Author: Brian Rudick, Senior Strategist

Years in the making, a U.S. Bitcoin ETF has finally been approved. We examine the pros and cons of its futures-based construction and look at what may come next.

A Long and Arduous Road: ETFs are securities that track an asset, basket of assets, or an index, can be bought and sold throughout the day on a stock exchange, and offer diversification, convenience, transparency, tax benefits, and high regulatory oversight. ETFs are often physically backed or backed by futures, the latter of which typically occurs when an asset is difficult to hold such as oil or livestock. The first Bitcoin ETF application was filed by Cameron and Tyler Winklevoss in 2013 and for many years the SEC cordially rejected all applications citing investor protection and a largely unregulated underlying market. As Bitcoin exchange-traded products flourished around the world – there are ~50 of them with a cumulative $15b in AUM – speculation began to mount that the U.S. would finally approve one, especially after SEC Chair Gary Gensler expressed his support for a futures-based Bitcoin ETF during a speech last month. In the SEC’s eyes, a futures-based product is preferable as Bitcoin futures trade on a regulated U.S. futures exchange/have been overseen by the CFTC for the last four years, and comes with significant investor protections afforded by the Investment Company Act of 1940. After much ado, the CME Bitcoin futures-based ProShares Bitcoin Strategy ETF ($BITO) debuted on Tuesday with resounding success, amassing ~$570m of AUM and ~$1b of trading volume, making it the largest natural debut in ETF history.

Negatives to a Futures-Based Bitcoin ETF: Though celebrated, there has been much consternation regarding the futures-backed, rather than physically-backed, structure of the ETF. The main complaints are:

-

- High Costs: The main drawback of a futures-based Bitcoin ETF is the cost and resulting underperformance over an extended period of time. Since futures expire, they need to constantly be rolled forward, with the manager selling near-dated contracts as they approach expiration and buying longer-dated contracts. But, since Bitcoin futures prices are generally higher the further out one goes, a situation known as contango, the manager is essentially selling a lower-priced contract to buy a higher-priced one, incurring roll costs that add up over time, also known as negative roll yield. The futures-based ETF should track spot Bitcoin well over a day, weeks, or even months, but likely materially underperforms over multiple years (this makes the product more appropriate for traders rather than HODLers). Moreover, market participants know the ETF manager needs to roll expiring contracts forward according to a set schedule and will try to front-run those transactions. This is all before fees and transaction costs.

- Potential Volatility: There is debate as to whether the futures-based structure creates additional volatility since CME Bitcoin futures volumes are less than that of the overall BTC spot market. That said, CME Bitcoin futures volumes are materially higher than that of any single U.S.-based crypto exchange. We do see the potential for some periodic deviation and/or volatility from the fact that CME futures have defined trading hours and its trading can be halted relative to spot Bitcoin which trades 24/7/365.

- Unclear Demand: While its initial trading debut appears to have proven otherwise, many had posited the demand for a futures-based Bitcoin ETF was unclear, as financial advisors have generally shied away from futures-based ETFs and CME Bitcoin futures have been available to institutions for several years.

Positives to a Futures-Based Bitcoin ETF: Despite these drawbacks, we see many positives in a futures-based Bitcoin ETF.

-

-

- Regulation: Perhaps the main benefit to the structure is the level of oversight and regulation. Indeed, Bitcoin futures are federally regulated by the CFTC and thus are subject to clear rules and regulations that are already familiar to investors. There are surveillance requirements, disclosure requirements, etc. By contrast, a physically-backed Bitcoin ETF has the issue that the coins trade on different locations, most of which aren’t overseen by U.S. regulators. Moreover, a futures-backed Bitcoin ETF is filed under the Investment Company Act of 1940, which contains stronger investor protections than the Securities Act of 1933, which would govern a physically-backed Bitcoin ETF.

- Less Manipulation Prone: Spot Bitcoin prices can vary by exchange, but CME Bitcoin futures track the CME CF Bitcoin Reference Rate, a volume-weighted average price from the five largest crypto exchanges by trading volume. As such, this reduces specific exchange risk, while also detering manipulation given that it uses median prices in its calculation and does so across a relatively long time interval, requiring successful collusion to be done across exchanges and for an extended period of time.

- Price Discovery: As is the case with most commodities, experts believe the futures market is a better place for price discovery than the spot market given its greater volumes relative to fragmented spot market liquidity. For example, this Bitwise report surveys the academic literature on the subject and conducts its own study to offer compelling support to this conclusion.

- Absence of Custody Risk: While one of the core principles of crypto is to remove intermediaries and allow for self-custody, a futures-based Bitcoin ETF eliminates the need for custody.

