Defi Explosion

Defi has had explosive growth in August in what has been a volatile month for the emerging yield farming niche within the crypto ecosystem. Projects appear to be popping up faster than most can digest their purpose or design. The excitement and irrational exuberance of the past few weeks has similarities to the volatility experience in the ICO boom of 2017. Yield Farming is where users are rewarded with tokens by providing liquidity in crypto to a Defi protocol, and it has captivated a segment of the market.

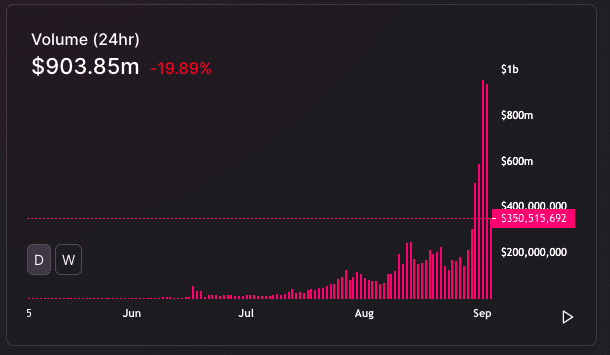

UniSwap Volume

Uniswap has been the decentralised exchange where most of the action has been taking place. On August 30th 24hr trading volume on Uniswap hit $426 million, surprisingly surpassing Coinbase at $348 million. Towards the end of August and early September Uniswap hit over $900 million in 24hrs, a figure that’s hard to comprehend given the protocol was relatively unknown outside of the Defi world until recently.

UniSwap 24hr volume, source uniswap.info:

Yearn.Finance

Yearn.finance’s (yEarn) native governance token, YFI, had rapid price movements in August, as the coin touched a high of $30,324 on Saturday the 29th. The YFI token has previously made headlines for outpacing Bitcoin by price per coin, as the value spiked to $16,000 on August 20th, with a market cap of $1.2 billion.

yEarn supports the stablecoins DAI, USDC, USDT, TUSD, and sUSD and moves the supported stablecoins between Compound, Aave, dYdX, and Curve depending on which asset pool is offering the highest yield. YFI is an ERC-20 token that governs the yearn.finance ecosystem. Andre Cronje, the tokens creator, intended for YFI to be “a completely valueless 0 supply token,” he wrote in a blog post. “We reiterate, it has 0 financial value.”

YAM.Finance

In the first half of August YAM came into the spotlight of the crypto world. YAM was an experimental project that had an unaudited contract. The project promised ‘equal opportunity’ staking with no premine and no founder shares.

It was designed as a ‘minimally viable monetary experiment’. At launch the YAM had zero value it would be entirely dependent upon YAM holders to determine the value and future development. Yam was designed to reallocate a ten percent portion of each supply expansion to buy a high-yield dollar denominated stablecoin called yCRV in what it termed a ‘rebase’. The tokens will be added to the treasury which is controlled via YAM community governance.

YAM had $585 million assets under lock as of Tuesday August 11th. Days later, YAM succumbed to a bug within its rebase function, meaning the coin lost control of its on-chain governance feature, rendering it worthless. Funds were lost, and YAMs founder apologized on Twitter to the community.

Spaghetti, another unaudited project followed, and in under 24hrs $200 million was poured into the project, continuing the yield farming craze.

Sushi also came on the scene, the unaudited Uniswap fork crossed the $700 million market in total value locked on August 31st. According to Defi Pulse, the value locked in the Defi ecosystem hit $9 billion on Sept 3rd.

Ethereum’s Mixed Reaction

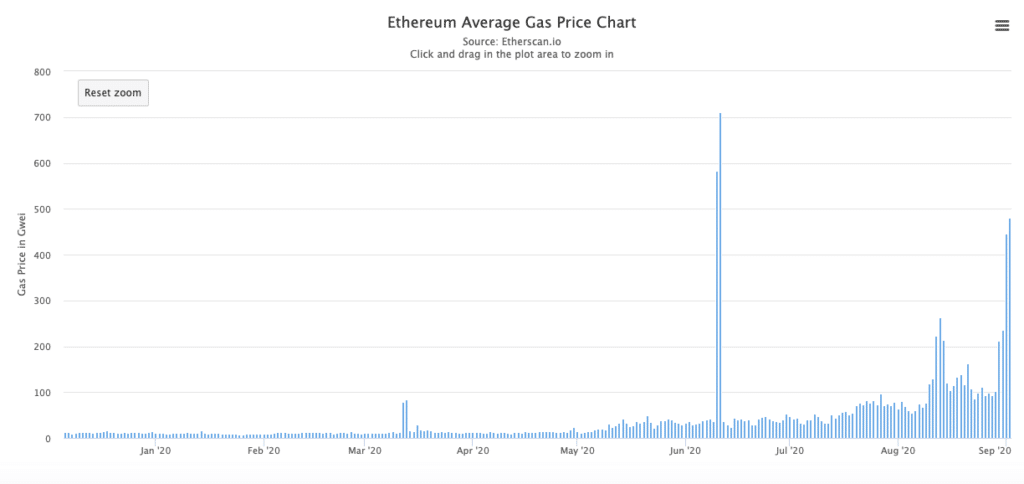

As a result of all this activity happening on Ethereum, its price has soured throughout August reaching a 2-year high, breaking $480 only to later pull back. However, all is not well in the world of ETH as the network has struggled to handle the level of activity, as a result fees have continuously spiked.

