The Market

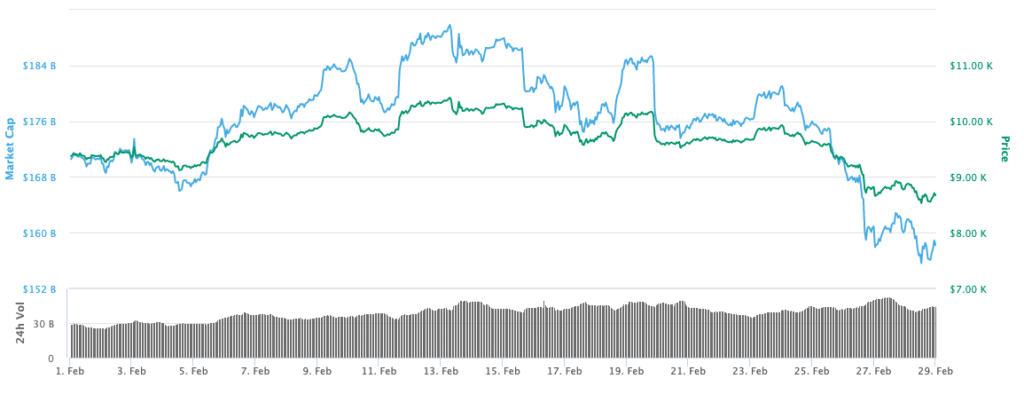

Bitcoin started off the month hovering above $9,300 and finished February at $8,600. The total market capitalisation fell by over $10 billion. As 2020 began, it was the most optimistic start to the market in 7 years, so this cooling off was to be expected. The substantial pullback in Bitcoin and nearly every other cryptocurrency is not a surprise, considering the strong rallies we have also seen in alt-coins at the start of the year.

Bitcoin price movement in February 2020. Source: Coin Market Cap

It’s counterintuitive to blame Bitcoin’s recent market weakness on the coronavirus, since it was credited for driving positive performance a few weeks back, when China was in the midst of outbreaks. There was higher uncertainty about the disease four weeks ago, whereas now it is clearer that it’s a very serious and contagious flu.

One notable difference is that the massive quarantine in China likely had a boost on crypto trading during that period. The absence of information coupled with falling Chinese stocks and market participants being stuck at home likely played a part in driving volumes.

Part of the reason that the current pullback towards $9,000 has been so sluggish is that the impact on the global economy is uncertain. A prolonged flu season is a negative event for risk-on assets, namely equities. But even if Bitcoin is an uncorrelated asset, a weaker global economy is not a bullish enough argument for crypto to rally. The narrative that Bitcoin is being used as a hedge to the mass uncertainty that currently grips the traditional financial world is still present and relevant, however, for the time being it remains unproven.

