Bitcoin and Ethereum

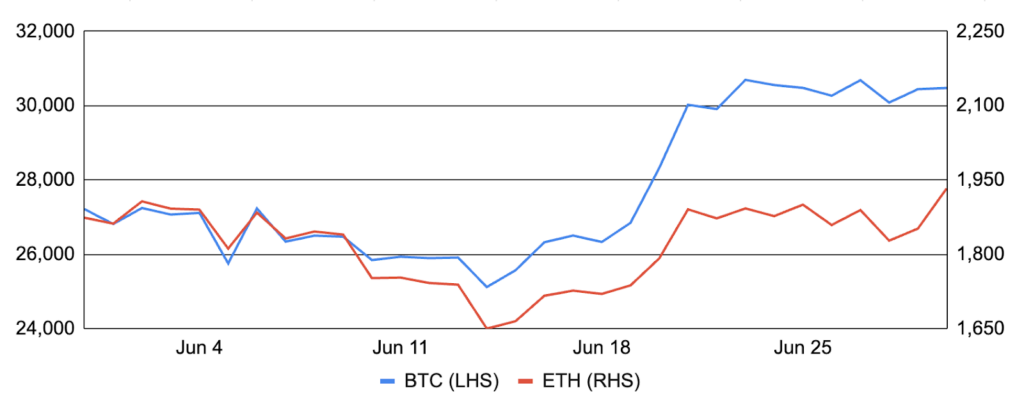

After realizing its first down month of the year in May, bitcoin once again produced positive returns, increasing 12% after entering the month around $27,200 and finishing at ~$30,500. The apex digital asset fell 8% over the first two weeks of the month on several negative catalysts – SEC lawsuits against Binance and Coinbase, a Friday evening altcoin-led sell-off, and a hawkish Fed meeting – though was relatively resilient compared to altcoins which saw their market cap decline 13% with the focus on what tokens may be securities. Moreover, bitcoin exuberance soon returned after the world’s largest asset manager, BlackRock, filed for a spot bitcoin ETF, and other asset managers quickly followed suit with applications of their own. In addition to the potential demand from a spot bitcoin ETF, bitcoin also benefited from greater regulatory clarity relative to other tokens after the recent SEC actions. In fact, bitcoin dominance increased ~4 percentage points over the month to 51%, and several bitcoin forks did extremely well, highlighted by Bitcoin Cash’s 169% one-month return. In other news, the GBTC discount narrowed to a nearly one-year low; the Volatility Shares 2x Bitcoin Strategy ETF, the first leveraged bitcoin futures ETF in the US, launched; Ordinals development continued with upgrades to index unrecognized inscriptions and to introduce recursion to unlock complex, interactive content; Binance set up Lightning nodes to ease deposits and withdrawals; Block’s bitcoin wallet Bitkey launched in beta; Microstrategy announced the purchase of 12,333 BTC over the last two months for ~$347m; and, Fed Chair Powell said that bitcoin has “staying power”.

Ethereum failed to keep up with bitcoin, but did post a positive return for the month, increasing 3% after entering June around $1,850 and finishing around $1,950. Ethereum followed a similar pattern as bitcoin throughout the month, though rallied much less in the latter half on the spot bitcoin ETF applications. And while Ethereum activity nudged down after the prior month’s memecoin mania, ETH supply still fell by ~12,500 ETH, marking its sixth consecutive monthly decline. Perhaps the most notable news of the month was the release of emails surrounding a 2018 speech by former SEC Director of Corporation Finance William Hinman in which he stated that ether was not a security. While the emails highlighted divided attitudes within the SEC over its approach to crypto, they also revealed that Hinman’s speech drew on input from multiple SEC officials, with some suggesting this demonstrates that the view that Ethereum is not a security was not that of a lone wolf but rather held by multiple SEC officials. Outside of the Hinman emails, it was also a busy month on the development front, where developers finalized the forthcoming Dencun upgrade, which includes five Ethereum Improvement Proposals including proto-danksharding (EIP-4844) aimed at decreasing transaction costs associated with transferring data from L2s to mainnet. Separately, developers also proposed raising the maximum validator stake from 32 to 2,048 ETH. While there are some potential risks to decentralization from the proposal, it would reduce the validator queue, simplify the process of running validators for large staking-as-a-service providers, and help solo stakers who would be able to compound rewards rather than needing to grow their rewards balance by 32 ETH to reinvest in a new validator. Other notable news includes: the amount of ETH staked (19%) surpassed the amount on exchanges; The Bank of China’s BOCI issued tokenized securities on Ethereum in Hong Kong; redemptions for Coinbase’s staked ether surged following the SEC lawsuit; Frax Finance announced it will launch an L2 named Fraxchain; and, Ethereum founder Vitalik Buterin penned a blog post outlining the three transitions Ethereum must undergo to succeed.

