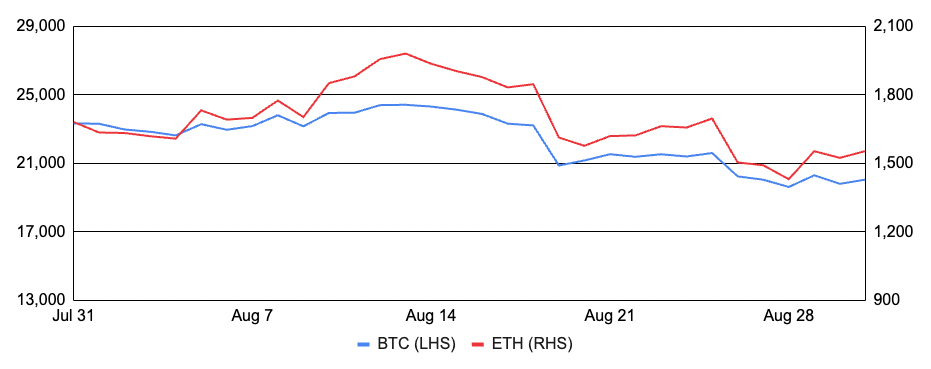

Bitcoin reversed its strong July performance and fell 14% in August, after entering the month at ~$23,300 and ending around $20,000. Bitcoin held up well through the first half of the month, but an increasingly hawkish stance from key central bankers contributed to a reversal in the second half of the month. Bitcoin and other cryptoassets saw particularly negative performance on the 19th and the 26th, with deleveraging contributing to the former and hawkish U.S. Fed Chair comments contributing to the latter. Outside of macroeconomic news, BlackRock had a busy month, first announcing a partnership with Coinbase Prime to provide institutional clients access to bitcoin spot trading and custody solutions, and later launching a private institutional bitcoin trust. MicroStrategy similarly had its fair share of headlines, as it recorded a nearly $1b impairment loss on its bitcoin during the quarter, and saw its CEO Michael Saylor step back from day-to-day operations and into the Chairman role. In bitcoin mining, the backdrop continues to erode as the price of BTC and transaction fees are down, while the network hashrate continues to climb. This has led to hash price, which measures the expected value of one terahash per second of hashing power per day, falling below 9 cents from nearly 40 cents last year. In response to the tough environment, Stronghold shifted its focus from mining bitcoin to selling power, Greenidge and Sai halted expansion plans, Compass shuttered its Georgia facilities, and Prime Blockchain and 10X Capital Venture Acquisition Corp II mutually ended their SPAC deal. Elsewhere, a decentralized version of wrapped bitcoin became available on Polkadot, the CME unveiled plans to launch euro-denominated BTC and ETH futures, and Brazilian brokerage firm XP launched BTC and ETH trading.

While Ethereum was not immune from the market turmoil, it outperformed bitcoin during the month, falling ~8% after entering August at ~$1,700 and finishing around $1,550. Progress towards The Merge, where Ethereum will switch from proof-of-work to proof-of-stake, continued to be the highlight of the month, including the successful Merge of the Goerli testnet, the specifying of mainnet’s terminal total difficulty (TTD) level, and the completion of the penultimate mainnet shadow fork, all covered more below. Beyond The Merge, layer two scaling solution Arbitrum successfully migrated its existing Arbitrum One network to Nitro to provide a 7-10x improvement in throughput, cheaper fees from improved calldata compression, and a broadly improved developer experience as standard languages and tools replace the custom-designed language and compiler previously used. Elsewhere, Coinbase launched its own ETH liquid staking token known as Coinbase Wrapped Staked ETH (cbETH), and added ETH to its expanding list of staking options for U.S. institutional clients. The largest ETH mining pool, Ethermine, also unveiled a new staking solution for its users and additionally announced it would not support a new Ethereum proof-of-work fork (ETHW). While Chandler Guo’s ETHW launched its first testnet recently, it does not appear to be attracting outsized community interest as many large applications and infrastructure providers like Circle, Chainlink, OpenSea, and others, have all pledged support to proof-of-stake Ethereum. In other Ethereum-related news: Flashbots made its MEV-Boost relay code open source, the CME announced plans to offer options on ETH futures, open interest in ETH options reached an all-time high, AntPool announced it would not maintain client assets on PoS Ethereum, and Herzner, the second-biggest hosting provider for Ethereum nodes, announced that running an Ethereum node violates its terms of service.

