PERFORMANCE SUMMARY

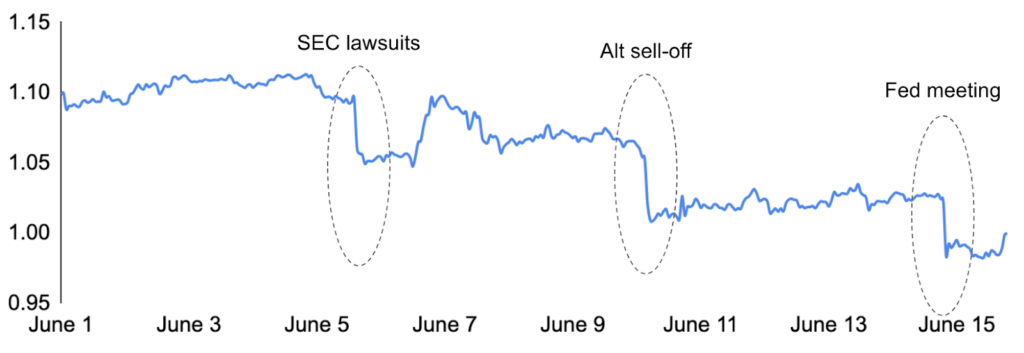

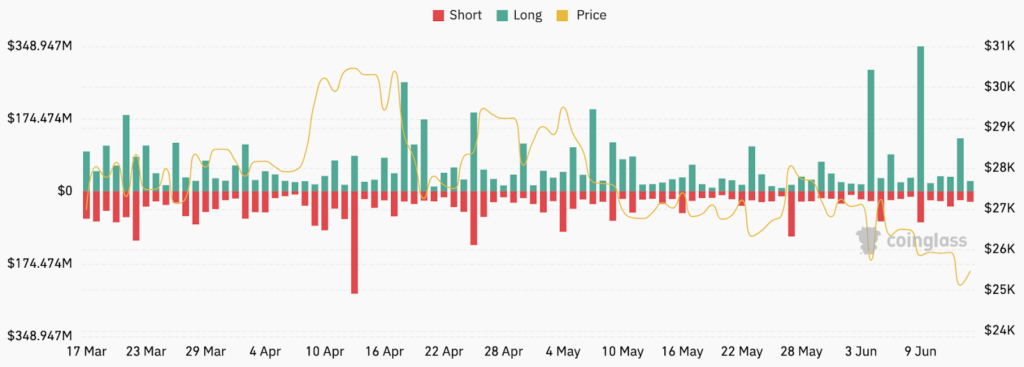

The past two weeks have been particularly eventful for crypto markets, as three distinct and sharp sell-offs occurred. The first was during the early part of last week as the SEC filed lawsuits against Binance and Coinbase on Monday, June 5th, and Tuesday, June 6th, respectively. The SEC accused Binance of offering unregistered securities (BNB, BUSD, staking services), failing to register as a clearing agency, broker, and exchange, commingling customer funds, and engaging in wash trading, among other charges. Bitcoin rapidly came off 5% and nearly $300m of crypto length was liquidated. For Coinbase, the SEC alleged that Coinbase failed to register as a clearing agency, broker, and exchange, and further claimed that Coinbase’s staking program violated securities laws. Coinbase’s stock fell in the wake of the news, though crypto prices proved relatively resilient, driven in part by the fact that a sizable amount of leverage had been already flushed out of the market the day prior and that the Coinbase action was expected given the previously disclosed Wells Notice.

