Bitcoin and Ethereum

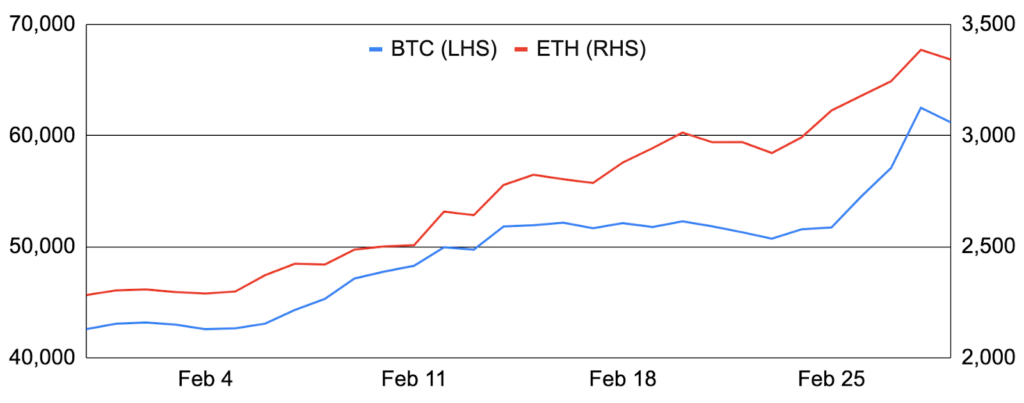

Bitcoin entered February around $42,600 and ended the month at ~$61,200, increasing a whopping 44% for its largest monthly gain since December 2020. Crypto’s apex asset drifted lower to start the month after the Fed expressed caution around near-term rate cuts post the latest FOMC meeting. However, bitcoin rallied as inflows into the spot Bitcoin ETFs picked up on February 8th and remained high for more than a week. Bitcoin’s ascent again paused mid-month as higher-than-expected US inflation pushed out expectations for easing monetary conditions before rallying towards month-end again on particularly strong ETF inflows. By the end of the month Bitcoin had hit new all-time highs in many countries, including China, Japan, the UK, India, Argentina, Turkey, and Egypt, and subsequently reached an all-time high against the US dollar this month before retreating. Elsewhere, innovation on Bitcoin continued as developers pushed to bring back the OP_CAT function and Bitcoin staking protocol Babylon launched on testnet. Bitcoin-focused payments app Strike rolled out services to Africa, while El Salvadorian President Nayib Bukele was reelected. Finally, Bitcoin futures open interest hit an all-time high, a research report found that Bitcoin and Ethereum are immune to 51% attacks, and new, never-before-seen Satoshi emails emerged in court.

Not to be outdone, Ethereum entered February around $2,300 and rose 46% throughout the month to finish around $3,350. ETH’s price was helped by Bitcoin’s move, and likely also by enthusiasm for a potential spot Ethereum ETF and the forthcoming Dencun upgrade set for March 13th. As a reminder, Dencun features EIP-4844 / proto-danksharding, which will materially expand mainnet’s data availability throughput via data blobs and will likely materially lower costs for L2s. Also during the month, the ETH supply fell by 46,000 ETH, equivalent to -0.5% annually, staking deposits passed 25% of circulating supply for the first time, and Ethereum TVL passed $50b for the first time since May 2022. Also notable was continued progress around client diversity, as Coinbase Cloud announced that it will migrate 50% of its validators from Geth to Nethermind over the next several weeks and will later add support for Erigon, both going a long way in reducing Geth’s execution client market share. In other news, Eigenlayer TVL skyrocketed as it lifted its deposit cap, StarkWare commenced its highly anticipated airdrop, Polygon and StarkWare announced new Circle STARKs and various Optimism-based chains deployed the Delta upgrade.

BTC and ETH

Source: Santiment, GSR.

