We previously wrote about the role of miners in the Bitcoin network, the inputs utilized to generate new bitcoin, as well as the bitcoin mining business model. In the final part of this series, we explore the environmental implications of mining bitcoin and regulatory backdrop.

Environmental Considerations of Bitcoin Mining

The Bitcoin network is frequently criticized for its energy consumption, as its proof-of-work consensus mechanism relies on electricity as the expense that disincentivizes malicious actors from attempting to change the contents of past transactions. In fact, aggregate miner revenue can be thought of as the total security budget protecting the immutability of the blockchain. It’s the size and scope of this electricity usage and the specialized hardware requirements that make the network economically infeasible to attack by even the most coordinated and well financed attackers. We refrain from opining on what constitutes ‘acceptable’ energy consumption for a new technology given the subjective and polarizing nature of value, but we aim to provide context to this conversation. Lastly, note that other blockchain networks also add to carbon emissions beyond what’s covered in this piece, however Ethereum is the only network with a similar magnitude of energy usage and researchers estimate that its power consumption will fall by more than 99.9% after its transition to proof-of-stake.

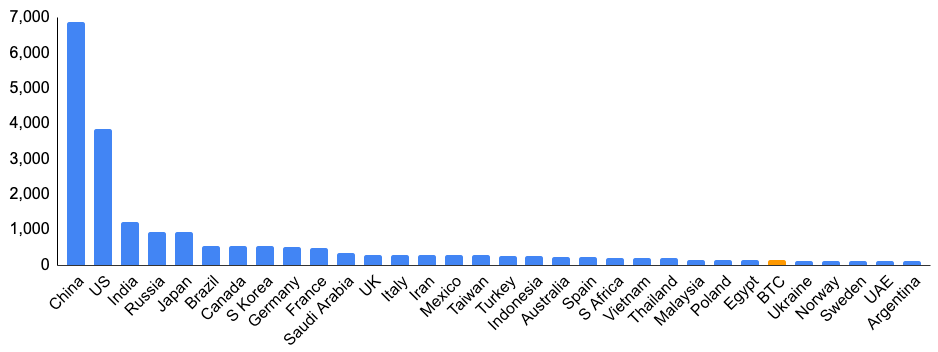

According to the Cambridge Centre For Alternative Finance (CCAF), the Bitcoin network is estimated to currently consume 137 terawatt hours (TWh) of electricity on an annualized basis. For context, this amounts to 0.5% of the global electricity production of 26,730 TWh based on 2018 estimates from the International Energy Agency. Examining estimates of total annual energy production to account for a broader array of industries that rely on energy sources other than just electricity such as diesel fuel, Bitcoin consumes less than 0.1% of total global energy production. Below we show Bitcoin’s annual electricity consumption compared to that of selected countries.

Exhibit 1: Annual Electricity Consumption by Country, TWh per year

Source: Cambridge Centre for Alternative Finance, GSR

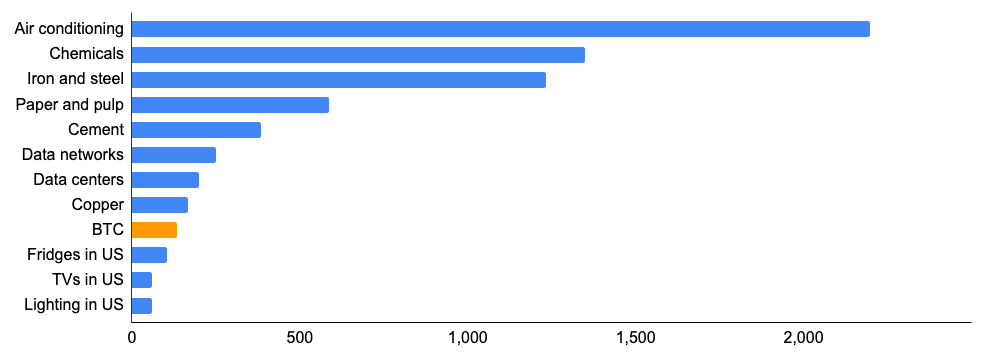

While critics commonly contend that Bitcoin uses more energy than many large countries, relative consumption looks more inline when compared to other common applications. For example, Bitcoin uses ~6.2% of the amount of energy that air conditioners use globally.

