After the quickest bear market drop in Wall Street’s history in March, Bitcoin has fully recovered. US stocks notched their biggest monthly rally in April since 1987, cutting the coronavirus-driven losses on the S&P 500 to about 10% year to date. This is due to the unprecedented speed and magnitude of the monetary intervention by the federal reserve. Stock markets have posted healthy gains in April despite the grim performances of national economies and the release of startling unemployment numbers. The FTSE All World index of global stocks had its best month since 2011. Understandably, many investors have expressed doubts about whether the rallies have further to run, but it is difficult to bet against the ‘infinite’ interventions of global central banks.

“The long-term case for crypto has been made stronger by the impacts of this pandemic,” said Richard Rosenblum, co-founder of GSR, Bloomberg, April 3rd.

By comparison, the Covid-19 stimulus has already dwarfed the easing implemented over the 12-months succeeding the collapse in 2008. This stimulus may not be reflected in decreased purchasing power quite yet, however monetary inflation will likely accelerate at some point in future. Central banks are injecting enormous levels of monetary and fiscal stimulus into the system, the likes of which have never been seen before.

“The record stimulus being deployed by central banks is a reminder of why bitcoin was created in the fallout of the last global market crisis,” Rosenblum wrote. “People are increasingly skeptical of conventional monetary systems. Bitcoin with its predictable inflationary scheme and 100% uptime offers some certainty in an environment that is otherwise very unpredictable.” Rich Rosenblum, Co-Founder of GSR, Coindesk, April 7th.

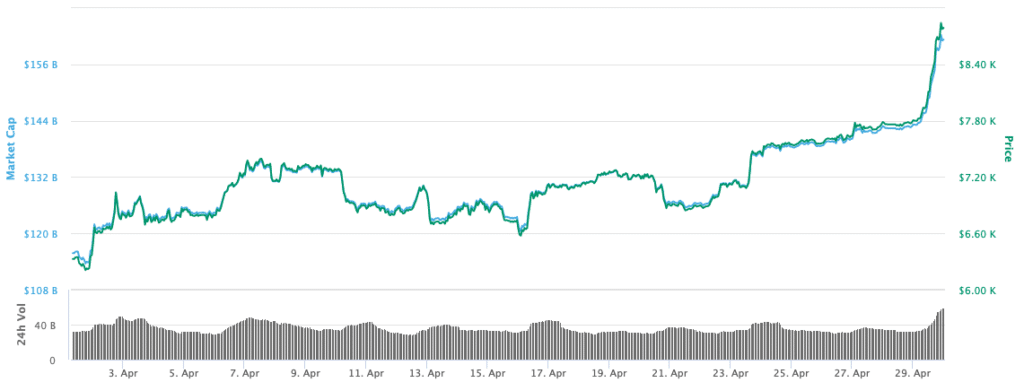

Bitcoin ended the month with an aggressive bullish move over 9k, gaining 29% in April. As the halving rapidly approaches, it is clearly helping to build positive momentum. There are increased signs of institutional adoption as bitcoin’s recent resilience has been attractive to investors who are searching for new sources of uncorrelated returns. Recent deflationary concerns due to increased unemployment and the oil price collapse is muddled with long term inflationary concerns from excess monetary easing.

“As the halving is less than 2 weeks away, it is clearly helping to build positive momentum. There are increased signs of institutional adoption as bitcoin’s recent resilience has been attractive to investors” Jakob Palmstierna, Director of Investments at GSR, The Block, April 30th.

Some short positions were liquidated amid bitcoin’s rally, which probably helped loosen up key levels resistance. We are in a period of heightened levels of volatility and expect the magnitudes of market moves to remain elevated for the foreseeable future.