Ethereum Gas Price Chart, Source etherscan.io:

The increase of GAS prices has resurfaced the doubts around the scalability of Ethereum. According to BlockChair average networks fees reached to $15.2 on Wednesday this week, up over 600% from a month ago, while gas prices soared past 450 Gwei. ETH miners are enjoying this momentum as according to Glassnode, miners earned $113M in August alone. Creator of Ethereum Vitalik Buterin has publicly compared the underlying economics of the Defi Tokens to the irresponsible monetary policies of the Federal Reserve.

‘Seriously, the sheer volume of coins that needs to be printed nonstop to pay liquidity providers in these 50-100%/year yield farming regimes makes major national central banks look like they’re all run by Ron Paul.’

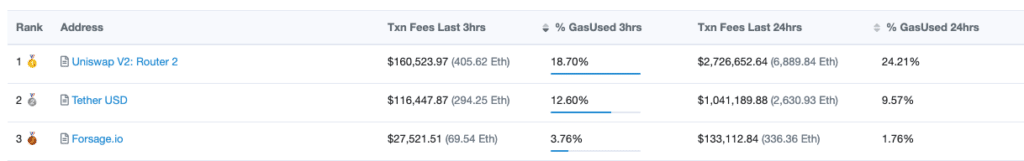

We can see that Uniswap is driving the gas usage of Ethereum.

Source etherscan.io:

Institutional Update

In what seems like a world away from the Defi meme driven craze, institutional acceptance for Bitcoin has continued to gain momentum. MicroStrategy, a Nasdaq listed business intelligence company, made it public that they have purchased 21,454 bitcoin. CEO of Microstrategy Michael J. Saylor stated “Our investment in Bitcoin is part of our new capital allocation strategy, which seeks to maximize long-term value for our shareholders.”

GSR trader Micah Erstling told Forbes “[MicroStrategy’s bitcoin purchase] serves as further confirmation of the institutional investment thesis of betting on bitcoin as a hedge to stimulus printing as well as global political and economic uncertainty,”

“MicroStrategy has recognized Bitcoin as a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash…and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.”

The move could give the green light to other institutions looking at taking the first step into the market. Additionally, a SEC filing published on Wednesday the 26th of August from Fidelity Notice of Exempt Offering of Securities (Form D) filing for a new bitcoin fund. Fidelity Digital Assets, the cryptocurrency arm of Fidelity Investments, will custody the fund.

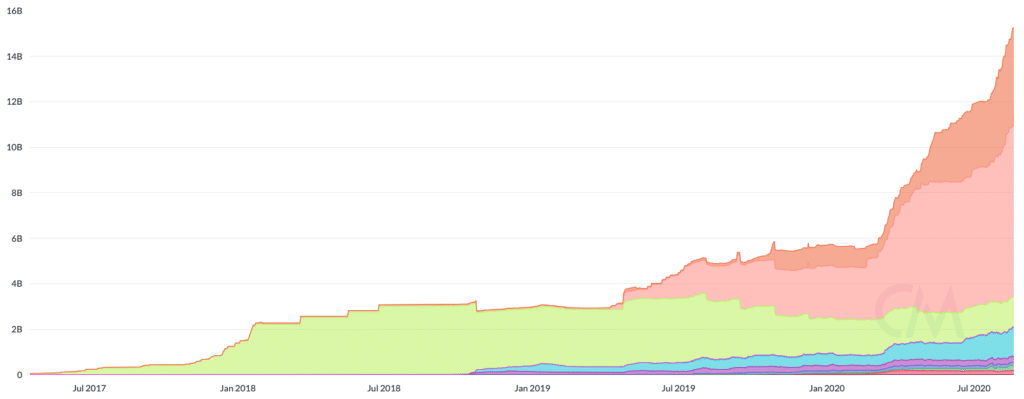

Stablecoins Continue to Grow

Away from all of the Defi drama, stablecoin volumes have been quietly reaching new heights. They have been adding $100m a day since mid July.

Stablecoin Growth, source Coinmetrics, h/t Nick Carter

GSR Update

GSR on Fox Business

In early August, GSR co-founder Rich Rosenblum talked to Fox Business about the value of bitcoin in recent weeks and the growing popularity of decentralized finance.

Copper Product Development

Copper announced an exciting new feature their ClearLoop trading infrastructure. For the first time, crypto derivatives can be traded OTC with dramatically reduced exchange & operational risk – creating an improved & strengthened marketplace for all. GSR, served as a key advisor in the product design process.

Suku Partnership

GSR has partnered with SUKU as a market maker and to assist with the formation of the SUKU OTC market. SUKU leverages decentralized finance (DeFi) protocols to enable transparency in supply chains and provide financial tools to disadvantaged suppliers.

Derivatives Deep Dive with Deribit

GSR’s Jakob Palmstierna joined CCO Luuk Strijers and industry leaders to discuss options growth, marketing making and trading strategies.

Reports, market reports, and other information (“Information”) provided by GSR or its affiliates have been prepared solely for informative purposes and should not be the basis for making investment decisions or be construed as a recommendation to engage in investment transactions or be taken to suggest an investment strategy in respect of any financial instruments or the issuers thereof. Information provided is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services and is not a recommendation to buy, sell, or hold any asset. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page. Trading from Singapore, please review The Monetary Authority of Singapore (MAS) compliance note.