Price Action

Bitcoin (BTC) started June with a push over $10,000 and finished the month at $9,190 down 10.5%.

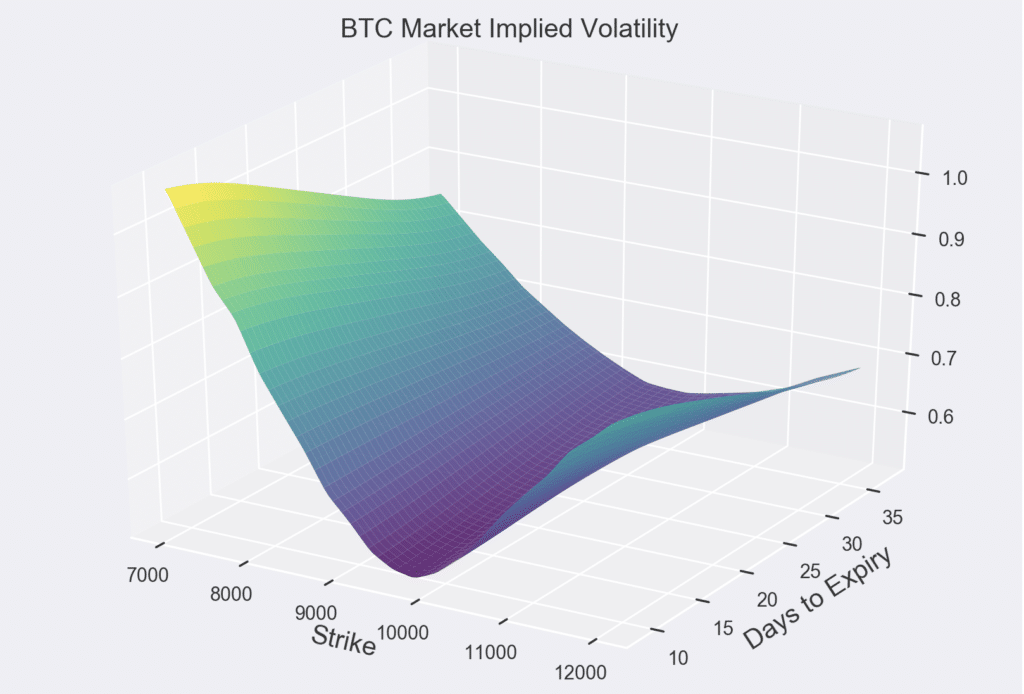

The aftermath of the halving and the search for yield in a limited accessible loan/low interest rate world, put tremendous selling pressure on BTC volatility. In early June, even with the swing up past $10,000 catalyzed by Trump’s threat of a military deployment and subsequent sell off/covering, which saw liquidations of over $240 million on BitMex alone, did not stop the trend. For context – the Bitmex Bvol Index (annualized BTC vol) now sits at 39.17% compared to the highs of 170% seen at the end of March and early April. As a result, the BTC term structure indicates that near dated vol is inexpensive.

Our 3d Jun Implied Volatility surface shows how low front dated At the Money vol is.

Close to 1$ billion of Bitcoin options expired on Friday the 26th which was a major focus point for the media in the preceding weeks.

“Options expiry is unlikely to have an influence on price action in comparison to the impact of futures expiry,” Richard Rosenblum of GSR told Coindesk “But, options could end up having a bigger impact in the long term.”

In the last weekend of June Bitcoin momentarily tested the $8,500-$8,700 level of support again, which is also the 200 2-Day moving average, a continued level of inflection for trend followers. Bitcoin difficulty had its biggest jump since mid April on June 17th, while on chain data firm CryptoQuant noted mining pool outflows calmed toward the end of last week. CryptoQuant claims two mining pools released over 7,000 BTC on June 24th. Bitcoin’s hashrate is yet to recover pre halving highs (122TH on May 8th), but it has made a substantial recovery to 116 TH on June 30th, implying competition is alive and well in the mining community.

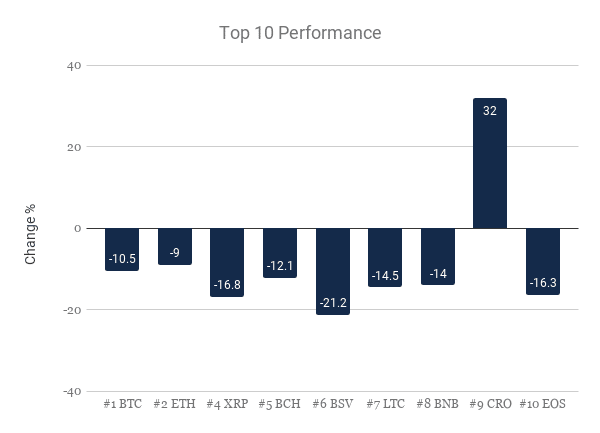

All major assets had poor price performances in June. The CRO token was the sole project to have positive gains in the top ten. The crypto asset class continues to show signs of correlation with wider macro markets and the S&P 500. Bitcoin’s relationship to the S&P 500 has returned to March levels of correlation according to the Block. Bitcoin’s correlation was very low throughout May, however, it has recently increased. The correlation between hourly returns of SPX500USD (S&P 500 futures) and BTC/USD on Coinbase, stands at 0.3. This level is low, but it is still statistically significant.

