Author: Brian Rudick, Senior Strategist

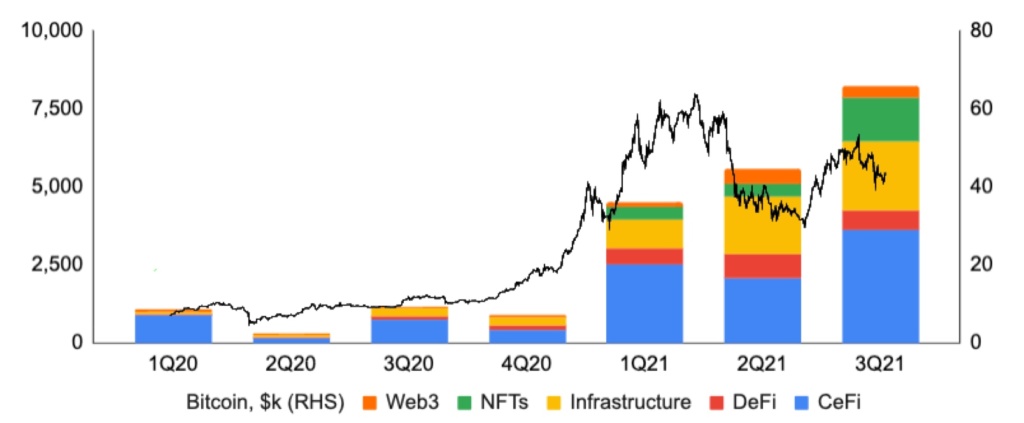

Venture fundraising by crypto companies continues to accelerate, driven by investment in centralized financial applications, infrastructure providers, and, more recently, NFTs. We break down fundraising trends and hypothesize what recent VC fund announcements portend for future fundraising in this week’s Chart of the Week.

- Rising Venture Investment: Satoshi Nakamoto created Bitcoin in 2008 out of a distrust for the existing financial system and its centralized authorities such as governments and central banks. Such distrust was arguably not misplaced as the existing system failed to prevent the global financial crisis and saw financial companies rescued with public funds and fiat currencies debased via quantitative easing. What’s somewhat ironic, however, is that the central bank money printing so vehemently opposed by core crypto ideals has inflated asset values around the globe, including cryptocurrency prices. The world is awash in capital, and much of it is finding its way into the blockchain/ cryptocurrency ecosystem. Indeed, fundraising by cryptocurrency companies totaled $3.4b for all of 2020, but skyrocketed to over $18b in just the first nine months of 2021, per Dove Metrics. Moreover, despite the summer downturn in cryptocurrency prices, fundraising actually accelerated, reaching $8.2b in 3Q21. Lastly, a larger and larger percentage of total global venture funding is finding its way into the blockchain/ cryptocurrency ecosystem, with that number rising from 1.6% in 1Q20 to 4.7% in 3Q21, per Pitchbook. Adding abundant capital to what in our opinion is already a compelling investment opportunity has only added fuel to the fire.

- Fundraising Summary Statistics: Given the hyper growth, we compile some interesting statistics below using Dove Metrics data. We find:

- Number of Rounds: Total fundraising rounds were 336 in 2020, but ballooned to 914 during the first nine months of 2021, with 303 in 3Q21. YTD, the number of deals are up 306% YoY.

- Deal Size: Save for 1Q20, which appears to be an outlier due partly to just 33 deals with disclosed metrics, both the average and median deal size has trended higher this year, with the former moving from $9m in 4Q21 to $30m last quarter and the latter moving from $3.0m to $5.0m.

- Mega Deals: In 2020, just 1.5% of funding rounds raised over $100m, while in 2021, that amount expanded to 4.0%, including 6.3% in 3Q21. As a percentage of total funds raised, 43% were in rounds raising $100m or more in 2020, which increased to 59% in 2021, including 68% in 3Q21.

- Largest Deals: All but one of the ten largest deals since the start of 2020 occurred this year, with Robinhood’s $1.0b raise in Jan 2021 topping the list, followed by FTX ($900m, July 2021), Revolut ($800m, July 2021), Sorare ($680m, Sept 2021), and Revolut ($500m, Feb 2020) rounding out the top five. Outside of the FTX, Revolut, and Sorare deals just mentioned, other large deals in 3Q21 include Genesis Digital ($431m, Sept 2021) and Fireblocks ($310m, July 2021).

- By Stage: The percentage of funds raised in pre-seed/seed deals and the percentage of funds raised in Series A and B rounds remained relatively constant from 2020 to YTD21. That said, later stage deals (Series C-H) fell from 42% in 2020 to 32% in YTD21, with the decline going to a greater percentage of alternative raises, such as community raises, crowdfunding, and treasury diversification rounds. In 3Q21, 46% of funds raised were part of Series A or B funding rounds and 27% were Series C-H, while pre-seed and seed rounds were just 6% of total funds raised.

- By Geography: Companies in Asia received a smaller percentage of total funds raised in 2021 so far (33%) compared to 2020 (42%). Asia’s fundraising share loss was fairly evenly distributed to North America (home to companies garnering 61% of total funds raised), Oceania (3%) and South America (2%). As far as countries go, 54% of total funds were raised by companies in the U.S. so far this year, followed by the U.K. (13%), France (6%), and Canada (5%).

- By Investors: From 1Q20 through 3Q21, AU21 Capital was the most active investor, leading or participating in 126 funding rounds, followed by NGC Ventures (96), Coinbase Ventures (91), LD Capital (80), and CMS Holdings (72). More recently, Coinbase Ventures led 3Q21 with 31 total deals, followed by Alameda Research (24), Divergence Ventures (24), Animoca Brands (19), and NGC Ventures (18). Some of Coinbase Ventures’ more notable investments this quarter include FTX ($900m total raised), DeSo ($200m), CoinDCX ($90m), MobileCoin ($66m), and Animoca Brands ($50m).

- By Type: Since the beginning of 2020, nearly 50% of all fundraising was done by centralized financial applications, followed by 26% for the infrastructure category and ~10% for each of DeFi and NFTs. That said, and while growth has been strong for all categories, centralized financial companies have lost 21 percentage points of fundraising market share in 2021 vs. 2020, while NFTs and infrastructure projects were the clear winners, splitting CeFi share loss evenly between the two. For 3Q21, the fundraising composition was: CeFi 44%, infrastructure 27%, NFTs 17%, DeFi 8%, and Web3 4%.

- Fund Announcements to Fuel Future Fundraising: While investor enthusiasm is clearly high and crypto prices will have some impact, we believe fundraising over the near-to-medium term will remain very strong given the increasing level of fund announcements by venture capital firms, which preclude actual investment. Indeed, announcements of new crypto-focused funds totaled $1.1b last year, but have totaled $8.0b YTD, including $3.4b in 3Q21 and $1.2b in just the first 12 days of October. Notable VC fund announcements include Binance Labs’ Growth Ecosystem Fund ($1.0b, Oct 2021), 10T Fund’s Growth Fund ($750m, Sept 2021), and Andreessen Horowitz’s Crypto Fund III ($2.2b, July 2021). With such large numbers, it’s likely to remain a hot fundraising market for blockchain/ cryptocurrency for the foreseeable future.

Exhibit 1: Venture Capital Crypto Investment by Category, $m

Source: Dove Metrics, GSR

To download this article as a pdf click here.

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.