MACRO + CRYPTO SUMMARY

The biggest game in town (the one between the markets and the Fed) is in full bloom. At the moment, we are looking at one more quarter point hike after which the Fed may prefer to pause rates for a period of time to let the core services ex shelter CPI fall, though the market at that point is pricing in 45 bps of cuts (down from 100 bps before the dust from the banking crisis settled). Stocks have recovered and yields have bounced from the lows that accompanied the heavier Fed rate cut expectations, while bitcoin and gold have lost their recent highs of $31k and $2,000, respectively, all indicative of lessened worries around the banking crisis.

Perhaps even more remarkable is the continued divergence in volatility. While rates volatility is high as illustrated above, equities and FX vol has been well behaved and are near multi-year lows.

For active traders, fading the moves has been more rewarding than sticking to medium-term views over the last few months. With peak banking worries dissipating, we are back to watching the data, which has been mixed. Core inflation remains persistent and employment data is solid, though there have been some inconsistencies in the data, with a strong Empire State Manufacturing Survey and very weak Philadelphia manufacturing as an example.

RATES, FUNDING AND BASIS

The market continues to price in Fed Funds inching higher over the next couple of months before moving lower, although this trend has dampened a bit over the last few weeks post the banking crisis. Perp funding rates continue to be biased higher across exchanges, especially in altcoins, reflecting broadly bullish sentiment. Stablecoin lending rates had shot up significantly in the banking crisis aftermath, especially as stablecoins depegged and market participants looked to borrow to create short positions, but this market has now largely normalized.

DERIVATIVES

BTC Derivatives

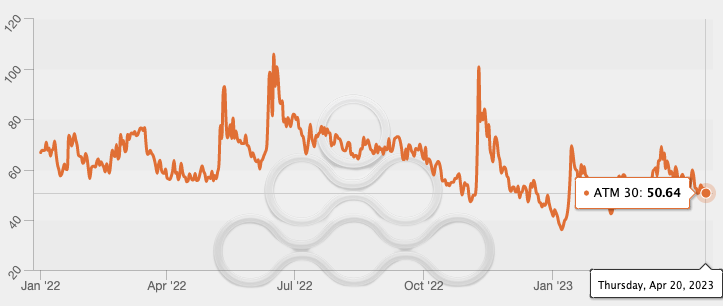

BTC 30 day implied volatility has drifted lower over the last month to 50.6% from a high of 69% last month. 30 day realized volatility is 48%.

BTC ATM Implied Volatility (30 Day)

Source: Amberdata, GSR

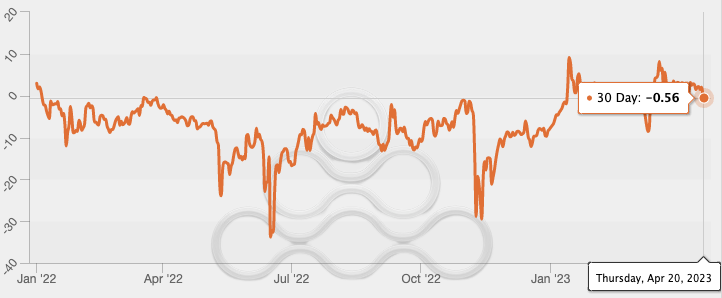

BTC 30 day 25d risk reversals remain slightly elevated priced at par, however vol may firm if BTC breaks above the recent high of ~$31,000.

BTC 25 Delta Call Skew (30 Day)

Source: Amberdata, GSR

ETH Derivatives

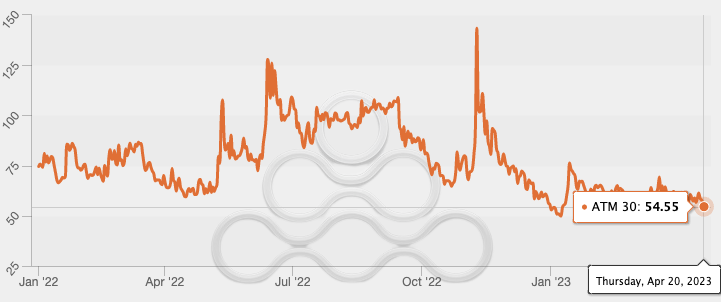

ETH 30 day implied volatility of 54.6% is back to a 15-month low and is sitting slightly above 30 day realized volatility of 52.5%.

ETH ATM Implied Volatility (30 Day)

Source: Amberdata, GSR

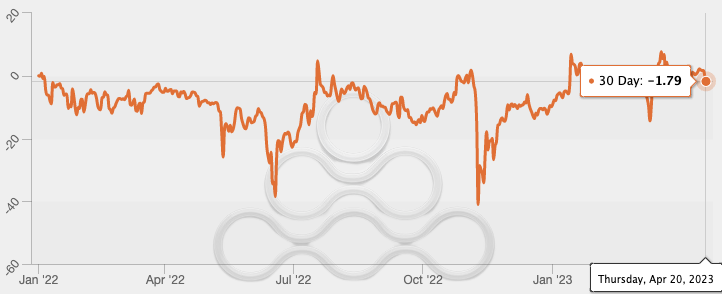

ETH 30 day risk reversals remain relatively elevated compared to earlier in the year at -1.79.

ETH 25 Delta Call Skew (30 Day)

Source: Amberdata, GSR

LIQUIDATIONS

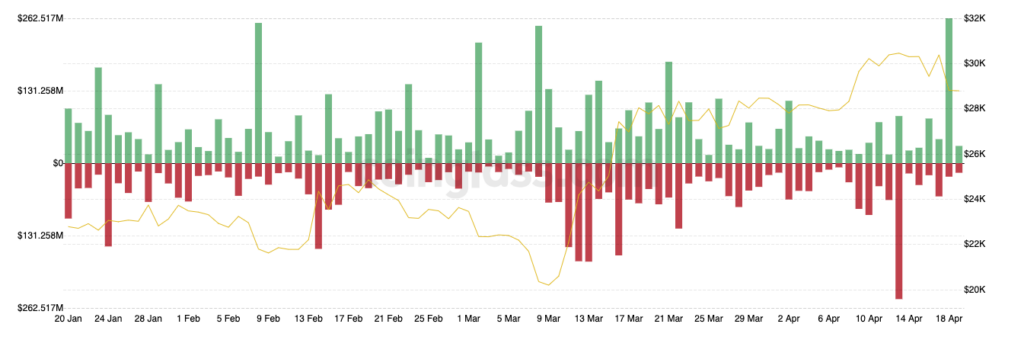

The past two weeks have led to some of the largest single day short and long liquidations of the past few months. A large number of shorts were liquidated on April 13th, despite BTC having already breached $30,000 a few days prior. April 18th saw a large number of longs liquidated on the dip below $29,000 during APAC hours. With price at current levels and material short and long liquidations over the past week, new pain points will likely need to be hit before another large number of liquidations come in.

Total Liquidations

Source: Coinglass, GSR

Authors

Mike Pozarzycki – Macro & Crypto Summary

Ruchir Gupta – Rates, Funding and Basis

John Cole – Derivatives

Christopher Newhouse – Liquidations

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.