Spot Bitcoin ETF Inflows Gather Momentum

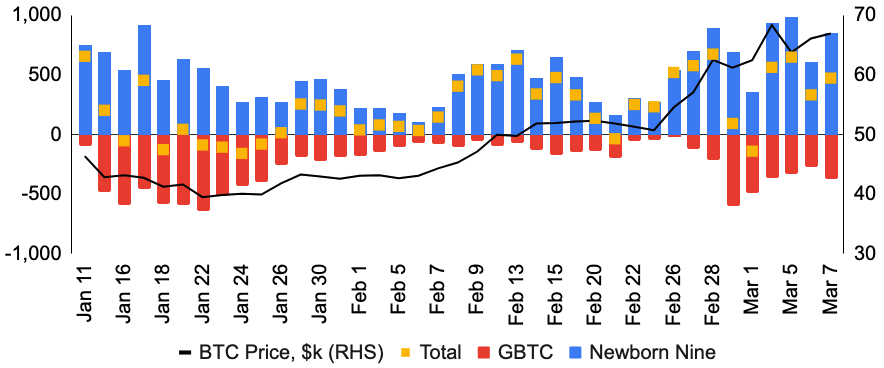

Average daily inflows into the new spot Bitcoin ETFs nearly tripled in February relative to post-launch January. And while much of February’s strength was due to subdued GBTC outflows that weighed much less on total inflows, the other spot ETFs continued to see extremely strong inflows during the month. In fact, total inflows spiked on February 8th and remained at $350m+ for seven straight trading days, helping to lift BTC’s price in the process. And while inflows slowed somewhat after, they came roaring back towards the end of the month, with February 28th’s $673m of inflows setting a new single-day inflows record, beating out day one’s $655m. In addition to flows, trading volume also skyrocketed during the last week of February, hitting $7.7b on the 28th alone.

While it remains to be seen what future inflows look like, most of the large wirehouses have yet to add the spot ETFs to their platforms, boding well for the future. Indeed, it was only just last week that Merrill Lynch and Wells Fargo reportedly began offering wealth management clients access to spot Bitcoin ETFs, while wealth managers such as Morgan Stanley and LPLA are said to still be evaluating whether to add the new spot ETFs to their platforms. All in, the spot Bitcoin ETFs finished the month with $48b of AUM, including $27b from GBTC, $10b from IBIT (which became the fastest ETF to hit $10b in history), $7b from FBTC, $2b from ARKB, and $2b from BITB.

US Spot Bitcoin ETF Inflows

Source: BitMEX Research, Santiment, GSR.

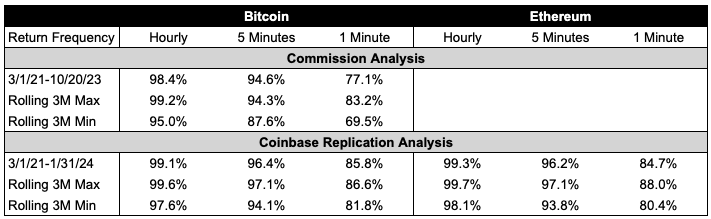

Waiting on a Potential Spot Ethereum ETF

As the crypto world awaits the next major Ethereum upgrade, Dencun, in a few short days, another major catalyst may be on the horizon – a spot Ethereum ETF. While there has been more speculation than news, the SEC must opine on Van Eck’s application by May 23rd, so we will likely receive clues regarding the potential outcome over the next several weeks and we will know for sure whether a near-term approval is in the cards by then.

While much less certain than for Bitcoin, the potential approval of spot Ethereum ETFs may play out in much the same way, where the SEC had approved futures-based Bitcoin ETFs and US courts subsequently ruled that the SEC’s differing treatment of futures-based and spot-based ETF applications was “arbitrary and capricious”, making it difficult for the SEC to continue to deny the spot applications. The one caveat, and in our opinion the key determinant for whether the spot Ethereum ETF applications go through, is that a major condition for this “like treatment” requirement for the futures-based and spot applications for Bitcoin was that the underlying spot and futures markets are/were closely correlated (see here for details). In other words, the SEC may still deny the spot Ethereum ETFs despite the court’s spot Bitcoin ETF ruling if the SEC finds that the Ethereum spot and futures markets are not sufficiently correlated. Moreover, the SEC has not revealed the full details of its correlation calculation, nor has it stated what its correlation threshold is. All that said, we find solace in Coinbase’s recent letter in support of the spot Ethereum ETFs, which included a correlation analysis that found Ethereum spot and futures markets to be as similarly correlated as those of Bitcoin. So while the SEC may ultimately deny the applications on other grounds and market-based indicators are presenting very different stories (the Grayscale Ethereum Trust is at just a 12% discount to NAV, while the Polymarket betting market assigns May approval odds at just 39%), we see the correlation between Ethereum spot and futures markets as the key determinant and are hopeful for an approval in May.

