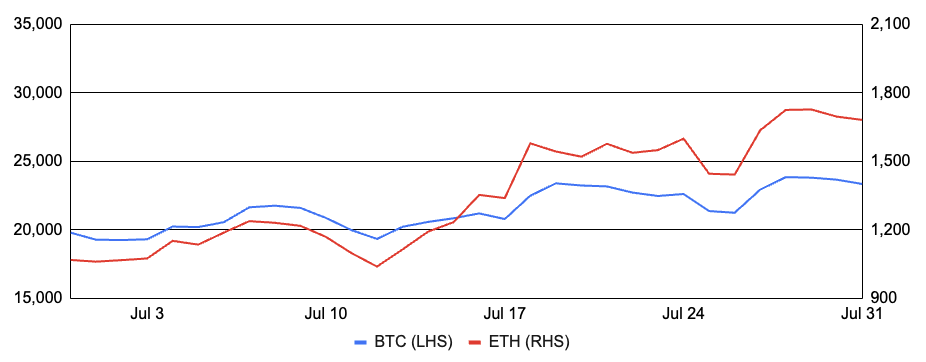

Bitcoin reversed its three-month downtrend, gaining ~18% during the month after entering around $19,800 and finishing near $23,300. While the macro backdrop continued to be challenging with rising inflation and negative growth in many jurisdictions, risk assets generally performed well, as the market appears to have priced in these economic developments. One particularly notable headline was Tesla’s announcement that it sold nearly $1b of bitcoin or ~75% of its total holdings. Elon Musk clarified that the sale was intended to improve Tesla’s cash position amidst uncertainty around Covid-19 restrictions in China and should not be interpreted as a “verdict on bitcoin.” While the precise timeline of the sale is not clear, the sale appears to have preceded the insolvencies of Celsius and Three Arrows Capital (3AC), as the average selling price reported in the SEC filing aligned with an early June timeline. Looking at Bitcoin mining, difficulty has fallen in each of the last three adjustments. This included the most significant decrease of the year on July 21st, which was likely attributable to several large Texas miners shutting down to help stabilize the grid during a heat wave mid-month. In addition, Core Scientific, Marathon, and Compass all announced deals securing additional hosting capacity, and Samsung announced that it’s working on a new 3-nanometer chip expected to improve mining efficiency by ~45%. Other notable bitcoin-related news included: NYDIG partnered with the New York Yankees to allow players and employees to receive portions of their salary in bitcoin; Hyuosung America partnered with DigitalMint to enable bitcoin purchases at the firm’s 175,000 ATMs across the U.S.; Honduras unveiled “Bitcoin Valley” where many businesses in the city of Santa Lucia are aiming to integrate bitcoin payments; 21Shares launched risk-controlled BTC and ETH ETPs that target 40% volatility through dynamic rebalancing with cash; and, the ECB hinted that a proof-of-work mining ban is “probable” by 2025 due to environmental concerns.

After underperforming for several months, Ethereum reversed course and materially outperformed bitcoin, gaining ~58% after entering July around $1,050 and ending the month around $1,700. Ethereum’s progress towards The Merge continued to be the highlight of the month as developers confirmed their expectation for mainnet to merge on or around the week of September 19th. In preparation, developers successfully merged the Sepolia testnet and further deployed additional shadow forks in the month, reaching ten mainnet shadow forks in total. In a final test before the merge, developers aim to merge the Goerli testnet with its associated Beacon Chain, Prater, in two parts between early and mid-August. Assuming no unforeseen issues with the Goerli merge, many expect more precise details, such as the total terminal difficulty level for mainnet, which acts as the triggering device for The Merge, to come shortly thereafter. Continued progress around The Merge has spurred demand for calls and pushed ether option open interest to a record high. Late in the month, a well-known Chinese Ethereum miner and early Ethereum Classic backer, Chandler Guo, revealed his intent to fork Ethereum to maintain a proof-of-work version. His ability to deliver on the proposal, however, remains to be seen, as many bluechip protocols will likely continue to support the Ethereum Foundation’s roadmap, a point that Tether’s CTO confirmed on Twitter. Beyond The Merge, there were multiple big announcements from Starkware, zkSync, Scroll, and Polygon in the zero-knowledge rollup space, as well as announcements from Aave, Curve, and Circle on the stablecoin front, with more on both below. Other notable Ethereum-related news includes: Deposits in the Ethereum staking contract breached 13m ETH; staking company Figment revealed plans to support MEV after The Merge; and, ether held on exchanges hit a four-year low.

