With The Merge successfully behind us, we expect many Ethereum users to begin participating in consensus by staking ETH for the first time. This report provides a practical guide to Ethereum staking, analyzing the tradeoffs between available approaches and providers.

Ethereum Staking 101

One defining characteristic of a blockchain is its consensus mechanism, where a decentralized network of unknown parties agree on which transactions should go into a block and onto the blockchain. Since Ethereum’s successful implementation of The Merge, Ethereum’s mainnet now uses a proof-of-stake (PoS) consensus mechanism to append new blocks to the chain. Nodes participating in PoS consensus are known as validators, and Ethereum validators must run full nodes and stake 32 ETH, proposing a new block when chosen to do so or attesting to the validity of a proposed block when not selected. Validators receive staking rewards for performing this work in a timely fashion. However, by requiring validators to stake ETH, they may also be financially penalized if they perform their responsibilities poorly or even slashed and removed from the network if they behave maliciously. Such actions provide the network with the ever-important function of consensus and at the same time, its security.

While Ethereum users have been able to participate in staking since the launch of the Beacon Chain in December 2020, we expect many new ETH holders to stake for the first time now that The Merge is behind us for a variety of reasons. First, Merge-specific risks are now gone, as the network successfully completed The Merge and finalized its first checkpoint under proof-of-stake on September 15, 2022. Second, staking yields have risen meaningfully as yields now include transaction priority fees and MEV. Additionally, profitable participation in consensus no longer requires the economies of scale inherent to mining that previously barred many normal users. Lastly, should Ethereum staking develop similar to other competing PoS networks such as Solana, Polkadot, or Avalanche, which have about 50-75% of their native assets staked, there is a vast opportunity for growth from the modest ~12% of ETH staked today. Eventually, an equilibrium range will be found, as staking rewards per validator rise (fall) as the number of validators decreases (increases). Today’s attractive yields will likely incentivize much higher validator participation on the way down to that equilibrium yield level.

The remainder of this report dives into the differing approaches to staking on Ethereum, evaluating the tradeoffs between available options. For those interested in better understanding Ethereum’s proof-of-stake implementation, see the Beacon Chain in our most recent report on Ethereum’s roadmap.

Approaches to Ethereum Staking

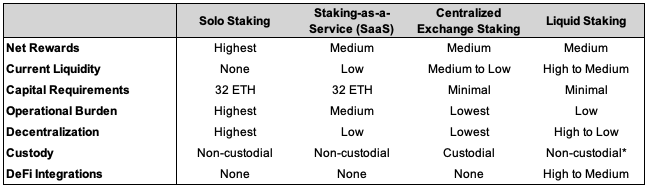

Staking on Ethereum can be bucketed into four primary groupings that include solo staking, using a staking-as-a-service provider, staking on a centralized exchange, or using a liquid staking protocol. Importantly, solo staking is the only Ethereum protocol-native way to stake ETH. Unlike many other PoS chains, Ethereum does not have a notion of delegation or nomination built into the protocol, where one can delegate their stake to another node operator. Hence, all the other categorizations discussed beyond solo staking necessarily incorporate a third-party service provider or a decentralized application built on top of Ethereum.

As suggested by its name, solo staking requires an individual to manage all aspects of staking ETH and participating in network consensus directly. Solo staking requires running a full Ethereum node, which means running and maintaining an execution layer and consensus layer client implementation, as well as depositing 32 ETH to activate a validator client which makes attestations on behalf of the staker. Given Ethereum’s multi-client architecture, solo stakers must select the client implementations they want to run for their execution and consensus layer clients, ideally selecting non-majority clients to mitigate the risks of any correlated failures. Solo stakers need to monitor the appropriate communication channels of the respective client teams to quickly remediate any issues that may arise. Since an offline validator accrues penalties and late attestations can result in decreased rewards or penalties, constant internet connectivity and sufficient bandwidth are required. A dedicated machine may also be necessary depending on one’s existing PC specs. Lastly, solo staking requires adequate knowledge of private key management and custody, as the staker will need to generate and safely maintain the keys associated with their validator.