BTC and ETH

Source: Santiment, GSR.

SEC Ups the Ante

On June 5th, the US SEC sued Binance, accusing the crypto exchange of offering unregistered securities (BNB, BUSD, staking services), failing to register as a clearing agency, broker, and exchange, commingling customer funds, and engaging in wash trading, among other charges. Binance responded by saying it was disappointed the SEC filed the complaint rather than engage in good faith to resolve its concerns, that it respectfully disagreed with the charges, and that it would vigorously defend itself. And just a day later, the SEC sued Coinbase for allegedly failing to register as a clearing agency, broker, and exchange and violating securities laws with its staking program. Coinbase filed a motion to dismiss the SEC’s lawsuit, claiming that the agency does not have the authority to continue its action, saying that it violates its “due process rights,” and calling it “an extraordinary abuse of process.” Bitcoin fell ~5% on news of the Binance lawsuit but was relatively resilient on the announcement of the Coinbase action.

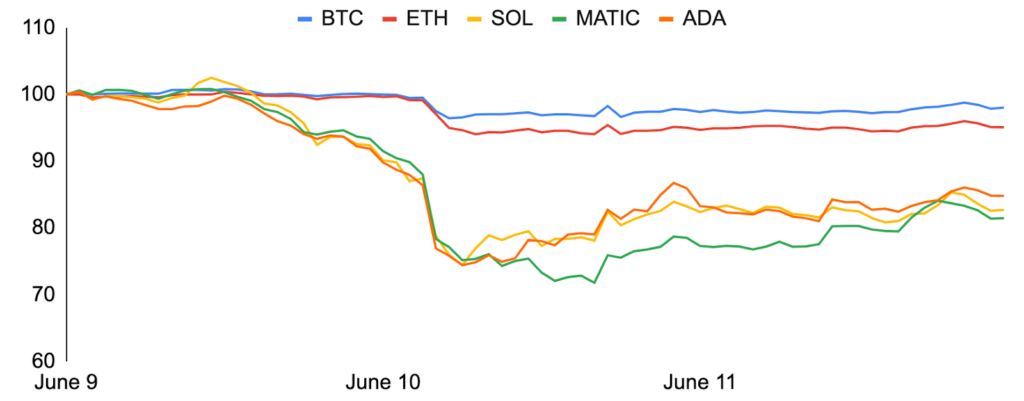

More Sell-Offs

The SEC lawsuits against Binance and Coinbase weren’t the only negative catalyst during the first half of the month. Next up was a large altcoin selloff late on Friday, June 9th / early on Saturday, June 10th, where several tokens cratered more than 30%. The large move was in part driven by trading app Robinhood’s announcement to delist MATIC, ADA, and SOL after the SEC alleged that the tokens are unregistered securities in its lawsuits against Binance and Coinbase. Adding to worries, onchain sleuths revealed that 22.5m MATIC was transferred from a Robinhood address that ultimately ended up on centralized exchanges. The three tokens have recovered some of their losses more recently but have significantly trailed BTC’s performance.

Also contributing to negative performance was the recent FOMC meeting, where the Fed, despite pausing rate hikes for the first time in over a year, took a more hawkish tone than expected and indicated that more rate hikes are still to come. The hawkish rhetoric negatively impacted traditional markets as well, and the decline in crypto prices was likely exacerbated by the large amount of uncertainty due to the US regulatory posture, the two large prior sell-offs, and concerns around dominant players like Binance (given the SEC lawsuit) and Tether (traders temporarily fled USDT on Curve and Uniswap).

Select Token Prices During June 9-11 Sell-Off

Source: Santiment, GSR.

