Just when we thought the year couldn’t get any worse, FTX collapsed, producing many knock-on effects and causing the total crypto market cap to fall 15% during November. We review what happened at FTX and the companies caught in its wake, examine the latest announcement from Flashbots, and look for macro greenshoots in this month’s Crypto Commentary.

Bitcoin and Ethereum

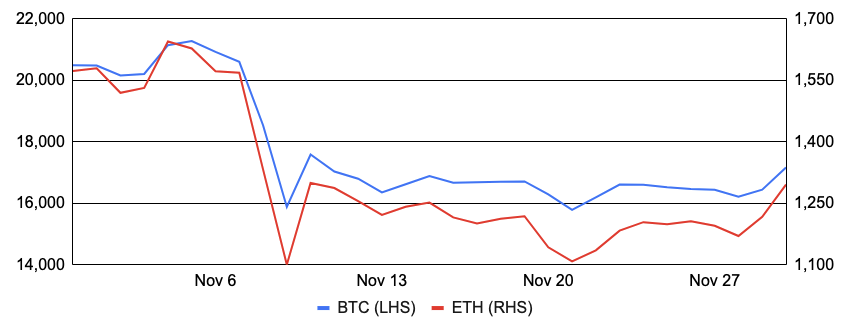

Bitcoin fell 16% in November after entering the month around $20,500 and finishing near $17,200. BTC traded modestly higher to start the month before falling sharply as solvency concerns around FTX and Alameda arose, covered in detail in the following section. During the peak of the selloff, more than $1.4b of crypto was liquidated in a span of three days, and BTC’s correlation to the S&P 500 fell to a calendar year low of ~0.25 as strong equity performance failed to materialize in the crypto markets given the contagion. Looking past recent crypto market turmoil, Bitcoin Core 24, a new version of the Bitcoin software, was launched to introduce new replace-by-fee logic. In the mining sector, New York state and Canada’s Manitoba province enacted temporary moratoriums on certain new proof-of-work mining operations. Elsewhere, the U.S. Attorney’s Office revealed that it seized more than 50,000 BTC last year that were previously stolen from the dark web marketplace Silk Road a decade earlier; El Salvador implemented a new dollar cost averaging strategy aiming to purchase one bitcoin every day; and, Sollet Wrapped Bitcoin (soBTC), a tokenized version of Bitcoin on Solana that FTX/Alameda wrapped, fell below five cents on the dollar in the aftermath of their bankruptcy filings.

Ethereum similarly had a rough November, falling ~18% during the month after entering at ~$1,550 and finishing around $1,300. The dispersion between BTC and ETH was muted during the contagion, and ETH’s correlation to BTC reached its highest level of the year at around ~97%. Net ETH issuance was deflationary for the second month in a row, and the total outstanding supply of ETH fell by ~2,100 during November. While net issuance was positive on most days, a sharp uptick in on-chain activity during the week of the FTX collapse resulted in the most significant burning of ETH since The Merge, with ETH supply falling by more than ~9,000 in that week alone. In addition to market dynamics, it was a significant month for Ethereum as Vitalik Buterin released an updated roadmap for the platform, outlining its long-term vision. Most prominently, the updated roadmap introduces a new category known as The Scourge that aims to mitigate the centralizing impact of MEV and redistribute MEV income while ensuring credibly neutral transaction inclusion. Other important changes include an increased focus on zk-SNARKs to make it easier for nodes to verify blocks, a transition of Ethereum’s proof-of-stake implementation to Single-Slot Finality, and a more explicit focus on transitioning to quantum-resistant cryptography in the future. Keep an eye out for an updated version of our Ethereum Roadmap report in the coming days. In other Ethereum-related news: a16z unveiled a new Rust-based light client called Helios to provide trustless access to Ethereum; Phantom wallet announced plans to expand support to Ethereum; Matter Labs, the team behind zero-knowledge rollup solution zkSync, raised $200m to support its mainnet launch; and, Ethereum’s Ropsten testnet will be shutdown in December.

