Originally viewed as a mechanism for boosted liquidity mining rewards, vote-escrowed CRV is now being used to control CRV emissions, and thus liquidity, and an ensuing battle to hoard as much as possible is in full force. We review the Curve Wars and its potential implications in this week’s Chart of the Week.

Curve Finance

Launched in January 2020, Curve is a popular automated market maker offering low-slippage, low-fee trading on Ethereum and other supported chains. Rather than employing the x*y=k constant product market maker function used by many AMMs, Curve’s big innovation is its StableSwap invariant, which significantly lowers slippage for stablecoin and pegged asset trades. Like other AMMs, Curve relies on liquidity providers to add tokens to various pools, which may be plain pools with two or more tokens, lending pools that also lend out liquidity on borrow-lend protocols for additional rewards, or metapools that allow for the exchange of one or more tokens with the tokens of one or more underlying base pools. To incentivize pool liquidity, Curve pays out a yield to LPs that comes from trading fees, lending interest income (for pools that lend), CRV emissions, and third-party protocols offering their native token as an additional reward. Mid-last year, Curve released a new AMM model dubbed Curve v2 that allows for non-pegged assets to be paired and for liquidity to automatically concentrate around the current price without the need for LPs to readjust their LP ranges. Given its innovative crypto market making algorithm, deep liquidity, the importance of stablecoin swaps, and tokenomics discussed below, Curve has amassed over $22b in total value locked, making it the largest protocol in DeFi.

veNomics

Curve launched the Curve DAO and its native CRV token in August 2020, allowing holders to participate in governance. In order to vote, CRV holders must lock their CRV into non-transferable vote-escrowed CRV, known as veCRV, with voting power determined by the amount of CRV locked and how long the CRV is locked up for, ranging from one week to four years. Of note, veCRV holders may vote to direct CRV emissions to the pools of their choice via a weekly gauge vote. Additionally, locking up CRV allows holders to earn 50% of all trading fees on Curve proportional to their veCRV balance, as well as boosted LP rewards with the boost proportional to the time-lock, maxing out at 2.5x for a four-year lock. Such a vote-locking mechanism creates a flywheel where the more CRV one has, the more they can accumulate in the future. Additionally, this mechanism yields two important byproducts. First, vote-locking CRV removes it from the circulating supply and supports its price. Second, it allows those who control vote-escrowed tokens to direct liquidity, which is particularly important for stablecoins as it both enables low slippage and helps support the peg. Not only does this add another source of CRV demand, but it also removes the need for protocols holding veCRV to engage in liquidity mining to generate liquidity for their pool. In other words, veCRV holders can incentivize liquidity using CRV rather than their native token, and the accumulated veCRV is an asset rather than an expense.

Convex, The Kingmaker

Various protocols such as Yearn Finance and Stake DAO have used Curve to generate rewards for their users, though generally sold the rewards upon receipt, depressing the price of CRV. However, Convex Finance came along to offer both a liquid staking solution for CRV and boosted rewards for Curve LPs. To do so, Convex allows CRV holders to deposit CRV tokens into Convex in exchange for cvxCRV tokens, which then receive the usual rewards from veCRV (mainly 3crv), 10% of Convex LP’s boosted CRV earnings, and CVX tokens. This is currently generating a 54% APR, comprised of 8% from 3crv tokens, 17% from CRV tokens, and 29% from CVX tokens. Importantly, depositing CRV into Convex is a one-way transaction, so Convex is able to lock the deposited CRV into veCRV for the maximum four years to generate a high rewards boost. This then allows Curve liquidity providers to deposit their Curve LP tokens into Convex to earn boosted Curve rewards without locking up CRV in addition to receiving CVX rewards and any third-party rewards as well. For example, a liquidity provider in the MIM-UST pool on Curve would earn roughly 3-6% today depending on their Curve boost, but would earn 10% by depositing the mimustCrv LP tokens into Convex, six percentage points of which come from CVX token rewards. Such a virtuous cycle – where boosted rewards cause liquidity to flow through Convex, allowing it to capture even more CRV – has allowed Convex to amass $16b in TVL, second only to Curve, and to accumulate 44% of all veCRV, giving it an enormous amount of power in dictating where rewards, and thus liquidity, get distributed on Curve. In essence, Convex figured out that CRV wasn’t just a governance/farming token, but also a mechanism to control liquidity.