Total Crypto Market Capitalization, $T

Source: Tradingview, GSR

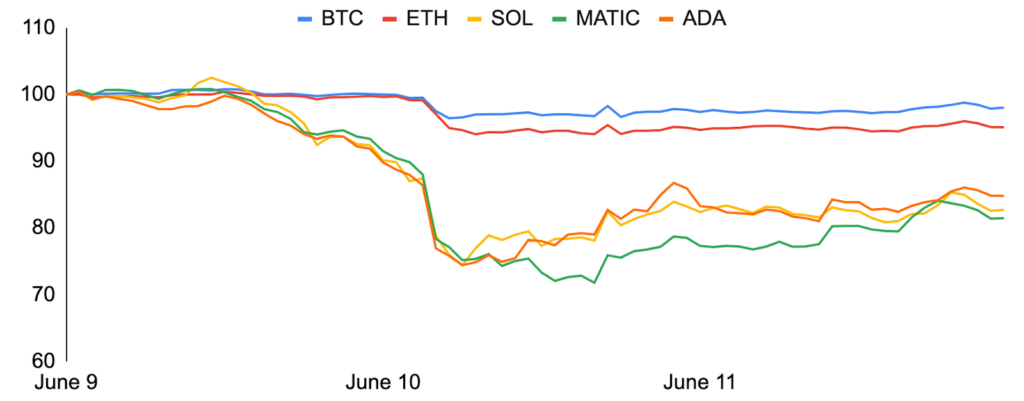

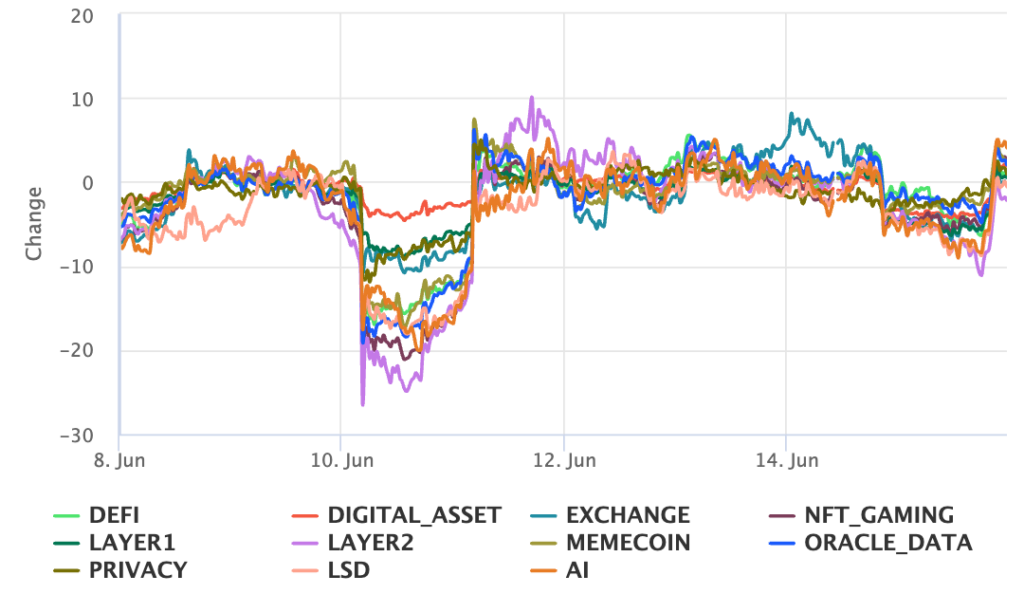

The second notable event occurred late last Friday, June 9th, when several altcoins cratered more than 30%. The large move was in part driven by trading app Robinhood’s announcement to delist MATIC, ADA, and SOL after the SEC alleged that the tokens are unregistered securities in its actions against Binance and Coinbase. Adding to worries, onchain sleuths revealed that 22.5m MATIC was transferred from a Robinhood address that ultimately ended up on centralized exchanges. All in, ~$350m of length was liquidated, and while the most affected altcoins partially recovered some of their losses, the recovery has since faded.