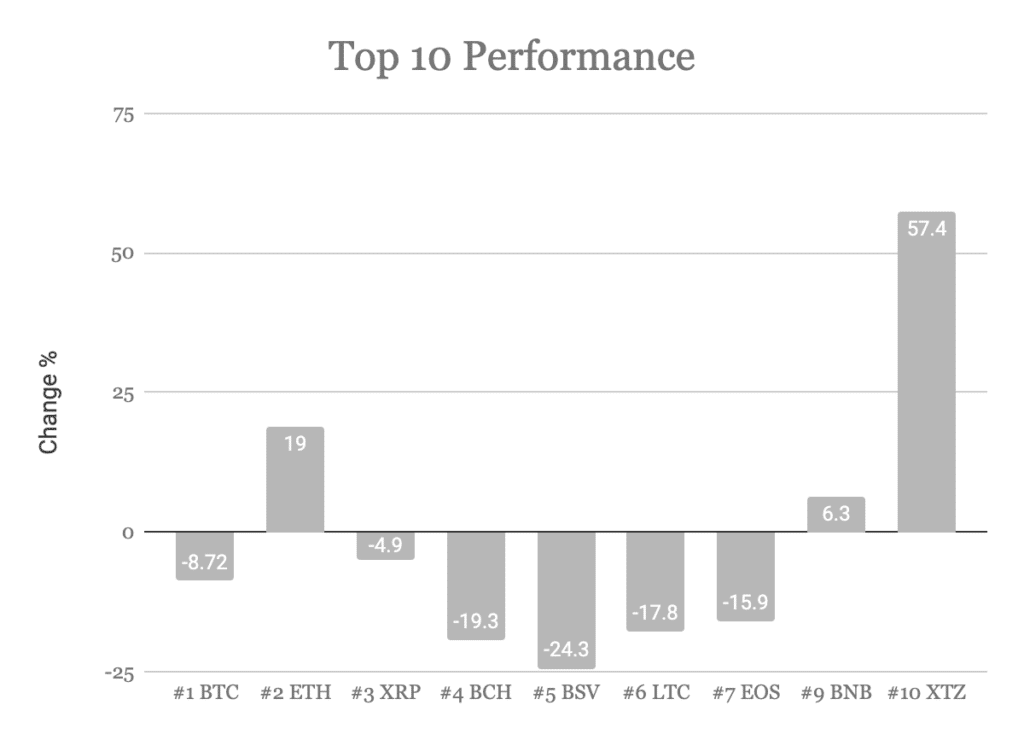

How the top ten crypto assets performed in February. Source: Coin360.com

Across the top ten assets, all projects retracted apart from Ethereum (ETH), Binance Coin (BNB) and Teszos (XTZ). Bitcoin fell almost 9%, with BCH and BSV seeing bigger sell-offs. This isn’t too surprising considering the strong performance of BCH and BSV in recent weeks.

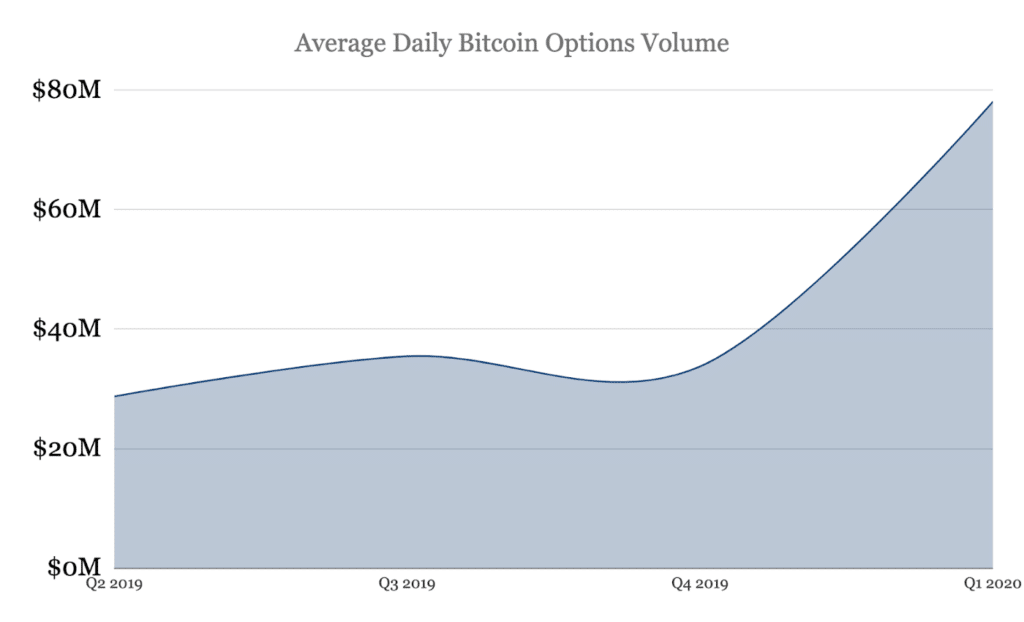

Options Show Steady Growth

Bitcoin Options have seen steady growth in 2020. The daily average trading volume is now approaching $80 million. This rise has been led by the Deribit exchange who are responsible for over 90% of options volume in 2020 and set a new volumes record on February 11th of $159 million.