All else equal, solo staking generally provides the highest returns as the validator isn’t paying fees to an outsourced node operator for managing the operational complexities of staking. Still, it does require some technical wherewithal that can result in lower returns should the staker fail to keep the validator online and performant. Additionally, since MEV will likely contribute a material amount to validator returns moving forward, solo stakers should have a stance on the tradeoffs amongst MEV relays and determine if they want to leverage a service like Flashbots’ MEV-Boost to maximize returns. Lastly, a solo staker’s staked ETH is not liquid or transferable until after the Shanghai hard fork, which is not expected for another six to twelve months. As an added benefit, solo staking is the most beneficial for network health and offers the highest degree of decentralization and security. However, optimizing for return maximization by using services like MEV-Boost, which censor transactions in compliance with relevant government requests, may partially mitigate the decentralizing benefits of solo staking. For those interested in staking ETH directly, Ethereum’s Staking Launchpad and the ETHStaker discord server are two beneficial resources. Also, see the Rocket Pool coverage towards the end of this piece as an alternative to solo staking.

Staking-as-a-service (SaaS) providers assume the operational complexities of managing a validator, typically on behalf of high-net-worth individuals or institutional clients. SaaS providers charge a management fee that is generally some percentage of the staking returns generated, but some providers like Stakefish have experimented with time-based, flat-fee structures. ETH stakers can leverage a SaaS provider on a non-custodial basis, opting to maintain control over their private keys. This can be done as Ethereum validators have two key pairs, a validator key pair for signing block proposals and attestations and a second withdrawal key pair that will allow the validator to withdraw and transfer their staked ETH after the Shanghai hard fork. ETH stakers can leverage SaaS providers while only granting them access to their validator key pair, allowing the provider to sign block proposals and attestations while preventing them from withdrawing or transferring the staked ETH. While this set-up allows ETH stakers to maintain custody of their assets, there are embedded trust assumptions that the SaaS provider will maximize rewards and avoid penalties and slashings. This trust assumption is embedded in all approaches that outsource node management, however. Institutions commonly use SaaS providers to offer staking services to their clients, relying on a white-label solution from a SaaS provider to facilitate their staking offering behind the scenes.

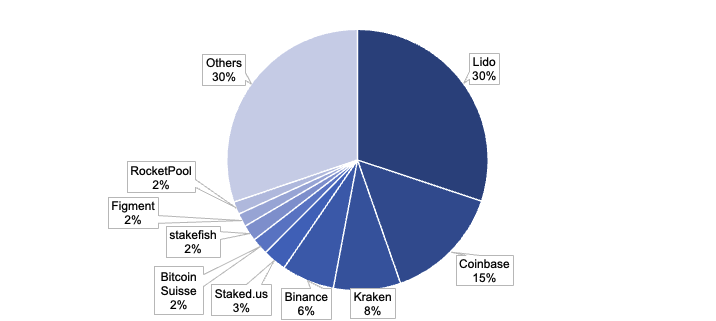

Many centralized exchanges also provide staking services similar to SaaS providers, with a few notable differences. Firstly, centralized exchanges are not running a particular validator instance for any specific exchange-based staker. Exchanges pool together client assets and manage validators on behalf of the pooled ETH in aggregate, allowing users to stake ETH without any account minimums in most cases. Secondly, the assets staked on a centralized exchange are those held in the exchange’s wallet, so this staking method is custodial. Centralized exchanges may additionally create different mechanisms in an attempt to provide liquidity for staked ETH within their centralized ecosystem, but this varies by exchange. For context, Coinbase, Kraken, and Binance are three of the four largest ETH stakers overall, which has engendered centralization fears, particularly in the wake of the U.S. Treasury’s Tornado Cash sanctions.

Liquid staking applications allow users to earn staking rewards with improved liquidity compared to previously covered offerings while still outsourcing the burdensome node management responsibilities. Liquid staking solutions leverage smart contracts on Ethereum to create liquid, tokenized (wrapped) representations of the ETH staked on the Ethereum network. These tokenized staking deposits are frequently referred to as liquid staking derivatives (LSDs), and they represent a tokenized claim or IOU on staked ETH. Similar to SaaS solutions, the ETH staked via liquid staking protocols is outsourced to a third-party node operator or a set of node operators, but additionally, users receive an on-chain LSD in exchange for their ETH deposit. Most liquid staking solutions are non-custodial and rely on smart contracts for custody. They also pool deposits, removing the 32 ETH deposit requirement, which enables smaller ETH holders to participate.