Select Token Prices During June 9-11 Sell-Off

Source: Santiment, GSR

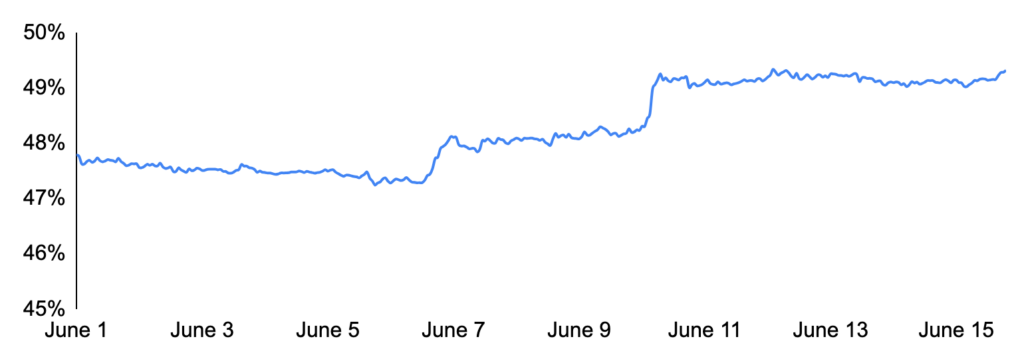

The final leg down occurred after the FOMC meeting on Wednesday, as the Fed, despite pausing rate hikes for the first time in over a year, took a more hawkish tone than expected and indicated that more rate hikes are still on the table. The hawkish rhetoric negatively impacted traditional markets as well, and the decline in crypto prices was likely exacerbated by the large amount of uncertainty due to the US regulatory posture, the two large prior sell-offs, and concerns around dominant players like Binance (given the SEC lawsuit) and Tether (traders fleeing USDT on Curve and Uniswap; more below). It’s worth noting that unlike the prior sell-offs, this downturn appeared to be ETH-led, which fell more than BTC/most alts, and had more outsized liquidations compared to BTC. In response to the heightened uncertainty, investors flocked to BTC as a safe haven, causing bitcoin dominance to hit its highest level since early 2021.

Bitcoin Dominance

Source: TradingView, GSR

OPTIONS MARKET

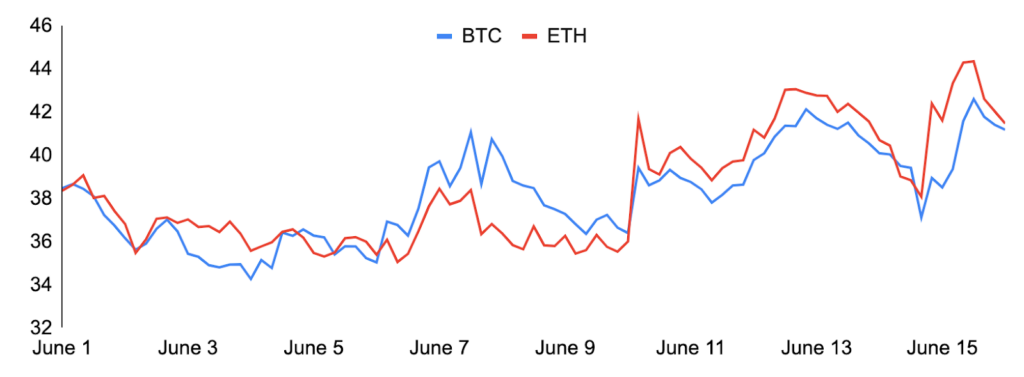

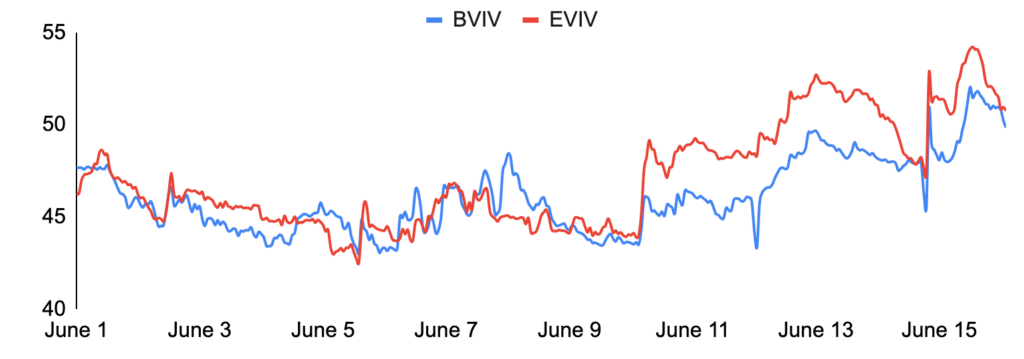

Following the increased realized volatility we’ve observed since June 5th, implied volatility has retraced from earlier lows.

BTC and ETH ATM Implied Volatility (30-Day)

Source: Amberdata, GSR

Note that ETH implied vol levels (and notably call skew) were trading at compressed levels and at meaningful relative discounts to BTC vols, before the sharp price moves over the past two weeks caused a retracement. This is due partly to notable flow in the ETH calendar spreads (buying the shorter-dated calls and selling longer-dated calls to collect premium) that have gone through in size across 1900-2300 strikes. BVIV and EVIV indices, proxies for short-dated implied volatility levels, are back up to the range we saw around the end of May, hovering around 50%, as realized 30 day vols hover around 40%.