Exhibit 2: Annual Electricity Consumption by Application, TWh per year

Source: Cambridge Centre for Alternative Finance, GSR

A common misconception frequently displayed throughout environmental criticisms of Bitcoin is the conflation between energy usage and carbon emissions. Electricity is a form of secondary energy, meaning it is generated from primary energy sources that can span the emissions spectrum from high-emission coal to zero emission wind, solar, or hydroelectric power (ignoring any initial emissions from manufacturing the renewable equipment). Furthermore, as the development of renewable technology has advanced, the cost of renewable energy has fallen drastically. According to the International Energy Agency’s 2021 Outlook, solar and wind energy are now the lowest cost solution in most markets. Given that electricity generally comprises the vast majority of a Bitcoin miner’s marginal cost of production, they are financially incentivized to use the cheapest electricity available, resulting in an increasingly sustainable miner electricity mix. Hence, when evaluating Bitcoin mining from an environmental perspective, the focus should be on the carbon emissions generated as opposed to the sheer amount of electricity used.

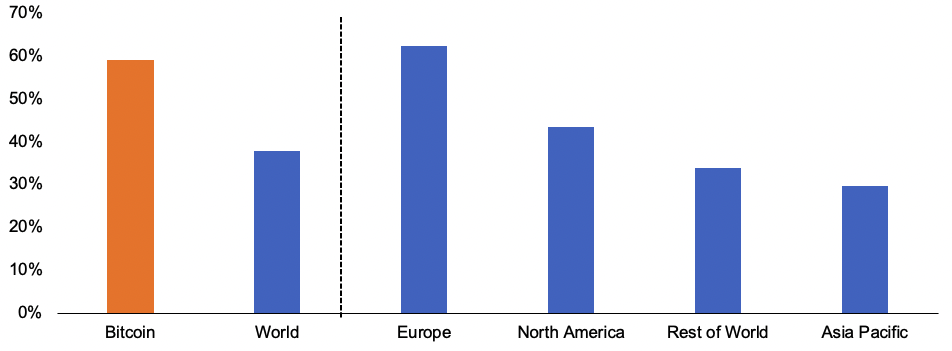

In 2019, the CCAF estimated renewable energy made up 39% of the Bitcoin network’s energy consumption with a high degree of dispersion across geographies, noting that the median percentage of renewables utilized in the US and Europe was 65-70%. More recently, The Bitcoin Mining Council (BMC), a voluntary global forum of Bitcoin mining companies representing about half of the network’s hashrate, estimated that the network’s hashrate was 59% ‘sustainable’ as of Q1 2022. The BMC defined ‘sustainable’ as being generated from hydro, wind, solar, nuclear, and geothermal without taking into account any renewable energy credits that miners frequently utilize to further offset their carbon emissions. This compares to 38% of the world’s aggregate electricity generation coming from sustainable sources. Bitcoin’s greater mix of sustainable energy means that Bitcoin miners generate less carbon per unit of electricity utilized compared to the global average and that its share of carbon emissions is lower than would be expected by examining electricity consumption alone. Indeed, NYDIG and CoinShares estimate Bitcoin’s 2020 carbon emissions to be 33 megatonnes of carbon dioxide (MtCO2) and 36 MtCO2, respectively, representing less than 0.1% of global emissions based on data from the Global Carbon Project.

Exhibit 3: Sustainable Energy as % of Electricity Generation by Geography

Source: BP Statistical Review of World Energy, Bitcoin Mining Council, GSR. Bitcoin estimates as of Mar 2022. Regional data as of 2020.