BTC and ETH

Source: Sansheets, GSR

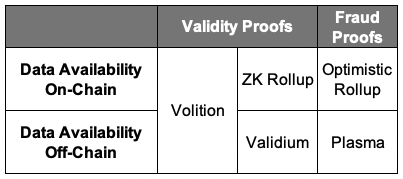

Rolling with Rollups

Rollups are a set of layer two (L2) scaling solutions that attempt to improve Ethereum’s traditionally slow transaction processing speed and typically high transaction costs. Rollups do so by bundling together multiple transactions, aggregating and executing them in batches off of the Ethereum mainnet (L1) before posting a smaller amount of data back to mainnet, allowing them to inherit the security guarantees of the L1. Optimistic Rollups (OR) and Zero-Knowledge Rollups (ZKR) are the two standard categorizations of rollups, though rollups can be further decomposed based on variables such as those surrounding data availability. At a high level, ORs and ZKRs both periodically publish state roots to mainnet, but the two solutions leverage different approaches to ensure that the batched set of transactions has been executed correctly and that its published state is accurate. ORs rely on economic incentives, and the posted state root is optimistically assumed to be valid, but any user can verify the state root’s accuracy and submit a fraud proof if the state transition was done incorrectly to earn a reward at the expense of the L2 operator (sequencer). Conversely, ZKRs rely solely on advanced cryptography, posting its state root alongside a validity proof which cryptographically verifies that the state transitioned correctly without ever revealing the underlying transactions. For more information on scaling solutions, please see our post On the Road to Mass Adoption with Ethereum Scaling.

July was a big month for rollups, particularly those in the ZKR category, with several projects announcing EVM-compatible ZKR solutions. Unlike ORs like Arbitrum or Optimism, which are by design compatible with the Ethereum Virtual Machine (EVM; the part of the Ethereum protocol that processes transactions), ZKRs are not readily EVM compatible. For example, StarkNet, a leading ZKR L2 platform, runs bytecode compiled from StarkWare’s internally developed smart contract programming language, Cairo, distinct from the EVM bytecode run by Ethereum. Cairo is not natively EVM compatible, and there are valid concerns around losing the network effects of a more familiar programming language like Solidity, which compiles to EVM bytecode. Projects like Nethermind’s Warp are being developed to solve Cairo’s lack of EVM compatibility by building a Solidity to Cairo transpiler. Still, this issue has inspired many teams to build a zkEVM that provides the benefits of ZKRs without requiring developers to materially adapt their existing EVM-based smart contracts. While no mainnet zkEVM exists today, Polygon, zkSync, and Scroll all announced in July that they would be the first project to release a zkEVM. zkSync appears likely to be ahead from a launch timing perspective, as its testnet has been live for more than six months and it has promised a mainnet launch in less than 100 days. Conversely, Polygon’s first testnet isn’t expected until later this summer, and Scroll just announced its private pre-alpha testnet. However, these announcements have started a debate within the Ethereum community around what technically constitutes a zkEVM and the tradeoffs between the different approaches used by ZKR providers. With that said, the competitive positioning of the various providers continues to evolve given the nascency of the technology.

Elsewhere in the ZKR space, StarkWare revealed details about its path to decentralization, announcing the launch of the StarkNet Foundation and the StarkNet token. Ten billion StarkNet tokens have been initially minted off-chain and allocated among StarkWare investors (~17%), core contributors (~33%), and the StarkNet foundation (~50%). The StarkNet token is targeting a September launch, and it will be used to govern the StarkNet blockchain, pay for transaction fees, and participate in consensus. In the OR category, Arbitrum launched its Aribtrum Nova blockchain on mainnet, leveraging its AnyTrust technology catering to gaming and social use cases. Additionally, Optimism’s TVL doubled during the month in large part due to growth from Velodrome, a new AMM recently launched on the network.