ETF Exuberance

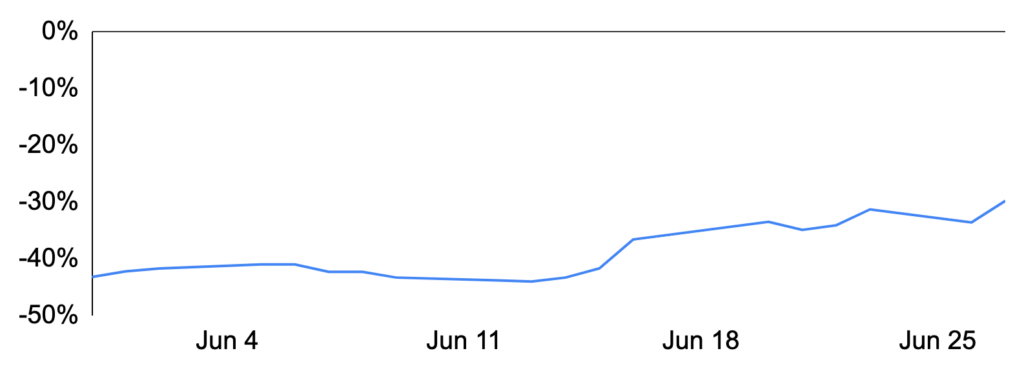

Despite a decade-long path riddled with rejection, optimism for a US-listed spot Bitcoin ETF has returned in the wake of a new June 15th filing by BlackRock, the world’s largest asset manager. Enthusiasm around a potential approval immediately increased given BlackRock’s 575-1 ETF approval track record, the inclusion of a new surveillance sharing agreement that may give the SEC comfort around the ability to prevent fraudulent and manipulative acts, the SEC’s recent approval of a leveraged bitcoin futures ETF, and the notion that the SEC may concede on bitcoin given Chairman Gensler’s stance that all other tokens are securities. In the wake of BlackRock’s filing, other issuers quickly moved to put their hat in the ring, with Bitwise, VanEck, WisdomTree, Invesco, Valkyrie, and Fidelity all refiling their applications in addition to the outstanding Ark 21Shares application. Moreover, the Grayscale Bitcoin Trust (GBTC) discount has improved from 43% prior to BlackRock’s filing to 30% at month end, as an approval of any spot bitcoin ETF would provide Grayscale with a viable path to conversion, which would immediately close its discount. And just last week, the SEC called the newly filed spot applications “inadequate” but simply sought more detail on the newly proposed surveillance sharing agreements, which could even be taken as a positive sign. All in, the situation remains highly uncertain, with closely-watched ETF analyst Eric Balchunas pegging the chance of approval by year end at roughly 50%.

Grayscale Bitcoin Trust Discount to NAV

Source: Grayscale, GSR.