ETH LSDs accrue validator staking rewards, and the LSDs will be directly redeemable for the initially deposited ETH plus accumulated rewards once staked ETH becomes withdrawable. In the meantime, LSDs offer significant utility as they are composable with the rest of the Ethereum DeFi ecosystem, and they can be swapped directly for vanilla ETH on protocols such as Curve or even used as collateral for a loan on lending protocols such as Aave. LSDs will continue to serve an important liquidity function even after staked ETH becomes withdrawable, as there may still be a validator exit queue that could impede access to one’s staked ETH for days or weeks.

Importantly, different LSDs employ different mechanisms for token value accrual. For example, one approach is for validator rewards to accrue directly into the LSD’s price. While this may offer relative tax benefits in certain jurisdictions compared to other mechanisms, the price of the LSD will generally grow faster than the price of ETH, resulting in the redemption value in terms of ETH varying through time (i.e., it will not be one-to-one). In contrast, another method is for validator rewards to bypass price but come in the form of new token issuance, rebasing the LSD’s outstanding supply by the amount of validator rewards through a mechanism analogous to a stock dividend in traditional finance. This rebasing approach is cleaner from a mental accounting perspective, as one’s quantity of the rebasing LSD will grow in alignment with the growth of their staked ETH, resulting in an LSD that is redeemable on a one-to-one basis consistently through time.

Regardless of approach, an LSD’s price is not pegged to ETH in any way, as LSDs are not directly redeemable for ETH today, and there are no arbitrage opportunities upon divergence. Rather, the price of an LSD depends on many factors, including the price of ETH, market sentiment, the LSD’s liquidity, the staking yield, the time until staked ETH is transferable, the mechanism by which rewards accrue, DeFi integrations, smart contract risk, and potentially many other factors. Indeed, an LSD may trade at a discount to the underlying ETH from time to time, as we saw during the market jitters in June.

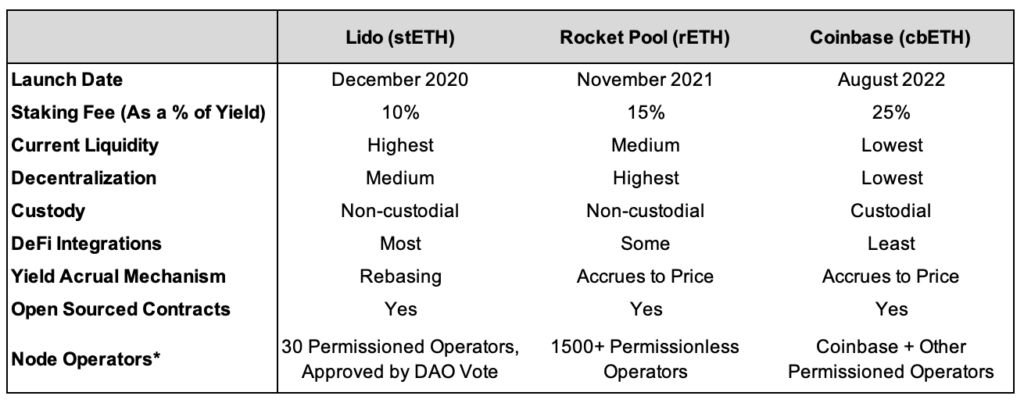

Ethereum’s liquid staking market is dominated by Lido’s stETH today, but Rocket Pool’s rETH is gaining steam, and Coinbase entered the space in August, announcing its cbETH token. Stakewise and Ankr both offer smaller liquid staking solutions as well.

Before diving further into liquid staking, it’s important to clarify that the operations of particular companies may span multiple staking service provider categories previously referenced. Coinbase is one notable example, offering centralized exchange staking, SaaS through their Coinbase Cloud business, and a liquid staking token in cbETH more recently. Additionally, the validators underpinning liquid staking applications like Lido, such as Blockdaemon, Figment, and others, also provide independent SaaS solutions beyond the scope of Lido’s liquid staking solution.

