The Market

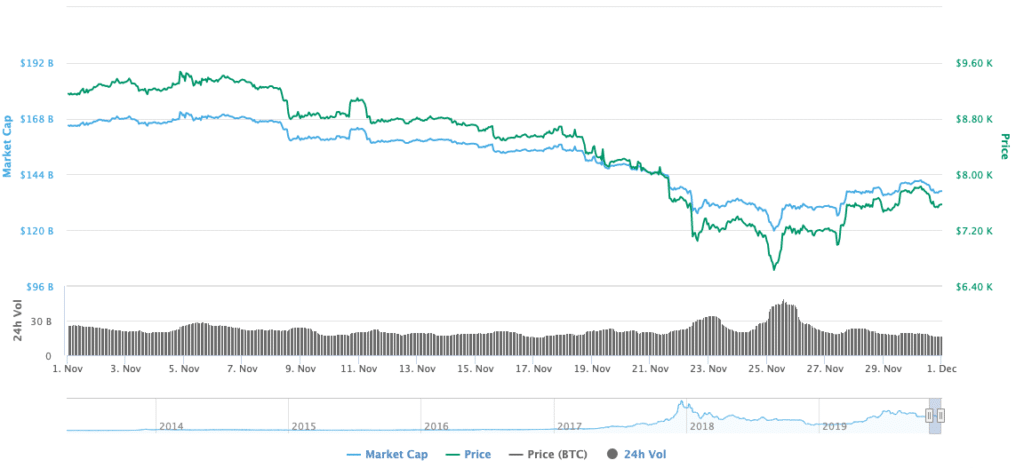

The crypto market was under some heavy selling pressure throughout the month of November. Bitcoin started off the trading at $9,100, a slow decline then developed into a substantial downward move to $6,600 on November 25th. Bitcoin ended the month trading around the $7,500 mark, down 18%.

Similarly to past months, many attributed this volatility to developments in China. It was reported in late November that 173 Cryptocurrency Exchanges and Token-Issuing Platforms were shut down, it was also reported that Binance’s Shanghai office was visited by the Chinese authorities, which is supposedly a part of an official crackdown on cryptocurrency exchanges across the country.

Market Cap and Price for Bitcoin in November (Coin Market Cap)

This reporting seems to be slightly misleading and has been exaggerating recent actions by Chinese authorities. Many articles cited an annual report on the stability of the Chinese financial system published by the People’s Bank of China on November 25th, as a catalyst. The articles suggested that the timing coincided with the recent announcement to investigate crypto trading platforms in China, but this looks to be purely coincidental (the previous year’s edition was also published in November).

Articles stated that 173 exchanges have been “successfully exited without risk” but this should be interpreted to mean that since the 2017 and 2018 editions of the report which encouraged more regulatory oversight of crypto trading, 173 exchanges have been successfully forced to move their main entity’s country of information outside of China. This has occurred, although it is well known many still have the bulk of their employees and users in China. It does not mean 173 exchanges were shut down in the last couple of weeks of November as many articles implied.

However, some of the more unscrupulous exchanges like MXC and Biki have indeed been investigated in the last few weeks, with some managers taken in for police questioning. It seems these exchanges are unlikely to survive. They have been well known as venues for illicit trading with questionable projects being listed.

Overall, recent events should clear out some of the shadier operators, giving more opportunities to the bigger players in the region such as Huobi and OKEx. We are not seeing the same scale of crackdown that occurred on Sep 4th, 2017, where the central security bureau issued the order. This time it was the Internet Finance Bureau which has less power and reach. It has certainly led to some risk-off trading in the markets towards the end of the month but the industry will come out of it in a cleaner and healthier state.

