Author: Brian Rudick, Senior Strategist

After years of speculation, the largest stablecoin issuers have finally released more information on their reserves. We analyze these reserves and examine stablecoin risk in general.

Stablecoin Basics: Stablecoins are digital currencies whose value is tied to that of another asset, most often US dollars, and are designed to reduce the volatility inherent in cryptocurrencies. Stablecoins are used to access crypto markets and facilitate efficient trading, power decentralized applications, for borrowing and lending, for payments/remittances, and as a settlement layer, among other uses, and offer many benefits including speed, cost, transparency, inclusion, and programmability. There are three general types of stablecoins, delineated by their collateral:

- Fiat-collateralized, where a centralized party is responsible for minting and burning the stablecoin, generally backing it with cash or debt instruments

- Crypto-collateralized, where a smart contract relies on monetary policy, arbitrage and overcollateralization to maintain its peg

- Algorithmic, where a stability mechanism maintains the peg despite the absence of collateral and are more theoretical in nature

With over 90% market share, fiat-collateralized stablecoins are by far the most popular.

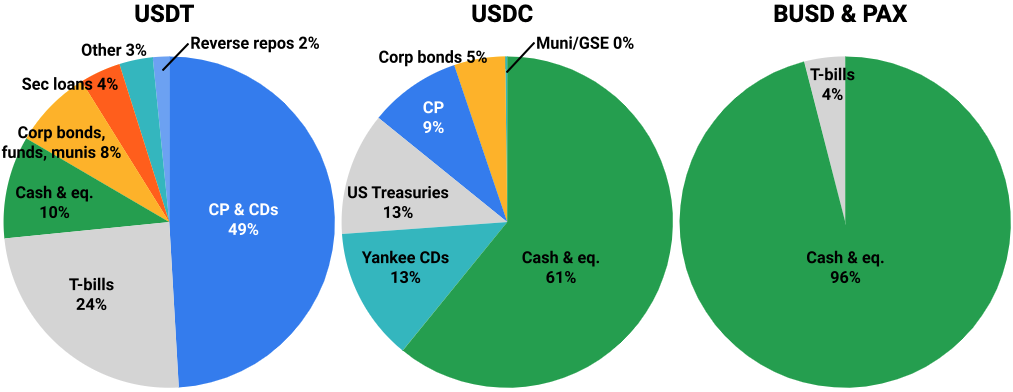

It’s All About the Benjamins: Stablecoin issuers make money on transaction fees and interest earned on assets. As such, issuers try to grow both the size of and yield on their assets, with the latter an incentive for issuers to back their stablecoin with higher yielding, riskier assets as opposed to cash. What was once thought to be US dollars in US bank accounts, recent disclosures have shown that not to be the case. For example, Tether, the largest stablecoin issuer by a wide margin, now releases quarterly attestation reports that show its USDT stablecoin is mainly backed by commercial paper & CDs (49%) and Treasury Bills (24%), causing consternation among some users given the high level of commercial paper with a relatively low rating and long duration compared to prime money market funds. Circle, the soon-to-be public company that created the second largest stablecoin USDC, also releases monthly attestation reports that show higher quality reserves relative to those of Tether but still with a surprising amount of debt. Finally, Paxos, the NYDFS-regulated issuer of both PAX and BUSD, seized the opportunity to highlight the quality of its reserves, which are 96% backed by cash and equivalents. See Exhibit 1 for a full breakdown.

Spotlight on Tether: First branded as Realcoin in 2014 and sharing the same owner and executive group as crypto exchange Bitfinex, Tether was one of the first stablecoin issuers and is by far the largest with $66B outstanding. Initially, Tether claimed to be backed 1-to-1 by traditional currency held in reserves, though later expanded this description to include loans to third parties and affiliated entities. The New York State Attorney General investigated Tether and Bitfinex over allegations the companies moved hundreds of millions of dollars to cover up an $850M loss of co-mingled client and corporate funds. During the investigation, Tether’s General Counsel also admitted the stablecoin was only 74% backed by reserves at the time. Tether settled with New York state, agreeing to cease business in New York, provide quarterly reserve reports for two years, and pay an $18M fine without admitting or denying wrongdoing. These controversies have contributed to Tether’s market share declining from 84% a year ago to 58% today.

Exhibit 1: Stablecoin Reserves by Issuer

Source:Tether, Circle, Paxos, GSR

Stablecoin Risk: With ~75% of recent crypto trading volume involving at least one stablecoin, a run on a major stablecoin could have a catastrophic impact on the crypto ecosystem, though one in which we ascribe low likelihood for a number of reasons. First, while banks in most jurisdictions are subject to stringent regulation, can borrow directly from their central bank, and offer accounts with government-backed deposit insurance, the modern banking system is built on a fractionalized reserve system underpinned by much riskier assets, making stablecoin issuer balance sheets look safer by those aspects. Second, we see it as unlikely that all holders of a certain stablecoin redeem at once, and even if so, there are some backstops in place, such as Tether’s terms of service agreement allowing it to delay withdrawals and to pay them in kind. In addition, issuers are seeking to boost confidence, with Circle looking to become a Federal Reserve-regulated national digital currency bank and Tether increasing the level of disclosure in its latest reserves attestation. Lastly, stricter regulations have been proposed such as the STABLE Act in the US and MiCA regulation in the EU, and regulators appear focused on stablecoins, particularly in the US. Should regulators implement stringent but sensible rules, such as guidelines on permissible reserve assets, rules governing reserve segregation and redemption claims, and perhaps capital requirements, we believe this would provide much needed solace for stablecoin users and be a tacit admission that stablecoins can coexist – even thrive – alongside central bank digital currency. Supporters within the Fed including Fed Vice Chair for Supervision Randy Quarles, investors who have poured hundreds of millions of dollars into issuers, and the holders of $118B worth of stablecoins appear to agree.

To download this article as a pdf click here.

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.