Author: Brian Rudick, Senior Strategist

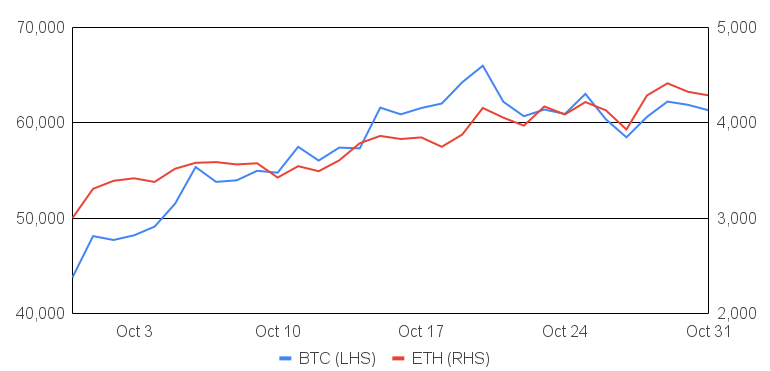

Bitcoin turned in its best monthly performance since December 2020, entering the month around $43,800 and finishing at $61,300, for a 40% increase during October. The main highlight of the month was the resoundingly successful launch of ProShares futures-based Bitcoin Strategy ETF, which debuted on October 19th and set a record for the highest natural first day trading volume in US ETF history (more on this below). Other important highlights include rising network transaction volumes, growing Lightning Network users, positive seasonality, and the coming Taproot upgrade, which is slated to be the network’s biggest upgrade in years.

Ethereum had a similarly strong 43% return during the month, having entered October at $3,000 and finishing at $4,300. The network’s Ethereum 2.0 Altair Beacon Chain update, which was activated successfully on Oct 27th and is considered a low-stakes warm up to Ethereum’s transformation to proof-of-stake consensus, brought about two important changes in additional light client support and increased penalties for being offline. Additionally, Ethereum Foundation community manager Tim Beiko believes the ETH 2.0 code could be completed by February, putting the network’s mainnet merge with the beacon chain PoS system around May or June of next year. Other items likely contributing to Ethereum’s strong performance are a rising TVL, continued record daily burns, and the potential for an ether US ETF.

BTC and ETH

Source: Sansheets, GSR

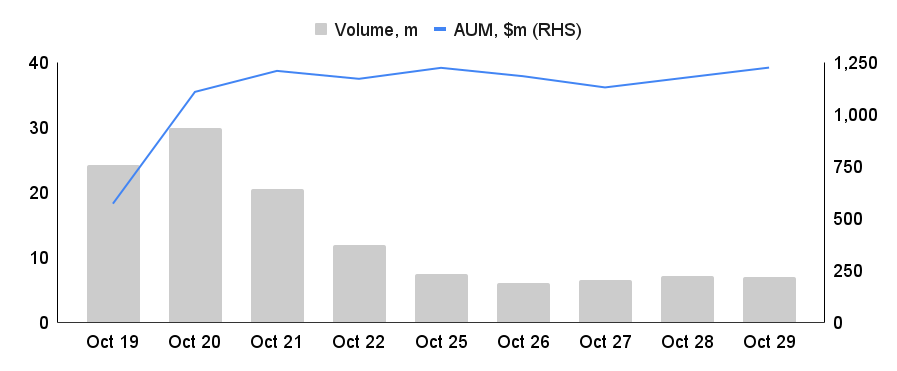

Bitcoin ETF

As mentioned above, the highlight of the month was the resoundingly successful launch of the ProShares Bitcoin Strategy ETF ($BITO), the first launch of a Bitcoin ETF in the US. Years in the making, the launch did not disappoint, as day one trading volume reached ~$1b, a record for the largest natural debut in ETF history. The fund has been so successful that it has now amassed ~$1.3b in AUM and is close to hitting the CME’s cap for Bitcoin futures positions. Additionally, Valkyrie debuted its Bitcoin futures ETF on October 22nd and there are over 40 other Bitcoin ETF applications pending, including Grayscale’s proposal to convert its $40b closed-end Grayscale Bitcoin Trust ($GBTC) into an ETF. We detail our full thoughts on the pros and cons of a futures-based ETF as well as what may come next in our recent chart of the week What a Futures-Based ETF May Mean for Bitcoin.

