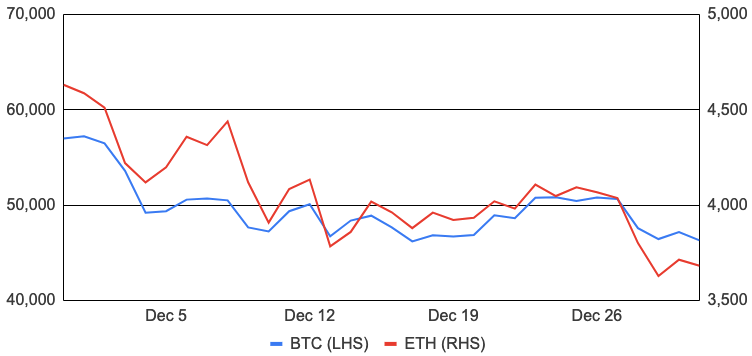

After hitting an all-time high of $69,045 in early November, bitcoin fell 19% in December, entering the month around $57,000 and finishing at $46,300. The decline primarily occurred in the first several days of the month due mainly to fears around central bank tightening and the new Omicron Covid variant, both discussed further below. During the month, the number of Bitcoin addresses with a non-zero balance reached an all-time high of nearly 40m, BTC in circulation passed 18.899m meaning that over 90% of BTC’s total maximum supply has now been mined, GBTC hit its largest discount ever at 22%, CME futures slipped into backwardation as bearish sentiment increased, and bitcoin dominance continued to fall, hitting 40% by the end of the month. Other news included Bitcoin Core developers John Newbery and Samuel Dobson stepping back from their duties and MicroStrategy purchasing an additional $94m worth of BTC.

Ethereum generally followed BTC’s path and fell 20% during the month after entering at $4,650 and ending at $3,700. Similar to BTC, the number of Ethereum addresses with a non-zero balance reached an all-time high of 72m addresses, helped in part by the rising popularity of NFTs. Ethereum co-founder Vitalik Buterin published a new blog post titled “Endgame” where he outlined a plausible roadmap for Ethereum scalability and developers continued to work on Ethereum 2.0, with the Arrow Glacier upgrade delaying the difficulty bomb until June 2022 and the release of the Kintsugi testnet allowing the public to experiment with ETH 2.0. Also during the month the CME launched a micro ether futures contract, scaling solutions Optimism removed its Whitelist and StarkWare announced planned Layer 3 blockchains, and various research reports came out in support of Ethereum over Bitcoin, such as Australian academics who cited ETH’s potentially declining supply and Fidelity’s Jurrien Timmer who cited Metcalfe’s Law.

BTC and ETH

Source: Sansheets, GSR

While general price action was seemingly dictated by concerns around monetary policy tightening and Omicron, activity around NFTs continued to increase, several layer one blockchains broke out, and we received many regulatory updates during the month, all detailed below.

Monetary Policy

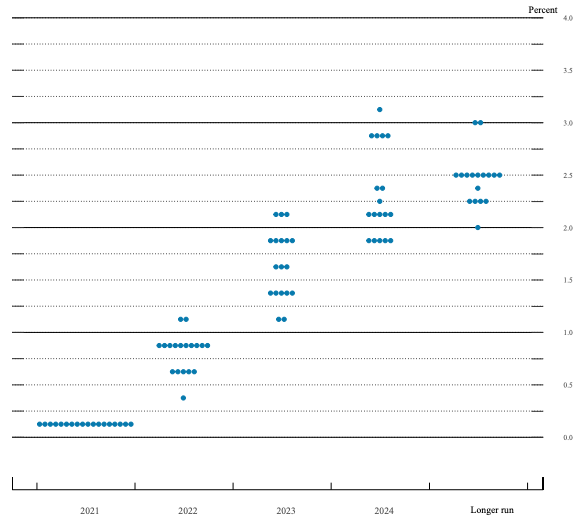

Much of the month’s negative performance started off after US Fed Chair Jerome Powell’s November 30th testimony to the Senate Banking Committee, where he stated that price increases have spread more broadly than anticipated, the risk of higher inflation has increased, and it’s a good time to retire the word “transitory” when talking about inflation. Observers took this as a signal the Fed would consider removing policy accommodation at a faster pace than previously expected. Such fears were realized on December 16th when the Fed concluded its two-day policy meeting, where it dropped the term “transitory” from the post-meeting statement, accelerated asset purchase tapering to $30b per month, and revealed expectations for three, two, and two rate hikes in 2022, 2023, and 2024, respectively. Central Bank action elsewhere was perhaps more mixed, with the Bank of England raising rates 0.25% compared to expectations for no change, though the ECB was more cautious, starting to wind down one asset purchase program but ramping up another.