Miner Flexibility

Miner’s are also frequently chastised for the ‘productivity’ of their energy use, noting that the energy could have been more productively deployed to other use-cases like powering a house or a hospital. This criticism is predominantly based on a perception that Bitcoin miners do not provide a benefit to society, and that there would be other end-users for this energy that could provide a more clear benefit. Ignoring the subjective assessment of value, opinions regarding which causes warrant energy usage, and the benefits around financial inclusion, power/wealth redistribution, etc. there are flaws in this criticism. For example, it assumes that electricity is a globally fungible asset, and that the world’s electricity generation is utilized to its fullest capacity such that any electricity utilized by one application is withheld from another in a zero-sum fashion. The unfortunate reality, however, is that electricity is not fully fungible and large swaths of energy are regularly wasted. This is because the movement of energy requires infrastructure that doesn’t sufficiently exist in certain areas resulting in trapped pools of energy that can be harvested by opportunistic parties on a localized basis. Additionally, forms of renewable energy like wind and solar only generate power intermittently, but if there isn’t a natural source of demand it may be wasted as battery technology isn’t sufficiently developed for cost-efficient storage at scale. Subsidies like the federal Production Tax Credit (PTC) in the US further incentivize generators to produce renewable power even if there is no corresponding source of demand to utilize the production.

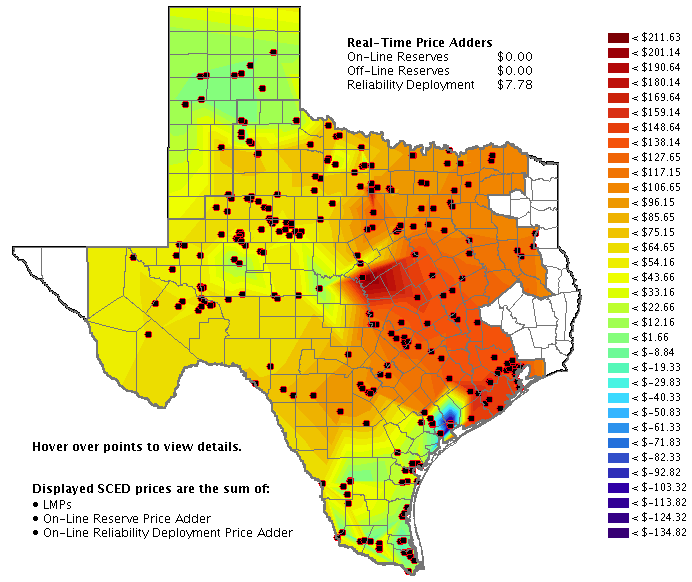

This lack of fungibility of electricity can be visualized through the dispersion of wholesale electricity prices by geography, a phenomenon that would not materially exist in an efficient and fully fungible market. The mere existence of negative electricity prices further illustrates this point and highlights the limitations of transporting electricity.

Exhibit 4: Texas Electricity Price Dispersion

Source: ERCOT. Data is an illustrative snapshot as of May 9 2022.

Bitcoin miners are largely location agnostic (subject to geopolitical/regulatory considerations) with the unique ability to co-locate at the source of energy production and monetize geographic dispersions in electricity prices. Indeed, miners require only their transportable mining hardware, a power source, and an internet connection with modest bandwidth such as satellite, and operations are quick to set up without any sort of permitting required in most jurisdictions. This geographic flexibility combined with an electricity-dominated cost structure encourages prudent miners to search for the lowest cost power solution regardless of where that may take them. Nic Carter, a general partner at Castle Island Ventures, illustrated this dynamic elegantly in the following quote: “Imagine a 3D topographic map of the world with cheap energy hotspots being lower and expensive energy being higher. I imagine Bitcoin mining being akin to a glass of water poured over the surface, settling in the nooks and crannies, and smoothing it out.”

In addition, population centers are typically located far from energy assets and energy transportation is expensive, allowing Bitcoin miners to locate at the energy source and avoiding competing for energy with households and businesses. In fact, a recent study in the iScience journal indicated that the cost of electrical transmission per delivered MWh can be up to 11 times more expensive than for natural gas pipelines. Miners remove these transmission costs and benefit from lower demand near where the energy is being produced by strategically constructing their operations around energy assets that are commonly in remote locations. This is directly observable by the large difference in power costs between miners and households or business – 4.6c per kWh versus 12-14c, per CCAF – with this price discrepancy indicating miners and households/businesses are generally not competing for the same power.

