Bitcoin started off April trading at $58,900 and settled at $57,000 four weeks later, however, there was plenty of volatility throughout the month. On the weekend of April 16th bitcoin fell over 16%. The catalyst for the volatility is rumoured to be related to a blackout in China that brought many miners offline, a substantial drop in bitcoin’s hash rate followed. Later in the month markets regained some composure as bitcoin rebounded. It is probable that investors saw this sell off as an opportunity to “buy the dip”. Bitcoin has since entered a period of sideways consolidation. For the time being, price action, trading volumes and media focus have moved to Ethereum markets.

Total hashrate (TH/s), the estimated number of terahashes per second the bitcoin network is performing in the last 24 hours (April). Source: blockchain.com

When asked about the period of volatility for bitcoin in mid April, Co-Founder of GSR Rich Rosenblum told the Wall Street Journal that “at its core, bitcoin is still heavily driven by retail, who choose to use a lot of leverage.”

Bitcoin price action, (BTC/USD) April.

Market Capitalization

The total market capitalization for cryptocurrencies is now approaching the $2.5 trillion mark. Due to the market moves of Ethereum, the market hit an all time high of $2.3 trillion at the start of May. The total market had expanded past the $1 trillion mark in early January for the first time. The combined market cap for bitcoin and ethereum now sits just over $1.4 trillion.

Total market capitalization, source CoinMarketCap.

The rise of Ethereum

On May 4th ethereum hit an all time high of $3,438. The ETH market is experiencing record volume numbers for spot, futures and DeFi. The wider alt market is performing strongly, as the total value locked in Defi is now just short of $80bn, and the hype around NFTs continues to bring new entrants into the market.

Ethereum price action, (ETH/USD) April.

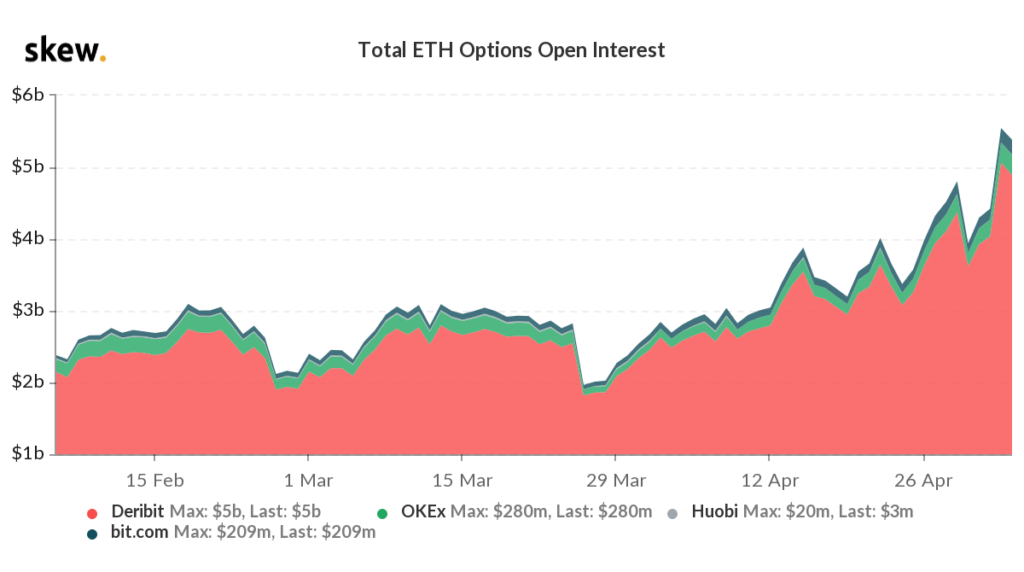

ETH options open interest has now hit an all time high, breaching $5 billion. (Source: Skew.com)