BTC and ETH

Source: Santiment, GSR

FTX and Alameda Crumble

Founded by Sam Bankman-Fried (SBF) and Gary Wang in 2019, FTX was one of the most prominent cryptocurrency exchanges, offering trading in derivatives, leverage products, spot, NFTs, FX, equities, and more. Notably, FTX was not SBF’s first successful crypto venture, the title of which goes to proprietary trading firm Alameda Research, which he founded in 2017 with Sara Mac Auley. Though FTX.com was headquartered in Hong Kong (later, The Bahamas), making it an “offshore exchange”, FTX was widely trusted due to its close association with US-based FTX.US and its highly visible and respected founder, who made frequent media appearances, donated tens of millions of dollars to political figures, and often testified to congress. With an easy to use interface, a diverse and innovative product set, access to over 300 tokens, and marketing deals with major celebrities and sporting organizations, FTX grew to be one of the largest crypto exchanges by volume, claimed over 1m users, and commanded a $32b valuation. However, it was not to last.

FTX’s downfall started with a CoinDesk article published on November 2nd, which claimed that FTX’s sister company Alameda Research had nearly $6b of it’s $15b of balance sheet assets made up of locked and unlocked FTT, FTX’s exchange token that offered discounts on trading fees to holders. Not only did the FTT have poor liquidity or was locked, but it also pointed to close ties between the two firms that were supposedly separate. Rumors began to swirl surrounding Alameda’s financial position, and CZ, the founder of the world’s largest crypto exchange Binance and whom SBF had been publicly feuding with of late, announced that Binance would liquidate its FTT position, which it owned through an early investment in FTX, adding to worries and pressuring the price of FTT. Alameda CEO Caroline Ellison responded on Twitter that Alameda would happily buy Binance’s FTT at $22, roughly the price of FTT at the time, which led to speculation that Alameda had posted FTT as collateral for leveraged positions and it was attempting to prevent getting liquidated. The following evening, FTT breached $22 and quickly fell below $5 the next day. Many began to question the extent of FTX and Alameda’s relationship as well as the health of both companies, leading to an estimated $6b of withdrawals from FTX in a matter of days. Binance offered a fleeting glimmer of hope when it signed a non-binding LOI to acquire FTX, though quickly decided not to pursue the deal, citing FTX’s mishandling of customer funds and investigations by regulators. That same day, FTX paused withdrawals, with SBF blaming higher-than-thought leverage from improperly labeled internal accounts and insufficient liquidity to meet the record outflows.

It soon became evident, however, that FTX had lent customer deposits to Alameda Research, which Alameda couldn’t pay back due to both significant losses as well as the illiquidity of the investments it made with much of the borrowed funds. And by November 10th, media outlets pegged the shortfall at FTX to be between $8b and $10b. With such a large hole, FTX was unable to raise additional outside capital, and subsequently, along with FTX.US and Alameda Research, filed for bankruptcy in Delaware. SBF resigned as CEO and was replaced by former Enron liquidation attorney John J. Ray III. Adding insult to injury, FTX reportedly suffered a $600m+ hack after its bankruptcy announcement, and warned users to avoid using the FTX website and apps, which could contain viruses.

Despite SBF continuing to claim that FTX’s problems stemmed from illiquidity, falling crypto prices, and poor business decisions, there are many reports of blatantly nefarious activity. Most importantly, per FTX’s terms of service, customer deposits were not allowed to be lent out, and it appears that at least four executives were aware of the transfer of customer funds to Alameda. This alone likely moves FTX’s collapse from negligence to criminal. Moreover, media reports suggest that FTX utilized software to hide the transfers from external auditors, and it appears that customer funds were being misappropriated as far back as late 2021 per on-chain analysis and in May and June with Reuters reporting that SBF funneled customer deposits to prop up Alameda during those months. Additionally, FTX lent its executives billions of dollars, often in an unsecured fashion. And FTX instructed customers to deposit funds to a bank account controlled by Alameda, and these wires totaled more than $5b over the years. And despite losing billions, Alameda had the decks stacked in its favor, with the prop shop reportedly having a secret exemption from FTX liquidation protocols, and also reportedly engaging in buying tokens ahead of FTX listing announcements. John J. Ray III, who has overseen many well-known bankruptcies and frauds including that of Enron, stated that he had never seen “such a complete failure of corporate controls and such a complete absence of trustworthy financial information” as at FTX, with its poor systems, faulty regulatory oversight, and a concentration of control in the hands of a small, inexperienced, and unsophisticated group of individuals.

