MACRO + CRYPTO SUMMARY

The long-awaited FOMC meeting finally arrived last week, where the Fed hiked rates by a reduced 25 bps and provided commentary that was interpreted by markets as dovish. This led to a risk-on environment, with yields coming off, the dollar falling, and stocks, gold, and other risk assets rallying. Many questioned the wisdom of such an interpretation, as some did not believe the FOMC statement and press conference to be that dovish. US payrolls data was released a few days later, which beat expectations by a significant amount, though the beat may have been helped by seasonal adjustments. Yields have since retraced and moved up past pre-FOMC levels, while gold has fallen and the dollar has risen. Looking ahead, the CPI on Tuesday and PPI on Thursday will be closely watched, and it remains to be seen whether the current expectation for eventual rate cuts will actually be met.

RATES, FUNDING AND BASIS

Funding rates across major perpetual venues continue to generally be biased positive as the market retains its bullish stance. As the Fed hike cycle continues and the cost of capital for large institutional players inches higher, it is possible this bias towards high funding rates sustains unless and until there’s a broader sell-off in the market.

Activity in lending marketplaces continues to be muted. There is capital looking for yield and borrowers looking for leverage, but the heightened level of caution in the credit market continues to win out and reduce activity.

DERIVATIVES

BTC Derivatives

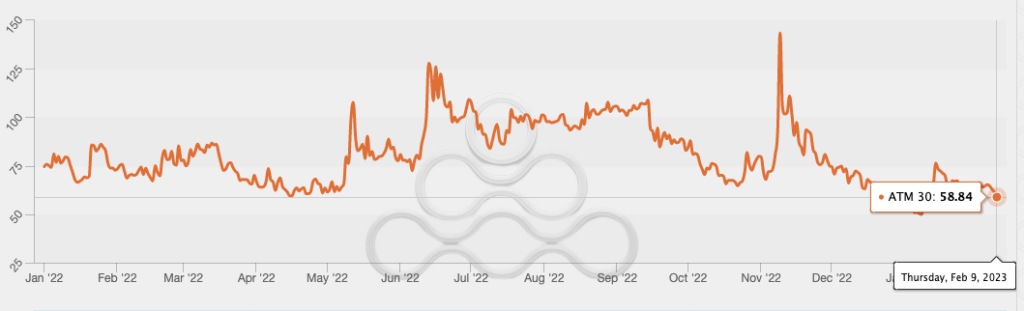

Vols have come in steadily since January 14th, with BTC 30-day implied volatility notably falling from 66% to 45%. Up to January 14th, BTC had rallied 30% on the year from $16,500 to $21,500 and realized volatility was around 100%. Since then, prices have stabilized at ~$23,000 and 10-day realized vol is now 38%. The US CPI, scheduled for release on February 14th, may cause a breakout from the recent range.

BTC ATM Implied Volatility (30 Day)

Source: Amberdata, GSR

As the price rally abated, 25 delta call skew drifted back to just under zero.

BTC 25 Delta Call Skew (30 Day)

Source: Amberdata, GSR

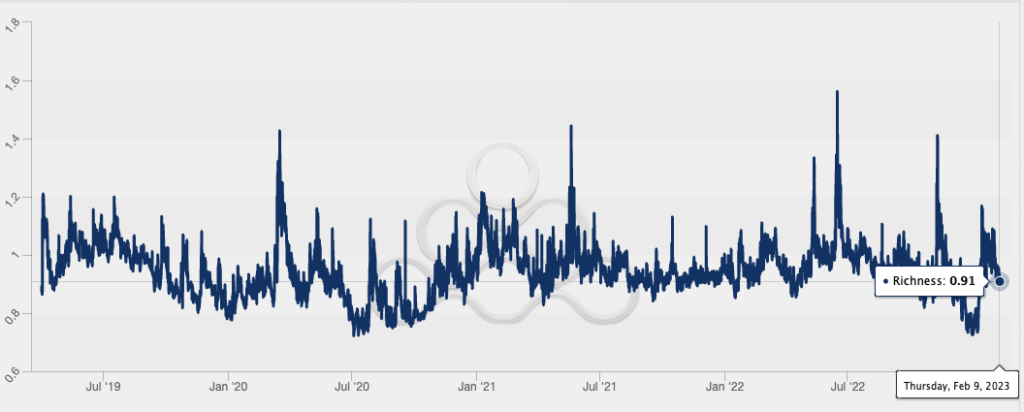

BTC term structure richness is at 0.91 and is a sign that realized volatility is softening. BTC term structure is in contango with shorter-dated tenors trading under long-dated tenors.

BTC Term Structure Richness

Source: Amberdata, GSR

ETH Derivatives

ETH 30-day implied volatility is sitting above its one-year low of 50%, currently at 59% while 10-day realized volatility is 53%.

ETH ATM Implied Volatility (30 Day)

Source: Amberdata, GSR

ETH call skew is in line with the relatively muted price action versus BTC and has struggled to go positive.