Variations Amongst Layer 2 Scaling Solutions

Source: StarkWare, GSR

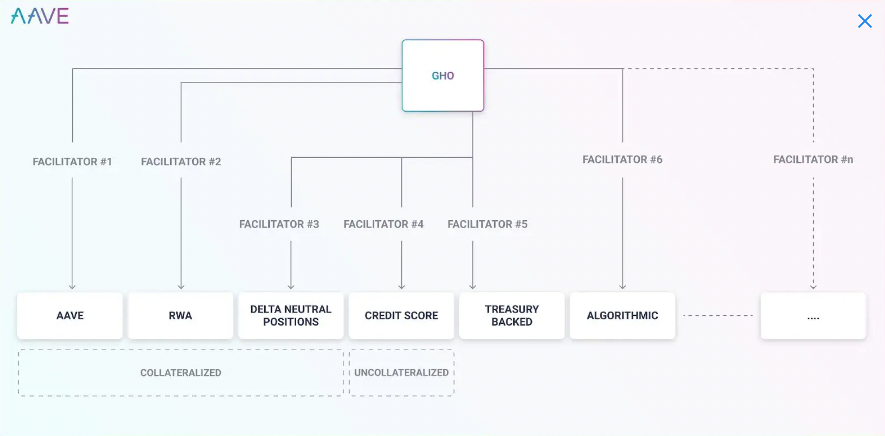

DeFi-native Stablecoins

July also saw a significant amount of stablecoin-related news as multiple bluechip protocol team’s revealed plans to launch a stablecoin. Decentralized lending protocol Aave, for example, announced plans early in the month to introduce the GHO stablecoin, and a snapshot proposal greenlighting its implementation received overwhelming support on the last day of July. Like MakerDAO’s DAI, GHO is an asset-backed stablecoin that users can mint backed by their collateral supplied on Aave. When the user repays the loan, the borrowed GHO will be burned, and the interest will be paid to the Aave DAO treasury. Additionally, AAVE holders that received stkAAVE for locking their tokens in the protocol’s safety module will be able to borrow against their stkAAVE at a discounted borrowing rate. This feature should attract more funds to the protocol’s safety module, which acts as an insurance fund in the case of a shortfall event, improving the overall security of Aave. The proposal also introduced the idea of ‘facilitators,’ which are Aave governance-approved entities that can manage the minting and burning of GHO tokens subject to the governance-approved limits for a particular facilitator. The Aave market on Ethereum is the first and only approved facilitator based on the recent snapshot vote. Still, Aave governance can vote to approve different facilitators, potentially opening up markets around borrowing on real-world assets, uncollateralized positions based on credit scores, or any other community-approved lending activities. GHO also has multichain ambitions, and in the future, it will look to leverage Aave V3’s portal feature to allow for the trustless distribution of GHO tokens across multiple blockchain networks.

Not to be outdone, decentralized stable swaps platform Curve followed Aave’s lead as its founder confirmed later in the month that an overcollateralized stablecoin was in the works. While details remain sparse, some have speculated that the stablecoin will be backed by Curve liquidity provider (LP) tokens, which are effectively receipt tokens representing a share of deposited liquidity in a particular Curve liquidity pool. The stablecoin could potentially look similar to Abracadabra’s MIM stablecoin, which uses interest-bearing LP tokens on protocols like Curve, Convex, and Yearn as collateral to back the issuance of MIM.

Circle, the company behind the industry’s second largest stablecoin USDC, increased its transparency during the month by issuing its first full monthly breakdown of reserve assets backing USDC as well as a complete list of its reserve custodians. The report stated that USDC is fully backed by a mix of cash and U.S. Treasury Bills with less than three months to expiry. Elsewhere in stablecoin-related news: the U.S. stablecoin bill was pushed back until after the August recess; the U.K. revealed plans to introduce stablecoin legislation by August; the Financial Stability Board (FSB) pledged to present stablecoin regulatory approaches in October to the G20 Finance Ministers and Central Bank Governors; Blackfridge launched poundtoken, the first British-regulated, fully-collateralized stablecoin pegged to the GBP; Brazilian fintech firm PicPay revealed plans to launch a Brazilian real-backed stablecoin; and, Shiba Inu developers announced plans to expand the meme ecosystem with the launch of its stablecoin, SHI.