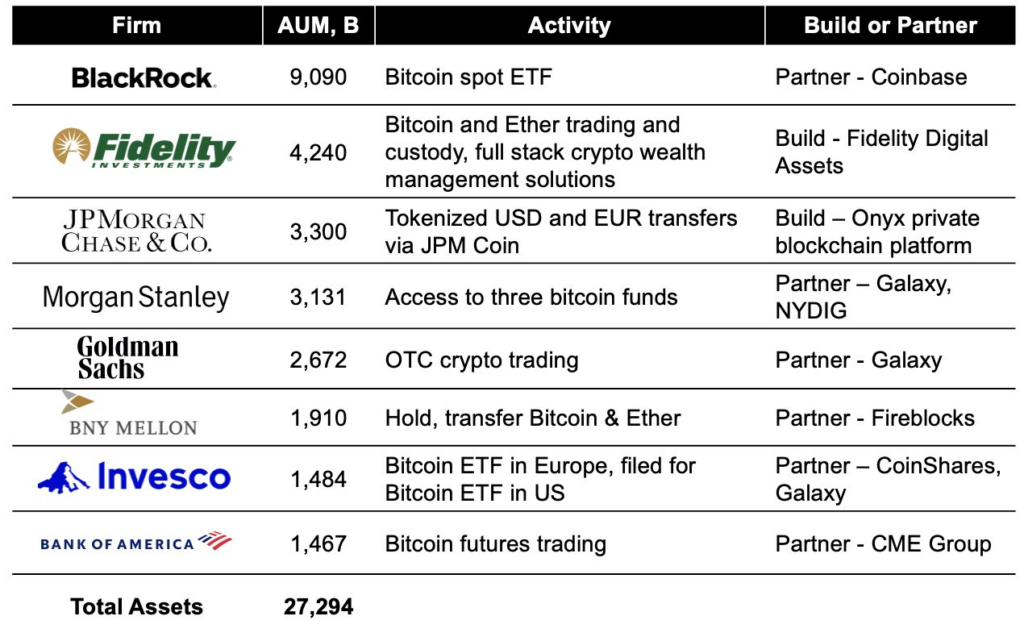

Corporate Activity Reemerges

While recent corporate digital asset efforts can best be described as slow but steady, a number of recent announcements have brought enthusiasm back to the space beyond BlackRock’s potential entrance. EDX Markets, an institutional-grade, non-custodial digital asset exchange backed by Schwab, Fidelity, and Citadel, launched this month, causing many to wonder whether its differentiated model more akin to a traditional exchange could encite greater institutional trading or whether Schwab and/or Fidelity could eventually enable their customers to buy EDX-listed assets. Elsewhere, JPMorgan expanded its JPM Coin to the euro to allow blockchain-based euro payments and additionally announced a partnership with six large Indian banks to introduce a blockchain-based platform for interbank settlement of US dollar transactions, highlighting the benefits and real world use cases of tokenization. Further, tech giant Apple unveiled the Apple Vision Pro, an augmented reality headset that promises to seamlessly blend the digital and real worlds, bringing renewed enthusiasm for the metaverse. And a study by Coinbase and The Block revealed that over half of Fortune 100 companies have pursued crypto, blockchain, or web3 initiatives since the start of 2020.

Digital Asset Trading & Asset Management Initiatives from Traditional Finance Firms

Source: @melt_dem on Twitter, GSR.

Continued Development

Another positive sign for industry is the continued rapid pace of development, with several key protocols completing notable launches or upgrades. For example, layer two network Optimism completed its highly anticipated Bedrock upgrade, which reduced transaction fees, shortened deposit wait times, enabled both fault and validity proofs, improved Ethereum equivalence, and enhanced node performance. Optimism has seens its daily transaction count increase by ~67% since the upgrade. In addition, restaking protocol EigenLayer executed its guarded mainnet launch, the first of three steps that will allow native ETH stakers and liquid staking token holders to restake their staked ETH, validating multiple additional services in exchange for additional yield and slashing risk, turning Ethereum’s staking ecosystem into a shared security layer. Given its nascency and with regard to protocol security, EigenLayer launched with restaking limits, which were reached on the day of its launch and hint at the strong demand for the restaking market. Also, Polygon Labs proposed transitioning its Proof-of-Stake (PoS) side chain into a zkEVM validium, a move that would enable the PoS chain to better inherit the security properties of Ethereum and to utilize zero knowledge proof scaling technology that many believe will be the ultimate winning scaling solution. If approved, the change could be implemented by the end of 2024, and would mark the first time that an existing chain added zero knowledge proofs and transitioned to become an L2. Moreover, leading decentralized exchange Uniswap announced its vision for the fourth version of its protocol, Uni v4, and released an early version of the code and a technical whitepaper. Uni v4 introduces several new features including more tailored liquidity pools via hooks (plugins to customize how pools, swaps, fees, and LP positions interact) and improved architecture for gas savings (all pools will be held in one singleton contract). Finally, other notable development events include: Polkadot revamped its governance system to allow simultaneous voting on multiple issues and eliminated the Polkadot Council and Technical Committee; BNB Chain unveiled opBNB, a new layer 2 scaling solution based on the Optimism OP Stack, to enhance scalability and security; zkSync unveiled the ZK Stack – a modular framework for ZK-powered blockchains operating on top of existing layer 2s, dubbed Hyperchains – to compete with Optimism’s Superchain vision; Offchain Labs released developer tooling for creating layer 3 “Orbit” chains on Arbitrum; and, Ethereum Name Service announced that it will soon support the web domain .box that can be routed on web browsers.

Verified Smart Contracts, Thousands

Source: a16z, GSR. Note: Contract verification assures that the published contract code is the same code running at the contract address, and the number of verified smart contracts is a proxy for the number of new crypto applications launched.