In the aftermath, a court-appointed liquidator for FTX in The Bahamas agreed to transfer the bankruptcy case to Delaware, and creditors are now in for what’s likely to be a long, drawn-out process. Many regulators are reportedly investigating FTX, including the SEC, DOJ, and The Bahamas Securities Commission. And after an unusual period of silence, SBF has re-emerged to hit the media circuit, offering an incomplete summary of what happened and failing to take full accountability.

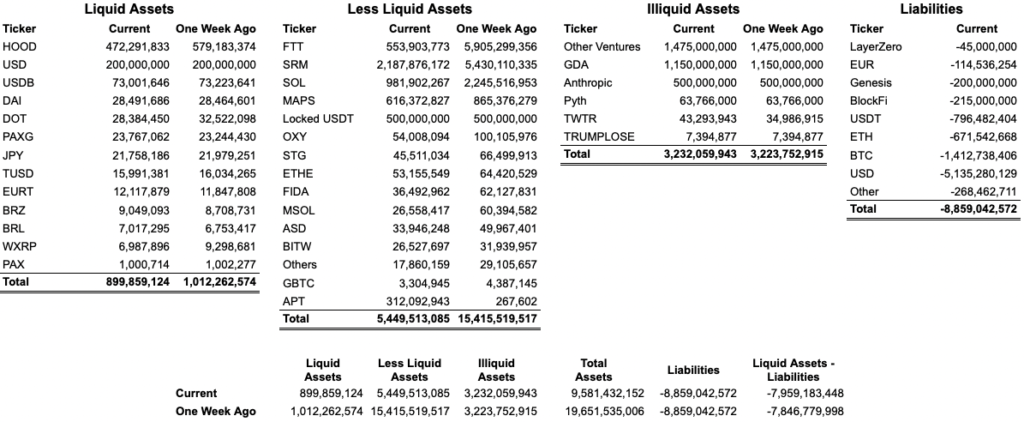

FTX Balance Sheet Dated November 10, 2022

Source: Financial Times, GSR. Data aggregated by GSR for visibility purposes. The original report can be found here and includes Sam Bankman-Fried’s comments, disclaimers, and notes. The gap between liquid assets and liabilities is allegedly from a poorly labeled negative $8b fiat account hidden from this view. If one believed this claim, liquid assets would have exceeded liabilities by ~$41m. Lastly, note that the real value of assets shown were almost certainly still overstated with the size of exposure to illiquid tokens like SRM, MAPS, and others.

FTX Collateral Damage

Unfortunately, the swift and shocking collapse of FTX impacted many individuals and entities in crypto. Perhaps most directly impacted were those who had funds trapped on FTX, whether due to letting FTX custody assets or from posted collateral required for derivatives trading. In fact, bankruptcy filings indicate FTX may have over one million distinct creditors, and users are unlikely to recover anything during the likely prolonged bankruptcy process. And it’s not just individuals who had funds on FTX, as projects such as Star Atlas and Oxygen and investment managers such as Galois and Ikigai lost the majority of their funds when FTX collapsed. Early investors in FTX will also likely lose their full investment, and Temasek ($275m invested), Sequoia ($210m), and SoftBank ($100m) have all already marked down their investment to zero. Companies that were being “rescued” by FTX like Voyager and BlockFi now hang in the balance, with Voyager ending the deal to sell itself to FTX and reopening the bidding process, and BlockFi pausing withdrawals and filing for bankruptcy protection.

