MACRO + CRYPTO SUMMARY

The week of The Merge opened with CPI beating expectations, sending risk assets into a wobble and US yields higher (market participants had even priced in some probability of a 100bps hike at last week’s Fed meeting). Subsequently, though Ethereum developers successfully completed The Merge on September 15, it turned out to be a non-event for the markets. Indeed, ETH sold off by about 7% several hours after The Merge was completed, with BTC correcting by a lower 2%, indicating overall long market positioning into The Merge. Fast forward to September 21st, the Fed raised its target rate by 75 bps as expected, but the projections for both future rate hikes and the economic forecasts put further pressure on risk assets. Shortly after, the BOE delivered a 50 bp rate hike, which was broadly interpreted as meek, and the UK government announced tax cuts and increased spending on Friday, further sending the cable to all-time lows of 1.035 against the greenback (don’t look at cable vols if you are prone to vertigo). With a strong dollar, rising market volatility, and higher sovereign bond spreads, among others, BTC and ETH are holding in rather well, above the $19,000 and $1,300 levels, respectively.

RATES, FUNDING & BASIS

Inflation pressures have led to significantly higher rates in the fiat world over the last couple of weeks. Just last week, the Federal Reserve raised rates by 75 bps, bringing short-dated US treasury yields to around 3%. On the other hand, low-risk yields in crypto, such as stablecoin supply APYs on decentralized lending platforms like Aave and Compound, are still hovering around the 1% mark, with a fairly significant amount of capital sitting there.

In our view, a primary driver for this is policy uncertainty, which means that a large chunk of market participants are happy to let their excess capital sit in low-yielding stablecoins rather than move them to “safer” fiat assets. Fiat rates are expected to continue to inch higher in the coming months. In the absence of a positive risk environment that could drive crypto rates higher, it’ll be interesting to see whether this “basis” continues to widen.