Bitcoins price performance in April. Source: CMC

This latest run past $8,000 is as much about positive macro sentiment as it is about the upcoming halving. We’re starting to have a lot more certainty, as more countries begin to share their plans to reopen the economy in May.” Rich Rosenblum, Co-Founder of GSR, Bloomberg, April 29th

This latest price run is as much about positive macro sentiment as it is the upcoming halving. There’s also the impact of the economic stimulus in the US. Many retail investors are adding to their positions in small increments, while new participants are coming into the market and taking small positions. Coinbase noted that there was a spike in $1,200 deposits immediately after stimulus checks were distributed, wallets with small balances are also at an all-time high. The mid-March sell-off drove many investors with bearish sentiment out of the market. The jockeying for position ahead of the halving is now starting. The majority of investors in the market are bullish, with many having a long-term investment horizon being unfazed by recent volatility.

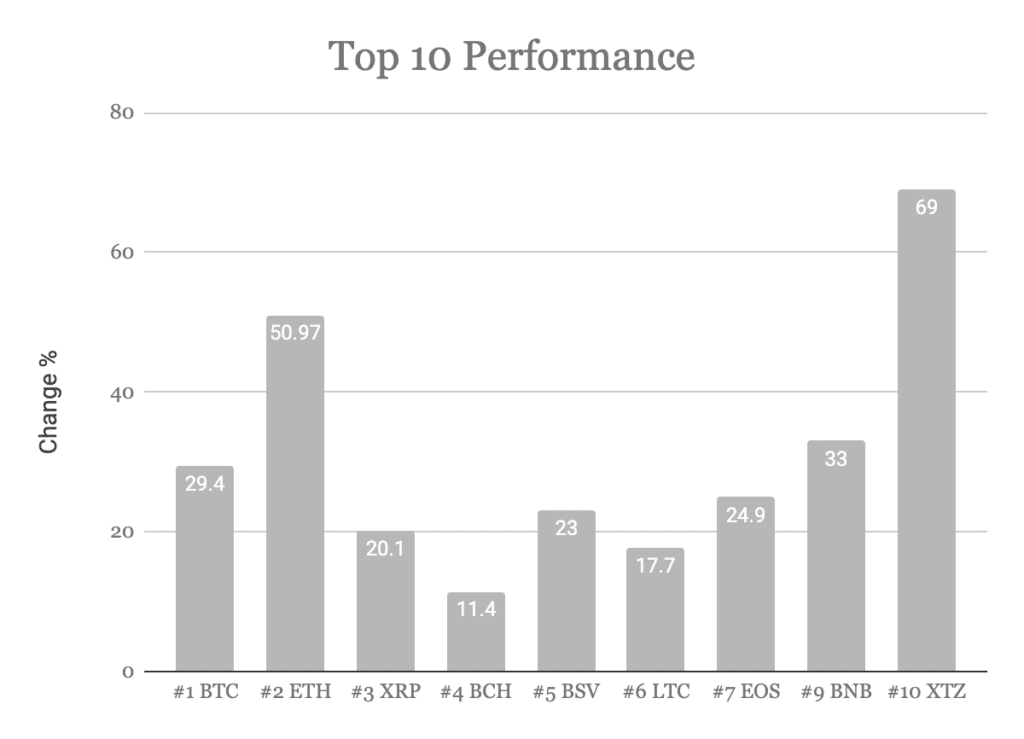

All of the assets in the top ten performed well in April. ETH gained over 50%, XRP 20%, BCH 11%, BSV 23%, LTC 17%, EOS 24%, BNB 33%, and XTZ 69%.

Unprecedented Stimulus vs The Halving

The most aggressive printing in monetary history is now perfectly aligned with the most hyped halving in Bitcoin’s history. The polar opposites in supply dynamics makes it difficult to not be bullish bitcoin in the longterm. The door is open for bitcoin to capitalize on an unstable macro future. Bitcoin needs a consistent positive performance that is decoupled from wider markets for it to show value as a hedge to uncertainty.