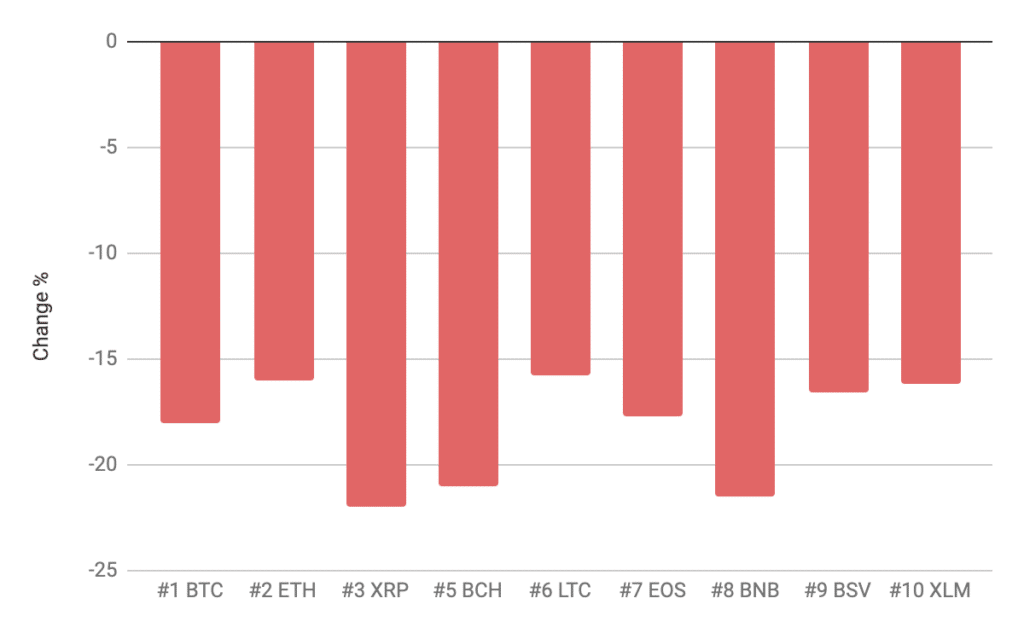

Losses across Top 10

All of the assets in the top ten saw substantial losses in November. ETH finished the month down 16%, XRP down 22.5%, BCH down 21%, LTC down 15.8%, EOS down 17.7%, BNB down 21.5%, BSV down 9.7%, and XLM down 16.2%.

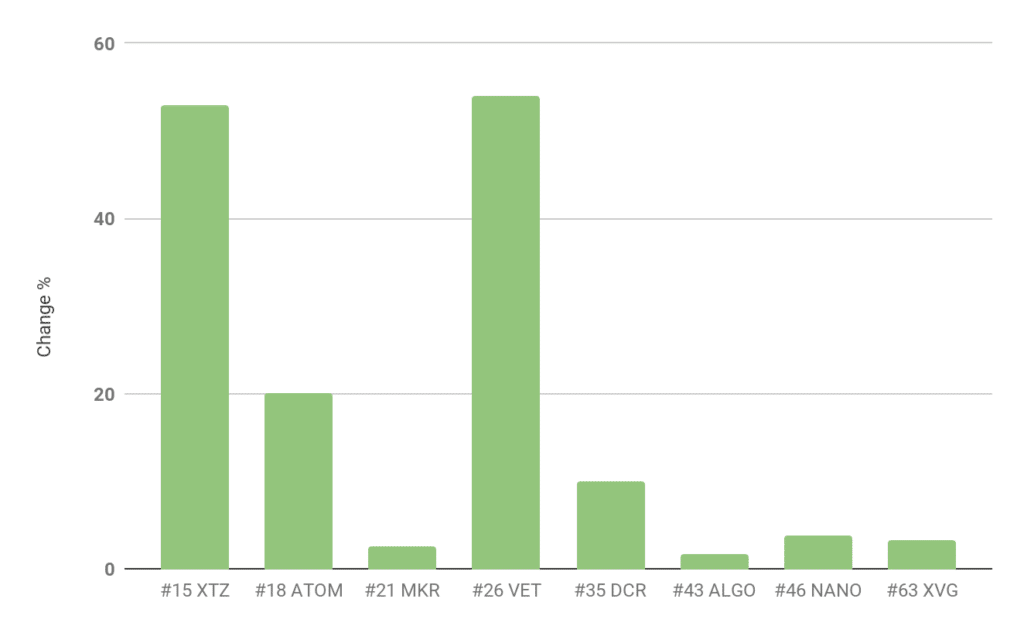

Inside the top 70, the main winners were ATOM up 20%, XTZ up 53.2%, VET 54.3%, DCR up 10%, NANO up 3.8%, Algo up 1.7%, XVG up 3.3%, and MKR up 2.5%.

Big Players, Bearish Prices

In recent months there have been many reputable companies entering the crypto space. Significant partnerships are being developed and new market products are coming to fruition. At present there is a lot of reasons to be positive when it comes to the cryptocurrency ecosystem, however, the market isn’t reflecting this.

The owners of the New York Stock Exchange are already trading bitcoin futures with options on the way. Major institutions such as Fidelity are expanding their digital asset offerings and doubling down on their intent to grow in this market. Fidelity’s Digital Assets arm was recently awarded a license by New York’s financial regulator. This license will allow the company to offer its cryptocurrency trading and custody services to companies based in the state. Many leading accounting and auditing firms, such as PWC, are taking on crypto funds as clients, and publishing thorough research on the market. These types of names were nowhere in sight when bitcoin hit its all-time highs in late 2017. Despite seeing substantial institutional interest in the media, the market, especially retail traders, seem to respond more to price hysteria than the slow but obvious entrance of the world’s biggest financial players. Despite this activity, the current market sentiment is undoubtedly bearish.

“It’s not going away. As long as the value is there, people will look to preserve that value,” Abigail Johnson, CEO of Fidelity, commenting on digital assets.

