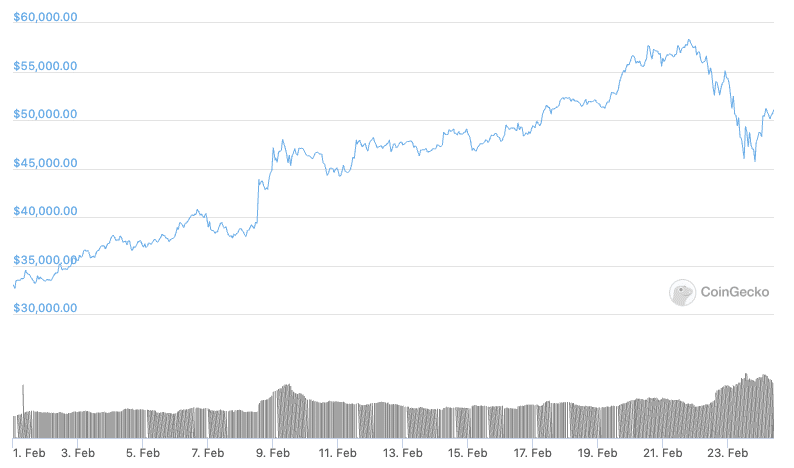

Bitcoin began the month trading at $34,000, and pushed on to reach an all-time high of $58,640 on the 21st of February.

On February 8th, in what was arguably the biggest ever headline in the digital asset industry, Tesla announced in an SEC filing that it purchased $1.5bn worth of bitcoin. The reasoning was stated as “more flexibility to further diversify and maximize returns on our cash.” Tesla also said it will start accepting payments in bitcoin in exchange for its products “subject to applicable laws and initially on a limited basis.” Tesla now joins Microstrategy and Square on the list of public listed companies with bitcoin on their balance sheet.

In other bullish news, the closely watched legal case involving Bitfinex and Tether has been resolved after 22 months. Bitfinex and Tether admitted to no wrongdoing and have agreed to pay $18.5 million as part of the settlement. Contrary to much online media speculation, there were no findings that substantiated the claim that USDT was used to manipulate bitcoin markets.

Coinbase’s S-1 filing with the Securities and Exchange Commission was made public on the 25th of February. The filing disclosed that Coinbase intends to list its Class A common stock on the Nasdaq under the ticker symbol ‘COIN’. Goldman Sachs, Citigroup, JPMorgan and Allen & Co are all listed as advisors. In 2020, Coinbase made a profit of $322.3 million. Currently there is no confirmed date for the listing, however, it is sure to bring increased volatility and interest to bitcoin.

Bitcoin price action February 2021, source Coingecko:

After the new highs bitcoin lost 18% of its value over a three day period, as large amounts of leverage was liquidated across the industry. As with most large market moves in bitcoin, a flurry of mainstream media declared bitcoin an overbought bubble.

There may be a period of consolidation for crypto markets over the short term, perhaps with further sell offs, but this was a market correction during an aggressive bull market that is not over. Substantial volatility has always been a normal part of expanding crypto markets, and bitcoin will continue to be volatile as more market participants enter digital assets. Bitcoin is up over 68% for the year. Rich Rosenblum of GSR told Coindesk:

“in the short term, this fresh institutional interest will contribute to more volatility, but over the long term, the existence of more significant institutional interest should reduce volatility.”

Macro Commentators

“Among an increasing number of investors and portfolio managers, bitcoin is considered a legitimate and distinct asset class.” Jurrien Timmer, Director of Global Macro at Fidelity Global Asset Allocation.

Jurrien Timmer published a report entitled ‘Understanding Bitcoin.’ Mr Timmer highlights bitcoin as a finite asset, with both a ‘unique supply and a unique demand dimension’, and as its network expands, bitcoin’s value and resilience could increase ‘even faster.’

Mr Timmer also touches on Inflation, ‘bitcoin may offer protection against inflation—and even hyperinflation.’ As a community we may have heard this type of commentary before, but it’s especially notable coming from such an established title and institution.

Similarly, Citibank recently released a report ‘Bitcoin At Tipping Point’ which outlines a birds eye view of bitcoin’s censorship resistant qualities as well as the well-covered digital gold comparisons.

ARK Invest CEO Cathie Woods continues to voice her investment thesis for bitcoin, stating that she believes companies will continue to put bitcoin on their balance sheets. Mrs Woods also noted a coming shakeup in the 60/40 (60% equity, 40% bonds) investment dynamic commonly seen in traditional markets. The investment thesis for bonds and fixed income has been greatly weakened in the current economic climate.