Another impact of FTX’s collapse has been lowered confidence in centralized exchanges, leading to billions of withdrawals around the industry. In fact, the percentage of BTC and ETH sitting on exchanges hit lows not seen since 2018 and 2016, respectively. To increase transparency and ease fears, many exchanges began producing proof-of-reserves, which are Merkle Tree-based cryptographic snapshots to show the tokens and coins an exchange holds. While not perfect – not all are produced by independent third parties, few show an exchange’s full liabilities, and some question whether they can be gamed by receiving deposits right before the snapshot – it’s definitely a step in the right direction towards restoring the faith that was so badly damaged.

Another party negatively impacted by FTX’s collapse is Solana, the high-speed smart contract blockchain that SBF had vocally advocated for, built applications on, and invested in. Given the connection and collapse, SOL is now down nearly 60% over the last 30 days, compared to BTC down 20%, and Solana TVL has fallen over 70% compared to 27% for Ethereum. In addition, several protocols in the Solana ecosystem were uniquely impacted by FTX’s demise, such as Serum, an on-chain limit order book created and controlled by FTX that was forced to fork itself, and wrapped tokens issued by FTX or Alameda such as soBTC that are now trading at just cents on the dollar.

Genesis, the crypto prime broker that along with Grayscale, Foundry, CoinDesk and others make up Digital Currency Group (DCG), has also been significantly impacted by FTX’s demise and further fallout could arguably push FTX-induced contagion to new heights given Genesis’s and DCG’s size and reach. Indeed, the trouble for Genesis started earlier this year with the bankruptcy of crypto hedge fund Three Arrows Capital, whom Genesis had lent $2.4b in undercollateralized loans. 3AC’s failure led to “hundreds of millions” in losses at Genesis and required parent company DCG to assume over $1b of 3AC debt to put Genesis back in good financial stead. Despite a few bumps such as losses to Bable Finance, it had appeared that Genesis had weathered the storm until FTX collapsed, and Genesis revealed that it had $175m of funds trapped on FTX. Market participants, including Gemini Earn users whom had lent $900m to Genesis via short-term loans and institutional lenders testing Genesis’s liquidity, made withdrawal requests from Genesis en masse amidst the uncertainty. DCG set out to raise $1b to buttress liquidity, but after failing to do so, Genesis was forced to pause redemptions and new loan originations.

The issues at Genesis began to engulf the larger DCG as speculation about intercompany loans ran rife. To assuage fears, DCG founder/CEO Barry Silbert penned a letter to shareholders, refuting the idea of a near-term bankruptcy and pinning the issue on illiquidity due to a mismatch in the duration of assets and liabilities. Also in the letter, Silbert revealed that DCG has over $2b of debt, $1.7b of which is owed to Genesis. Such a large debt burden likely makes it more difficult for DCG to raise additional funds, and many are speculating how this may all play out, particularly if DCG fails to repay the money it owes Genesis and leaves the prime broker with a large hole. Already, DCG has hired Moelis to explore all possible options including bankruptcy, there have been reports of Genesis attempting to sell its loan book to Binance and Apollo, and others are questioning whether Genesis will need to sell one of its subsidiaries like CoinDesk. For reference, DCG last raised equity in 2021 at a $10b valuation, though this was with much higher earnings and at the height of the crypto market.