-

What May Come Next: We see the launch of the ProShares Bitcoin Strategy ETF as a significant milestone for Bitcoin and the mainstreaming of cryptocurrency in general. Specifically, we see:

-

- $BITO AUM: Prior to launch, forecasters had differing predictions on the AUM the first futures-based Bitcoin ETF could garner in its first year, with most centered around $4-5b but some as high as $50b. The extremely strong performance so far may suggest the low end is too low, but we see the high end as unlikely, given historical first-year flows of other first-to-market single commodity ETFs, led by GLD (tracks gold) at $3.0B and SLV (tracks silver) at $1.7B. At any rate, we see a physically-backed product, if/when it is allowed, attracting many more assets, given the tens of trillions of financial advisor money that is more likely to be allocated to it. Note that high AUM could materialize quite quickly, particularly as Grayscale has filed to convert its $43b closed-end Grayscale Bitcoin Trust ($GBTC) into an ETF.

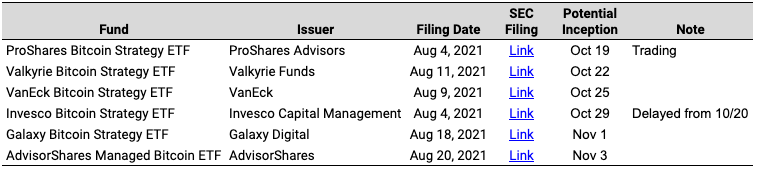

- Next Up: Given the flood of futures-based Bitcoin applications roughly 75 days ago, which corresponds to the SEC objection period, we’re likely to see similar ETFs come to market over the next few weeks, which we show in Exhibit 1 below using data from Bloomberg Intelligence Senior ETF Analyst Eric Balchunas and various news sources. Having cleared all regulatory hurdles, Valkyrie ($BTF) is likely to launch on Friday, followed by VanEck ($XBTF) next week, as well as potentially Invesco, which it delayed from this week. Given a significant and sticky first-mover advantage and typical dominance of just one or two funds, unseating ProShares’ offering is a tall task, though many will surely try, likely competing on price or brand.

- Beyond Futures-Based Funds: Bigger than the launch of the first Bitcoin ETF itself, in our opinion, is the fact that it gets the SEC more comfortable with crypto-based products, and may be the first step to an Ethereum futures-based ETF, a physically-backed Bitcoin ETF, and eventually cryptocurrency basket ETFs. These would clearly be positive for investors, given the benefits discussed above, as well as likely declining fees over time.

- Impact on BTC Price: We see the futures-based ETF as price positive for Bitcoin. This is due not only to a complex interrelation between futures and spot markets, but perhaps more simply due to the hedging typically done by the writers of the futures contracts who hedge their short position by going long in the spot market. This may have already been partially, fully, or even more than fully incorporated into the current price of Bitcoin, but continued growth of Bitcoin ETF products, all else equal, should continue to have a positive impact.

Exhibit 1: Potential Near-Term Bitcoin ETF Inception Dates

Source: SEC, Bloomberg / Eric Balchunas, GSR

To download this article as a PDF, click here.

Sources

SEC: SEC.gov, FINRA: Exchange-Traded Funds, Etfdb.com: Three Huge Benefits of a Bitcoin Futures ETF, Etfdb.com: The Problem With a Bitcoin Futures ETF, Etfdb.com: New Bitwise Bitcoin Filing Drops a Research Bomb, Eric Balchunas: Twitter Feed, Yahoo Finance: What to Make of the First Bitcoin Futures ETF Launch with Eric Balchunas, Patrick Boyle: Bitcoin on The Big Board – The Bitcoin ETF, Coin Bureau: It’s NOT What You Think!! Bitcoin Futures ETFs!!, Anthony Pompliano: Bitcoin ETF: Everything You Need to Know, Bloomberg: Bitcoin Bull Lee Says Futures ETF May Attract $50 Billion in First Year, Cointelegraph: Bitcoin futures ETF debuts with highest-ever first day ‘natural’ volume of $1B, Bitcoin.com: SEC Chairman Gary Gensler Looks Forward to Review of Bitcoin Futures ETF Filings, Bitcoin.com: Sources Say Valkyrie Bitcoin Strategy ETF Set to Launch on Nasdaq This Week, Decrypt: SEC Clears VanEck to Launch Bitcoin Futures ETF Next Week, Decrypt: Invesco Drops Bitcoin Futures ETF Filing, CoinDesk: Grayscale Files With SEC to Convert Its Bitcoin Trust Into an ETF

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.