ETH 25 Delta Call Skew (30 Day)

Source: Amberdata, GSR

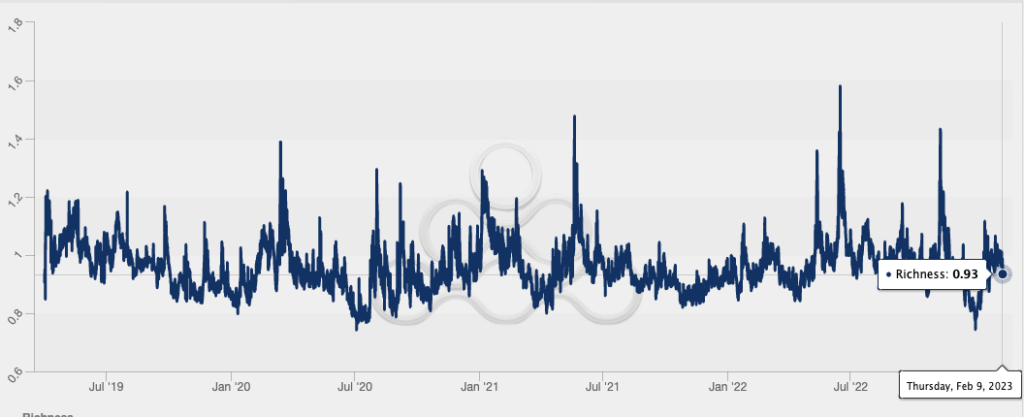

ETH term structure in contango at 0.93.

ETH Term Structure Richness

Source: Amberdata, GSR

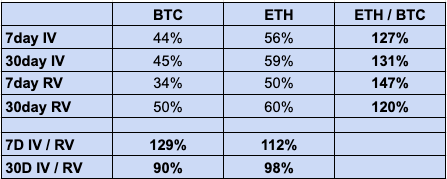

ETH realized vol has recently outperformed BTC (147% 7-day vs. 120% 30-day) and consequently 7-day implied vol is only 112% over realized vol compared to BTC at 129% over.

BTC and ETH Implied vs. Realized Vols

Source: Amberdata, TradingView, GSR

FLOWS AND LIQUIDATIONS

Some of the most interesting flows over the past few weeks has been the demand for longer-dated upside calls in BTC as represented by outright purchases of the 31MAR23-32K calls happening about a week ago. A noticeable trend in these blocks is the demand for outright calls occurring over a week ago, whereas two large blocks of call sellers occurred this past week.

Deribit BTC Block Trades, Last Two Weeks

Source: Amberdata, GSR

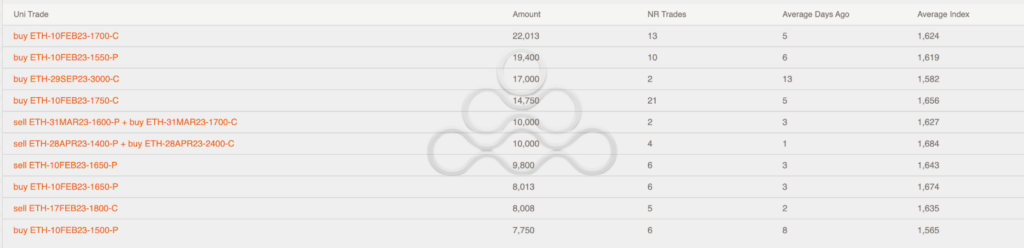

ETH block trades were mainly focused on short-dated tenors with 10FEB23 and 17FEB23 the primary targets for outright options trades. Noticeably, however, there was a large block buyer of 29SEP23 3K ETH calls around 13 days ago. Recent trades show an interest in demand for call skew as the 28APR23 risk-reversal blocked around 10,000 contracts.

Deribit ETH Block Trades, Last Two Weeks

Source: Amberdata, GSR

In terms of liquidations, longs have been under fire over the past few days whereas the long/short liquidations were a bit more balanced two weeks ago. The recent reversal and rejection of key levels such as the $1,700 region in ETH and $24,000 level in BTC has led to new shorts opened, longs liquidated, and a stalemate in terms of establishing a new range higher in both of the majors.

Total Liquidations

Source: Coinglass, GSR

ALTCOIN VOLS

Altcoin vols remained relatively static at the beginning of the recent rally, increasing a point or two in aggregate off the back of a few tokens. As belief in the rally began to grow, the shape of the vol curves changed as call skew grew more expensive relative to put skew. In the past week, altcoin vols have exploded higher with trailing 3-month vols up an average of 10 points. This reinforces the idea that altcoin vols are directly proportional to market speculation, rather than inversely proportional to price as we often see in equities.

Authors

Mike Pozarzycki – Macro & Crypto Summary

Ruchir Gupta – Rates, Funding and Basis

John Cole – Derivatives

Christopher Newhouse – Flows and Liquidations

Mitch Galer – Altcoin Vols

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.