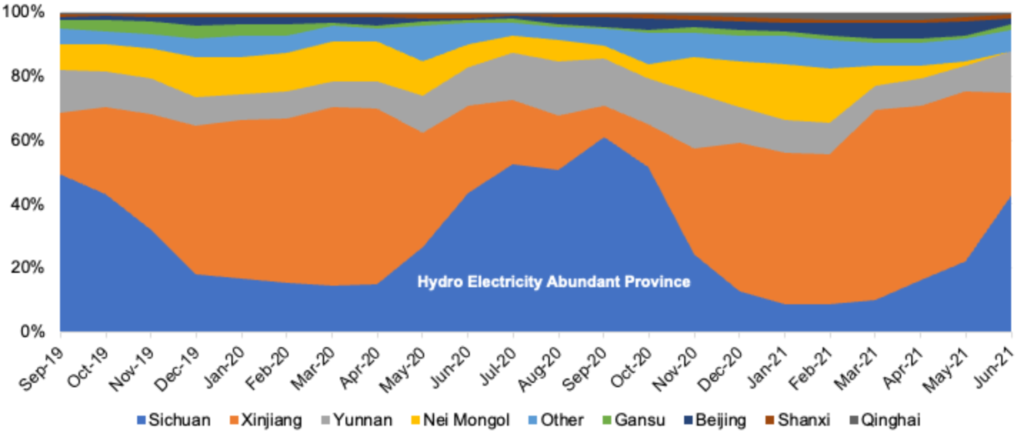

Historically speaking, the geographic flexibility of Bitcoin miners was most prominently on display in China prior to the ban on mining during the monsoon season. Specifically, a large portion of Chinese miners would migrate down to the Sichuan province during the wet season to capitalize on the region’s surplus hydroelectric power. As the seasons transitioned, miners would move back up to the more stable, coal-powered region of Xinjiang. To further contextualize the magnitude of the surplus energy, Sichuan had installed hydropower capacity of 77.1 GW in 2017 while the province’s electrical grid could only support 41.8 GW, implying a lot of clean energy went to waste. In fact, the CCAF estimates that the electrical power of the Bitcoin network is less than 16 GW today.

Exhibit 5: Seasonal Migration: Share of Chinese Hashrate by Province

Source: BP Statistical Review of World Energy, Bitcoin Mining Council, GSR. Bitcoin estimates as of Dec 2021. Regional data as of 2020.

While wasting hydropower is a suboptimal allocation of resources, the waste itself does not have a corresponding cost in carbon emissions. However, this is not always true with other energy sources, and Bitcoin miners may actually utilize stranded energy assets to mine Bitcoin at a net negative carbon cost. The most prominent example of this is a miner co-locating on an oil field and utilizing natural gas that would have otherwise been flared. Flaring is the process of burning (wasting) gas that was produced as a by-product of oil extraction. This gas typically cannot be economically collected and brought to the market, so the gas is often flared for safety reasons. Additionally, high wind conditions can negatively impact the combustion efficiency of flare towers as the flame size is reduced. This results in excess gas being leaked directly into the atmosphere (vented) which is even worse for the environment as natural gas is predominantly composed of methane which is 25 to 31 times more damaging to the environment than carbon dioxide when it comes to warming the planet over a 100 year period. Alternatively, Bitcoin miners can co-locate their data centers at these oil fields, harvesting the natural gas onsite and burning it in an internal combustion engine with a much higher level of combustion efficiency.

CoinShares research studied the carbon impact of oil field mining using assumptions around combustion efficiency and realistic wind conditions, and concluded that Bitcoin miners actually prevent about 0.11 tonnes of methane from entering the atmosphere for each tonne of CO2 emitted. Looking at the greenhouse effect of this over a 100-year period implies that for each tonne of CO2 emitted by oil field miners, Bitcoin miners are removing ~3.4 tonnes of CO2 equivalents, resulting in a net ~2.4 tonne reduction of CO2 equivalents for each tonne of CO2 emitted. Bitcoin is one of the few applications that can co-locate on these oil fields and harvest this cheap energy at the source while reducing carbon emissions on a net basis. Additionally, since flaring is so widespread today, the CCAF estimates that the global gas recovery potential from flaring is enough to power the entire Bitcoin network five times over, hence there is immense potential to expand Bitcoin’s energy consumption while reducing its carbon emissions. Crusoe Energy and Great American Mining are two companies leading the charge in oil field mining today, and many other oil field miners such as Jai Energy, Giga Energy, Nakamotor, and Upstream Data have begun to specialize in the space as well. Finally, both ExxonMobil and ConocoPhillips have also created programs in recent periods leveraging oil field miners to help reduce their own carbon emissions.