BTC and ETH

Source: Sansheets, GSR

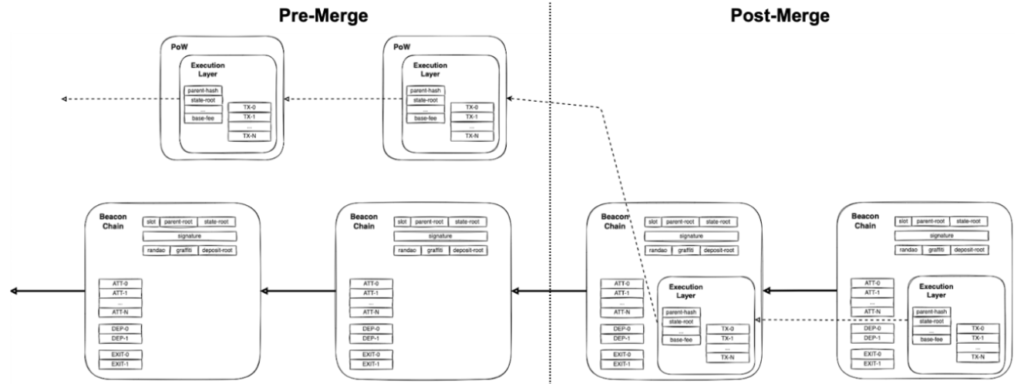

Approaching The Ethereum Merge

Ethereum continued to make significant progress in August towards The Merge, which will move the network from proof-of-work to proof-of-stake and result in significantly lower energy consumption, stronger finality guarantees, lower ETH issuance, and a higher staking yield. After successful testnet merges on Ropsten and Sepolia in prior months, developers successfully completed their third and final testnet merge on Goerli, transitioning the testnet to a full proof-of-stake chain. Soon after, developers declared a terminal total difficulty, which will activate The Merge on Ethereum mainnet and allow mainnet to merge with the Beacon Chain. While the network will likely reach TTD on September 15th, it may move in either direction depending on miner behavior, and an updated timing estimate can be tracked here. In addition, developers successfully completed the penultimate mainnet shadow fork, which was executed with zero missed block proposals in the most successful test to date. Finally and after the month ended, developers successfully completed the Bellatrix upgrade, which gave the Beacon Chain logic to be aware that The Merge is coming.

Outside of The Merge itself, much attention will be paid to the upcoming Ethereum fork (ETHW), which is spearheaded by Ethereum miner and early Ethereum Classic backer Chandler Guo and will maintain proof-of-work to help struggling miners. Once forked, there will suddenly be two copies of each token, NFT, stablecoin, and smart contract between the two networks, causing confusion at the very least. However, most believe ETHW will struggle to gain acceptance as protocols, and importantly stablecoin issuers, have pledged allegiance to proof-of-stake Ethereum, making ETHW rife with issues. Still, ETHW does have some backers such as Tron founder Justin Sun, and markets are ascribing some value to the new token, with Poloniex’s ETHW IOU token trading at $37, or 2.4% of ETH’s value as of the time of writing. Moreover, traders have put on strategies to try to capture any potential value in ETHW, such as buying spot ETH and shorting ETH futures to capture the airdrop while hedging against changes in the price of ETH, though this has helped push the price of futures below the spot price. While many are attempting to position themselves to profit from the fork, there will certainly be a lot to watch at the very least.