ProShares Bitcoin Strategy Fund

Source: ProShares, Yahoo Finance

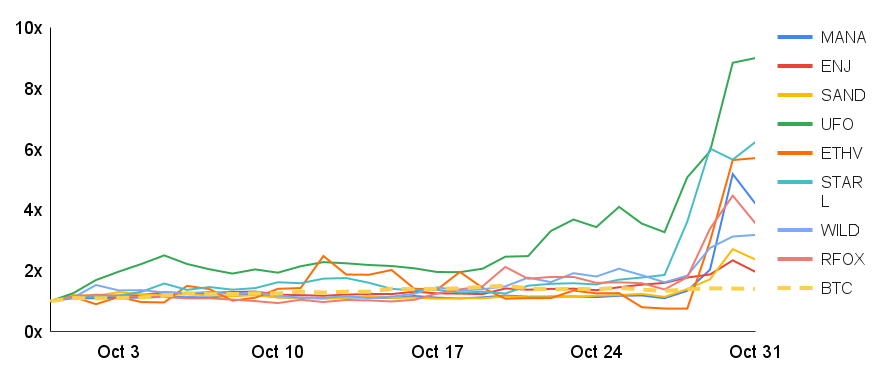

Memes & Metaverse Lead the Way

Two categories that broke apart from the pack during October were memecoins and metaverse tokens. Within the former, Shiba Inu has been the headliner, increasing over 9x during the month to crack into the top ten digital assets by market cap and overtake Dogecoin as the top memecoin. A tweet from Elon Musk featuring a picture of his new Shiba Inu puppy seemed to kick off the phenomenal rise, with speculation that Robinhood may list the asset and the launch of the Shiboshis Social Club and Shiba Inu-generated NFTs also contributing. Many smaller memecoins also skyrocketed during the month as investors looked to find the next Shiba Inu, such as Dogelon Mars (ELON; up +44.0x on the month), Baby Doge Coin (BABYDOGE; +6.0x) and Floki Inu (FLOKI; +5.2x)

Metaverse-related tokens have also been particularly strong, with their breakout occurring after Facebook revealed its vision to bring the metaverse to light, complete with changing the company’s name to Meta to better reflect this focus. Facebook believes the metaverse is the successor to the mobile internet, and will usher in new forms of socialization, entertainment, gaming, exercise, work, education, and commerce. Many metaverse tokens increased 2-4x post Facebook’s Thursday announcement through October end, including MANA, STARL, ETHV, UFO, RFOX, SAND, and WILD.

Metaverse Token Performance

Source: Santiment, CoinGecko

On the Verge of Regulation

State and international regulatory bodies continued to make progress on cryptocurrency regulations during the month. The Financial Action Task Force (FATF) updated its 2019 guidance, where it noted a lack of Travel Rule implementation, pushed for countries to adopt crypto regulations, and mentioned NFTs, DeFi, P2P trading, and stablecoins for the first time. On the national front, the Bank of Spain opened a registry for crypto-service providers, the Indian securities market regulator (SEBI) banned advisors from dealing with unregulated assets, the Dubai Financial Services Authority launched a framework for investment tokens, and the US Treasury’s Office of Foreign Assets Control (OFAC) released new crypto industry sanction guidelines.

Despite the regulatory progress in October, it feels like we’re on the verge of much more. Indeed, India’s crypto law is now expected to come in February 2022, the Pakistani high court ordered the government to regulate crypto within three months, US banking regulator the OCC added crypto to its 2022 bank supervision operating plan, Australia plans to create crypto legislation soon, and South Korea has also hinted at forthcoming regulations. But perhaps the most anticipated was the US Treasury’s Report on Stablecoins, released on November 1. The report analyzes prudential risks posed by stablecoins used for payment and provides recommendations to address gaps. It asks Congress to promptly enact stablecoin legislation to address risks to users and guard against runs, address concerns about payment system risk, and address additional concerns about systemic risk and concentration of economic power, before outlining actions the agencies can take in the immediate term while waiting for Congress to act.

GSR Update

- GSR has appointed Jake Dwyer to lead its rapidly expanding DeFi business, which now trades more than $1b daily on decentralized exchanges. Mr. Dwyer will continue spearheading the strategic direction of GSR’s DeFi business line, which offers key products including liquidity seeding, market access, market liquidity, and treasury management.

- GSR joined the President’s Circle of The Chamber of Digital Commerce, a leading trading association representing the digital asset and blockchain industry.

- GSR attended several industry conferences in October, including The Trading Show, Token2049, Gulf Blockchain Week, World Blockchain Summit, Medici, and Money 2020.

- GSR participated in several funding rounds last month, acting as a strategic partner to GooseFX, ZKLink, Derived, Minima, and Swivel Finance, among others.

GSR in the Media

- GSR Turns Up DeFi Activity in Strategic Shift

- The Block: Why the largest crypto trading firms are becoming venture capitalists as well

- Blockworks: When Could an Ethereum Futures ETF Hit the US Market?

- Business Insider: An ethereum-based ETF may come as soon as this year, but other altcoin funds will have to wait, an expert says

- Coindesk: Dying for a Bitcoin Futures ETF? Watch Out for ‘Contango Bleed’

- City Am: Banks increasingly keen to enter crypto space say industry experts

- Yahoo Finance: Bitcoin Peeps Above $56K, May Ignore US Jobs Report

To download the October 2021 Market Update, click here.

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report. This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.