While oil field mining is the most prominent example of Bitcoin mining helping the environment and it is likely the largest opportunity, there are other beneficial approaches being utilized today. Stronghold Digital Mining’s operations are powered through the removal and utilization of environmentally harmful coal refuse that is a byproduct of historical coal mining operations. Stronghold removes the coal refuse from nature, burning it in an emissions controlled fashion, and they receive environmental tax credits for this approach. Product Recovery Technology International (PRTI) is another notable company in this arena. PRTI leverages a proprietary ‘de-manufacturing’ process to break waste tires down into oil, syngas, carbon, steel, and heat, leveraging a portion of the commodities produced through this recycling process to mine bitcoin.

Grid Infrastructure

Electricity demand varies throughout the day and year, requiring a robust electrical grid to have overdeveloped power generation infrastructure, resulting in electrical grids most often operating below peak capacity. However, building surplus energy infrastructure to support infrequent, peak loads (demand) results in capital intensive energy assets often sitting idle, increasing the downstream cost of energy for all stakeholders. Additionally, most end-user energy demand is inflexible, so grid operators historically balanced supply versus demand without much ability to impact the demand side of the equation. However, Bitcoin mining can help solve this by acting as a flexible load that can be curtailed during times of peak demand, supporting the grid in tail events while improving the efficiency during times of more normal demand. In other words, Bitcoin miners may not only accelerate the transition to renewable energy sources, but also strengthen the world’s electrical grids.

The simplicity of the Bitcoin mining business model provides this flexibility. Most other businesses are far more complex and have more dependencies that require consistency in their operations. As an example, a cloud service provider must operate 24/7/365 with a resiliency plan to ensure customers have constant access. If a cloud provider were to shut down at random intervals totalling 10% of each day, they would lose far more than 10% of their revenue as customers who are dependent on constant access would simply move to a competitor. Bitcoin miners, however, operate without broader business dependencies and, all else equal, their revenue is generated linearly in time as they operate. In other words, if a miner shuts down for a day, it would simply lose that day’s revenue without any impact to future revenue.

One prominent display of miners acting as a resource to the electrical grid is in Texas’s deregulated electricity market. Many of the largest miners and hosting service providers have developed facilities connected to the Texas Interconnection (Texas’s grid), which is managed by ERCOT. These miners frequently procure multi-year contracts to buy a fixed amount of power at a fixed price called power purchase agreements. This supports the resiliency of the grid by adding a constant source of demand irrespective of the time of day or year. In addition, these miners often participate in demand response programs, where they actually shut down and sell their pre-purchased electricity back to the grid in times of extreme demand shocks. When a cold front recently approached Texas in February 2022, five industrial grade mining operations all voluntarily shut down and sold their power back to the grid to help with stabilization. These firms included Riot’s Whinstone facility, which is the largest mining operation in North America, and in aggregate, these five firms returned enough supply back to the grid to power multiple cities right when the grid needed it most. Hence, Bitcoin miners represent a unique source of flexible load that can be cut at times of instability, and provide grid operators an extra lever to adjust the demand side of the equation. While we believe Bitcoin mining enhances grid resiliency, we caution that it is not a panacea for grid infrastructure. Miners invest large sums of capital in hardware and infrastructure with finite lives in order to mine bitcoin. They are able to support the grid with their flexibility during extreme scenarios, but they are not adjusting their demand on a daily basis outside of unusually disruptive events.

