MACRO + CRYPTO SUMMARY

The past couple of weeks have seen a sharp reversal of post-FOMC exuberance. US CPI data for January came stronger than expected, as did the PPI, and then Wednesday’s ISM print added to inflation worries. US Treasury yields increased steadily as a response, and global equity markets have generally grinded lower over the last couple of weeks. Crypto prices were initially a bit more resilient than traditional markets, but eventually caught up, with BTC and ETH down 5% and 4%, respectively, over the last two weeks. A reversal from here would likely require a change of course in the macro data, and investors will closely watch the next US CPI release on March 14th. The FOMC next meets on March 21st and 22nd, and futures are pricing in 72% chance of a 25 bps hike at the meeting and a 28% chance of a 50 bps hike.

RATES, FUNDING AND BASIS

Rates continue to inch higher in traditional markets, with the Fed Funds rate expected to be well past 5% into the summer. Funding rates in perp markets continue to be largely positive as a bullish bias persists. Structurally higher USD rates should also imply a generally higher bias in funding rates, as market participants will have a higher opportunity cost of holding a long spot position.

The discrepancy between low-risk/risk-free interest rates in crypto (Aave/Compound < 2.0%) versus traditional markets (4.5%-5.0%) has caused a number of projects to work on solutions to bridge the gap. A number of crypto-native institutions are stuck with stablecoin capital, either because of an inability to move money into fiat or an unwillingness to do so for regulatory/tax reasons. These projects are trying to solve this by creating fund or SPV structures that can take in stablecoin deposits, swap into fiat USD, invest into T-bills or money market funds, and issue receipt tokens in return. The biggest challenge to this market though could potentially be the high chance that such receipt tokens are classified as securities, which would restrict them in terms of geographies and/or client types.

DERIVATIVES

BTC Derivatives

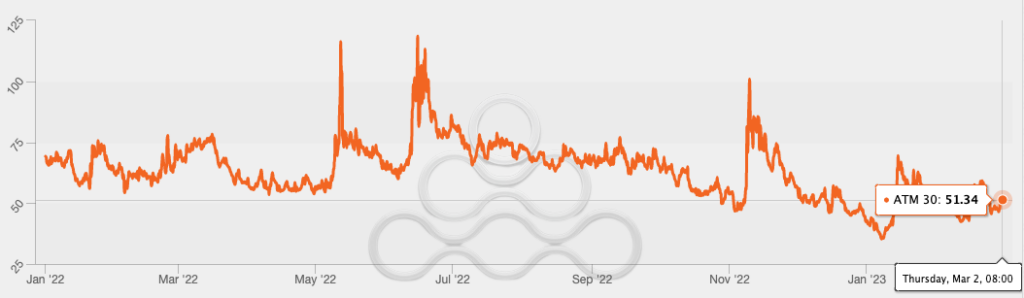

With BTC price unchanged in February, 30 day implied volatility sits at a relatively low level of 51%. However, owning and hedging the straddle will carry negatively if realized volatility remains around its 30 day average of 45%.

BTC ATM Implied Volatility (30 Day)

Source: Amberdata, GSR

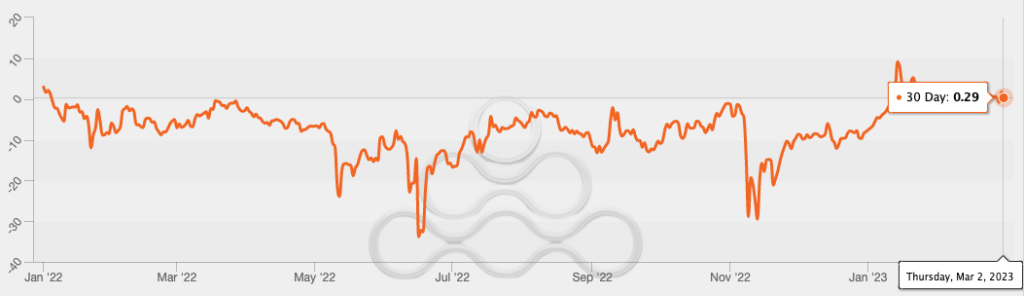

Call skew is currently elevated at 0.29.

BTC 25 Delta Call Skew (30 Day)

