Alongside its unique challenges, 2020 presented a wealth of growth opportunities for GSR and the digital asset market.

We are proud to say that we seized upon many of those opportunities, strategically navigating a tumultuous environment and emerging with an even stronger leadership position in the market. We captured momentous growth across the board, from our trading operations’ reach and activity to the quantity and strength of our partnerships and client relationships.

As the new year begins, we wanted to share a few highlights from the year and offer reports on what may lie ahead for our industry in 2021.

Trading: Record volumes, exciting partnerships

Throughout 2020, GSR played a substantial role in the over-the-counter options market, leveraging our seasoned team’s extensive domain knowledge to further build out our offerings and extend our foothold in this fast-growing space.

Derivative volumes grew rapidly as institutions and others sought alternative means of exposure to cryptocurrency assets. However, exchange-listed options can be relatively limited in their scope. With markets maturing, a need emerged for contracts with greater flexibility. GSR was highly successful in attracting market participants looking for custom products. This includes Bitcoin and Ethereum miners that have specific hedging needs which are not well served by listed derivatives due to the fluctuating dynamics between electricity rates, underlying asset prices and network hash rate. Our custom products trading activity with the mining community alone surpassed an annualized run rate of $250M by the end of 2020. For multiple periods throughout the year, GSR’s BTC options’ total daily open interest surpassed CME-listed options.

The company also facilitated multiple options markets for altcoins, as a growing number of projects and investors require bespoke products to manage their unique risks and exposures. GSR executed over $1 billion worth of such custom contracts in 2020.

Growing in tandem, GSR continues to expand its market-making business year-on-year, supplying hundreds of millions of dollars of robust liquidity to the crypto ecosystem daily.

All in all, GSR recorded its most successful year of trading to date, with annual volumes far surpassing previous records. The team now manages a significant book of complex options risks, one of the largest in digital assets.

Additionally, GSR expanded its partnerships within the exchange and projects ecosystem, working with exciting marketplaces such as Crypto.com and Coinlist and adding industry-leading innovators such as Ocean, Aragon, Algorand and Filecoin as liquidity partners.

Business: A rapidly growing footprint

With business and trading activity growing rapidly, GSR continued to invest in its personnel, adding over 25 professionals to the team, which is now fast approaching 100 people globally. Many of these additions were made to help drive ongoing expansion in key regions and to support the company’s ongoing commitment to technological excellence. Indeed, the bulk of these new hires were in the engineering and software development teams.

Technology: A focus on scale

As volumes peaked and volatility spiked, GSR was well positioned to handle the market’s needs.

Many of our technological investments in 2020 focused on ensuring scalability and robustness, in time for March’s dramatic swings and well ahead of the cryptocurrency bull run later in the year. Specifically, GSR deployed three new AWS regions and increased capacity by 500CPUs.