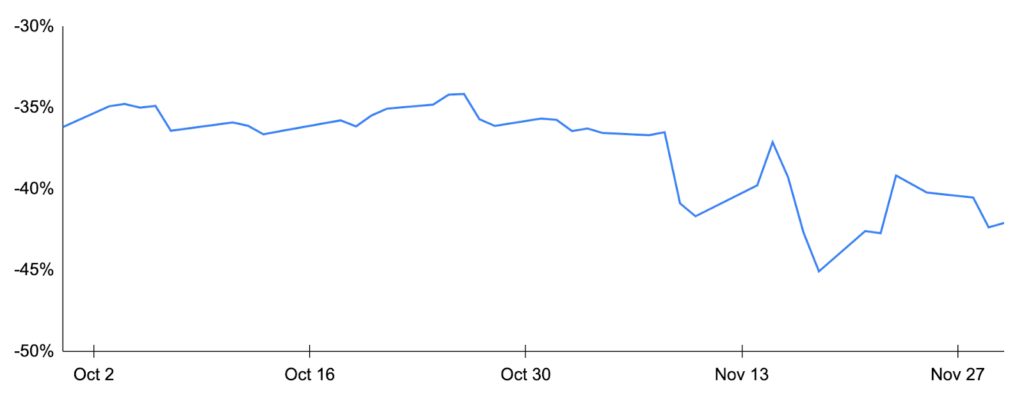

Further speculation has centered on what may happen with Grayscale, including whether DCG would sell the ~$850m of GBTC shares it purchased on the open market (though others argue there are limits prohibiting this), file with the SEC for Reg M relief allowing it to create and redeem shares at par (though most don’t believe this would be approved), or dissolve the trust altogether. Dissolving the trusts would be a particularly draconian event for crypto, as there are 635,000 BTC (~$10.7b) and 3,000,000 ETH (~$3.8b) underlying the Grayscale trusts, and it is not entirely clear whether Grayscale would have to sell these underlying assets in such a scenario. However, with the potential to wreck the markets and as its prized subsidiary, DCG is incentivized to avoid this option at all costs.

GBTC Discount, Last Two Months

Source: Y-Charts, GSR

The End-Game for MEV?

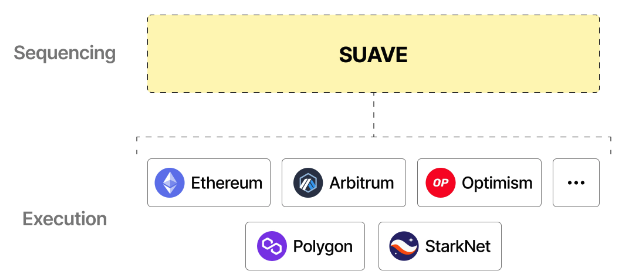

Flashbots, the company most prominently known for illuminating the dark forest of Ethereum’s mempool with products like MEV-Geth and MEV-Boost, unveiled SUAVE, its end-game plan for Maximal Extractable Value (MEV). SUAVE, or the Single Unifying Auction for Value Expression, is a distinct EVM-compatible blockchain intended to act as a modular sequencing (transaction ordering) layer to be used by other blockchains. As such, SUAVE unbundles the mempool and block builder role from existing chains, providing a MEV-aware encrypted mempool for users and a turnkey block builder for rollups and other L1 chains.

MEV – a measure of profit that a validator can extract from block production beyond the block reward and gas fees by including, excluding, and changing the order of transactions in a block – is actually a centralizing force, as those without MEV extraction expertise will simply delegate ETH to others, putting MEV extraction at odds with the Ethereum ideal of decentralization. While other solutions such as MEV-Boost have successfully isolated the centralizing effects of MEV to a specialized block builder role, variables like exclusive order flow and cross-chain MEV present emerging risks of an anti-competitive builder monopoly. SUAVE addresses these emerging centralization risks that went unanswered in previous solutions. While we will be publishing more detail on SUAVE, in the end, it attempts to maximally decentralize blockchain sequencing, maximize MEV revenue for validators, and allow open access to user and searcher transactions, all while improving the execution and privacy for user transactions.