The hype of the halving may mean Bitcoin will be overbought in the short-term, hurting new retail investors who are drawn to Bitcoin headlines for the first time. But for the long-term holders who are unfazed by the volatility, crypto has now found itself in an interesting position, its fundamentals are clearly appealing for the decade that lies ahead.

“The majority of investors in the market are bullish, with many having a long-term investment horizon unfazed by recent volatility. This overall sentiment could act as support for the bitcoin price over the next few weeks,” Rich Rosenblum, Co-Founder of GSR, Forbes, April 29th.

Creaking Payments Infrastructure

For many years crypto has been a solution without a problem. This has started to slowly change. Powerful American policymakers were seriously considering the idea that the Federal Reserve should issue “digital dollars” in March. In the end, policymakers decided to move forward with existing methods to distribute the stimulus package to American citizens. What transpired was a combination of errors and inefficiencies. Perhaps the reason policymakers were considering bringing digital dollars to the centre stage prematurely, was because they knew the current system could not handle the mass distribution of the capital in an effective way.

Several states have made desperate requests to a short supply of COBOL developers as they struggled to process unemployment claims on the 40-year-old system. When sending the stimulus packages, the U.S. government used a combination of direct deposit and mailing physical checks. Using cheques has clear disadvantages, for example, a man in New York stole nine of them.

“There’ll be lots of postmortems and one of them on our list will be how did we get here where we literally needed COBOL programmers? we have systems that are 40-plus-years-old,” New Jersey Gov. Murphy

China’s digital currency has been gathering momentum, its launch will act as a strong impetus for American policy makers to follow a similar path and upgrade their payments infrastructure.

Covid-19 didn’t create new technological trends, it just accelerated the ones that were already there. As a new economy that is more digital emerges from the pandemic, the case for decentralized crypto infrastructure will be made stronger.

“A major theme that’s arisen in this pandemic is the acceleration of technology’s prevalence in everyday life, which helps to explain why the tech sector is the best performer and why energy is suffering.” Rich Rosenblum, Co-Founder of GSR, Forbes, April 21st.

The Halving — A Battle of Firepower

With the Bitcoin Halving fast approaching, anticipation is growing in the crypto community. As the 210,000 block is reached, the miner’s reward stake generated per new block, issued about every 10 minutes, will drop from 12.5 to 6.25 BTC — an inherent 50% reward slash.

Each halving lowers the supply generated, lowering Bitcoin’s inflation. In theory, demand will stay the same causing a price increase. However, it is not quite that straightforward. For the past two halvings, Bitcoin dropped in the days before and after the event but then went on unprecedented runs over the following months. In 2016, after the halving occurred, Bitfinex reported that Bitcoin’s price dropped from $683 to $572 over a period of 77 days before prices began to gradually recover over the next few months, eventually entering the March rally of 2017.

This time around, there could be more initial volatility (perhaps to the downside) before any historical repeat of a rally. Covid-19 has had a detrimental effect on global markets and business operations, and its influence on the event is hard to predict. In past halvings, there was speculation that miners tend to sell before the event in order to finance their operations for the following months. Miners would sell Bitcoin and hoard cash to be compensated for the adjusted breakeven price. This time round some forward-thinking miners, some of whom are GSR’s trading counterparts, will have prepared for the halving through risk management strategies. However, a concern due to Covid-19 is supply chain management and operational costs. With parts of the world still on lockdown, miners could be slow to receive or unable to upgrade their facilities and computing power. The backlog of manufactured parts could slow the production of optimal mining rigs.

Reports, market reports, and other information (“Information”) provided by GSR or its affiliates have been prepared solely for informative purposes and should not be the basis for making investment decisions or be construed as a recommendation to engage in investment transactions or be taken to suggest an investment strategy in respect of any financial instruments or the issuers thereof. Information provided is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services and is not a recommendation to buy, sell, or hold any asset. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page. Trading from Singapore, please review The Monetary Authority of Singapore (MAS) compliance note.