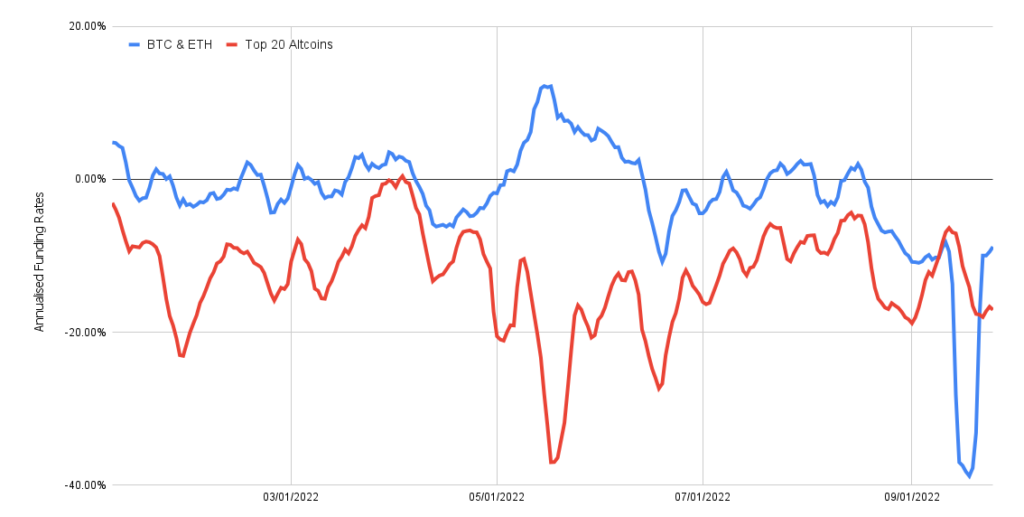

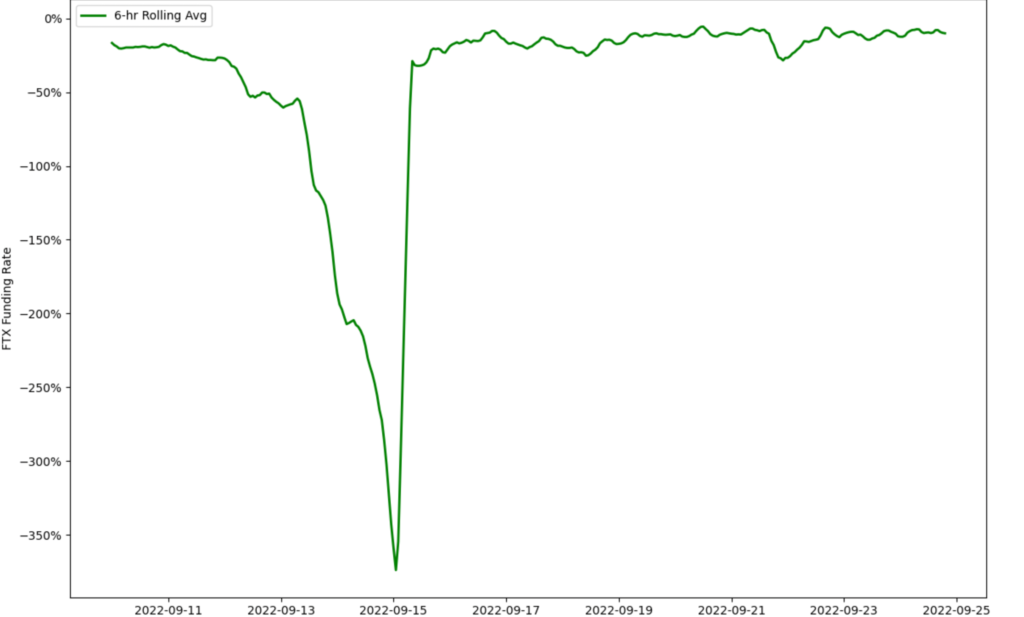

In the perps market, we continue to monitor funding rates across our equally-weighted BTC & ETH index, as well as the top 20 altcoin index. Altcoin funding rates have continued to be fairly depressed given the macro sentiment and continued forward selling pressure. The BTC & ETH index had a significant dip lower driven by ETH funding rates during The Merge event. The market was expecting an ETH PoW airdrop for holders of spot ETH at the time of The Merge, leading to traders buying spot and selling perps. The six-hour moving average touched -370% on an annualized basis right before The Merge, before reverting back after the event.

7-Day Rolling Average on Perp Funding Rates

Source: FTX, GSR

ETH-Perp Historical Rolling Averages

Source: GSR

DERIVATIVES

BTC Derivatives

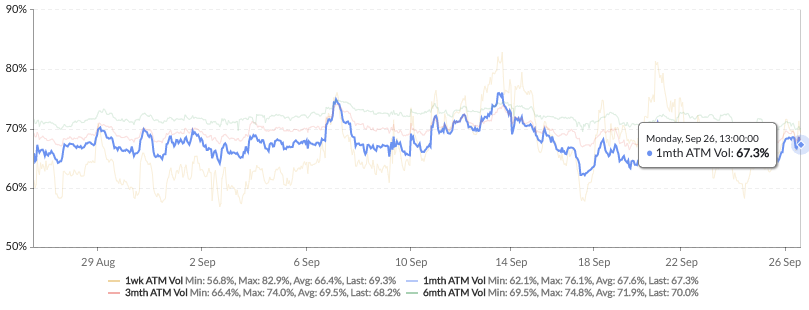

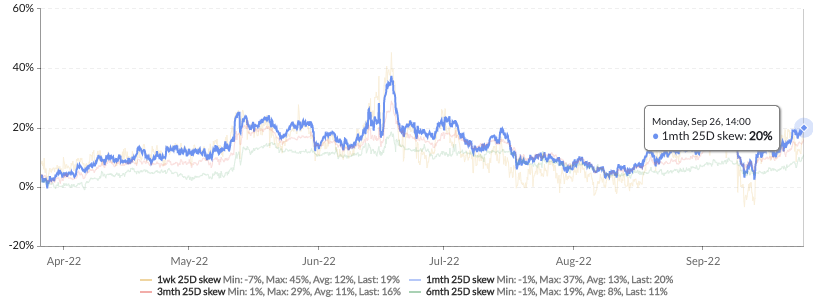

1 month BTC vol remains relatively steady and range bound within the general 65-70% zone (currently 68%). 1 month put skew is extremely elevated by historical standards at ~20%.