Ethereum Block Architecture Pre & Post Merge

Source: Danny Ryan, Tim Beiko, Annotations by GSR

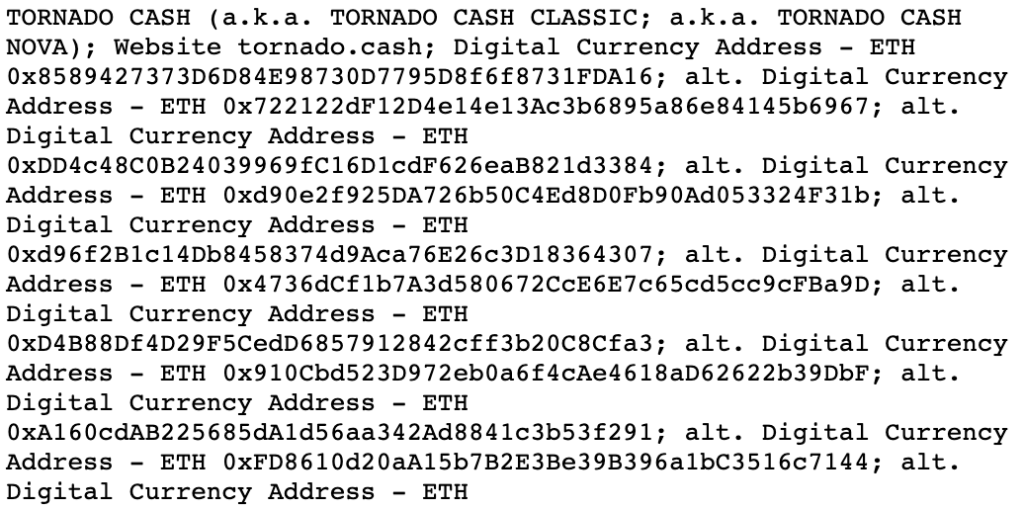

Tornado Cash

On August 8th, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) sanctioned crypto mixer Tornado Cash, prohibiting U.S. citizens from using Tornado Cash and calling it a threat to national security. OFAC claimed Tornado Cash, which adds privacy and anonymity to transactions by mixing them together to obfuscate their origin and destination, has been used to launder over $7b of cryptocurrency and “repeatedly failed to impose effective controls designed to stop it from laundering funds for malicious cyber actors.”

With the sanctions, OFAC added Tornado Cash-related addresses to its Specially Designated Nationals And Blocked Persons List (SDN List), a list on which OFAC publishes the names of sanctioned terrorists, authoritarian regimes, and international criminals. Unless exempted or authorized by OFAC, all persons and businesses within the U.S. are prohibited from doing business with its blacklisted constituents. Notably, the list is typically reserved for individuals and entities, and this is the first instance of a smart contract being sanctioned. Proponents of the sanctions believe that Tornado Cash’s efforts to deter malevolent behavior were insufficient, the government should have the ability to trace financial information when there is probable cause, and the sanctions will deter criminals from using the mixer for illicit purposes or from even committing crimes in the first place. Detractors, however, believe that the sanctions violate a right to privacy (anonymity is not a crime), the Treasury should pursue criminals rather than sanctioning the tools they use, and OFAC may have overstepped its statutory authority, as the entity that created Tornado Cash does not own it or have the right or ability to control open source software residing simultaneously on the thousands of computers around the world.

Though the Treasury has yet to detail how it will enforce the sanctions, which is typically communicated via a frequently asked questions document or a general license framework, many companies and services immediately began to incorporate them soon after they were announced. The largest Ethereum mining pool Ethermine, for example, stopped processing transactions from Tornado Cash-related addresses, and similar actions were taken by developer platforms Alchemy and Infura, USDC stablecoin issuer Circle, and programming depository vault GitHub to name a few. An anonymous user even sent hundreds of celebrities and famous business people such as Jimmy Fallon, Brian Armstrong, and Shaquille O’Neil ether from a Tornado Cash address, perhaps in protest or a mark of defiance.

