Author: Brian Rudick, Senior Strategist

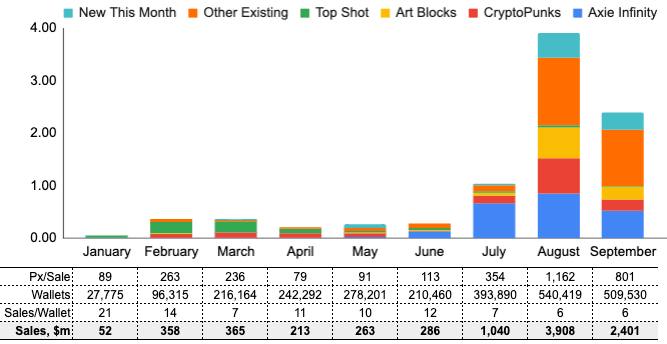

After a 7x increase in NFT volumes from July to August, volumes, though still elevated, fell considerably in September. We examine which projects have been driving this year’s growth before decomposing volumes into the number of wallets, sales per wallet, and price per sale in this week’s Chart of the Week.

2021 – What a Year: Whether measured by trading volumes, prices, owners, investment, or cultural awareness, 2021 has been a phenomenal year for all things NFT. Use cases such as sports (eg. NBA Top Shot), gaming (Axie Infinity), collectibles (CryptoPunks), and art (Art Blocks) are seeing record awareness and adoption. And while some of the ferver is undoubtedly part speculation, there is also an enormous amount of real utility that’s increasing as the space innovates at a breakneck pace. Such speculation, utility and innovation helped drive NFT volumes to $10.7b in Q321, up 704% from the prior quarter and 38,060% from the prior year, per DappRadar.

Top Projects Driving Volume: We compile data for the top 50 NFT projects by all-time sales volume from CryptoSlam to find that four projects – Axie Infinity, CryptoPunks, Art Blocks, and NBA Top Shot – have accounted for 60% of 2021 top project volume and, as such, have generally driven volume trends this year. Indeed, Top Shot both started the party in February, accounting for the vast majority of that month’s growth, and then drove the April decline as sales cooled off. June and July were then all about play-to-earn game Axie Infinity, which experienced parabolic growth after moving to its Ronin sidechain. August sales were then multiples of July’s, with ~$500m of growth from each of CryptoPunks, Art Blocks, and new project launches, and over $1b of sales growth from other existing top 50 projects, two thirds of which came from Bored Apes, 0N1 Force, Parallel Alpha, Pudgy Penguins, and Meebits. Volumes for the top 50 projects then fell ~40% in August, with 75% of the decline due to the lower CryptoPunks, Art Blocks, and Axie Infinity volumes.

Breaking Growth into Its Components: We can decompose sales volume into the number of active wallets, the average number of sales per wallet, and the average price per sale for a different cut of volume drivers. Under this view, growth in February was driven by both a higher price per sale, due to the rising average Top Shot sale price and a mix shift towards CryptoPunks, and an influx of new wallets, 90% of which came from new Top Shot users. April’s lower sales were driven by a lower average sales price, which itself was driven by the average Top Shot moment sale price declining from $160 in March to $70 in April. The growth components were relatively steady in the summer until July when Axie Infinity spurred total wallet growth (accounting for 85% of July wallet growth) and average price given Axie’s $500 average ticket price. August then saw strong user growth, driven by Axie Infinity, and a skyrocketing average sale price, driven by the average CryptoPunks sale price rising from $97,000 in July to $268,000 in August. September’s decline was then driven by a lower average sale price as a smaller percentage of total sales came from CryptoPunks.

Positive Trends Suggestive of Continued Growth: While growth may have cooled somewhat in September, activity certainly did not, and suggests positive future trends. Wallets should grow as additional use cases are developed, access and user experience ease, and awareness continues to rise. Average prices for legacy projects may rise as demand outpaces often fixed supplies and new projects are still additive to total sales volumes. And over the longer-term, sales per wallet should grow due to greater prevalence and use cases of the technology. Indeed, September alone saw new NFT marketplaces/announcements (OKEx, FTX, SushiSwap), companies increase their involvement (Google, Twitter, TikTok, La Liga, NFL, Coach), celebrities raise awareness (Steph Curry, Snoop Dogg), new capabilities develop (Koii’s transforming NFTs, Arcade OG’s augmented reality, JPEG’d and NFTfi’s NFT lending), new games/gaming platforms (WonderHero, IMVU, TangoChain), and over $1b invested into NFT companies (including $680m into Sorare and $250m into Dapper Labs). While the current pace of growth won’t be maintained forever, the future of NFTs looks bright.

Exhibit 1: NFT Volumes and Volume Breakout, Top 50 Projects, $b

Source:CryptoSlam!, GSR

Note: Uses Top 50 projects as measured by all-time sales volume.

To download this article as a pdf click here.

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.