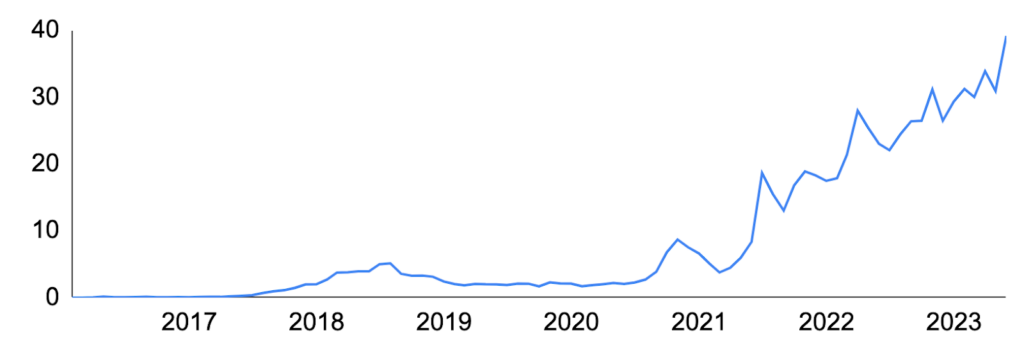

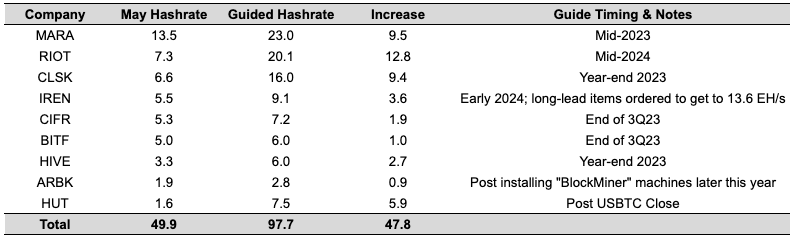

Miners Piling In

With the Bitcoin network hashrate reaching new heights and the next halving now less than 10 months away, top public miners continue to announce new rig and site acquisitions, both to capture network hashrate market share as well as remix their fleets towards the most efficient rigs. Indeed, the halving strategy for many miners appears to be to ensure low cost power and to improve fleet efficiency, with success on these metrics ensuring low production costs and better profitability post the halving when others may need to unplug.

June saw several rig purchase announcements that were characterized by both their sheer size as well as the strong efficiency of the purchased ASICs. Riot Platforms, for example, announced the purchase of 33,280 high performance MicroBT miners that will add 7.6 EH/s upon full deployment in 2024 (Riot also secured the option to purchase additional miners to add another 15.3 EH/s). CleanSpark was also active, announcing the acquisition of 12,500 Antminer S19 XPs and two mining facilities in Georgia, giving the company enough machines to exceed its year-end total company hashrate guidance of 16 EH/s. Iris Energy announced the construction of the remaining 80 MW at its Childress site, which is expected to bring its potential operating capacity to 9.1 EH/s from 5.6 EH/s by early 2024 (Iris further announced it has ordered long-lead items to eventually bring company hashrate to 13.6 EH/s). And Bitfarms also purchased 4,660 high performance miners that will add 0.6 EH/s. All in and though with different timing, a select group of public miners have guided for their combined hashrate to nearly double over the coming year.

Current and Guided Hashrate for Select Public Miners, EH/s

Source: TheMinerMag.com, Company Websites, GSR; Note: Uses self-mining hashrate only. May 2023 hashrate uses realized hashrate from TheMinerMag for comparability. Target hashrate is typically on installed hashrate. Terawulf recently achieved its 5.5 EH/s goal, and has an 130 MW expansion opportunity between two sites that would bring total company hashrate to 10.5 EH/s.

GSR in the News

- Bloomberg – A New Crypto Banking System Arises Under the Shadow of a Regulatory Crackdown

- CNBC – EDX crypto exchange goes live offering bitcoin and ether trading, backed by Schwab and Fidelity

- Cointelegraph – Wall Street giants back EDX Markets, a new cryptocurrency exchange

- Crowdfund Insider – Crypto Market Maker GSR Selects Fireblocks, Elliptic to Scale Compliance Capabilities

- TechCrunch – Fidelity, Schwab, Citadel backing new crypto exchange EDX signals TradFi’s deeper dive into digital assets

- Bloomberg – Bitcoin Offshoot Has More Than Doubled Over The Last Week

- Bloomberg – Crypto Exchange Backed by Citadel Securities, Fidelity Goes Live

- Bloomberg – Bitcoin Offshoot Has More Than Doubled Over The Last Week

- Bloomberg – Bitcoin Hits a Six-Week High as Financial Titans Step Up Crypto Initiatives

- Bloomberg – Crypto Traders Are Betting on Asia as a Haven After US Crackdown

- Bloomberg – Crypto Weekend Slump Compounds Jitters of Investors Already on Edge

- Bloomberg – Bitcoin Surge Sparked by Optimism Over ETFs Pauses Around the $30,000 Level

- Fortune – Bitcoin dips below $25,000 as Fed takes hawkish tone after pausing interest rate hikes

- WSJ – Crypto Exchange Backed by Citadel Securities, Fidelity, Schwab Starts Operations

- Coindesk – Ethereum Ecosystem Is Getting Busier, Not Quieter, Amid Layer 2 Shift

- The Block – Charles Schwab, Citadel-backed crypto exchange goes live today

- Coinmarketcap – Crypto Derivatives: An Ecosystem Primer

- Boomfi – BoomFi raises $3.8M Seed to lead the charge in crypto payments

- Coindesk – Bitcoin Cash, FTX’s FTT Token and COMP Led Crypto Market Gains in June

Authors:

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Disclaimers

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.