While it’s still unclear whether validators will be subject to the sanctions, perhaps more alarming to many in the community is the potential for censorship at the network level should it be deemed illegal for U.S.-based validators to propose or attest to blocks containing sanctioned addresses. Moreover, Ethereum’s move to proof-of-stake makes this even more prescient, as the bulk of current Beacon chain validators are U.S.-based or could arguably be subject to the sanctions, including Coinbase, Kraken, and Lido Finance. Such a situation could push Ethereum into an existential crisis, pitting censorship resistance against compliance.

Also of note, complying with the sanctions, should U.S.-based validators be legally obligated to do so, is no small feat. For example, a transaction may be sent to a non-sanctioned address, but that address may be a smart contract that kicks off a series of transactions that ultimately ends up at a sanctioned address that is impossible to know in advance. In addition, further complications would be introduced should validators be required to determine whether an asset is a part of blocked property, as it would require validators to check an asset’s history rather than just an address. And once Proposer-Builder Separation is instituted, block proposers may not even see the contents of the block they are proposing until after they’ve signed their proposed block. Alternatively, validators impacted by sanctions could cease operating validator nodes for the time being by initiating a voluntary exit, though their stake would remain locked and illiquid until an expected upgrade is implemented six to twelve months after The Merge.

OFAC’s SDN List – A Subset of Sanctioned Tornado Cash Entities / Addresses

Source: U.S. Treasury, GSR

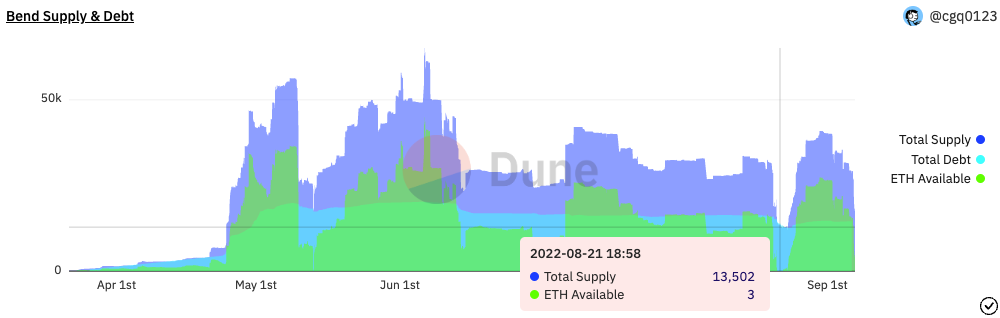

BendDAO and Everything Else NFTs

It was a busy month for NFTs despite the challenging market backdrop and plummeting volume. One particularly notable story in the month was BendDAO, a peer-to-peer NFT-backed lending protocol. BendDAO allows lenders to deposit ETH into a pool to earn yield paid by borrowers that borrow the ETH from the pool and post NFTs from one of seven bluechip NFT collections as collateral. Borrowers may instantly borrow up to 40% of the collection’s floor price of the posted NFT and will pay a variable interest rate depending on the utilization of the ETH deposited in the protocol, similar to mechanisms used by fungible token lending protocols like Aave. The liquidation process, however, is notably quite different. The protocol uses a ‘health score’ to evaluate the riskiness of loans, with liquidations beginning if a loan’s health score drops below one. In short, the loan will get liquidated when the debt plus interest reaches 95% of the collection’s floor price, a level known as the liquidation threshold. However, instead of the collateral NFT getting liquidated as soon as possible after a loan’s health score falls below one, a 48-hour auction mechanism begins. During this auction process, BendDAO users can bid on the collateral NFT, with the highest bidder keeping the NFT unless the owner pays back half of the debt plus a 5% liquidation fee before the end of the auction, with the fee going to the first auction bidder to incentivize participation. Additionally, there were further constraints on the auctions, such as requirements that bids be within 5% of OpenSea’s listed NFT floor price and above the debt amount that the NFT was collateralizing.

