MACRO + CRYPTO SUMMARY

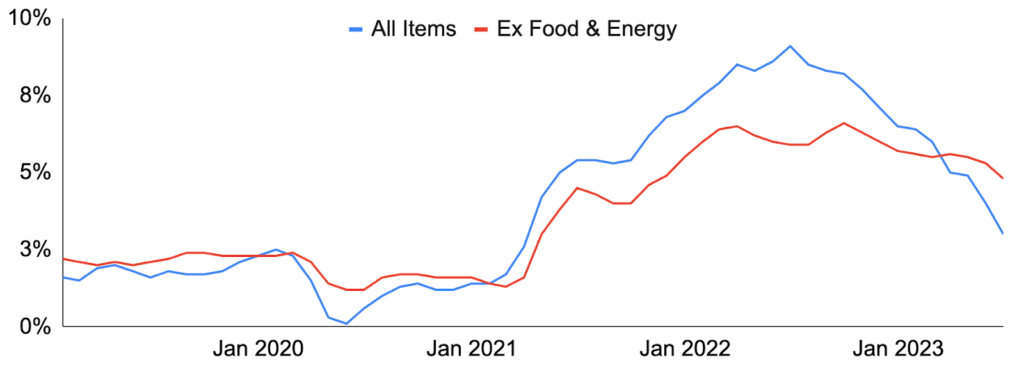

The month started out with the release of the June FOMC meeting minutes, revealing that some officials had wanted to hike rates as opposed to the pause the Fed ultimately took. This caused market participants to view June’s “hawkish pause” as even more hawkish than initially perceived, with rates subsequently rallying. The narrative since then, however, has shifted toward slowing inflation (as DXY grinded down 2.3% over the past month), with the annual US consumer price increase in June coming in lower than expected for both headline and core inflation, the latter of which excludes volatile food and energy prices. It wasn’t just consumer prices that were milder than anticipated, as producer prices beat expectations as well for both headline and core. And in Europe, Eurozone inflation slowed materially in June from the prior month, while UK inflation released this morning also fell and beat expectations.

US CPI, Year-Over-Year Percent Change

Source: Bureau of Labor Statistics, GSR

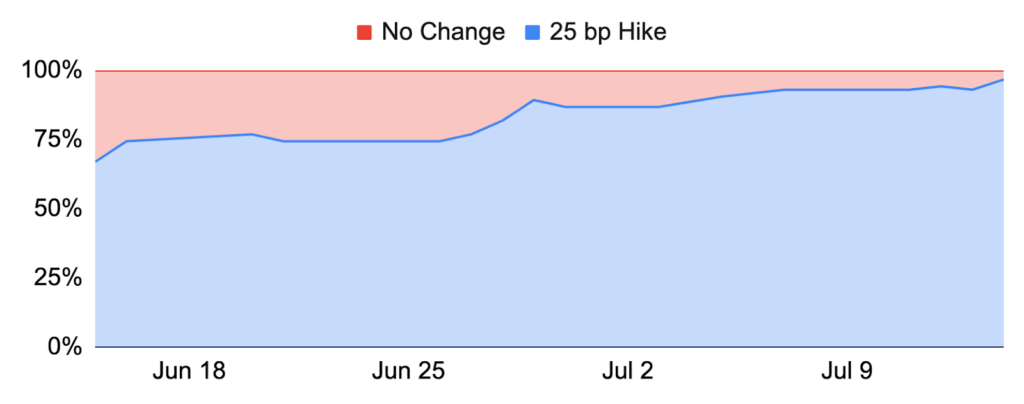

The lower-than-expected inflation gives the Fed a bit more leeway to raise rates by a smaller amount or more slowly. While the market widely expects the Fed to raise rates by 25 bps at its meeting next week (the CME’s FedWatch suggests a 97% market implied probability), observers will be closely watching for clues about what it may do at its subsequent September meeting.