60/40

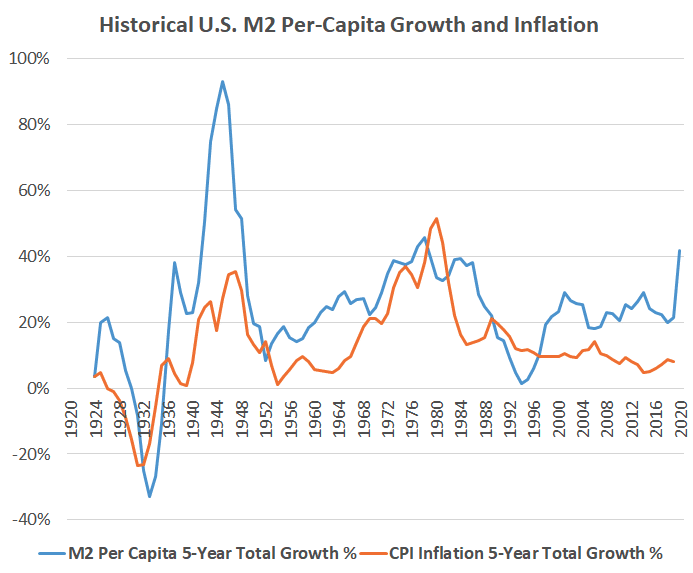

Many investors across the globe have voiced their concern over the growing possibility of inflation. Due to the massive increase in government spending and the floods of liquidity distributed by central banks since last March, investors have now noted subtle signs that inflation is on the way. 60/40 portfolios are designed to provide healthy long-term returns with limited volatility. They have had a very successful history, however, with bond yields so low and inflation fears emerging, investors are unsure how the dynamic will perform over the next 5 to 10 years.

Due to this monetary expansion, central banks have arguably inflated technology stocks in global equity markets. Rock bottom interest rates and extensive bond buying programs have left global economies in unprecedented territory. The question emerges how long central banks will hold down interest rates in the event of rising inflation. The combination of monetary expansion and the probable post-pandemic economic booms that global economies will enjoy as restrictions ease and vaccines take hold is a dynamic at the forefront of investors minds.

Global governments have implied that they will not tighten monetary policy if inflation rises until global economies make a sustainable recovery from the pandemic. For those in control of monetary policy, the risks of high unemployment and extreme economic pressure on the working class outweigh the risks of inflation as a result of stimulus.

So the question arises for asset managers around the world, where do you put your capital?

Monetary policy has forced investors to take more risks to find yield, Bank of America’s recent survey showed that average cash reserves are at an eight-year low of 3.8%.

The easy answer is what has worked before will work again, commodities, gold, real estate, collectibles, equities, silver, art. A big question investors are pondering is whether equities could get dragged down this time round. If history is to be trusted a moderate increase in inflation that is due to strong economic activity can be good for equities.

For bitcoin, the question isn’t whether financial institutions are allocating capital to hedge inflation, it is how many, and how much volume can this transpire into. As new innovative portfolio constructions are required, bitcoin is an appealing choice. It is the only asset that resides outside the financial system. Its finite supply and scarcity are a powerful combination, especially when the backdrop of accelerated technological trends is considered. The stage is set for new bitcoin highs in 2021, and volatility is guaranteed.

For the few who are saying inflation will not happen, who knows, maybe this time it will be different.

h/t Lyn Alden

GSR Update

GSR has hired David Sola, former managing director of global investment bank Houlihan Lokey’s Financial Institutions Group, as its new Chief Operating Officer. We are delighted to also announced the appointment of Trey Griggs, III, a former J. Aron and Calpine executive, as Chief Executive Officer of GSR Services USA, a subsidiary of GSR’s global operation.

Prior to joining GSR, Mr. Sola spent a decade as the head of Houlihan Lokey’s deal-making team in London. His work has centered around the convergence of traditional and digital finance and other industries, helping firms navigate the technological, financial and regulatory aspects of this fast-growing space. He has been the lead M&A banker on over $80 billion of completed transactions across multiple geographies. He also spearheaded equity and debt financings for clients in the public and private markets and advised on financial restructurings and joint ventures. He brings an extensive network of contacts from across the European banking industry, which will be vital as GSR continues to expand its business among traditional financial firms entering the digital asset marketplace.

Prior to his time at Houlihan Lokey, Mr. Sola was a Managing Director for SoftBank Europe, overseeing the conglomerate’s technology investments in the region. He also spent seven years at UBS Investment Bank, where he was the co-head of European M&A.

The appointment of Mr. Griggs as CEO of GSR Services USA will also bring extensive experience to GSR’s leadership team. Prior to joining GSR, Mr. Griggs led efforts to locate and evaluate acquisition opportunities at Kindle Energy, a Blackstone portfolio company. Mr. Griggs also worked at independent power producer Calpine in roles including President, Chief Commercial Officer and Executive Vice President.

Earlier in his career, Mr. Griggs worked at Goldman Sachs’ J. Aron division for 14 years alongside GSR founders Cristian Gil and Richard Rosenblum. Trey led Goldman’s North American Energy Risk Management activities and went on to establish and lead the Houston based Commodities Sales & Trading Office from 2011 to 2015.

Graduate Program

GSR launched a new graduate program which includes seven new positions across four global locations. The roles are centered around three key aspects of the firm, Trading, Information Technology and Business Development.

GSR Custom Options Continue to Expand

“After exponential growth for our bespoke options in 2020, we are excited to facilitate the growth of FIL, DOT and ALGO options markets in 2021, as there is already substantial interest, along with many others,” GSR co-founder and president Richard Rosenblum told the block.

Reports, market reports, and other information (“Information”) provided by GSR or its affiliates have been prepared solely for informative purposes and should not be the basis for making investment decisions or be construed as a recommendation to engage in investment transactions or be taken to suggest an investment strategy in respect of any financial instruments or the issuers thereof. Information provided is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services and is not a recommendation to buy, sell, or hold any asset. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page. Trading from Singapore, please review The Monetary Authority of Singapore (MAS) compliance note.