL and on PCV. Pioneering DeFi protocols who created the building blocks are not going away, but rather will become more important than ever, and can simply adopt DeFi 2.0 constructs where appropriate. And DeFi 2.0 will continue to improve collaboration, speed to market, and utility, with more DAO to DAO activity and greater tools for improved DAO community management. All this can one day usher in mass DeFi participation, where DeFi is incorporated into daily lives and regularly interacted with, oftentimes unknowingly, by the general population at large. Whether the term DeFi 2.0 sticks or quietly fades away, one thing is clear – DeFi continues to innovate and improve to bring about a more efficient, open, and equitable financial system for all.

Exhibit 1: Olympus DAO (top) and Tokemak (bottom) Dashboards

Source: Olympus DAO, Tokemak, GSR

Author: Brian Rudick, Senior Strategist

To download this article as a PDF, click here.

Sources: Olympus DAO: Docs, Tokemak: Docs, Finematics: DeFi 2.0 – A New Narrative?, Messari: Beyond DeFi 2.0 – What’s driving DeFi’s Current Innovation?, Messari: Protocol Owned Liquidity as a Service, Messari: Mount Olympus: Fact and Fiction, Tokemak: The Evolution of DAOs, Bankless: The Secret Weapon of DeFi 2.0 | Zeus from Olympus DAO, Bankless: Defi 2.0 Summit

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report. This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country shere such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.