Implied Probabilities for the July 25-26 FOMC Meeting

Source: CME, GSR

RATES, FUNDING & BASIS

The bullish BTC sentiment that emerged from the flurry of ETF filings in the US has caused the GBTC discount to narrow from 43% at the beginning of June to 26% currently. Moreover, this positive sentiment is reflected in the CME basis (i.e. the difference between futures and spot prices), which surged higher to 15-18% over the last couple of weeks. As a large fraction of traditional market investors cannot touch spot BTC as of today, this premium makes intuitive sense. That said, the basis is likely to normalize to more compressed levels if and when a pure US-based spot BTC ETF comes into play.

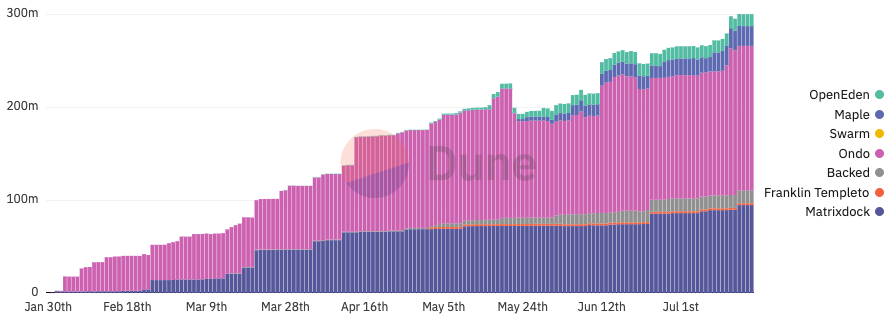

The sizable disparity between interest rates in traditional and on-chain markets continues to be of note, with a significant number of service providers trying to bridge the gap. Both crypto-native institutions and traditional asset managers are now offering “tokenized” money market funds or T-bills to on-chain investors. While challenges certainly remain – these tokens can be perceived as securities, have stringent KYC requirements, and have not been stress tested by the markets or courts – the market cap of these securities tokens continues to rapidly rise.

Market Cap of Tokenized Yield Issuers

Source: @Steakhouse, GSR. Data only includes Ethereum, Gnosis, and Polygon-based chains

The surge of interest in liquid staking tokens (LSTs) and the sizable demand for staking ETH (20% of the ETH is now staked) has led multiple providers to develop benchmark indices around the global staking yield earned by Ethereum validators. The two most prominent examples include CoinFund’s Composite Ethereum Staking Rate (‘CESR’) and the Compass Staking Yield Reference Index (‘STYETH’). Both crypto-native and traditional exchanges are exploring offering linear derivatives using these rates, while stakers, staking providers, and speculators are increasingly examining derivative strategies tied to these benchmarks.

DERIVATIVES

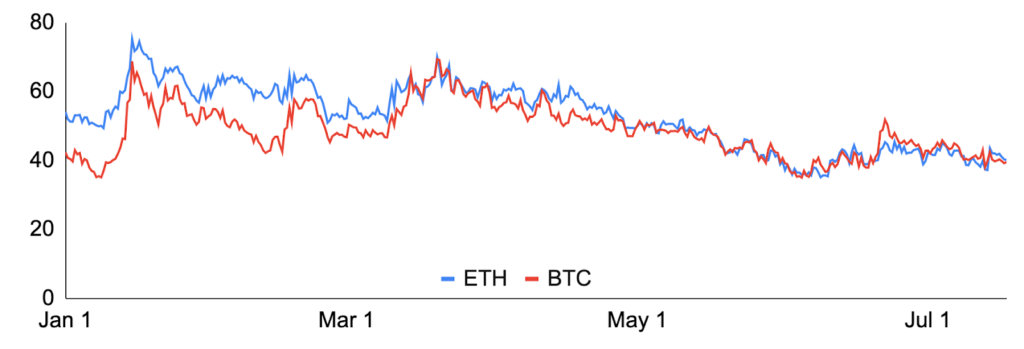

After spiking in June due to the SEC actions against Coinbase and Binance, the BlackRock ETF filing, an altcoin-led sell-off on the back of Robinhood delisting news, and a hawkish Fed pause, both BTC and ETH IV retraced to earlier levels, and remain relatively muted.