L1s & Rollups Outsource Sequencing but Retain Execution

Source: Flashbots, GSR

Positive Macro Backdrop

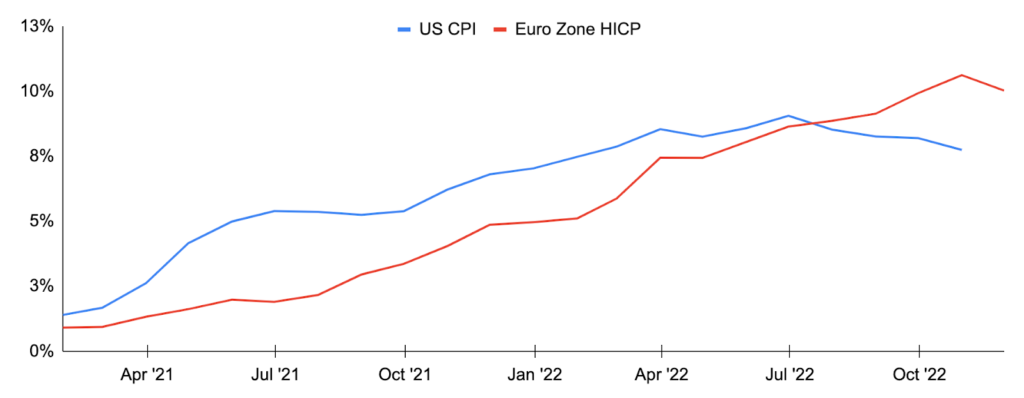

One positive during November has been the macro backdrop, highlighted by better than expected inflation and a subsequent rally in equity markets. Indeed, US CPI rose 7.7% year-over-year in October, a decline from +8.2% the prior month and lower than the +7.9% consensus. Core CPI, which excludes volatile food and energy costs, rose 6.3% year-over-year, also beating expectations by 0.2 percentage points. In the euro zone, inflation also improved as preliminary headline inflation increased 10.0% over the year in November, down from 10.6% the month prior and representing the first sequential decline in nearly 18 months. However, the drop in euro zone prices was partly attributed to volatile energy prices.

All eyes now turn to central bank policy, where Fed Chair Powell just last week played down the recent positive inflation trends and signaled that rates have further to climb, but did concede that the Fed could slow its pace of rate hikes starting at this month’s FOMC meeting. Fed fund futures now imply an 80% chance of a 50 bp hike and 20% of a 75 bp hike, compared to a month ago where investors pegged the chance of a 75 bp hike to be 42%. In Europe, ECB President Lagarde similarly expressed skepticism that inflation has peaked and the ECB is widely expected to raise rates again at its December meeting, with all eyes turning to the ECB’s 2023 inflation estimate that was last predicted in September to hit 5.5%.

Despite the cautious central bank rhetoric, markets reacted positively on the notion that inflation may have peaked and that we may be on the cusp of a Fed pivot. With a few exceptions, most major equity markets increased by mid-single digits percent in November.

Headline Inflation, Year-Over-Year Percent Change

Source: Eurostat, US Bureau of Labor Statistics, GSR

GSR in the Media

- The Block – The Block: Crypto trading firm GSR sees opportunities in Alameda’s demise

- CoinDesk TV – Bitcoin Back Above $17K Amid FTX Fallout | Video | CoinDesk

- CoinDesk – After Bitcoin’s Worst Week in 5 Months, Here’s What Crypto Analysts Are Saying

- CoinDesk – Coinbase, MicroStrategy Bonds Tank as FTX Collapse Dents Institutional Confidence in Crypto

- CoinDesk – FTX Contagion Revives Dreaded 2022 Crypto Knell – the ‘Withdrawal Halt’

- Crypto Briefing – Binance Commits $1B to Crypto Industry Recovery Fund

- CoinDesk – First Mover Asia: Bitcoin Stays Calm at $16.5K

- CoinDesk – Bitcoin’s Stagnant Crypto Dominance Points to Investor Exodus After FTX Bankruptcy

- Fox Business Mornings with Maria – Maxine Waters seems to have a ‘soft spot’ for Sam Bankman-Fried: Rich Rosenblum

Authors:

Matt Kunke, Junior Strategist | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Telegram, LinkedIn

View November 2022 Market Update

Disclaimers

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.