GHO’s Facilitator Model Illustrated

Source: Aave, GSR

Celsius Lawsuit

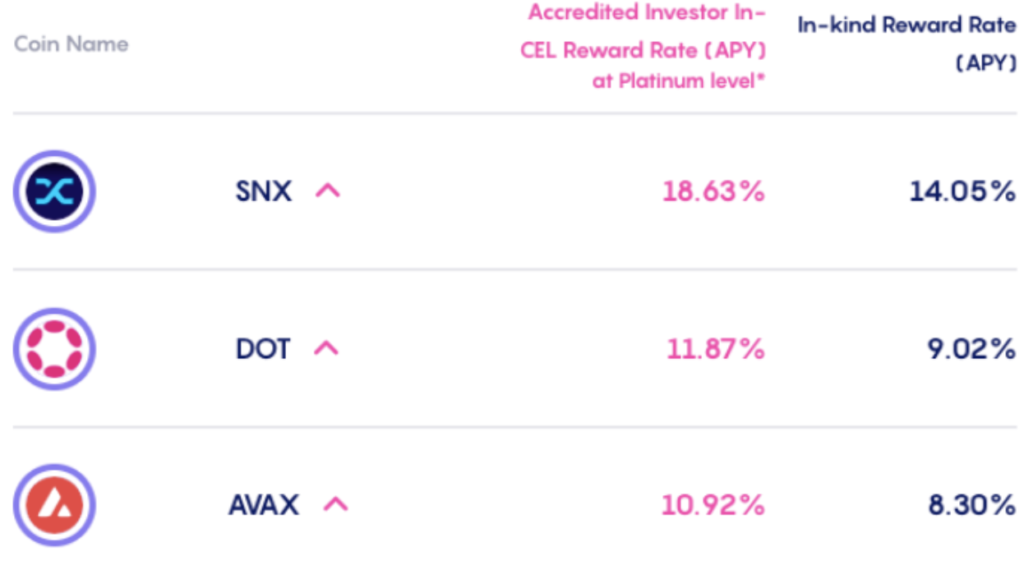

Since covering the collapse of Celsius and 3AC in detail in our last monthly update, pseudonymous DeFi whale, 0xb1, filed a lawsuit against Celsius that claimed he had managed nearly $2b of assets on Celsius’ behalf, and which further detailed the company’s inner workings. While the claims are unproven, it paints a picture of reckless disregard for client deposits, material accounting issues, and outright market manipulation. The suit states that Celsius used customer deposits to buy the Celsius token (CEL), a token which customers often elected to have their interest payments denominated in to receive boosted rewards, inflating the price of CEL and allowing the company to pay out fewer CEL tokens to its users in rewards. The suit further alleged that the company accounted for its customer deposits in USD, which are liabilities to Celsius, despite the real liabilities being denominated in various cryptocurrencies such as BTC or ETH. This left the company with a relatively market-neutral exposure from an accounting perspective, but economically speaking, Celsius had a short crypto exposure. The plaintiff claimed this simple accounting error and misunderstanding of directional risk resulted in Celsius accruing a hundred-million-dollar deficit by early 2021, well before the company’s issues publicly surfaced.

Snapshot of Boosted Rewards for Holding CEL Tokens

Source: KeyFi versus Celsius court documents, GSR

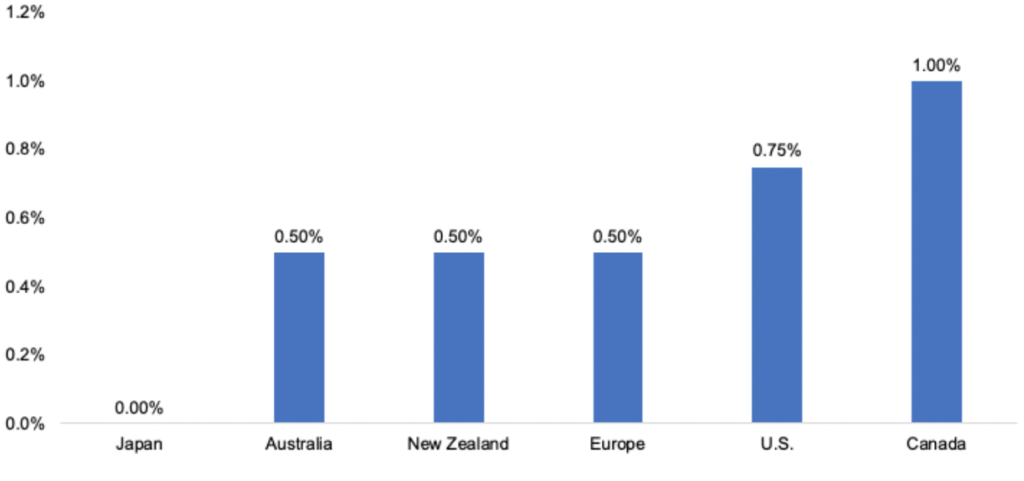

Attempts to Tame Inflation

Monetary tightening continues to be the theme amongst developed economies battling inflation globally. For example, the Fed implemented its second consecutive 75-basis-point rate hike, as inflation in June reached a 40-year high of 9.1% and exceeded expectations. The target Fed Funds range is now 2.25% to 2.50%, the highest level since 2018. Meanwhile, U.S. GDP fell by 0.9% in Q2, its second consecutive quarterly decline, marking a recession by one common, yet still debated, measure.

The ECB also hiked rates during the month, which was the first time it had done so in eleven years. While the hike was expected, the magnitude surprised to the upside as it raised rates by 50 basis points, increasing rates from negative territory back to zero. Canada also implemented a 100-basis-point rate hike, similarly exceeding expectations and amounting to its largest in 24 years. Australia and New Zealand continued their hiking trajectory, in line with expectations, while Japan continued to stick out from the pack, maintaining its dovish policy.

Developed Economy Interest Rate Hikes in July

Source: Investing.com, GSR

Authors:

Matt Kunke, Junior Strategist | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Telegram, LinkedIn

GSR in the Media

- Barron’s – Bitcoin Soars, but Don’t Get Excited

- Blockworks – Funding Roundup: Some $300 Million Poured into Crypto Projects Last Week

- CoinDesk – Decentralized Crypto Exchange Hashflow Raises $25M at $400M Valuation

- Reuters – Cryptoverse: The bonfire of the NFTs

- Yahoo! Finance – Bitcoin briefly regains $24,000 as crypto markets continue rally

Disclaimers: “This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report. This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.”