As the NFT market continued its downward bleed into August, a prominent NFT trader known as CirrusNFT warned on August 17th that cascading liquidations on BendDAO were the “single biggest risk to the NFT market.” The warning further noted that the majority of the protocol’s collateral value consisted of Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) NFTs, with most of the NFTs posted as collateral in late April and early May when valuations were substantially higher and the market more active. The trader posited that the deteriorating liquidity in the NFT market would be insufficient to absorb the number of BAYC and MAYC NFTs at risk of liquidation if floor prices fell much further. In the days following the warning, BendDAO exhibited characteristics of a bank run as lenders withdrew their ETH, fearing bad debts could arise from falling NFT prices. As liquidations occur through an auction, the length of the auction and the minimum bid requirements often impede price discovery. Notably, the auction’s minimum bid requirements resulted in bidders paying a 5% premium to take a synthetic exposure similar to a 48-hour expiry short put option on an NFT in a fast-moving downmarket. This proposition didn’t attract much interest from liquidators and caused many auctions to receive zero bids. The run on BendDAO resulted in lenders withdrawing ~16,000 ETH, decreasing the ETH available for new loans to roughly zero over ~48 hours from late August 19th to August 21st. And these withdrawals caused asset utilization to rise to ~100%, borrowing costs rising to more than 100% on an annualized basis, and lenders to have their ETH stuck in the protocol until NFTs were liquidated or until borrowers paid back their loans.

As a result of the turmoil, BendDAO proposed a series of emergency proposals, with voting beginning on August 22nd and 23rd for BIP#9 and BIP#10, respectively. While more proposals are currently in voting, so far, a few of the community-approved proposals include: removing the requirement that forced bids to be within 5% of OpenSea’s floor price, reducing the liquidation threshold from 95% to 80%, increasing the base interest rate from 10% to 20%, and reducing the duration of the auction from 48 hours to 24 hours. The protocol appears to have bounced back strongly, with ~30,000 ETH available to borrow by August’s end.

Elsewhere in NFT-related news: OpenSea’s launch of its gifting feature caused controversy as it allowed users to buy an NFT from one wallet and gift to another wallet in a single transaction, but the feature was exploited to make it look like prominent crypto influencers bought the gifted NFTs directly, potentially boosting the price as others copy-trade the prominent accounts; NFT marketplace X2Y2 announced it would no longer force buyers to pay creator royalties on certain NFT purchases, making the creator fee that was traditionally baked into transactions on NFT marketplaces optional in many cases; Tiffany launched its first series of NFTs, quickly selling out all 250 for a mint price of 30 ETH, with each NFT being redeemable for a physical gold and gemstone pendant resembling the owner’s exact CryptoPunk; PROOF, the private community behind Moonbirds, raised $50m in VC funding and announced it would be transitioning Moonbirds to an entirely on-chain NFT with the art “constructed from the contract itself” instead of pointing to an external URI; Moonbirds founder Kevin Rose controversially announced Moonbirds and Oddities would transition to a CC0 license; Solana’s top NFT marketplace by volume, Magic Eden, expanded to Ethereum; and, the rarest Pudgy Penguins NFT sold for 400 ETH.

BendDAO Total ETH Deposited, Debt, and ETH Available to Borrow

Source: cgq0123’s BendDAO Dune Analytics Dashboard, GSR. There was ~31.5k ETH supplied and ~16k ETH available on the evening of the 19th.

Authors

Brian Rudick, Senior Strategist | Telegram, LinkedIn

Matt Kunke, Junior Strategist | Twitter, Telegram, LinkedIn

View August 2022 Market Update

GSR in the Media

Bloomberg – Ex-Goldman Banker’s Crypto Startup Backed By Key Market Makers

CoinDesk – Cboe Digital Names Jump Crypto, Robinhood and DRW Among Expected Equity Partners

CoinDesk TV – Ethereum Merge Is a ‘Powerful Force’: GSR Trader on Institutional Allocation to ETH

The Defiant – Crypto Markets Hold Up As Stocks Swoon

The Defiant – Markets Rise As U.S. Unemployment Rate Ticks Up To 3.7%

MarketWatch – Crypto bulls’ comeback? Here are factors driving up institutional interest

Disclaimers: “This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report. This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.”