Blockchain technology is ushering in new paradigms, with perhaps none more important than governance. We review the many benefits of decentralized autonomous organizations before digging into specific examples and pondering the future in this week’s Chart of the Week.

DAO Basics

Decentralized autonomous organizations (DAOs) are blockchain-based organizations managed by a set of automatically enforceable rules that allow for bottoms up decision-making and the organization of communities around shared goals. Unlike traditional companies that are run by boards of directors and senior management with governing rules set out in charters and bylaws, DAOs are collectively managed and owned by their members, with no hierarchical structure and governance codified into smart contracts. DAOs are essentially coordination mechanisms, offering trustless management and organizational transparency, participatory decision making and borderless collaboration, and novel funding and ownership mechanisms. Already, DAOs are being used to govern protocols, fund grants, distribute creative work, direct investment, unite members socially, and serve other DAOs, to name a few. In practice, membership of a DAO is determined by ownership of the DAO’s token, which is typically freely obtainable and allows any holder to table and vote on governance proposals such as how to spend treasury funds. While DAOs are democratic, inclusive, permissionless, and transparent, DAOs have been criticized for having low voter participation and the potential for coercion, a lack of privacy, and over-influence by large token holders, though many of these issues can be overcome such as with large holder influence and quadratic voting.

DAO History

DAOs were first conceptualized as Decentralized Autonomous Corporations in 2013 before Vitalik Buterin expanded the definition into what we know today as DAOs in his influential 2014 post DAOs, DACs, DAs and More: An Incomplete Terminology Guide. But it was perhaps The DAO that truly brought DAOs into the collective awareness. The DAO was a community-directed venture capital fund created in 2016 to invest its treasury based upon member votes. The DAO quickly amassed $150m worth of ETH, or 14% of all outstanding ETH at the time, before $60m was hacked from its treasury just three months after its creation (disagreement on whether to restore the funds led to the network splitting into Ethereum and Ethereum Classic). Unsurprisingly, DAO activity quieted substantially post The DAO and during 2017’s ICO boom, though new frameworks like Aragon, DAOstack, Moloch, and Colony were later developed to automate DAO creation. DAOs started to regain traction in 2019 with MolochDAO, an Ethereum development grants program, and Nexus Mutual, a smart contract insurance provider. DAOs are now heavily relied upon for DeFi protocol governance, such as with Uniswap, Compound, and Aave. And more recently, DAOs have been set up as art collectives (PleasrDAO), social communities (Friends With Benefits), and even to buy a rare copy of the US Constitution (ConstitutionDAO, which raised nearly $50m from 19,000 contributors in its failed auction bid).

Largest DAOs

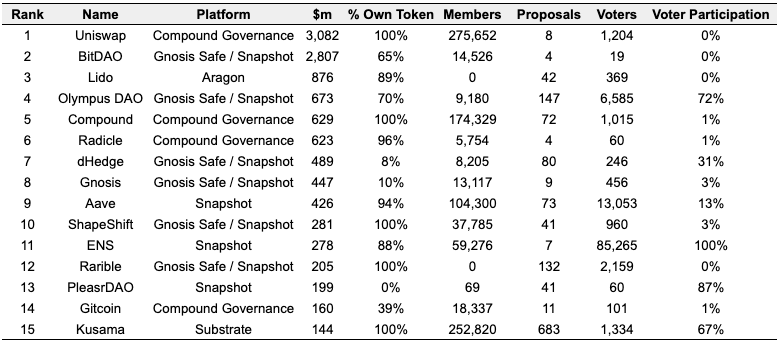

The number of DAOs and the value of DAO treasuries have grown substantially, particularly over the last year. In fact, the 186 DAOs tracked by DAO analytics platform DeepDAO control nearly $13b. That said, DAO treasuries are quite concentrated, with the two largest DAOs controlling nearly half of all DAO treasury funds, and the top 15, which we show below in Exhibit 1, controlling 88%. Note that many of the largest DAOs exist to manage treasuries associated with revenue-generating projects and that most DAO treasuries consist mainly of their respective native tokens. Below we highlight several of the largest DAOs and review their governance mechanisms.