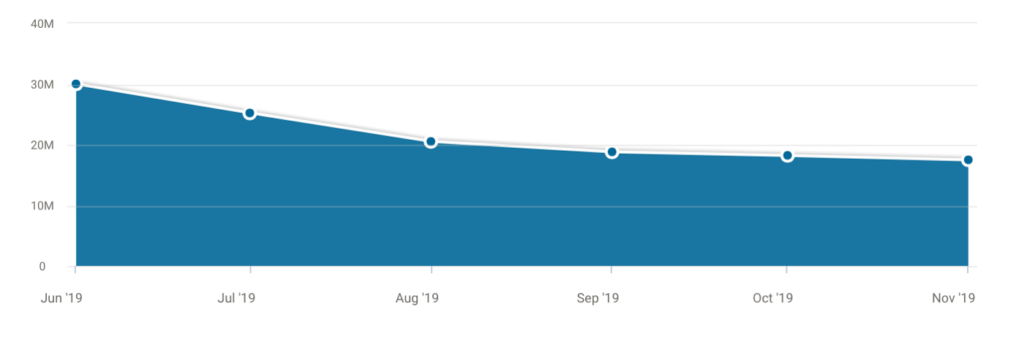

Traffic to the top 37 cryptocurrency exchanges has been consistently dropping since June. Below is a 6-month snapshot displaying the steady decline of traffic to the popular exchange Binance, a decrease of 12.5 million visitors. At present, retail traders seem to be gradually showing less interest.

Data taken from similar web

ADAM releases Code of Conduct

In mid-November, the Association for Digital Asset Markets (ADAM) released a code of conduct for the cryptocurrency market. GSR is one of the founding members of ADAM and has worked to develop standards around market ethics and best practices for digital asset trading.

It was announced that Anchorage, BitGo, BlockFi, Tagomi, and CMT Digital have all joined the association. This framework will help promote integrity, fairness, and efficiency in digital asset markets and GSR is proud to lend our trading and financial expertise to help develop these standards.

“With our extensive experience in traditional and digital asset markets, we understand the importance of transparency and integrity needed to propel this emerging industry forward. This was our ambition in forming ADAM, joining other market participants who have the same vision for digital assets. This code of conduct is the next step in making trust and fairness a hallmark of the cryptocurrency markets. It supports our efforts to continually transform how participants trade, access liquidity and manage risk.” Rich Rosenblum, Co-Founder, GSR.

As we reach the end of 2019, it has become clear that crypto is undoubtedly here to stay, and has never been better positioned to fulfil its potential of becoming an accepted global asset class. It is very important that established companies in the digital asset ecosystem use their experience and expertise to outline best practice and ensure a level playing field is created and maintained for those considering entering the industry.

A New Band of Hodlers

At present, software that reads the market’s volatility, volume, and social media sentiment is indicating that there is extreme fear in the market. The market may have further to fall in the short term, but the long term outlook looks positive.

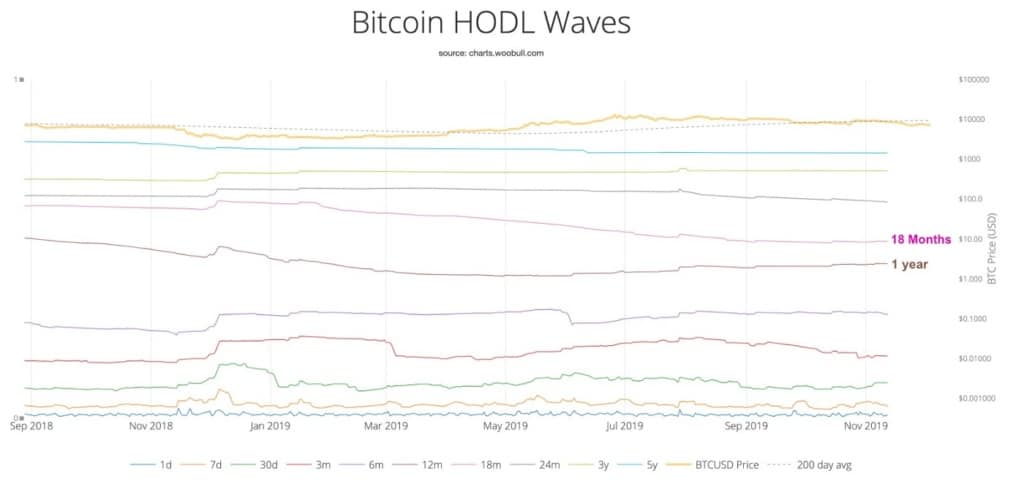

Data taken from woobull.com

If we assess the different bands of hodlers in the chart, we can see that the bitcoin being held for 12 months (brown line) and 18 months (pink line) are completely steady despite the recent market sell-offs. The bands below six months have shown a lot more volatility. This implies the new wave of holders who perhaps were introduced to digital assets in the bull run of 2017, are completely unphased by the recent selling pressure and negative media. They understand the market’s cyclical nature and are betting on the long term rise of the asset class.

GSR Update – ADAM Release

Read the latest coverage about the release of ADAM’s code of conduct.

DAS Markets

The GSR team thoroughly enjoyed the Digital Asset Summit in New York. GSR’s Rich Rosenblum gave his perspective on how institutions are integrating into the crypto market.

Rich was joined by Jack Tatar of Forbes, Chris Wittenborn of Velocity Markets Inc. Blockdaemon Founder Konstantin Richter, and Brooke Navarro Head of Capital Markets at tZERO Group, Inc.

GSR Careers

GSR currently has five open positions across our trading and engineering teams. If you would like to introduce yourself, email us at recruiting@gsr.io with your resume.