Correlation Between Coinbase Spot Market and CME Futures (Front Month) Market

Source: Coinbase, GSR. Note: Table reproduced for readability.

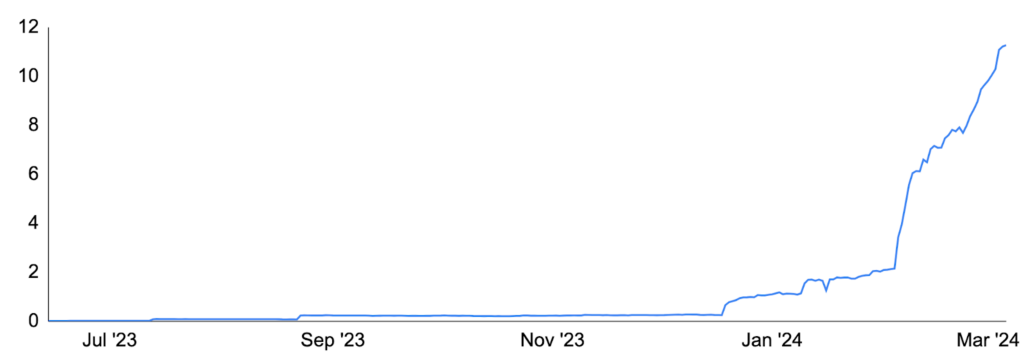

EigenLayer TVL Skyrockets

EigenLayer is a marketplace for decentralized trust, or perhaps more concretely a security-as-a-service protocol, and is one of the biggest innovations in blockchain technology in some time. Rather than Ethereum’s narrowly-targeted decentralized trust, where validators stake ETH to determine the canonical chain and validity of blocks – ie. Ethereum provides economic security for its decentralized applications, but not beyond – EigenLayer expands Ethereum’s trust layer by enabling native ETH stakers and LST holders to restake their ETH to secure bridges, oracles, sidechains, and many more. Such applications, known as Actively Validated Services or AVSs, simply rent security from restakers, alleviating the need to otherwise bootstrap their own validator set and offer high inflationary rewards, while restakers receive additional yield in exchange for taking on increased slashing conditions. And, this is all made possible by (node) operators, who accept staked ETH that are delegated to them (or use their own stake) and run the AVS software modules that perform the validation services for the AVSs. Now, anyone can build new blockchain services beyond simple dapps without having to worry about procuring security, allowing developers to focus on the product or service at hand and ultimately unlocking a flurry of innovation.

Though EigenLayer has been one of the most anticipated projects in years, it has taken a risk-first approach by imposing deposit caps that have only been increased gradually and incrementally. This has caused EigenLayer’s TVL to remain well below where it otherwise would have been, with the caps as the key determinant for TVL. In addition, a large ecosystem of liquid restaking tokens (LRTs) has sprung up, where LRT protocols not only select the operators and AVSs on behalf of restakers who are likely in a poor position to do so, but also provide receipt tokens for restaker deposits, generating liquidity on restake that would otherwise have been locked. LRTs such as EtherFi, Puffer Finance, Renzo, and KelpDAO have seen billions of dollars of staked ETH flow into their protocols, which are then restaked with EigenLayer, inflating EigenLayer’s TVL in addition to direct deposits. While TVL has been impacted by the appreciation of ETH as well as the temporary removal of EigenLayer’s staking cap in early February, EigenLayer has grown to be the second largest decentralized application by TVL with $11.4b, and growth is likely to continue as more ETH / staked ETH becomes restaked in the quest for additional yield.

EigenLayer Total Value Locked, $b

Source: DefiLlama, GSR.

