The Market

For the last number of weeks Bitcoin has shown strong support at both $9,200 and $8,800, acting as a foundation for continued attempts at breaching $10,000.

Bloomberg’s recent commodity report stated that Bitcoin is building a foundation for further price appreciation, defining the market as a ‘resting bull.’ Bitcoin has seen a shift in its investor demographic towards more institutional players. The CME has shown substantial growth in trading accounts and record levels of open interest. Deribit also achieved a new record of $1 billion Open Interest (before May expiry) in BTC options.

It appears Bitcoin is being more seriously considered as a speculative hedge to long term inflation, and general macro uncertainty. With the recent political turmoil the narrative of Bitcoin as a silent protest against the mainstream establishment has grown. Reputable commentary from traditional investors has increased since renowned hedge fund manager Paul Tudor Jones stated that 1% of his portfolio is currently in Bitcoin, declaring it a ‘great speculative investment.’

“Every day that goes by that bitcoin survives, the trust in it will go up,” Paul Tudor Jones.

Infrastructure Improvements Still Needed

While major headlines such as this are great for momentum, what will be key is if the infrastructure from traditional derivative markets will follow. For example, CME futures seem to be the avenue where traditional asset managers are most comfortable to explore as they take their first steps into the crypto world. If there is robust demand, CME could possibly implement multilateral post trade compression services, as they do for Vanilla Interest Rate Swaps and Equity Options, which provides participants and their FCM’s capital relief in listed products without materially changing the risk exposure of a given participant’s portfolio (compresses bucketed/offsetting positions). As more robust traditional infrastructure and third parties such as custodians and prime brokers are better established, the entrance of institutional players into the market will become more seamless.

Not all Positive

As momentum seemed to build around bitcoin’s role being more defined in a chaotic financial system, Goldman Sachs declared the opposite. In what initially was hyped as a bullish anecdote, Goldman had a conference call with clients titled ‘“US Economic Outlook & Implications of Current Policies for Inflation, Gold and Bitcoin.” Bitcoin’s mention ended up being completely negative, highlighting its volatility, and how it does not have the characteristics of an asset class.

There are some reasons why one should take this commentary with a grain of salt. Goldman is a leader in traditional finance. Digital finance and de-fi using newer technology are threats to Goldman’s long term business model, so it is not a surprise that Goldman’s formal view is that bitcoin is not the future.

It should also be considered that Goldman hired Justin Schmidt in 2018 as ‘Head of Digital Asset Markets’ along with dozens of other representatives. It was revealed by the Wall Street Journal that their competitor JP Morgan is now offering banking services to both Coinbase and Gemini. JPMorgan chief executive Jamie Dimon called bitcoin a “fraud” in September 2017.

The Halvening

The most aggressive printing in monetary history perfectly aligned with the most hyped halving in Bitcoin’s history. When chaos was spreading throughout the financial and political world, the bitcoin halving came and went. The event was a timely reminder that regardless of events in the political and wider world bitcoin keeps on going.

The halving was full of anticipation that resulted in a rather subdued outcome as we crossed the 630,000 block milestone. Google trends for ‘bitcoin halving’ reached all time highs, exceeding the past halving by 350%. The halving was a symbolic event that has reminded many of bitcoin’s strong fundamentals in a time of macro uncertainty.

With a highly leveraged market and rocketing open interest, bitcoin sold off the day prior to the halving from $9,800 to $8,200 in the span of an hour. The drop liquidated over $295mil on BitMex alone, 98% of which held long positions. For some, live streams and panels may have been the biggest highlight for the event.

Bitcoin’s hash rate did however reach an all time high of around 140 EH/s, while an estimated 30% of existing miners, unable to upgrade their rigs, are thought to now be unprofitable. After the event there was a gradual drop to 90 million terahashes per second bottoming in late May, hashrate has now begun to rise again.

Interestingly, Chinese bitcoin-mining pool f2pool, which won the reward for block No. 629,999, embedded a message into the blockchain record: “NYTimes 09/Apr/2020 With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue.” This was a clear homage to Satoshi Nakamoto’s iconic headline “brink of a second bailout” message in the original genesis block.

‘Even though the halving event had minimal impact, it has been impactful in the psyche of retail and institutional investors alike’. Rich Rosenblum, Coindesk, May 13th.

Despite the liquidations, the CME saw a 43% increase in BTC futures trading over the course of the event. Understandably, vols were quite elevated as there was an apparent ATM weighted shift of the curve (shorter maturities).

GSR Update: Consensus 2020

GSR’s Co Founder Rich Rosenblum was on the First Mover panel at Consensus distributed. Rich discussed Institutional Mining and Financing alongside Zac Prince of BlockFi, Thomas C. of ErisX and Brad Keoun of Coindesk.

Rich discussed the media attention and timing of the halvening as well as how Chinese miners have been using derivatives and trading with GSR.

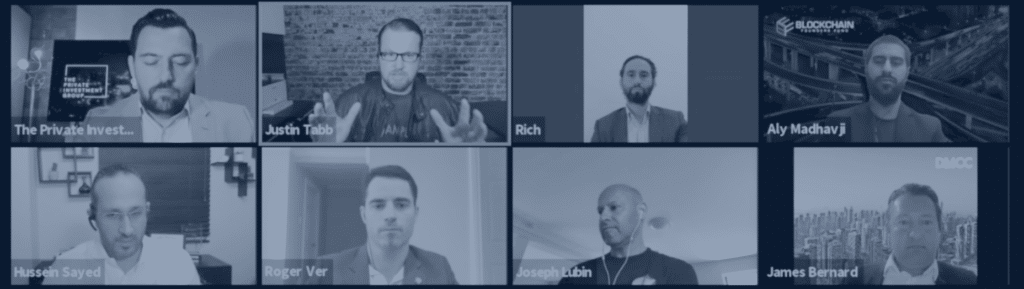

Rich Rosenblum, Joe Lubin, Roger Ver and others discuss the digital asset investment landscape

Rich Rosenblum of GSR was joined by Joseph Lubin of Consensys, Roger Ver of Bitcoin Cash, Justin Tabb, Aly Madhavji 穆亚霖, and Saeed Hareb Al Darmaki to discuss the digital asset investment landscape. The panel was moderated by CNBC’s very own Hussein Sayed, CFA and hosted by The Private investment group.

ADAM Announces New CEO

The Association for Digital Asset Markets (ADAM) announced the appointment of Jeffrey Blockinger as its first Chief Executive Officer. Mr. Blockinger plans to broaden and deepen ADAM’s role in fostering fair and efficient digital asset markets where participants can transact with confidence.

“Jeff’s extensive experience in guiding traditional and alternative asset managers through periods of momentous change is a major asset for ADAM’s overall mission,” said Richard Rosenblum, Co-Founder and Head of Markets at GSR.

Reports, market reports, and other information (“Information”) provided by GSR or its affiliates have been prepared solely for informative purposes and should not be the basis for making investment decisions or be construed as a recommendation to engage in investment transactions or be taken to suggest an investment strategy in respect of any financial instruments or the issuers thereof. Information provided is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services and is not a recommendation to buy, sell, or hold any asset. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page. Trading from Singapore, please review The Monetary Authority of Singapore (MAS) compliance note.