Bitcoin and Ethereum

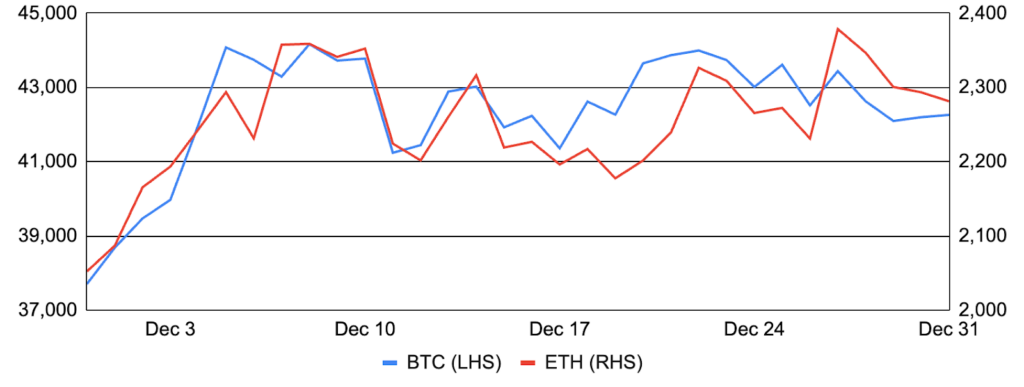

Bitcoin gained ~12% during December after entering the month around $37,700 and finishing at ~$42,250. The majority of gains came during the beginning of the month as ETF optimism grew. In addition, risk assets in general were bolstered by the month’s dovish Fed meeting and updated dot plot that suggested the Fed will cut rates three times in 2024. Still, with performance driven mainly by idiosyncratic ETF news, bitcoin’s correlation to equities declined despite the strong monthly return in both asset classes. Bitcoin also saw increased inscription activity that added to fees for miners, discussed more below. Elsewhere, Mt. Gox began its first disbursements to certain creditors that opted-in to using PayPal; Brazil’s largest bank Itau Unibanco launched a bitcoin trading service; Bitcoin Core version 26.0 was released with improvements to network connectivity and syncing speeds; and, a Taproot Wizards contributor open-sourced a script that would rid one’s node of inscriptions by rejecting such blocks, telling the anti-inscription crowd to “run the script” or admit that they’re virtue signaling.

Ethereum also had a strong month, gaining ~11% after entering December at ~$2,050 and finishing around $2,300. It was a notable month for onchain activity, which caused the net ETH supply to fall by ~54.1k ETH, the second largest monthly decline despite a lull in activity around the holidays. Notably, Vitalik released his third annual roadmap diagram, where single-slot finality and combatting stake centralization garnered increased focus while verifiable delay functions (VDFs) and state expiry were relatively deemphasized (see our Ethereum roadmap report for a dive into these topics). Developers also outlined a tentative path for the forthcoming Dencun hard fork that includes the throughput-improving Proto-Danksharding upgrade, discussed more below. Elsewhere, EigenLayer raised and quickly reached its newly set LST deposit caps and its TVL now exceeds $1.5b; Mantle launched an LST using the ticker mETH; Kelp DAO and Renzo each launched new liquid restaking tokens (LRTs); and, Blocknative unveiled its real-time Ethereum mempool explorer.

BTC and ETH

Source: Santiment, GSR.

On Target For a Spot Bitcoin ETF Approval Despite the Confusion

The SEC is widely expected to approve the 11 outstanding spot Bitcoin ETF applications today, Wednesday, January 10th, for a number of reasons. First, the SEC is facing the final deadline on the Ark/21Shares application and thus must either approve or reject that application by today. In addition, the SEC uncharacteristically delayed two ETF applications early in November, with many theorizing the move set up a window that ends today enabling it to approve all applications at once. Moreover, the SEC is seemingly boxed into an approval after suffering a scathing loss in Federal Appeals court to Grayscale last August. Also, the SEC’s engagement with issuers on certain topics (cash vs. in-kind creations) and the speed of responses are rather unprecedented in spot Bitcoin ETF application history. Lastly, a series of tweets from SEC Chair Gensler warning about the risks of crypto assets (here and here) align with the warning posts made prior to the SEC’s approval of Bitcoin Futures ETFs in 2021. While the SEC tweeted out a false approval notice last night after its Twitter account was compromised, it’s widely expected that a legitimate approval will still come later today, and executives at multiple ETF issuers have indicated trading may begin as soon as Thursday morning.