Bitcoin and Ethereum Volatility Indexes (BVIV and EVIV)

Source: TradingView, GSR

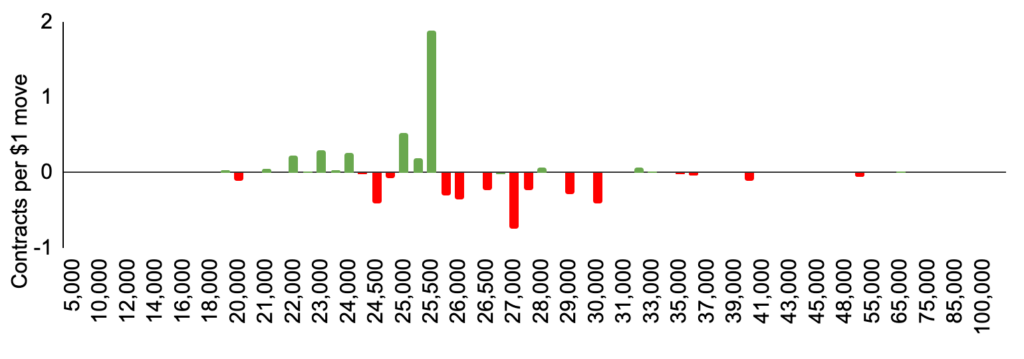

Market maker positioning highlights pockets of short gamma around current price levels across both majors. It’s the $24.5k and $27k strikes in particular for BTC, and the $1.6k strike for ETH. These localized neighborhoods of short gamma are historically unstable points for underlying price.

BTC Gamma Positioning (GVOL GEX Gamma Level by Strike)

Source: Amberdata, GSR

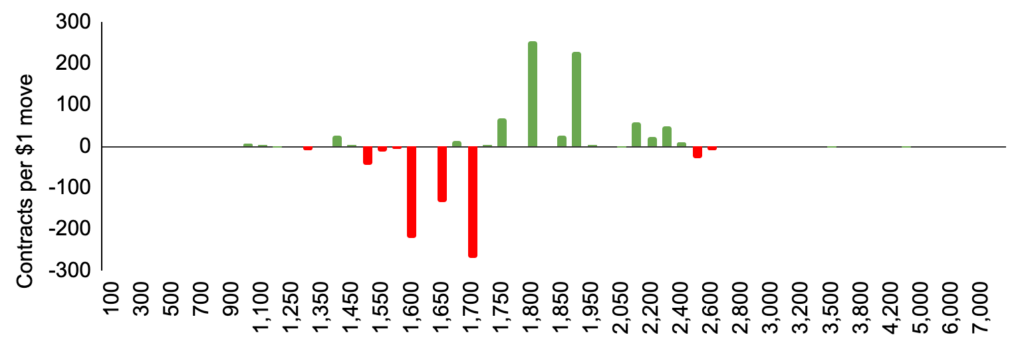

The ETH gamma positioning in particular suggests the equivalent synthetic exposure of short call spreads (i.e. shorter lower strike out of the money options, longer higher strike out of the money options).

ETH Gamma Positioning (GVOL GEX Gamma Level by Strike)

Source: Amberdata, GSR

Outside of the majors, broader implied volatility levels remain relatively steady in the alt space despite the heightened realized volatility since the end of last week. With the recent regulatory action by the SEC coming to the forefront, the market is pricing in higher event risk premia in both calls and puts for altcoins in the short to medium term.

Altcoin Relative Performance by Sector

Source: Laevitas, GSR

FUTURES MARKET

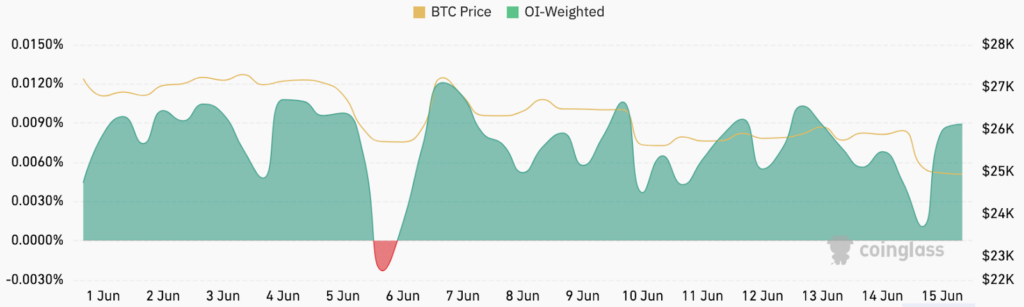

The relative resiliency of BTC is highlighted by the fact that BTC’s OI-weighted perp funding rate only went slightly below par for one eight-hour session during the first selloff. This further reiterates that the maturity and broader dominance of BTC continues to provide a safe haven during consecutive volatile price moves.