BTC 1 Month ATM Vol Over 1 Month

Source: Skew

BTC 25 Delta Put Skew Over 6 Months

Source: Skew

ETH Derivatives

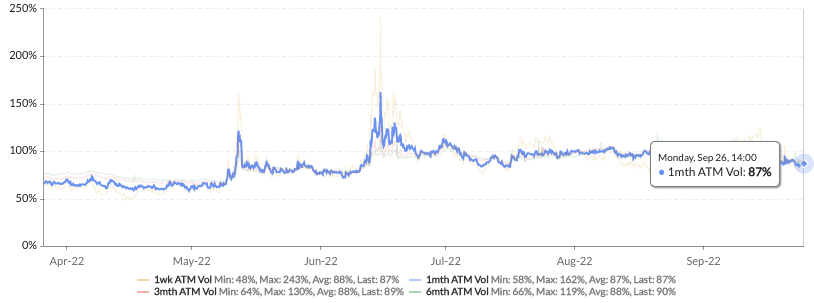

1 month ETH vol quickly came in from 106% pre-Merge to 87%, which marks the lowest level since June, but is still a long way above the pre Luna level of 58%. 1 month Put Skew steadily increased to 18%, moving in tandem with BTC.

ETH 1 Month ATM Vol Over 6 Months

Source: Skew

ETH 25 Delta Put Skew Over 6 Months

Source: Skew

Flows and Liquidations

Over the past two weeks, both The Merge and various macro events have impacted price action in the short-term. Liquidations have been sporadic but leaning heavily towards the long side as the days after the merge saw a large number of long liquidations. The past week has been relatively quiet compared to the immediate days after The Merge with the four days post-Merge liquidating around $718 million longs and $345 million shorts. With one of the largest crypto catalysts out of the way, eyes are now mainly focused on future macroeconomic forecasts.

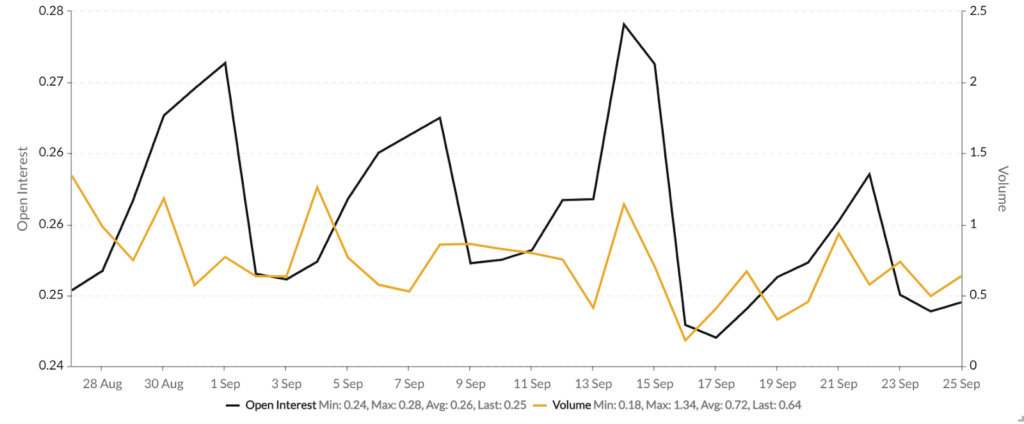

With the ETH Merge occurring on September 15th, put/call ratios may help provide greater clarity on market sentiment. In the chart below, the P/C ratio by open interest has fallen from 0.28 to 0.24 and stabilized around 0.25 over the past few days. P/C ratio by volume has remained below 1 for every day after The Merge indicating more calls traded than puts.