Macro Volatility and Uncertainty Remains

In what are unprecedented times, crypto is seeing a correlation to wider macro markets during times of high volatility. There has been an extraordinary amount of volatility in equity markets, and further turbulence could mean bigger moves for the digital asset sector. As world economies begin to open up some market analysts are saying the V-shaped recovery is complete. However, if we take a deeper look at the scale, circumstances, and velocity of the rally experienced at the end of March, it is clear investors should analyse it with equal amounts of skepticism and caution.

The world is fighting the greatest pandemic in a 100 years and the worst economic contraction in over 80 years. However, the stock market, which is supposedly a measure of current prosperity and an indicator of future economic health – was able to rally a record advance and nearly recapture all time highs. On February 19th 2020, the US stock market hit an all time high with the S&P 500 reaching 3,386. The market then dramatically began pricing in the aggressive coronavirus outbreak and the S&P 500 fell 35% in five weeks to a low of 2,237. The market low coincided with the federal reserve implementing record breaking stimulus packages, and resulted in one of the fastest recoveries ever witnessed.

There was a 17.6% gain from March 24th to March 26th, the biggest three day increase in 80 years. By the end of the first week of June, the recovery was up 45% from its lows. The market rose 33 of 53 trading days within this time period. By June 8th the S&P 500 was even for the year and only 4% off it’s all time highs. These all time highs had occurred in February when the US economy was bustling and relatively positive outlooks were on the horizon.

When the Fed buys securities they are not doing it with value in mind, they are doing it to preserve liquidity and support the financial health of multinational companies. This process then puts money into the hands of sellers. A large portion of that capital is then reinvested which drives up assets prices and decreases interest rates as well as the likelihood of future returns. Investors placed great trust in the actions of the US fed to aid an economic recovery. It was made clear early on that the federal reserve would do anything to stop further downturn in the markets, and investors appeared to get great confidence and optimism from their actions.

The rally was built on the Federal Reserves quick action and potentially too much optimism from investors, it’s difficult to justify prices where they are, and Bitcoins ‘on again off again’ correlations make the next big move hard to predict.

While there have been plenty of distractions, it is clear that institutional interest is growing in the space, and regardless of short term volatility, the fundamentals Bitcoin offers to those building investment portfolios continue to make it very appealing.

GSR Update

In June GSR announced strategic additions to its trading leadership team, naming Aman Bhalla as Director of Trading Operations and Meng Hwee Neo as Director of Trading, Asia.

Mr Bhalla and Mr Neo are the latest institutional traders and business leaders to join the GSR team. They bring extensive expertise in traditional financial markets, namely commodities and derivatives, essential for GSR’s continued development of institutional-grade products and market-making services for the digital asset space. GSR trading volume so far this year has already surpassed its total for all of 2019.

As Director of Trading Operations, Mr. Bhalla will oversee all aspects of GSR’s Trading Operations functions including assisting the business to support new products, focusing on credit risk and helping to expand the firm’s back and middle office functions. Prior to joining GSR, Mr. Bhalla held the position of Commodities Business Manager in Europe at Citadel. He has also served as Head of Financial Operations (EMEA) at Mercuria Energy Trading S.A, and Vice President at Goldman Sachs, managing its Commodities Middle Office team.

“We’re committed to adding the sharpest talent from traditional finance as we continue to help build a mature digital asset marketplace,” said Cristian Gil, Co-Founder. “Aman and Meng Hwee’s extensive experience at some of the world’s most respected financial institutions will help pave the way for further growth and ensure that we continue to meet the needs of an increasingly sophisticated investor base.”

Mr. Neo will manage and expand GSR’s regional trading relationships and implement trading strategies tailored to regional and country-level needs and trends. Mr. Neo previously served as a Senior Equity Derivatives Trader at United Overseas Bank (UOB), Southeast Asia’s third largest bank by total assets. At UOB he specialized in managing exotic derivative portfolios. Mr. Neo has also worked as Head of Risk and Global Markets at Levitas Capital, a Quantitative Risk specialist at CIMB, and a Business Analyst at JPMorgan Chase.

“Asia has long held a position of importance in digital asset markets, especially for exchanges and institutional investors interested in expanding their exposure to this rapidly growing asset class,” said Mr. Neo. “I look forward to further expanding GSR’s footprint in the region.”

GSR also made hire across Trading, Business Development, Engineering and HR. See our full list of new hires here.

Reports, market reports, and other information (“Information”) provided by GSR or its affiliates have been prepared solely for informative purposes and should not be the basis for making investment decisions or be construed as a recommendation to engage in investment transactions or be taken to suggest an investment strategy in respect of any financial instruments or the issuers thereof. Information provided is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services and is not a recommendation to buy, sell, or hold any asset. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page. Trading from Singapore, please review The Monetary Authority of Singapore (MAS) compliance note.