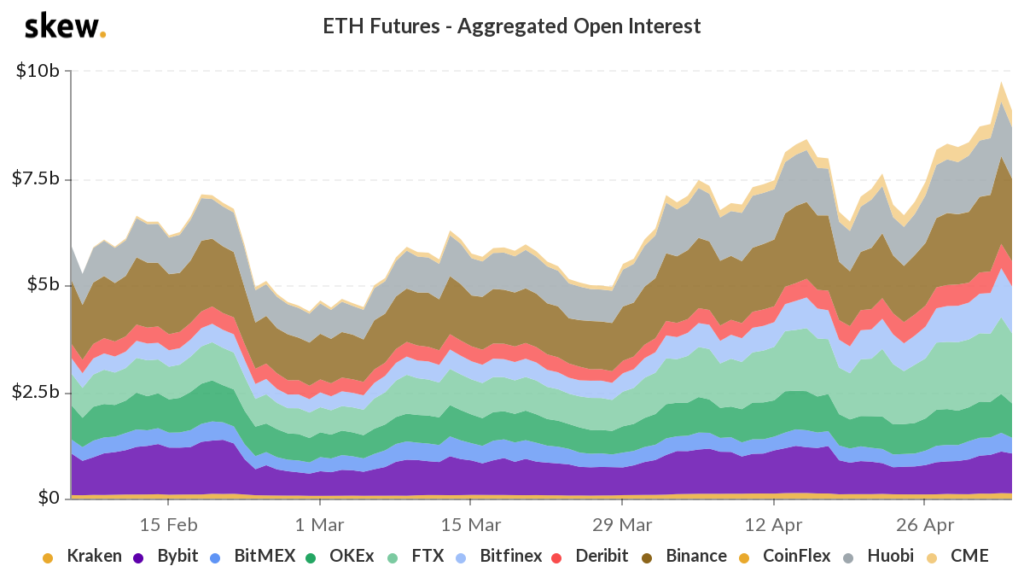

Similarly, ETH futures aggregated open interest has now hit an all time high, fast approaching $10 billion. (Source: Skew.com)

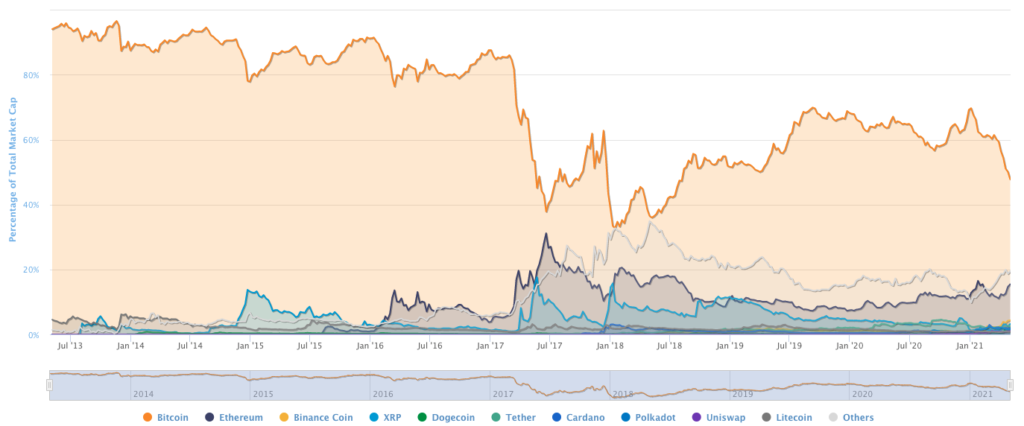

When we look at the wider breakdown of the market, we can see that bitcoin’s percentage of the total market capitalization has taken a substantial drop, not seen since the bull market of 2017. It’s the season for alternative cryptocurrencies, or “alts,” Rich Rosenblum, Co-Founder and president of GSR told Coindesk.

Percentage of total market cap, source: CoinMarketCap, (2013-2021).

“When new money flows into BTC, people are less focused on alts,” Rosenblum told CoinDesk. “Once it feels like the bullish pattern for BTC breaks down, people roll some of those profits into alts.”

“As the space matures, we’ll see more dispersion,” Rich Rosenblum of GSR told CoinDesk. “BTC is increasingly a proxy for traditional finance coming to the space via regulated platforms, while ether is more of the crypto natives buying ETH directly or indirectly as a result of DeFi.”

This has been a substantial separation in activity as bitcoin remains quiet, it is safe to say that all focus will be on bitcoin once again in the near future.

Institutions continue to enter

State Street is the latest banking giant to be rumoured to enter the crypto space. The bank is reported to be providing the infrastructure for a new bank-grade trading platform for digital assets set to go live mid-year. They join a growing list of entrants from traditional finance including Goldman Sachs, Morgan Stanley, Bank of New York Mellon.