Source: Amberdata, GSR

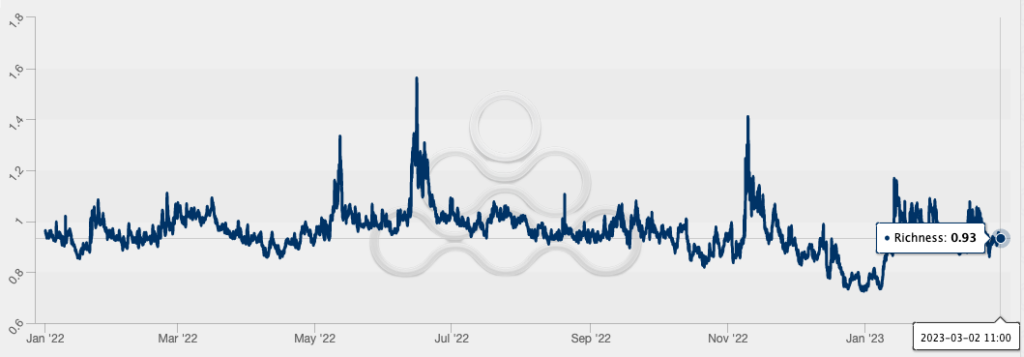

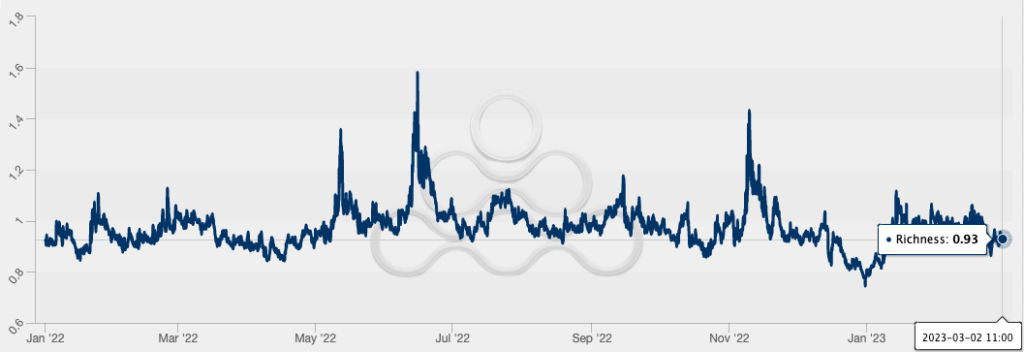

BTC term structure richness is in contango at 0.93 and indicates the recent reduction in gamma performance.

BTC Term Structure Richness

Source: Amberdata, GSR

ETH Derivatives

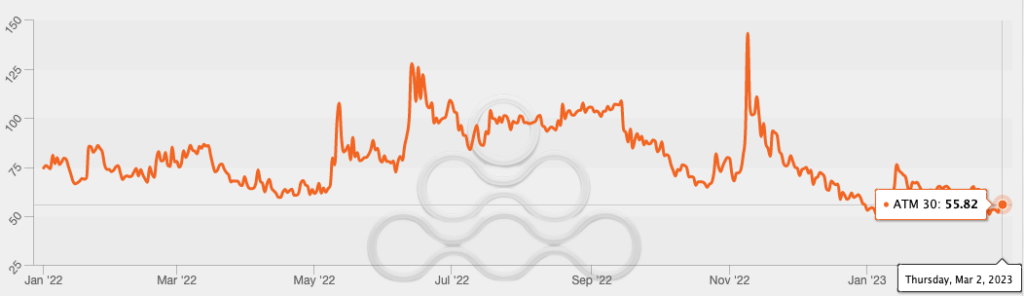

ETH implied volatility is at 14 month lows at 55.8%, which is understandable with price relatively unchanged since January 20th. Owning and hedging the straddle will also carry negatively if 30 day realized volatility remains at the current level of 51%.

ETH ATM Implied Volatility (30 Day)

Source: Amberdata, GSR

ETH call skew is also relatively elevated at -4.0.

ETH 25 Delta Call Skew (30 Day)

Source: Amberdata, GSR

ETH term structure is in contango at 0.93.

ETH Term Structure Richness

Source: Amberdata, GSR

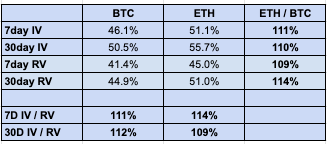

ETH 30 day implied volatility is relatively cheap at 109% versus 30 day realized volatility, and against the equivalent BTC 30 day.

ETH is also performing 114% of BTC indicating a long ETH / short BTC gamma spread would theoretically be profitable.

BTC and ETH Implied vs. Realized Vols

Source: Amberdata, TradingView, GSR

FLOWS AND LIQUIDATIONS

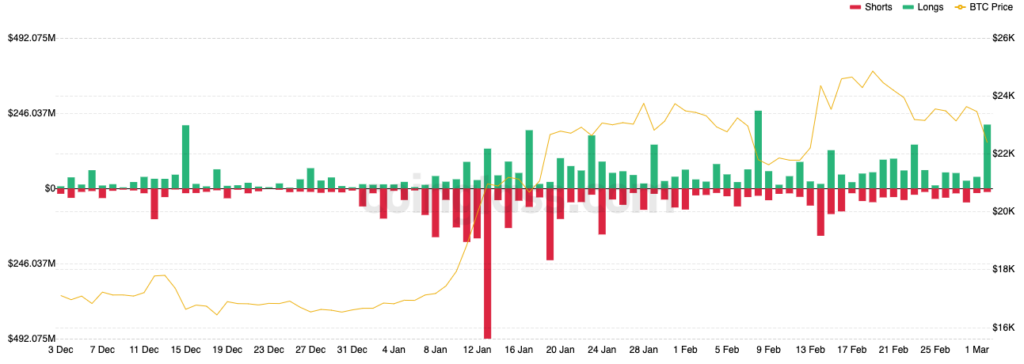

There have been some noticeable liquidations throughout the month of February, with the price action on February 8th leading to the largest amount of long liquidations over the past few months and a flush of leverage as we dipped back below $22,000. A similarly large cascade of liquidated longs shed $1,000 off BTC’s price yesterday evening.

In terms of open interest, February had one of the larger option expiries across the majors with around $1.8B in open interest expiring in BTC options alone. Short-term speculation toward the upside had occurred during the multiple tests of $25K, and after multiple rejections dealers are now thought to be net short gamma from the $25K-30K region.

Although the beginning of the month started out with some heavily bullish bets in short and longer-dated tenors, flows towards the end of the month have been mixed to slightly bearish. Interestingly, it looks like some of the longer-term bets on volatility have started to wane as last weekend saw one of the more drastic shifts downward in term structure (surprisingly in the longer-dated tenors, which had previously stayed relatively firm), suggesting the demand for longer-term optionality is starting to decline.

Total Liquidations

Source: Coinglass, GSR

Authors

Mike Pozarzycki – Macro & Crypto Summary

Ruchir Gupta – Rates, Funding and Basis

John Cole – Derivatives

Christopher Newhouse – Flows and Liquidations

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.