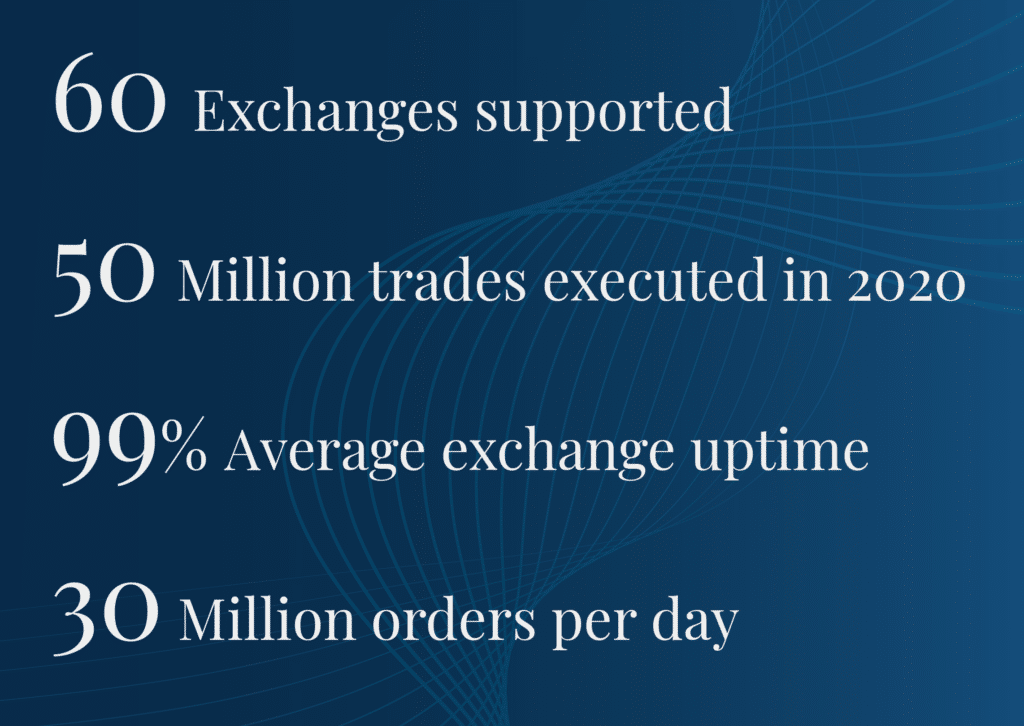

GSR’s trading platform maintained 99% uptime throughout 2020 and efficiently handled the biggest trading days in crypto market history. Our trading platform and systems have scaled to comfortably trade over half a billion dollars of crypto assets in 24hr periods, ensuring liquidity is seamlessly pooled from a global market that is still fragmented.

Today, we are integrated into over 60 trading venues, giving our trading counterparties unrivaled global market access as well as an operational consistency that few other platforms can match.

Looking towards 2021

The cryptocurrency market is showing no sign of slowing down. Bitcoin has made a momentous start to the year, breaching $30,000, then $40,000 in quick succession. Additionally, the overall market cap of cryptocurrencies has broken through $1 trillion for the first time, a landmark moment that has many skeptics starting to acknowledge the validity of the asset class.

In 2020, we saw global socio-economic turmoil – and related monetary policy actions – push institutional investors to finally make the plunge into digital assets. Along with a continuation of the same fundamentals that have driven the market to new highs, we can anticipate some developments that may characterize the market in 2021:

More institutional allocators…

On the heels of top hedge fund managers, major institutions entered the Bitcoin market in the latter half of 2020. In December alone, MassMutual and Ruffer Investment disclosed their allocations, while the global investment manager Guggenheim revealed the possibility of a sizable investment.

What is notable is that, given the size of these firms, investment decisions would have been made many weeks and months prior due to the lengthy compliance, legal and analytical processes that must occur.

While hedge fund managers like Paul Tudor Jones are nimble and can be mercurial, investment managers like Guggenheim tend to move more steadily, their potential entry is monumental for the industry. When major institutions enter, others inevitably follow, and this alone bodes well for Bitcoin’s trajectory.

…and more institutional interest in Ethereum

As Bitcoin climbs higher, investors tend to cycle out of the asset into other cryptocurrencies. It is possible that institutions will begin exploring the possibility of doing the same.

The CME expects to launch Ether futures in February 2021, further expanding the accessibility of ETH to institutional investors. The Grayscale Ethereum Trust now sits at $3bn – well behind the $21 billion tally of its Bitcoin equivalent, but fast gaining traction.

Given the growth seen in institutional-grade investment vehicles and trading products, one wonders whether this could be the year that a Bitcoin ETF is finally launched. The demand is certainly there.

Listed options for Altcoins

Unlike the ICO craze of 2017-18, the teams behind many current popular projects are more strategic – they have sought to preserve and grow their capital to help propel their ecosystems’ future growth.

Many of these project teams have turned to market makers like GSR to create custom options markets to achieve this. The purpose of these instruments is to mitigate risks and optimize balance sheet efficiency.

We predict that these custom options markets will facilitate liquidity and lay the foundation for what will eventually be listed altcoin products on exchanges.

US miners take a larger slice of the market

In Q2 of 2020, research published by the University of Cambridge stated that US miners controlled 7.24% of hashrate, up from 4% in Q3 2019. Reports have speculated that this share is now closer to 15% – 20%.

With investors like Digital Currency Group putting $100 million into the Foundry, one of the largest Bitcoin miners in North America, it is possible that the US will continue to be more competitive with China’s hashrate. Investment in this industry will bring diversified talent, long-term planning, and a rise in the sophistication of financial products used to manage risk.

The further rise of NFTs

Marketplaces like Nifty, Rarible and Super Rare gained popularity in 2020 as the NFT marketplace has expanded its user base and trading volumes. There is a natural correlation here with the gaming world and sports collectibles. The continued momentum of the Ethereum network will help drive NFT adoption and crypto marketplace liquidity.

Thank You

Our success in 2020 couldn’t have come without the trust that you and our other trading counterparties have put in us to help you navigate the market’s opportunities and challenges. We truly value our relationships as partnerships – and have since we first opened our doors 8 years ago.

We look forward to continuing our work together in the year ahead and wish you much success in this expanding market.