Exhibit 1: Staking Tradeoffs by Category

Source: GSR. Note: This table is a generalization. There are many different providers across SaaS, liquid staking, and centralized exchanges, all with distinct terms and conditions. Additionally, there can be overlap between categories, further complicating categorizations. Hence, this table aims to generalize the tradeoffs broadly across categories. *Liquid staking solutions are typically non-custodial, but there are caveats with Coinbase and other LSDs issued by exchanges.

Liquid Staking Tokens

Lido Finance is the first-to-market liquid staking solution for Ethereum that allows users to earn staking rewards without locking up assets or maintaining staking infrastructure. Lido users may deposit ETH to the Lido smart contract, which it then routes through 30 Lido DAO-approved professional node operators to earn a staking yield. In return for depositing ETH through Lido, the user receives an LSD known as Lido Staked ETH (stETH) that represents a claim on the staked ETH, accrues staking rewards via a rebasing mechanism, and unlike ETH staked to the Beacon Chain directly, can be freely used for other purposes, such as for collateral to borrow funds or to provide liquidity to a decentralized exchange. Moreover, Lido reduces operational risk by distributing pooled user funds to many professional node operators and also aggregates staking token liquidity by alleviating the need for each staking-as-a-service provider to have their own LSD. Lido additionally has the most DeFi integrations of any LSD and enjoys the largest Curve pool by TVL, allowing users to more easily trade stETH for ETH. However, like all LSDs, stETH introduces smart contract risk and the risk that its stETH deviates from the price of ETH. In fact, stETH has rather persistently traded at a discount to ETH since its launch, a feature which adept market participants often monetized by purchasing stETH on DEXs instead of minting it on a one-to-one basis through Lido. Nevertheless, Lido has been so successful that it has captured a 90%+ market share of the ETH liquid staking segment, and roughly one-third of all ETH staked is done through Lido. Despite Lido’s success, it is still the target of many criticisms related to the magnitude of stake controlled by the protocol, sometimes brushing up against the important one-third stake threshold, which could temporarily prevent mainnet finality. Importantly though, Lido relies on a diversified set of node operators, so no individual operator has breached this threshold, which mitigates this risk meaningfully relative to a more centralized operator controlling an equivalent proportion of stake. However, Lido breaching this threshold still presents a risk due to a potential contract exploit or governance attack, so concentration remains an important variable to consider in determining a liquid staking provider.

Rocket Pool’s rETH is the second largest LSD despite only representing ~5.2% of Lido’s stake. Stakers can mint rETH by depositing ETH into Rocket Pool, but unlike stETH, validator rewards accrue to the price of rETH. Hence, depositing one ETH will mint less than one rETH, and that number will continue to decrease with time as rETH accrues validator rewards. Rocket Pool’s rETH is newer than stETH, and it consequently has fewer DeFi integrations and lower liquidity. However, this is ramping up in real-time as Rocket Pool introduced liquidity incentives on numerous DeFi protocols in August. Importantly, Rocket Pool stands out from competing liquid staking providers due to its decentralization, with its stake divided among more than 1,500 node operators that permissionlessly opted to participate. While this is a substantial tailwind for network health, rewards data indicates Rocket Pool has slightly underperformed most other staking service providers that rely on a permissioned set of professional node operators1.

Rocket Pool validators only need to deposit 16 ETH instead of the 32 ETH required with protocol-native staking, with the lower deposit possible as Rocket Pool pairs the validator’s deposit with another 16 ETH pooled from individual stakers using Rocket Pool. Rocket Pool validators receive the full yield generated on their 16 ETH, plus they collect a 15% node commission rate on the 16 ETH they stake on behalf of others. Hence, Rocket Pool validators may be able to generate a higher yield than solo stakers. However, since managing a Rocket Pool validator is permissionless, additional safeguards that are unnecessary in Lido’s permissioned system are incorporated. Most prominently, validators are required to stake 1.6 ETH (10%) worth of Rocket Pool’s native RPL token as a bond, representing additional insurance beyond the operator’s 16 ETH stake should they be penalized or slashed. In the event of a penalty or slashing that takes the validators balance below 32 ETH, the node operator will assume all of the downside risk, covering all losses with their stake and/or RPL bond, and rETH holders will only subsidize losses in an extreme scenario where the node operator is slashed more than the ~17.6 ETH equivalent that they deposited. As a result, Rocket Pool node operators have a levered exposure to staking yields, as they can generate extra commissions from Rocket Pool stakers, but they must subsidize all losses for penalties that reduce their balance below 32 ETH2. Lastly, one could argue that Rocket Pool’s security guarantees are better than Lido’s by having a financial alignment between node operators and stakers and a more decentralized governance process.