BTC and ETH Year-to-Date ATM Implied Volatility (30 Day)

Source: Laevitas, GSR

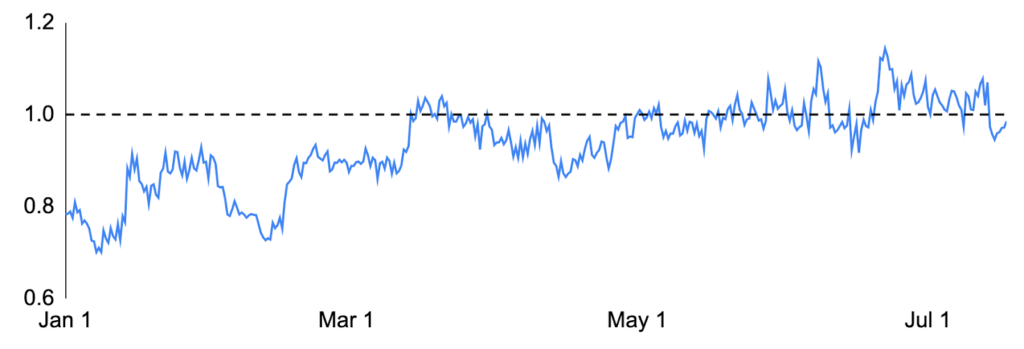

Markets have historically implied higher volatility for ETH compared to BTC, as ETH has tended to realize larger relative moves. However, the significant vol selling in the form of backend call overwriting and calendar spreads (buying prompt options and selling deferred) that we observed throughout the summer introduced a saturation of ETH vega into the market and compressed relative vol levels lower. This, in conjunction with upside spec buying due to BTC-centric catalysts, namely a flight to quality during the banking crisis and the flurry of BTC spot ETF applications, has forced implied vols to trade closer to parity between the majors.

BTC/ETH ATM Implied Volatility (30 Day), Year-to-Date

Source: Laevitas, GSR

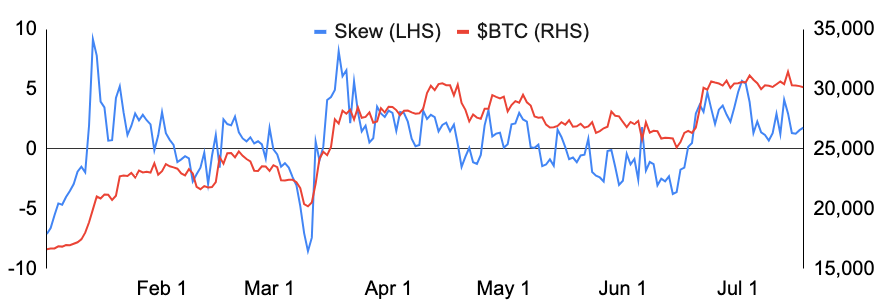

BTC 25 delta skew has calmed down to 2% in favor of calls, after rallying a few vol points higher in the second half of June. Unsurprisingly, the most notable changes in skew since the beginning of the year have been driven by a resurgence in spec confidence in Jan, March, and June as market participants piled into upside convexity.

BTC 25 Delta Skew (30 day) vs. Price, Year-to-Date

Source: Amberdata, GSR. Note: Skew = (25 delta call IV – 25 delta put IV), and we use a constant 30 day maturity. Positive skew ‘to the call’ implies calls are more expensive relative to puts for a given delta and expiry.

In terms of majors flows that have gone through in the market since the start of the month:

- The earlier call overwriter has bought back >300k vega originally sold in the form of ETH Dec ‘23 and Mar ‘24 calls into the market around the 2200-2300 strike range, reducing a significant amount of OI across those tenors. This combined with a general uptick of ETH flow (namely around Jul 2000 calls) has led ETH volumes to exceed BTC volumes on Deribit, likely for the first time since the Shapella rally.