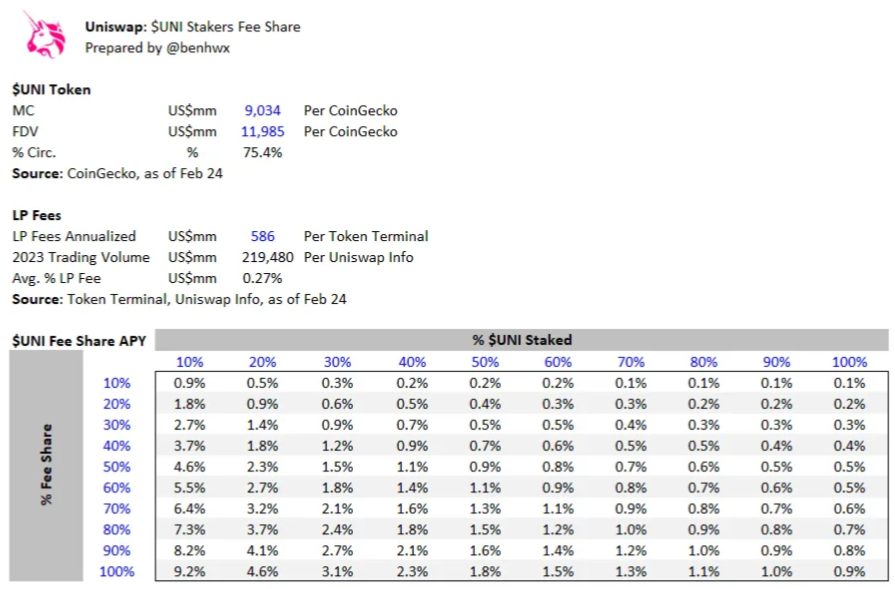

All Hail the Fee Switch

Even Uniswap, the most successful and well-known decentralized exchange with hopes of one day becoming the liquidity layer of the internet, is not immune from governance challenges. Indeed, less than 10% of circulating UNI is used to vote on governance proposals, and a large portion of existing delegation is stale with 14 of the top 30 delegates by voting power having not voted over the last 10 proposals. To fix this, the Uniswap Foundation released a governance proposal on February 23rd to upgrade protocol governance to incentivize active, engaged, and thoughtful delegation. Specifically, the proposal suggests upgrading the protocol so Uniswap’s fee mechanism rewards UNI token holders who have delegated and staked their UNI tokens.

While Uniswap’s “fee switch” has been speculated on for years, many believed it was unlikely to occur near-term, with token holder yield potentially increasing the risk of UNI being deemed a security in the US. In addition, past attempts to turn on the fee switch have failed, though this one notably had the support of the Uniswap Foundation. As such, the price of UNI immediately skyrocketed 70% in the wake of the proposal, and crypto Twitter was set ablaze with many wondering whether Uniswap knew something about the regulatory environment that would give it confidence to invoke the fee switch, or whether other protocols would be forced to consider fee switches of their own, possibly igniting the next DeFi wave (Frax Finance subsequently pledged to publish proposed revenue sharing). Nevertheless, the proposal passed a snapshot vote on Wednesday and now heads for an on-chain vote.

Potential Uniswap Yield

Source: Medium via @benhwx, GSR. Note: Uniswap currently charges LP fees of 0.3% on Uniswap v2 pools and 0.05-1.00% on Uniswap v3 pools. The example above assumes Uniswap inaugurates a 0.05% protocol fee that is shared with UNI stakers and then varies the percentage of UNI staked and the percentage of fees shared. See here for more details.

GSR in the News:

- The Dales Report – TLDR – TDR News highlights – January 31st / February 1st

- CryptoTimes – GSR Appoints Former JPMorgan Executive as Head of Trading

- CoinGape – Former JPMorgan Head Koukorinis Moves to GSR for Crypto Push

- Bloomberg – Bitcoin ETFs Start to Reshape Crypto Markets

- The Block – Blockchain interoperability project Analog raises token round at $120 million valuation

- DL News – First Bitcoin, now Ethereum. Analysts see four drivers behind an even bigger surge

- Bloomberg – Bitcoin Tops $53,000 to Reach Highest in More Than Two Years

- Washington Post – Bitcoin hits record high, breaking pandemic-fueled 2021 highwater mark

- MarketWatch – Meme coins like dogecoin and Pepe are rallying again. Here’s what it means for crypto.

- Bloomberg – Bitcoin Faces ‘Sell-the-News’ Moment After Setting Record High

Authors:

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

View February 2024 Market Update

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.