ETH Put/Call Ratios

Source: Skew, GSR

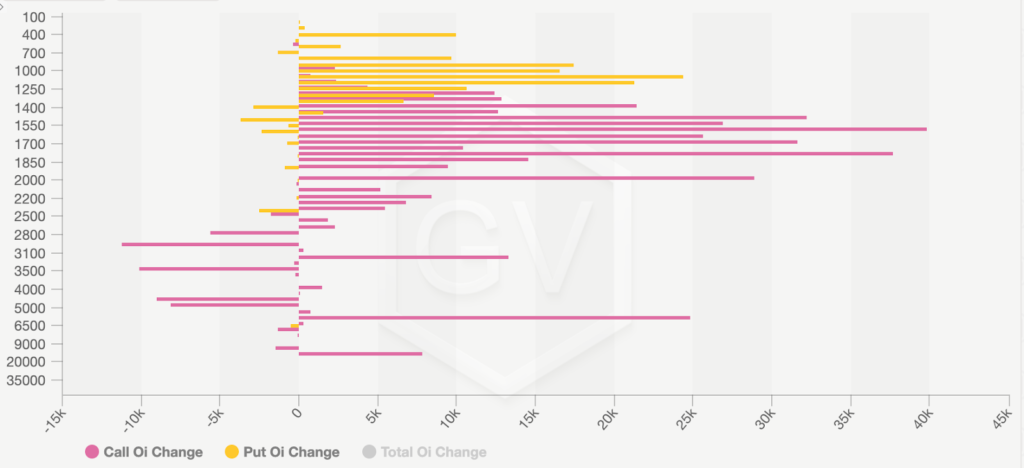

Taking a look at ETH option flows after The Merge, there has been a significant increase in call contracts opened around the $1,400-$2,000 strike range. There also has been large open interest in the $6,000 strike calls, with large closures at the $4,500-$5,000 level. Most put open interest lies around the $900-$1,250 range with the largest closures at the $1,400-$1,600 level.

ETH Put/Call Open Interest by Strike

Source: Genesis Volatility, GSR

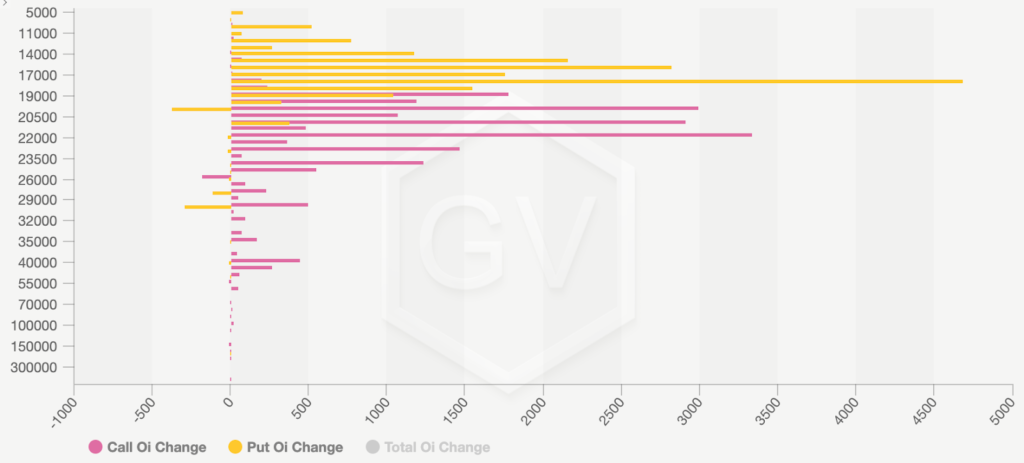

BTC option flows show a significant amount of puts opened at the $18,000 strike, with most call open interest increasing at the $22,000 level. The largest decline in open interest has been at the $20,000 and $30,000 level for puts, and at the $26,000 level for calls. In summary, flows in ETH indicate a larger open interest in calls relative to puts, whereas the opposite is true for BTC.

BTC Put/Call Open Interest by Strike

Source: Genesis Volatility, GSR

Altcoin Vol

The ETH Merge greatly increased implied vols across the entire market but was ultimately a non-event. Altcoin vols followed suit with ETH and are down significantly over the past two weeks. In line with expectations, alts seem to be following ETH moves more closely, which is being driven by macro-related headlines more than anything else.

DeFi

DeFi saw some headwinds over the past few weeks, with a draft bill in the US House of Representatives proposing to ban algorithmic stablecoins for two years. Projects like Frax came under scrutiny as investors reevaluated the impacts of these proposed changes.

Elsewhere, protocols that offer fixed fees for getting into positions like Synthetix, GMX, and Gains Network saw renewed skepticism upon evidence of potential price manipulation using oracles. A malicious actor got a large position on AVAX on GMX on September 18th and proceeded to manipulate the price on Coinbase by bidding aggressively. The actor then sold the position on GMX before unwinding on Coinbase. The ability for this to be profitable was quickly curtailed on all related platforms by limiting OI but it proves that such a model is unsustainable. The Synthetix DAO has also been discussing this issue over the last month.

Authors:

Mike Pozarzycki – Macro & Crypto Summary

Ruchir Gupta – Rates, Funding and Basis

John Cole – Derivatives

Christopher Newhouse – Flows and Liquidations

Mitch Galer – Altcoin Vol

Calvin Weixuan Goh – DeFi

Disclaimers: “This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report. This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.”