Average daily bitcoin Bitcoin options volume since Q2 2019. Source: Skew.com

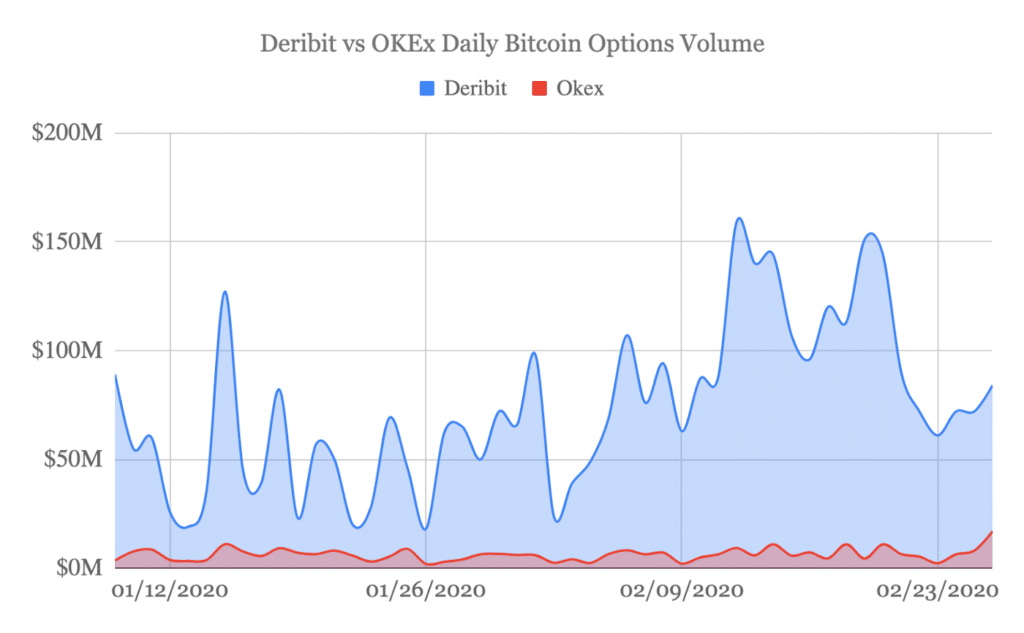

At present, Deribit’s most pressing challenge comes from OKEx. However, there is still a large gap between the two exchanges. A comparison in daily Bitcoin options volume for 2020 between the two can be seen below. Given that OKEx only entered the market in early January, it can be seen as a healthy entrance so far, and a decent foundation to build on.

A comparison of options volumes on Deribit and OKEx in so far in 2020. Source Skew.com

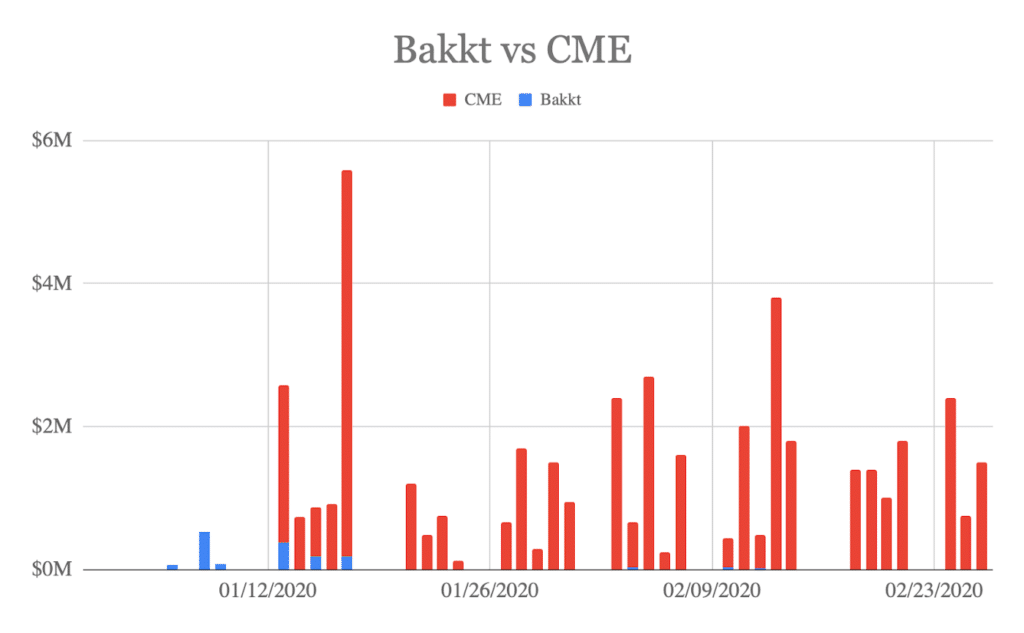

On the regulated side of the options market Bakkt and the CME continue to struggle. Bakkt has slowed to a crawl with a resurgence nowhere in sight.

A comparison of Options volume for Bakkt and the CME for 2020. Source: Skew.com

Rumoured New Entrants to the Options Market

Given the broad range of global market participants, from retail to institutional, there is room for more winners in the space aside from Deribit. Options have been the fastest-growing product segment of the crypto market in 2019, with the trajectory of volumes likely to accelerate in 2020, there are vast opportunities in this area and still plenty of demand to expand the market within crypto, even without further growth of the asset class.

In bound questions from journalists would suggest a major exchange in crypto is entering this market soon. If the past history of spot exchange competition is anything to go by, Deribit will have more serious challengers in the near future.

GSR Update

The GSR team is looking forward to the Digital Asset Summit on March 10th in London, hosted by Crypto Compare. GSR’s Director of Investments Jakob Palmstierna will be discussing the growing trend of risk management for crypto institutions.

Jakob also spoke about how best to find liquidity in crypto markets alongside Tom Wilson of Reuters and Tim Mc Court of the CME at DAS London on February 10th.

In early February, GSR took part in the first Bitcoin US dollar trade to be negotiated using a proprietary artificial intelligence system.

‘GSR said it supports new institutional platforms that aim to make the market more efficient.’ Bloomberg, February 4th, 2020.

Reports, market reports, and other information (“Information”) provided by GSR or its affiliates have been prepared solely for informative purposes and should not be the basis for making investment decisions or be construed as a recommendation to engage in investment transactions or be taken to suggest an investment strategy in respect of any financial instruments or the issuers thereof. Information provided is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services and is not a recommendation to buy, sell, or hold any asset. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page. Trading from Singapore, please review The Monetary Authority of Singapore (MAS) compliance note.