The Block Research recently released its 2022 Digital Asset Outlook, commissioned by GSR, examining the state of the market, investment trends, decentralized finance, blockchain gaming, and other important cryptocurrency sectors. We summarize the report’s 2022 outlook in this week’s Chart of the Week.

The Block’s 2022 Digital Asset Outlook

2021 was a phenomenal year for all things crypto. From Tesla’s addition of BTC to its balance sheet to Beeple’s $69m NFT sale, Coinbase’s IPO, and El Salvador’s declaration of BTC as legal tender, cryptocurrencies entered a new level of cultural awareness. And with record hiring, investment, and corporate activity, the future looks bright. To think about the coming year, The Block Research recently released its 2022 Digital Asset Outlook, commissioned by GSR, recapping the most important cryptocurrency developments in 2021 and looking at the future of the space over the coming year. The report covers many topics, including the state of the market, investment trends, and various cryptocurrency subsectors like institutional custody, layer one and two platforms, DeFi, Web3, and NFTs, and blockchain gaming. While the report offers tremendous reports on all of the above, we focus our recap on the 2022 forward-looking components.

Institutional Custody

Institutional investors continued to enter the digital asset space throughout the year, further solidifying custody as a foundational layer of the digital asset ecosystem. Custodians spent much of 2021 improving their multisig, multi-party computation, and hardware security module custody solutions and expanding value-added services such as trading and lending, both organically and via acquisitions. In fact, 2021 was a record year for both fundraising and M&A by custody-focused companies. In 2022, it’s likely new entrants will enter the custody space. In addition, regulations will progress and potentially become more stringent, particularly for direct custodians compared to technology providers enabling self-custody. Custodians may be subject to custody-specific regulations and will also be impacted by regulations pertaining to stablecoins, digital asset service providers, and digital assets more generally. Lastly, international custodians may face increased local licensing requirements and/or requirements to establish local branch offices this coming year.

Layer-1 and Layer-2 Platforms

2021 saw skyrocketing activity, both on Ethereum as well as on competing smart contract blockchains. The growth of non-Ethereum chains was boosted by performance capabilities, such as speed and cost, as well as by monetary incentives, which for some networks are now worth over $1b given rising token values. Larger TVL chains often saw Ethereum mainstays move up the leaderboard post-launch, though smaller chains have seen some native protocols remain TVL leaders. In 2022, interoperability will become more important, heightening the need for cross-chain bridging solutions and highlighting their respective speed, security, and decentralization tradeoffs. Solutions similar to AnySwap could see outsized growth, given the lower inherent risk in its non-custodial bridge transfer mechanism. Layer two solutions are also likely to become more formidable competitors to layer ones given their low fees/fast transactions, high level of security, additional yield offerings, potential to issue native tokens, and a likely rising number of dapps.

Decentralized Finance

2021 saw DeFi total value locked increase over 6x, and most areas of DeFi saw significantly increased activity often with a leading protocol, such as derivatives and dYdX, structured products and Convex Finance, liquid staking and Lido, and algorithmic stablecoins and UST, to name a few. Looking ahead, 2022 will likely see Euro stablecoins gain adoption, due in part to a relatively more welcoming regulatory attitude. Tokenization of real-world assets could bring a vast pool of “old wealth” into DeFi. In derivatives, concepts from perpetual futures could be ported to create “everlasting options” to simplify strategies for users and consolidate liquidity from multiple expiries. New liquidity bootstrapping mechanisms that reward efficiently-placed liquidity or dole out rewards based on quantitative targets like concentration, loyalty, and others could proliferate. 2022 will also likely see protocols experiment with different implementations of governance to align interest among protocol users and token holders. And we’re likely to see DeFi bifurcate with some protocols offering permissioned DeFi services for institutional investors and others speeding up decentralization.

NFTs & Blockchain-based Gaming

NFT trading volume exploded in 2021, totaling ~$9b with roughly 60% in art and collectibles such as CryptoPunks and ArtBlocks and 40% in gaming NFTs like Axie Infinity. Blockchain-based gaming brought about new features, such as allowing players to own in-game assets and giving developers additional revenue streams such as taking a cut of secondary sales. Other key developments in 2021 included gaming guilds, elevated fundraising/valuations, and non-Ethereum activity. Going forward, gameplay will likely need to improve to withstand a potential downturn and concurrently lower monetary rewards. Moreover, while their long-term utility is clear, prices for some NFTs may be frothy, and NFT projects will have to drum up demand through marketing or added utility to stay relevant. Further, multichain scaling solutions will be key to mass adoption of NFTs. And the metaverse is inevitable, though a truly user-owned, decentralized version will take time.

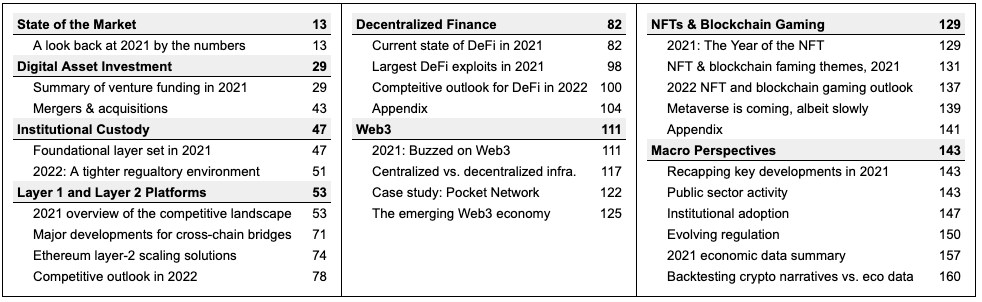

Exhibit 1: The Block’s 2022 Digital Asset Outlook Table of Contents

Source: The Block, GSR

Author: Brian Rudick, Senior Strategist

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.

This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.