Coinbase notably entered the liquid staking market last month with its announcement of cbETH. Now, Coinbase clients that have their ETH staked via the Coinbase exchange have the option to wrap their illiquid staked ETH to receive cbETH. Additionally, cbETH is listed for trading on Coinbase’s exchange so that it can be bought or sold directly, similar to any other Coinbase-listed asset. While cbETH is the newest LSD, it has some notable distinctions from the LSDs previously covered with Lido and Rocket Pool. Coinbase’s cbETH is much more centralized, as Coinbase maintains full custody of the underlying ETH’s private keys. Coinbase does enlist multiple node operators, but there isn’t public transparency into those used or the distribution of stake among them. While cbETH is still less liquid than stETH, it has ramped its liquidity faster than competing LSDs due to its exchange listing. Ease of access is perhaps cbETH’s most prominent advantage as it widened the potential user base of LSDs to include a more novice demographic unlikely to interact with a liquid staking protocol on a non-custodial basis. This differentiated client base may allow Coinbase to maintain their higher 25% fee. Lastly, given its nascency, cbETH has few DeFi integrations at this point, but we expect this to grow quickly.

Exhibit 2: Staking Tradeoffs by Liquid Staking Providers

Source: GSR. *Node Operators are the individuals or companies managing the maintenance of client software and hardware necessary for a validator to make attestations about the chain’s state. In solo staking, the individual staker is the node operator, whereas, in other methods covered, the node operator function is outsourced to one or more third-party providers.

The Path Forward

Going forward, we expect the amount of ETH staked in the network to grow as increased rewards and decreased risks incentivize staking participation until an equilibrium level is found. Liquid staking providers and centralized exchanges will likely continue to attract the majority of incremental stake as they minimize the operational burdens placed on stakers. Additionally, Coinbase’s entrance to the liquid staking market may catalyze a blurring of lines between centralized exchange staking and liquid staking, and more exchanges may follow suit and issue a liquid receipt token offering increased utility to stakers via DeFi integrations. We expect liquid staking providers prioritizing decentralization like Rocket Pool to gain further traction as integrations grow and the liquidity gap between stETH and rETH decreases. Lastly, the leverage achievable by operating a node on Rocket Pool may attract increased demand from long-term ETH HODLers that prioritize yield maximization. However, we expect this will continue to represent a small minority of the total stake, given the high operational burdens relative to fully outsourced solutions.

Exhibit 3: Percentage of ETH Staked by Provider

Source: Hildobby Dune Analytics, GSR

Footnotes:

-

Based on rated.network data. Rocket Pool’s consensus layer APR has been slightly below peers, which logically makes sense as they distinctly do not constrain node operators to a permissioned list of professional validators. Conversely, Rocket Pool’s net APR has actually exceeded most competing providers since The Merge, as a higher percentage of Rocket Pool validators have leveraged MEV-Boost to generate extra MEV returns compared to peers. Despite this, we do not believe this will be an area of edge between validators in the long run as MEV extraction becomes the norm. Hence, we believe it’s plausible that stakers using Rocket Pool may incur a small cost via validator underperformance to benefit decentralization and network health. With this said, post-Merge data is minimal and differentiation between providers remains to be seen.

-

Notably, this doesn’t prevent Rocket Pool node operators and subsequently rETH holders from underperforming, as node operators are only covering losses that result in the validator losing money overall (a negative percentage return). For example, if a validator accrued 1 ETH of rewards and then was penalized or slashed 1 ETH, the validator and stakers would each receive a 0% return. Node operators are only insuring outright losses; they are not insuring against underperformance.

Authors:

Matt Kunke, Junior Strategist | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Telegram, LinkedIn

Sources:

Ethereum.org, Hildobby ETH 2 Deposits – Dune Analytics, Staking Rewards, Lido, Rocket Pool, cbETH White Paper, Rated.Network

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.

This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.