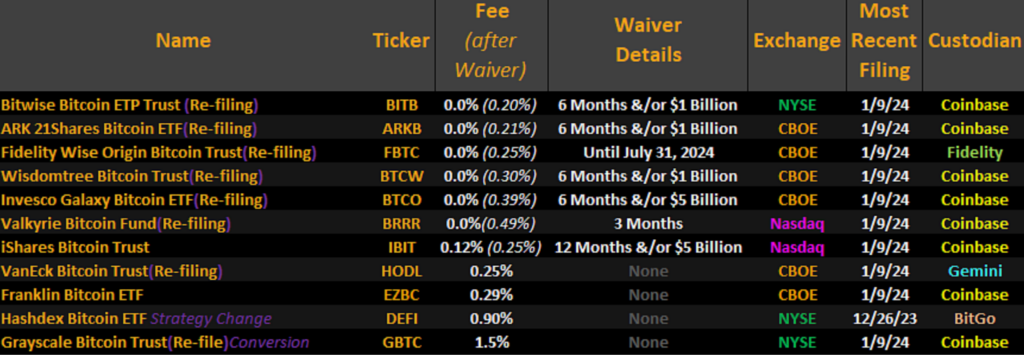

With an approval seemingly a done deal, there have been several notable surprises in the prospectus amendments over the last two days. Overall, fees have compressed to a greater degree than expected, with many issuers charging 20-30 bps, much lower than existing Bitcoin Futures ETFs/spot ETFs in other regions, and several issuers are also employing fee waivers to temporarily reduce fees even further. The one notable exception is Grayscale, which set its fee at 1.5% and will remain 7.5x more expensive than Bitwise’s cost leading 0.2% fee. Grayscale may be relying on a sticky user base, with its heavy retail owners less likely to switch and its more sophisticated investors potentially more likely to stick around due to the tax considerations of large unrealized gains. It’s also possible that Grayscale may launch a second ETF with lower fees to compete for new assets while leaving their existing higher fee assets in place. This approach was executed by BlackRock in the past with the launch of IEMG and IAUM to compete against lower fee issuers without fully cannibalizing its existing higher-fee ETFs in EEM and IAU.

Spot Bitcoin ETF Applicants’ Tickers, Fees, and Waivers

Source: James Seyffart (Bloomberg Intelligence), GSR.

Inscriptions Everywhere

It was also a big month for inscription-based activity, both on Bitcoin and elsewhere. As a reminder, inscriptions are based on Ordinal Theory, a Bitcoin meta-protocol created by Casey Rodarmor that orders and assigns a unique identifier to each individual satoshi. Such a protocol enables sats to be “inscribed” with arbitrary content such as text, images, or video to create “inscription” NFTs. Later, pseudonymous developer Domo extended Ordinal Theory usage by proposing a method to inscribe data on to sats to create a fungible token standard dubbed BRC-20s and allowing anyone to deploy, mint, or transfer fungible tokens such as ORDI, the first BRC-20 token contract deployed.

The debate around inscriptions on Bitcoin continued to heat up during the month, both following Ocean Mining Pool’s decision to reject inscription transactions last month and due to a continued rise in ordinals activity and associated fees on Bitcoin. Opponents of inscriptions have likened them to spam, while others bemoaned its extension of Bitcoin’s narrow monetary use case as well as its impact on fees for everyday users. Proponents, however, cautioned against banning arbitrary data, while others celebrated rising blockspace demand as a solution to Bitcoin’s declining security budget (several blocks during the month saw fees outweigh the block reward, such as this one). Despite the debate, activity continued and we saw several notable items that continue to increase credibility for inscriptions on Bitcoin. These include ORDI’s 282% rise during the month, Sotheby’s holding its first Bitcoin Ordinals sale, and Honey Badger inscription #8 selling for a record $450,000 on Magic Eden.