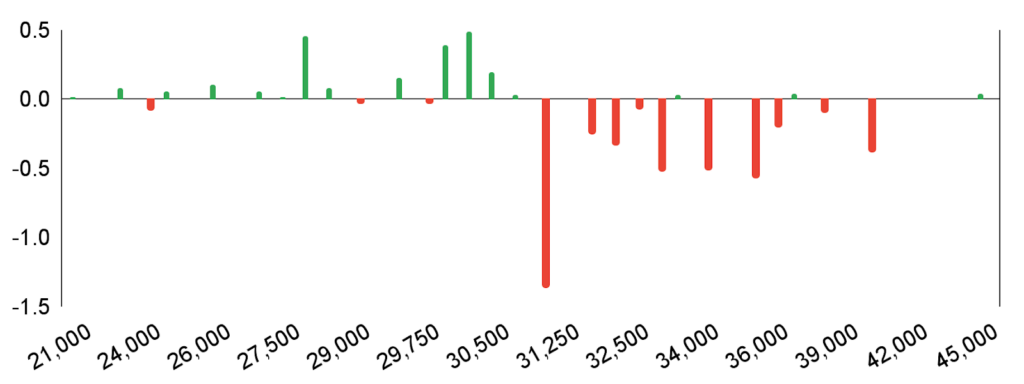

- Upside call buying in BTC has persisted, with the greatest OI increases across the 31k, 32k, and 40k strikes since the start of the month, possibly suggesting a continuing pocket of short market-maker gamma to the upside.

BTC Market-Maker Gamma Positioning

Source: Amberdata, GSR

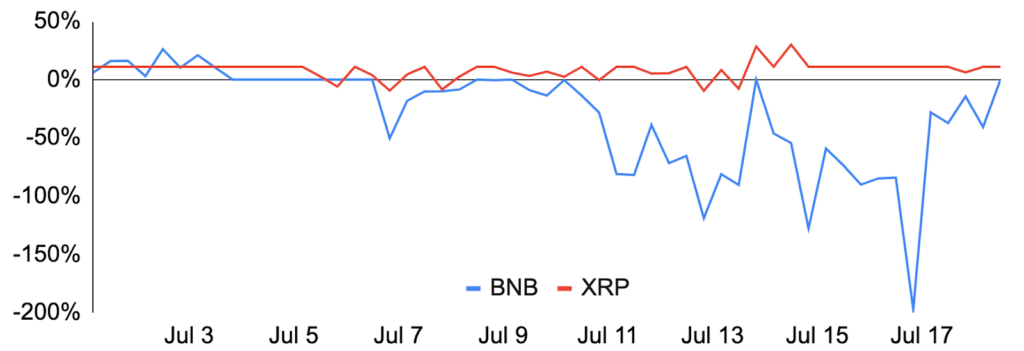

In the altcoin space, one of the more notable developments was the severely negative funding rate on BNB perps, which reached -197% annualized during one funding period on Binance earlier this week before reverting to flat. The BNB funding rate first broke to the downside when the SEC sued Binance on June 5 and has continued to fall amidst continued negative news, such as a declining exchange market share, executive departures, and general layoffs, and exits from Belgium and Austria. In addition, part of what likely drove the sharp move down in BNB fundings rates was the Arkham (ARKM) token sale on Binance Launchpad, where traders would buy spot BNB to receive a larger token allocation and then short BNB perps to delta hedge their long spot position (there was over $2.4b worth of BNB committed to the sale).

Interestingly, the XRP funding rate shot up in the wake of Ripple’s partial court victory against the SEC, rallying to ~30% annualized before quickly renormalizing to baseline levels. The retracement is likely driven by the initial exuberance of the ruling wearing off, as well as market participants aiming to collect the elevated funding by buying spot and shorting the perpetual.