Beyond acting as a lever for load response, miners may actually help to incentivize increased development of renewable energy infrastructure. Research produced by Block, formerly Square, using 2019 data indicated that there were more than 200 GW of delayed solar and wind capacity in just three US grid interconnections. This is 200 GW of clean power with ready developers and financing, but existing grid infrastructure cannot currently accommodate the power. Bitcoin miners could partner with some of these renewable projects, co-locating with them and purchasing power from them directly, behind-the-meter until they are able to establish a grid connection. This is exactly what Marathon’s most recent deal with Compute North does. They are deploying their rigs at industry-low electricity rates primarily leveraging behind-the-meter renewable energy sources. Blockstream and Block also recently formed a partnership to test a similar thesis, announcing that they will leverage Tesla’s solar panel and battery technology to build a 100% solar powered bitcoin mining facility. Partnerships like these could expedite the build out of renewable infrastructure by improving the economics of energy generation projects. They may also potentially accelerate the investment into transmission infrastructure as more generation projects are brought online sooner. These expedited investments could further act as a flywheel, pulling forward the cost reductions expected to occur through time as more investment is made in renewable technologies.

Bitcoin Mining Regulation

Given the environmental implications of Bitcoin mining, regulators from many jurisdictions have implemented or are considering implementing regulations, but these policies vary widely by country, state, and city and are also evolving in real-time. This creates risk for miners as future regulatory changes may impact their operations. The ban on mining in China, for example, highlighted the importance of operating in a geography that has a pro-Bitcoin regulatory stance. Miners operating in China suffered a materially adverse financial hit after being forced to turn off their machines, as their revenue quickly fell to zero and the value of their rigs plummeted. While the drivers of China’s decision to ban mining are still up for debate, other countries like Kazakhstan, Iran, and Kosovo have more clearly imposed bans on mining temporarily to dampen the pressure on their less-robust electrical grids during periods of high power consumption.

In the US specifically, there is no federal mining legislation in place and state-level legislation varies. House Democrats recently wrote a letter to the EPA requesting them to “evaluate proof-of-work mining facilities’ compliance with environmental statutes”, which was quickly followed by a point-by-point rebuttal letter penned by a consortium of crypto industry stakeholders. At the state level, the New York State Assembly recently passed a two-year Bitcoin mining moratorium this past month. The bill is more narrow in scope than past attempts to ban mining in the state, and it would only apply to miners that use carbon-based fuels seeking new permits or renewals while an environmental study is conducted. Additionally, the bill still requires approvals from the State Senate and state governor prior to becoming law, but it has the potential to be the largest piece of mining legislation in the United States to date. Note that while New York has unsuccessfully attempted various bans on mining in the past, many other states have taken a more pro-Bitcoin stance, incentivizing mining operations with tax breaks and other benefits. Texas, Georgia, and Kentucky, for example, are doing just this, partly due to the tax revenues and jobs they create. The city of Fort Worth even initiated a pilot project where the city is mining bitcoin directly at a small scale inside City Hall.

In the EU, lawmakers have been working since 2020 on creating a comprehensive regulatory package known as Markets in Crypto Assets (MiCA). MiCA aims to provide a strong regulatory framework across EU member states covering crypto assets outside the scope of existing financial services legislation. The framework initially contained a controversial provision that sought to prohibit crypto services from utilizing proof-of-work-based cryptocurrencies, which was frequently referred to as an “indirect ban” and would clearly have had a large impact on miners, but was later voted down and replaced with an alternative amendment bringing crypto assets under the same sustainability-related taxonomy as other financial products. Informal tripartite discussions known as trilogues are now occurring, and will subsequently need to be formally approved by each of the institutions involved before MiCA becomes law.

Regulation remains an evolving part of the story with each of these high profile examples occurring in the last year alone. In time, we expect more thorough regulatory frameworks to develop and mitigate many of the uncertainties that exist today. Until then, miners are forced to factor regulatory uncertainty into their decision making, selecting facilities in locations with cheap energy assets, a reliable power grid, and a stable regulatory environment with a strong rule of law.

Authors:

Matt Kunke, Junior Strategist

Brian Rudick, Senior Strategist

Sources:

Braiins – Bitcoin Mining & The Grid (Part 1)

Braiins – Bitcoin Mining & The Grid (Part 2)

Cambridge Centre For Alternative Finance

CoinShares – The Bitcoin Mining Network

Global Cryptoasset Benchmarking Study

iScience Journal – Cost of Long-Distance Energy Transmission

Letter to the EPA From Congress

Statistical Review of World Energy 2021

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.

This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.