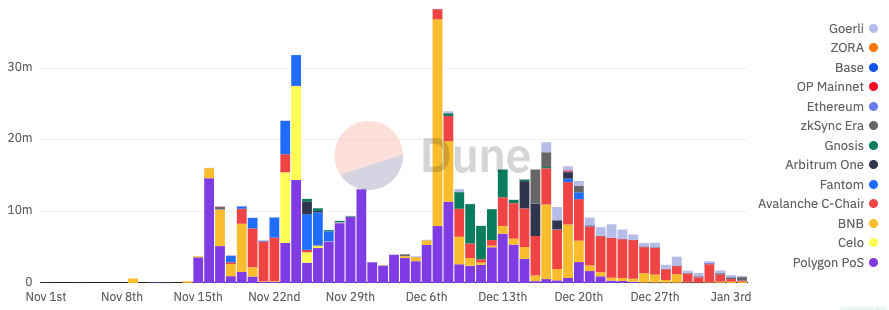

Beyond Bitcoin, many inscription-inspired protocols are now popping up on other blockchains like Ethereum, Polygon, The Open Network, Mantle, NEAR, and Fantom, among others. Unlike Bitcoin inscriptions, which store arbitrary data on chain in the witness section of a transaction or typical Ethereum NFTs that map NFTs to wallet addresses via smart contracts, inscription-inspired assets simply store token data in transaction calldata – the equivalent of the “notes field” – and then utilize offchain indexers to interpret this data. Ethscriptions, for example, encodes JSON data into calldata and then interprets it via deterministic protocol rules. Such a method has several key benefits, such as storing all data onchain, materially lowering costs given the lack of smart contract interaction, promoting a more fair launch than typical NFT launches, and enabling retail to access low-cap crypto assets. However, they also heavily rely on off-chain indexers all following the same rules and enable low cost speculation that has allowed bots to spam and even bring down several chains such as Arbitrum, zkSync Era, Avalanche, Cronos, TON, and Celestia. In our view, while there are certainly some benefits, EVM inscriptions and their reliance on off-chain indexers are a bit of a step back vis-a-vis more traditional NFTs with logic codified into smart contracts.

Daily EVM Inscriptions, Past Three Months

Source: Dune.com via @Hildobby, GSR.

Solana Outperformance Continues

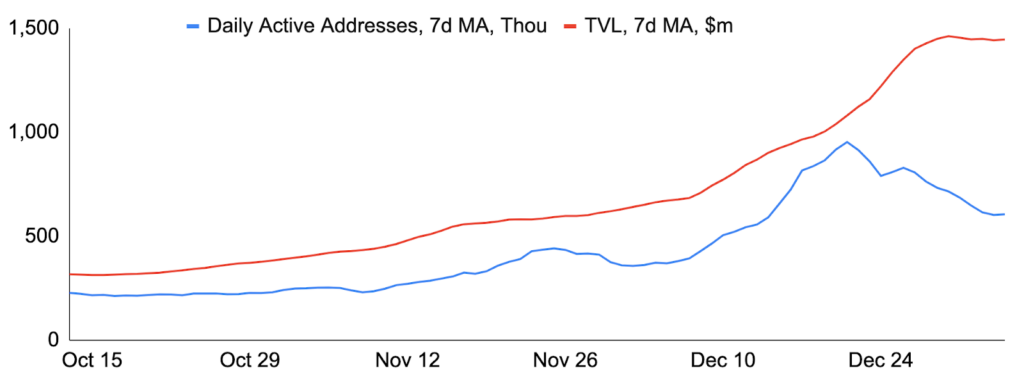

Solana continued to exhibit spectacular performance during December, increasing a remarkable 71% (+919% in 2023) and flipping XRP to become the fifth largest token by market cap. Much of Solana’s recent price action is due to increased activity on the chain, such as rising daily active wallet addresses, increasing TVL, and NFT trading volume that has recently eclipsed that of Ethereum. In addition, great products with strong product market fit are now coming to market, resulting in recent high profile airdrops from the likes of Pyth, a speed-focused oracle, Jito, a Solana validator client/liquid staking provider/MEV optimization engine, and Juptier, a DEX aggregator originating ~80% of all Solana organic swap volume. Moreover, there also appears to be a newfound appreciation for Solana’s technology, including its parallelized execution and local fee markets, which helped it to attract successful projects to move from other chains to Solana, such as Render, a decentralized compute platform, and Helium, an IoT/5g DePIN protocol. Even memecoins have gotten in on the action, with BONK increasing 3.5x in December, and helping Solana to sell out its Saga mobile phone that comes preloaded with a BONK airdrop. And, with positive future catalysts such as the coming launch of the Firedancer validator client, Solana’s price has followed suit.

Not to be outdone, Avalanche (AVAX) had a strong December as well, increasing 80% on rising activity and strength in key verticals like gaming and RWAs. Lastly, there continues to be increased innovation around blockchain architecture, particularly around new VMs and modular components, with investors rewarding several key tokens in this area, including NEON (+370% in December), ICP (+195%), SEI (+135%), INJ (+95%), NEAR (+95%), and TIA (+85%).

Solana Metrics, Last 75 Days

Source: Artemis.xyz, GSR.