-

- Uniswap: With nearly $700b in trading volume since its 2018 launch, Uniswap is the leading decentralized exchange and is the largest DAO with a treasury worth over $3.0b. Initially, development decisions were decided upon by Uniswap’s development team, but the September 2020 launch of its UNI governance token gave token holders the ability to vote on development proposals and control the community treasury, among others. Any UNI holder can submit a proposal, first by submitting a forum post on the Uniswap governance webpage, before passing three levels of required voting, the last of which is a formal proposal with audited code and decided upon by on-chain voting. Importantly, to reach on-chain voting, 2.5m UNI must be delegated to the proposer’s address and 40m UNI must vote yes, whether directly so or via delegation, for the proposal to be implemented.

- BitDAO: Founded by derivatives exchange Bybit in June and with support from Pantera, Dragonfly and others, BitDAO is one of the world’s largest DAOs with a mission to promote open finance and a decentralized, tokenized economy. BitDAO is owned and governed by BIT token holders who support BitDAO’s mission by voting on how the DAO should provide research and development resources, liquidity, and funding, as well as core protocol functions such as governance and treasury management. Any BIT token holder can engage in governance discussions on Discord and Forum, and soft proposals for BitDAO’s Snapshot that have received 200,000 BIT delegated to the proposer’s address are displayed before an official community vote requiring participation of 100m BIT is taken. Ideas successfully passing an official community vote still need to be adopted by a development team, which completes audited code before administrators deploy it. Note that BitDAO is working on phase two of its governance module to enhance the power of BIT token holders and support future productions and functionality.

- Gitcoin: Gitcoin is a platform to build and fund digital public goods such as open source software, and it has provided over $40m in funding via hackathons, grants, crowdfunding, and its accelerator. Gitcoin rewards grants via quadratic funding, which identifies community support by weighing the number of contributors more than the amount funded. Gitcoin launched its GTC governance token in May and is in process of progressively decentralizing via its GitcoinDAO. The GitcoinDAO oversees the community treasury as well as a governance framework for delegates called stewards to participate in key ecosystem decisions. GitcoinDAO plans to gradually introduce more formal frameworks for the ongoing development and maintenance of Gitcoin managed through on-chain voting.

The Future of DAOs

The benefits of DAOs are profound and should only grow going forward. In the future, DAOs will likely improve civic engagement, streamline business creation and fundraising, reward early contributors and fervent promoters, and give way to shared financial and social capital. Workers, unconstrained by national, regulatory, or legal boundaries, will contribute self-defined work based on true passion, often working across multiple DAOs as they see fit. Such self-organization will remove unnecessary activity and create empowering and enriching roles to enhance productivity and motivation. Birthed by the very community intent on consuming them, products and services will better match demand and align output with societal needs. And perhaps most importantly, meritocratic, contribution-driven ownership and reward just might open up opportunity, financial freedom, and the pursuit of happiness for all.

Exhibit 1: Largest DAOs by Treasury Size

Source:DeepDao.io, GSR

Author: Brian Rudick, Senior Strategist

Resources

Galaxy Digital: DAOS: The Future of Organizing Communities Online, DeepDAO: Introducing Deep DAO — Analytics for Decentralized Organizations, Vitalik Buterin: DAOs, DACs, DAs and More: An Incomplete Terminology Guide, Vitalik Buterin: Moving Beyond Coin Voting governance, Vitalik Buterin: Blockchain voting is overrated among uninformed people but underrated among informed people, Aragon: DAO Learning Center, Stanford BioE 60: Beyond Bitcoin – Decentralized Autonomous Organizations (DAOs), Bankless: How DAOs Will Change Everything | Kain Warwick, CoopahTroopah, Tracheopteryx, Coinmarketcap: A Deep Dive Into How the Top 10 DAOs Work

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.

This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.