The Battle for veCRV & The Bribe Economy

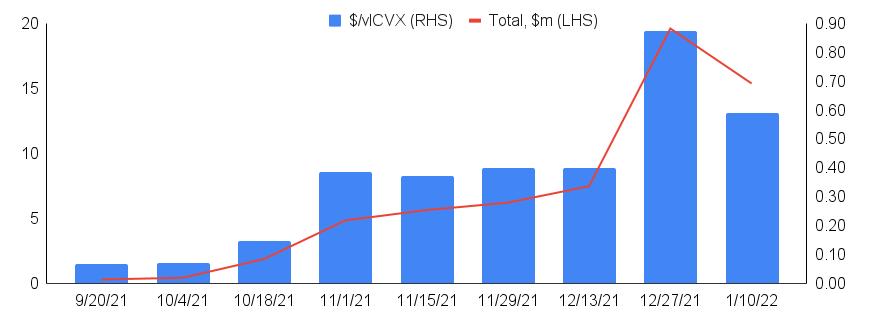

Convex has given its holders the ability to direct its veCRV votes by locking CVX into vote-locked CVX, known as vlCVX, for a period of ~16 weeks and voting via bi-weekly snapshot votes. While this meta-governance is essentially voting on voting, if one believes veCRV is valuable for its ability to direct CRV emissions, then one must also believe that vlCVX is valuable for its ability to direct veCRV votes. Moreover, as there are currently 5.1 CRV tokens locked on Convex for every CVX token locked, one CVX token bestows the same voting rights as 5.1 CRV tokens. Given this enormous power with Convex essentially governing Curve, there is now a race among protocols to control as many CVX tokens as possible, with Alchemix, BadgerDAO, Abracadabra, Status, Olympus, and Keeper DAO all accumulating CVX tokens, to name a few. In addition, CVX voting rights may also be delegated to Votium and a cottage industry around CVX vote-bribing has popped up, similar to how it has for CRV votes with Andre Cronje’s bribe.crv.finance. In fact, while locking CVX on Convex appears to offer just a 3% APR, this doesn’t take into account the lucrative bribes, which were $0.59 per vlCVX, or $15m in total during the last two-week round, and $0.87 per vlCVX and $20m in the prior round, shown below in Exhibit 1 and equating to a 40%+ APR. Currently, each $1 spent on bribes to CVX holders generates $2.05 in CRV emissions, so it’s advantageous for protocols to bribe CVX holders versus offering liquidity mining rewards.

Shortcomings and Risks

Curve has pioneered veNomics to allow for community-driven liquidity direction and CRV to be locked up, Convex has allowed Curve users to band together for greater rewards and created a black hole to slurp up CRV, and together Curve and Convex have created one of the most synergistic, powerful flywheels in DeFi. However, all this is not without setbacks and risks. While some have called Curve’s liquidity direction decentralized as it’s decided upon by the community, others have criticized it for its ability to be controlled by whomever has the most wealth. And liquidity for some Curve pools may run dry simply because would-be users were unable to amass enough CRV voting power to direct rewards there. In addition, Convex needs cvxCRV to at least somewhat closely track CRV in order for users to continue to be willing to trade CRV for cvxCRV. This peg is not guaranteed as arbitrage opportunities don’t exist without a mechanism to redeem cvxCRV back into CRV. In addition, risks are stacked as protocols build on top of each other, inheriting the smart contract risk of each layer beneath it. Finally, it remains to be seen what may happen during the next crypto winter, as a falling CRV price makes the rewards less valuable, dampening the flywheel.

What Could Be Next

Despite these risks, we see a bright future for Curve and Convex, and offer the following thoughts. There are several protocols attempting to capture as much CRV and CVX as possible, such as Bent Finance, which builds on top of Convex to allow users to bend their CVX into bentCVX for an even higher yield (ie. the Convex of Convex), and Redacted Cartel, an authorized OHM fork that is using Olympus tokenomics to attract CRV and CVX voting power. There will surely be more. And, existing protocols are likely to continue to battle to accumulate CRV and CVX outright in order to direct liquidity to their pools. And, as it still makes more economic sense to bribe CVX holders to vote liquidity to targeted pools rather than offer liquidity mining rewards, bribes should increase in value and come from additional protocols as the number of non-pegged cryptocurrency Curve pools grows. The demand for liquidity direction should be supportive for the price of CRV and CVX, all else equal, especially as DAOs and protocols are buyers in addition to typical retail demand. Further, Convex will likely look to expand to other protocols with similar token-locking models as it recently announced with Frax to reduce its reliance on Curve and to move it from a Curve rewards optimizer to a more generalized governance gauge black hole. And lastly, Curve and Convex are likely to become more important as the demand, usage, and market cap of stablecoins grows. All that said, what’s clear is that innovative tokenomics are giving way to new liquidity provisioning mechanisms that can benefit the protocol and its token price rather than harm it. And with the release of non-pegged cryptocurrency pools, it’s possible that Curve might just one day become the backbone of DeFi, with everything built on top and tapping into its liquidity.

Exhibit 1: Votium vlCVX Bribes by Round

Source: Llama Airforce, GSR

Author: Brian Rudick, Senior Strategist

Sources

Curve Docs, Convex Docs, Delphi Digital: Convex Continues Compounding CRV, Messari: The Convex Complex: How Convex Finance is Shaping DeFi, Incentivized: This is why the Curve Wars are Being Fought, IntoTheBlock: Understanding veNomics, CryptoTube: CURVE WARS EXPLAINED $CRV $CVX, Justin Bram: Everything you need to know about The Curve Wars, RektFoodFarmer: Curve Wars Explained! NEW PLAYERS SLURPING up $CRV and $CVX !

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.

This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.