L2s Join In Too

It wasn’t just L1 tokens that exhibited exceptional performance in December, as many Ethereum L2s also exhibited strong price action. The main catalyst was Ethereum’s AllCoreDevs call on December 21st, where developers decided upon a tentative testnet schedule for the Dencun upgrade. As a reminder, Dencun features Proto-Danksharding (EIP-4844), which introduces a new Ethereum transaction type called a Blob-carrying transaction enabling for data to be posted in ‘blobs.’ Blob-carrying transactions are like regular transactions, but they also include an extra data blob that materially increases the amount of data available for rollups, and should cause the cost of posting data to Ethereum to plummet. While many had pegged Dencun to go live in March or April this year, solidifying this timeline and the reminder of the benefit for L2s helped tokens such as OP, IMX, and ARB increase 122%, 67%, and 54%, respectively, during the month.

Outside of improvements to the base layer, many L2s made notable progress in their own right. Manta Pacific, for example, became the first L2 to transition to Celestia for data availability, lowering transaction costs for users by an order of magnitude. In addition, EigenLayer and AltLayer announced the concept of restaked rollups, which bundles decentralized sequencing, verification, and fast finality based on EigenLayer enabled security. Other notable developments include: Metis announced its expectation to become the first optimistic rollup to decentralize its sequencer early this year; Linea saw record activity during its Voyage campaign; StarkNet unveiled a pilot program to reward developers with a percentage of transaction fees; Cronos announced an upcoming Cronos zkEVM Chain built with Matter Labs’ ZK Stack; and, Immutable collaborated with Polygon for its Immutable zkEVM enabling gasless transactions.

Dencun Testnet Schedule

Source: Twitter.com via @timbeiko, GSR.

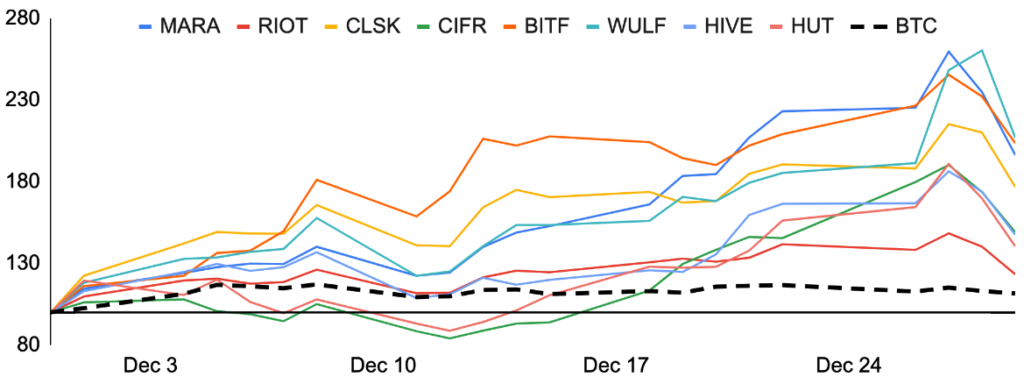

Bitcoin Mining Stocks Pop

Bitcoin mining stocks also enjoyed a particularly strong December, with many names increasing 50% or more during the month. While much of the performance was likely driven by BTC’s phenomenal rise and investors looking for a levered play on bitcoin into a likely ETF approval, there were also many positive fundamental announcements during the month. For example, mining profitability increased during the month, with hashprice – the expected value of 1 PH/s of hashing power per day – increasing over 30% in December. In addition, Middle East-based Bitcoin miner Phoenix Group listed on the Abu Dhabi Securities Exchange and later announced a $380m deal for Whatsminer mining equipment. Riot Platforms also announced the purchase of 18 EH/s of MicroBT miners and secured additional purchase options that may bring it over 100 EH/s. In addition, Hut8 and US Bitcoin Corp (USBTC) completed their merger bringing together 825 MW of energy across 11 sites focused on self-mining, hosting, managed services, and high-performance computing. And Core Scientific reached an agreement in principal on the terms of its bankruptcy plan with an expected exit this month. Lastly, Iris Energy announced a new Bitmain rig order as well as plans to double its hashrate in 2024, while Cipher Mining also announced a large purchase and purchase option of Bitmain rigs that could see its hashrate more than triple to over 24 EH/s.

Bitcoin Mining Stock Performance in December (Nov 30, 2023 = 100)

Source: Yahoo Finance, GSR.

GSR in the News

- Fortune – Predictions from top investors on cybersecurity, crypto, and fintech for 2024 | Fortune

- Yahoo! Finance – Crypto had a surprisingly great year. It still faces threats in 2024

- Cointelegraph – How crypto adoption grew in 2023, from investing to new ventures

- CoinDesk – Gauging Spot Bitcoin ETF’s Impact on Price Volatility

- The Block – Crypto’s secretive corner is heating up

- CoinDesk – Solana, Avax, Helium Led Digital Assets Gains This Year. What’s Next?

Authors:

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

View December 2023 Market Update

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.