BTC OI-Weighted Funding Rate

Source: Coinglass, GSR

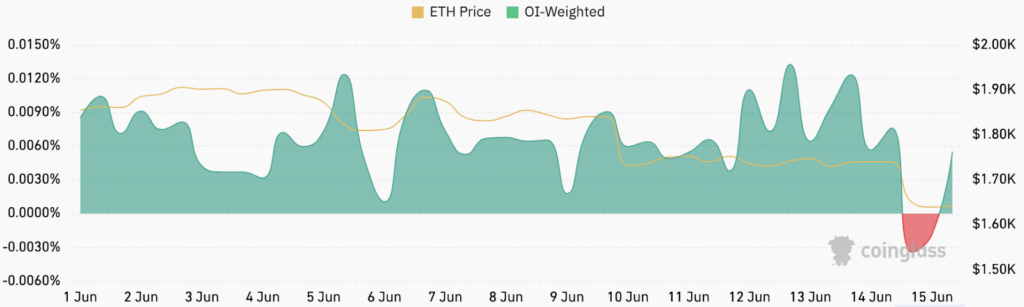

The ETH OI-weighted perp funding rate also fell into the red, but only during the most recent drawdown, reiterating the narrative that the most recent selloff was ETH-led.

ETH OI-Weighted Funding Rate

Source: Coinglass, GSR

Liquidations have been outsized amidst recent risk events, and have further exacerbated the price moves. In fact, roughly $300m and $350m of total long liquidations occurred around the SEC lawsuits and the Friday evening altcoin sell-off, respectively, accounting for the two highest daily liquidations totals of the year.

Total Liquidations

Source: Coinglass, GSR

DEFI UPDATE

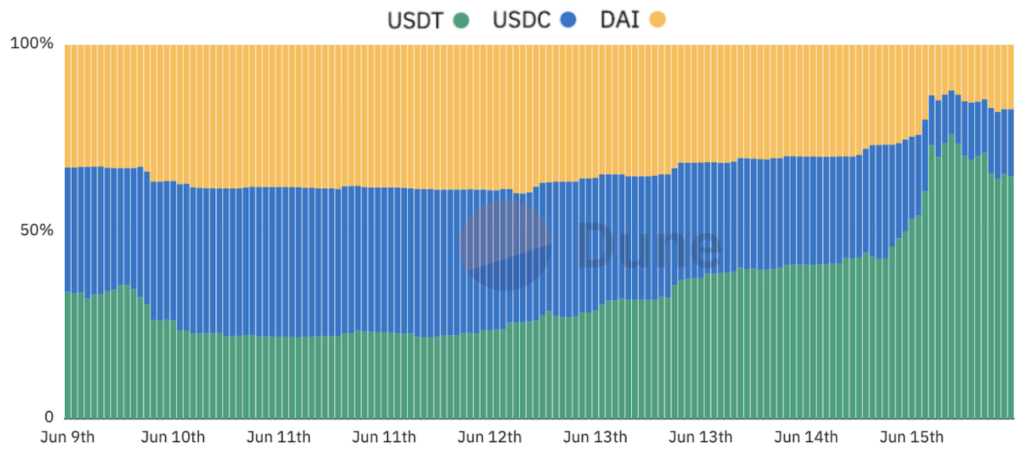

It was also a busy two weeks in DeFi, with perhaps the most notable event being a mass on-chain exodus from USDT as traders fled into alternative stablecoins. Indeed, USDT’s share of Curve’s 3Pool rose from below 22% days earlier to more than 76%. Moreover, USDT grew to comprise ~98% of Uniswap’s USDC/USDT pool. Tether’s share has come down in both of these pools in recent hours, but we continue to watch USDT redemptions.

Curve 3Pool Composition (USDT/USDC/DAI)

Source: @Gaslight Dune Analytics

Outside of Tether, other notable DeFi events include:

- DEX vs. CEX spot volume hit a record ~22% in May. The ratio has fallen to ~16% so far in June, but this is still in line with the second-highest monthly share on record.

- Traders are closely watching CRV’s price as the protocol’s founder has employed Aave to borrow $62m USDT against ~289m CRV tokens (~$178m). While the position isn’t at imminent risk of liquidation, CRV’s liquidity has worsened in recent months and Gauntlet proposed freezing CRV’s future use as collateral to mitigate the risk of potential bad debt, should the position need to be liquidated in the future.