In other headline news, sources close to JP Morgan disclosed that the bank will let clients invest in a bitcoin fund for the first time. The JPMorgan bitcoin fund will be actively managed and is expected to roll out this Summer.

EFT decision looming

The U.S. Securities and Exchange Commission (SEC) has pushed back making a decision on VanEck’s proposed bitcoin ETF (or exchange-traded fund) until at least June. The SEC can take up to 240 days to determine whether it will approve or disapprove any ETF application. To date the agency has taken the full time for most of the bitcoin ETF applications, and then rejected every one.

It has been eight years since the first bitcoin ETF application was submitted, currently eight promising applications sit with the SEC. With several ETFs already launched abroad have gained positive traction, the crypto market is hopeful this Summer the US will finally see approval.

More than $1 billion in investment has flowed into Bitcoin ETFs in Canada in recent weeks, with three Ethereum ETFs being approved in mid April.

GSR update

GSR is delighted to have Andrew Moss join the team as Managing Director of GSR Capital. Andrew’s background in derivatives trading, investment management and trading and operations is extensive, featuring stints at several top firms. He spent 14 years at Winton, helping to build the boutique hedge fund into one of the most respected and largest investment firms in Europe. Prior to serving as co-COO from 2017 through 2019, Andrew was the CEO of Winton Investment Management and the Global Head of Investment Solutions, leading an overhaul of the firm’s fund structure and sales teams as it transitioned into an institutional-focused manager.

We are delighted to add Andrew to our rapidly expanding team, which now boasts several former directors, heads of trading and other executives from major banks and hedge funds.

“Having helped build one of the top-performing hedge funds in the world, Andrew will play a central role in developing a new generation of trading and investment products. The flow of intellectual capital from major institutions is a testament to the growth and promise of our industry,” Cristian Gil, co-founder of GSR.

Other News

– GSR is proud to support the launch of Crypto Climate Accord. We’re on a mission together to make crypto and blockchain 100% sustainable, powered 100% by renewableenergy by 2030.

– GSR has joined the PL^Gnet Partner Alliance, the PL^Gnet network enables asset custodians to leverage any asset from any network in its synthetic form, allowing multiple chains to operate and leverage DeFi in one network. Read more about the network here.

– GSR is backing Qredo, a decentralized digital asset management infrastructure and product suite. Qredo uses a novel blockchain protocol that enables users to access cryptocurrencies on Layer 1 blockchains, such as Bitcoin, and Ethereum over a Layer 2 network. This innovation allows users to securely participate in new DeFi innovations such as accessing ‘cross-chain’ liquidity pools, trading collateralized derivatives, and executing cross-chain atomic swaps.

– The GSR Foundation is excited to announce our support for The Visiola Foundation, a social impact organization committed to bringing cutting-edge STEM education to girls in Africa. Through hands-on learning opportunities like their after-school STEM clubs, STEM camps, and Coding Bootcamps, the Visiola Foundation builds a pipeline of future female African engineers, scientists, programmers, mathematicians, and tech innovators. Our funds will enable 40 young women to participate in the virtual spring and summer 2021 Coding Bootcamps. Join us in our support of the Visiola Foundation: https://www.visiolafoundation.org/

GSR In the Media

– GSR talked to the Wall Street Journal in mid April about the rise of FTX

– GSR talked to the Wall Street Journal in late April about leveraged trading in bitcoin markets

– Rich Rosenblum joined CoinDesk TV to discuss the latest developments making waves in the crypto markets, including NFTs, DeFi and the most recent influx of institutional investors.

– The Block covered GSR’s recent hire Andrew Moss

– GSR talked to Market Watch about the recent market exuberance in crypto

– GSR talked to Coindesk to discuss the recent market separation between bitcoin and ethereum

Reports, market reports, and other information (“Information”) provided by GSR or its affiliates have been prepared solely for informative purposes and should not be the basis for making investment decisions or be construed as a recommendation to engage in investment transactions or be taken to suggest an investment strategy in respect of any financial instruments or the issuers thereof. Information provided is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services and is not a recommendation to buy, sell, or hold any asset. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page. Trading from Singapore, please review The Monetary Authority of Singapore (MAS) compliance note.