BNB and XRP Annualized Perpetual Funding Rate on Binance

Source: Binance.com, GSR

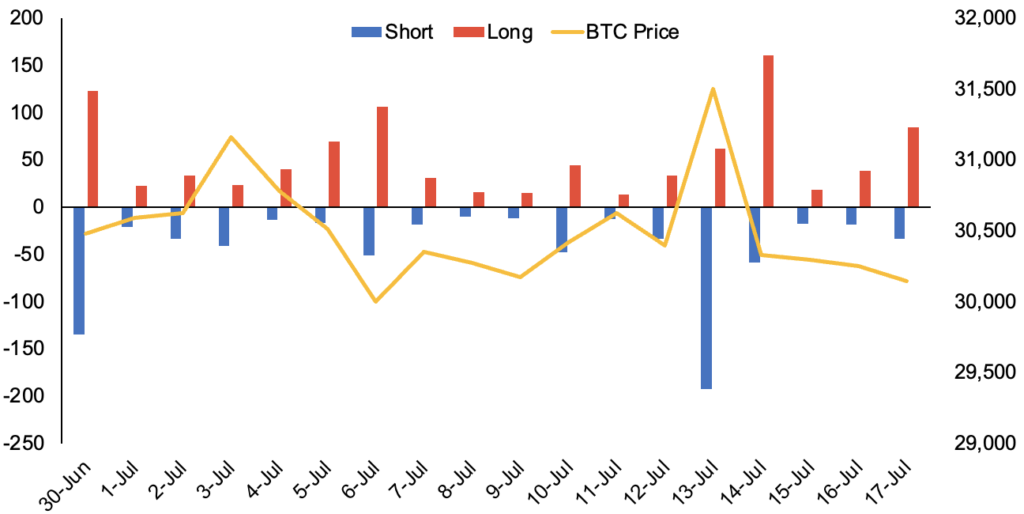

LIQUIDATIONS

The two most notable liquidations as of late occurred on June 30th and July 13th/14th. The first series of liquidations came after the SEC called the flurry of spot Bitcoin ETF filings inadequate, causing bitcoin to quickly fall 4% and sparking ~$100m of long liquidations during a 12-hour period. The second series of liquidations arose after XRP’s court ruling on July 13th, and $185m of shorts were liquidated during a 12-hour window before the market became overextended and $125m of longs were liquidated during the same 12-hour window on the following day.

Total Liquidations, $m

Source: Coinglass, CoinGecko, GSR

DeFi

There have been a number of interesting happenings in DeFi, including:

- As the amount of ETH staked continues to growth with more than 2.5m ETH currently waiting in the validator activation queue, more liquid staking protocols continue to emerge. Stader’s (ETHx) liquid staking platform went live with many similarities to Rocket Pool, Swell’s swETH continued to grow market share and its weight was doubled in the unshETH liquid staking index, and Diva executed an airdrop as it aims to build community before deploying its distributed validator technology-enabled liquid staking platform.

- Aave’s overcollateralized GHO stablecoin closely resembling MakerDAO’s DAI went live on Ethereum mainnet. GHO has consistently traded at a $0.005 to $0.02 discount since launching on July 15th, but some have predicted the discount could close as incentive rewards are introduced next week.

- Arbitrum-based decentralized perp exchange Vertex continued to flourish, realizing daily volume over $100m on consecutive days earlier this week, a first for the protocol. Synthetix also announced it would launch its own perp DEX in the coming months catering to CEX users.

- The UniswapX whitepaper was released introducing a new Dutch-auction based decentralized trading protocol that aggregates both onchain and offchain liquidity and enables gas free swaps. An opt-in beta is available, and cross-chain functionality is expected to be introduced later this year enabling swaps/bridging to be combined into a single action.

- Decentralized lending protocol Compound saw its outstanding debt on Ethereum surpass $1b, its highest mark in a year.

- Early DeFi protocols such as COMP, SNX, AAVE, and MKR had a material resurgence in performance, gaining 154%, 52%, 41%, and 4% over the last 30 days, respectively.

Authors

GSR OTC Desk

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.