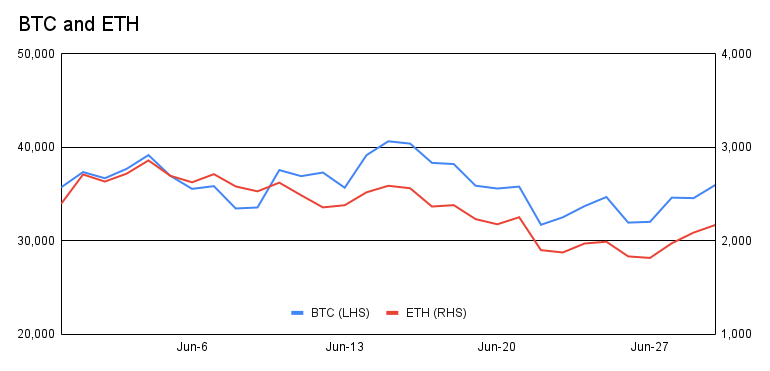

After a rough May that saw renewed regulatory pressure, increased environmental concerns, and critical Elon Musk tweets, June was similarly busy, but at least a little more balanced. This caused Bitcoin, which opened the month at $37,300 to trade as high as $40,900 and as low as $29,700, but to finish the month down a resilient and relatively unchanged 6% to $35,200.

Ethereum fell a bit more, opening the month at $2,700 and trading as low as $1,750 before closing the month down 16% at $2,300.

BTC and ETH price action for June, source CoinGecko:

Regulatory Pressure

The declines were caused by what seemed like an endless deluge of regulatory pressure, with China taking center stage and various others participating.

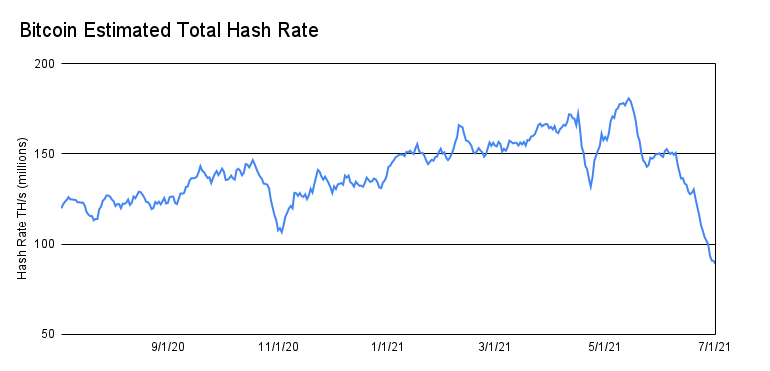

On the mining front, authorities in China halted mining in four provinces and instituted restrictive regulations in a fifth. Importantly, the crackdown doesn’t appear directly related to environmental concerns as even mining in hydro powered Sichuan was banned. As a result, miners fled the country, moving to the likes of Kazakhstan and the US, with the movement causing a severe decline in the hash rate. While a short-term negative given the disruption and reduced hash rate, the miner exodus from China is likely a long-term positive, as it demonstrates the robustness of the network, removes a long-standing overhang, and will be a net positive for the environment.

Bitcoin estimated total hashrate, source Blockchain.com:

Other crypto participants in China were not spared, as the PBOC told major banks and payments platforms to stop providing digital currency trading, clearing and settlement services. These pressures caused companies to announce more restrictive measures, from Huobi prohibiting users in China from trading derivatives to AgBank stating it will vigorously vet clients for illegal crypto activities to internet companies Baidu and Weibo appearing to censor keyword searches for major crypto exchanges.

South Korea also witnessed more restrictions, with its Financial Services Commission issuing new guidelines for crypto exchanges, banks reportedly reassessing their relationships with crypto exchanges amidst the uncertainty, and a number of Korean crypto exchanges delisting or warning against numerous tokens.

The UK and Canada also got into the act, with the UK telling Binance to halt its regulated activities and seeing many crypto companies abandon their bids to register with the FCA, while the Ontario Securities Commission in Canada has called out for alleged violations or caused reduced services from KuCoin, Bybit, and Binance.

Legal Tender

While the regulatory pressures mounted, June did have its fair share of good – even historic – news. Case in point is El Salvador, which officially made Bitcoin legal tender. The new law requires merchants to accept bitcoin as payment, includes zero capital gains taxes on Bitcoin, and allows tax payments to be made in Bitcoin. The government is also releasing a new interoperable and commission-free Bitcoin wallet (along with $30 in BTC for every citizen who downloads it!). Following El Salvador’s monumental move, legislators from several other Latin American countries including Paraguay, Mexico, and Panama threw their support behind the cryptocurrency.

Bitcoin also saw its Taproot upgrade achieve the required 90% of its mining hash rate signal for the protocol improvement. The upgrade, which will be the biggest in years, replaces Bitcoin’s current elliptic curve digital signature algorithm with Schnorr signatures, which in turn will increase privacy and efficiency and unlock the potential for smart contracts. The upgrade is slated to take effect in November.

Not to be outdone, Ethereum took a major step forward with its London hardfork, which launched on the Ropsten testnet last week. The London hardfork includes five improvement proposals, including the highly anticipated EIP-1559 that overhauls Ethereum’s gas fees and includes fee burns which could make Ethereum deflationary. The upgrade is expected to progress through various testnets at roughly weekly intervals before a firm date for mainnet deployment is chosen.

Lastly, corporates continued to demonstrate their interest in digital assets last month, whether it was from traditional financial companies such as Visa, Mastercard, Citigroup, BBVA, and State Street entering or beefing up crypto capabilities, investment and asset management companies like Point72, Soros Fund Management, and Blackrock having interest or already participating in the space, or continued direct investments such as additional Microstrategy Bitcoin purchases or multiple daily venture capital-backed fundraising rounds by crypto start-ups.

GSR Update

GSR has had another busy month of growth, onboarding many new crypto market making and OTC clients and deepening our talent pool. GSR is pleased to welcome Eva Sanchez, former AQR Capital Management general counsel, as GSR’s first Chief Legal Officer, as well as former JPMorgan compliance executive Eugene Ferrara as Chief Compliance Officer.

GSR in the Media

CNBC: GSR: The Big Drop in Cryptocurrencies Has Knocked A Lot of Leverage Out of the System

Bloomberg Law: Digital Asset Platform GSR Taps Hedge Fund for First Legal Chief

The Block: Crypto Market Maker GSR Goes Carbon Neutral, Including For its Bitcoin Mining Business

The Block: Crypto Market Maker GSR Goes Carbon Neutral, Including for its Bitcoin Mining Business

Reports, market reports, and other information (“Information”) provided by GSR or its affiliates have been prepared solely for informative purposes and should not be the basis for making investment decisions or be construed as a recommendation to engage in investment transactions or be taken to suggest an investment strategy in respect of any financial instruments or the issuers thereof. Information provided is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services and is not a recommendation to buy, sell, or hold any asset. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page. Trading from Singapore, please review The Monetary Authority of Singapore (MAS) compliance note.