- Ribbon’s decentralized derivatives exchange Aevo opened to the public as it removed its permissioned access.

- EigenLayer deployed on Ethereum mainnet.

- The first draft of Uniswap v4’s white paper was unveiled.

MACRO & POLICY

June started out with some positive news on inflation with May Eurozone inflation, both headline and core, falling more than expected and headline inflation of 6.1% year-over-year hitting its lowest level since February 2022. Inflation in the US is also trending downwards, first with average hourly earnings slightly beating expectations and then with consumer prices, where headline inflation of 4.0% beat expectations and fell to its lowest level over two years (core inflation fell, though in line with expectations).

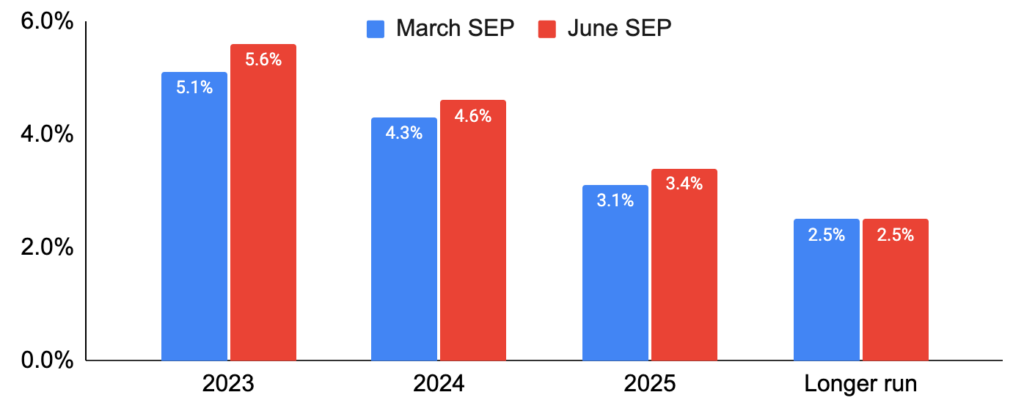

The decline in prices gave the Fed confidence to pause its rate hike campaign for the first time in over a year on Wednesday, though markets were caught off guard by its hawkish tone. In fact, the median projection from the Fed’s dot plot showed two more rate hikes by year-end, 50 bps higher than Fed members were projecting at the March meeting.

Federal Reserve’s Summary of Economic Projections: Median Federal Funds Rate Forecasts

Source: Federal Reserve, GSR

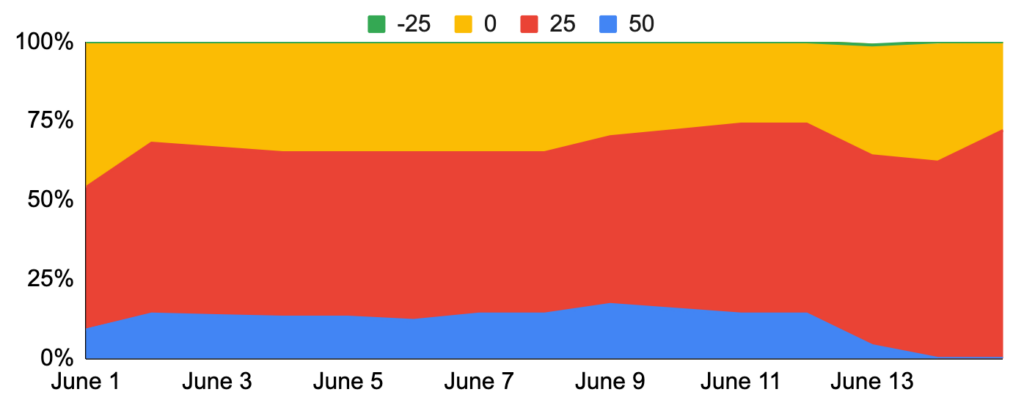

In addition, Fed Chair Powell stated during the press conference that the Fed hadn’t made a decision on July’s policy move yet. Given the dot plot and Powell’s hawkish tone, the market currently expects another quarter-point hike at the Fed’s July meeting.

Market Implied Probabilities for the July 26, 2023, FOMC Meeting

Source: CME, GSR

Outside of the Fed, note that Canada and Australia surprised markets with unexpected rate increases this month. And the ECB raised rates by 25 bps, with ECB President Lagarde stating that outside of a major change, “it is very likely the case that we will continue to raise rates in July.”

Authors

GSR OTC Desk

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.