Importantly, central bank tightening is occurring as inflation is rising around the world. Inflation in the US, for example, grew 6.8% year-over-year in November, the fastest rate since 1982 and slightly higher than expected. Prices in the UK rose 5.1%, hitting a 10-year high, while Euro zone inflation shot up to 4.9%, the highest on record in the 25 years the data has been compiled (though driven in part by higher, more volatile energy prices). While rising inflation is a positive for BTC, all else equal, given BTC’s fixed supply and perception as an inflation hedge, investors worry that the removal of policy accommodation by central banks could both dampen risk asset prices as well as temper future inflation compared to what it would have been.

US Federal Reserve Summary of Economic Projections: FOMC Participants’ Assessments of Appropriate Monetary Policy as of Dec 2021

Source: Federal Reserve, GSR

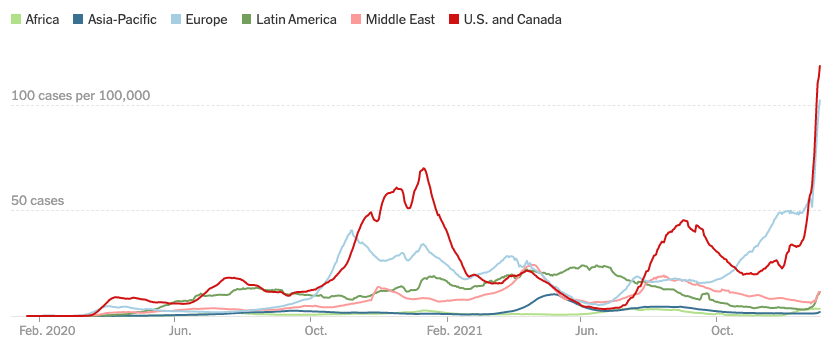

COVID

One item with the potential to slow central bank tightening though also depress asset prices is the Omicron Covid variant, which is spreading with no abandon around the world. First discovered in South Africa in November, the variant has an unusually large number of mutations making it more transmissible and vaccine resistant than SARS-CoV-2 or prior variants. As seen in the chart below, per capita Covid cases are rocketing past previous records in North America and Europe and clearly have the potential to do so elsewhere. Countries have responded with a variety of local rules around mask wearing and large gatherings, vaccination status declarations, travel restrictions, and even lockdowns, among others. The good news is that the severity of Omicron appears to be less than that of other Covid forms, with hospitalizations and deaths so far avoiding similarly sized spikes. In addition, South Africa is now seeing declining cases and has lifted some restrictions, offering hope to the rest of the world.

Covid Cases per 100,000 by Region

Source: New York Times, GSR

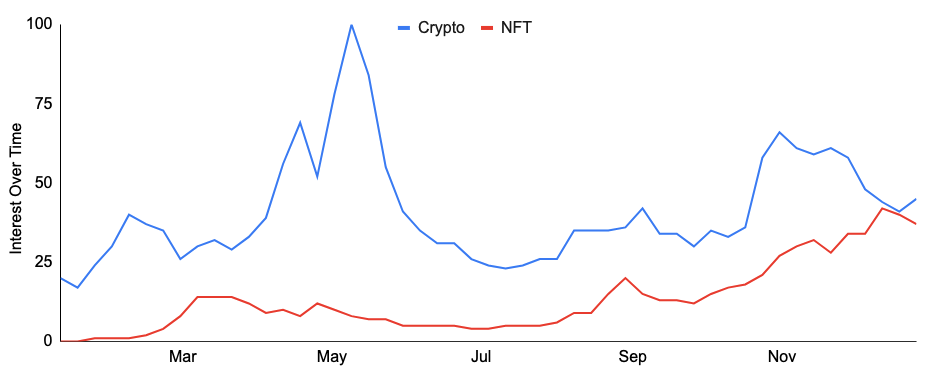

Non-Fungible Tokens

While we remain far off the peak NFT sales volumes of August, other metrics suggest that activity continues to increase. Google trends, for instance, show searches for the term ‘NFT’ has steadily gained interest over last year, and has accelerated since late summer. Moreover, internet users googled the search term ‘NFT’ roughly as much as they googled ‘crypto’ in mid-December, showing just how much public awareness of the technology has grown. And even though sales volumes are down, the number of monthly active traders of Ethereum-based NFTs on OpenSea hit a record in December at 363,000, rising 24% above the previous high in October, per Dune Analytics/@rchen8.

NFT-related news also accelerated across various segments using the technology. Notable NFT-related news items include:

- NFT Marketplaces: Blockchain.com and Kraken both revealed plans for forthcoming marketplaces, FTX.US started listing Ethereum NFTs in its marketplace, and OpenSea walked back plans to IPO after widespread criticism.

- Metaverse: Adidas announced it was entering the metaverse in collaboration with BAYC and others, metaverse infrastructure platform Infinite Assets/InfiniteWorld announced plans to go public via a SPAC, Shanghai revealed plans to potentially use the metaverse to deliver public services, popular Japanese game Gensokishi Online announced the launch of its Metaworld metaverse, the NYC Times Square New Year’s Eve ball drop was recreated in Decentraland, and NFT land sales ballooned, sometimes surpassing $100m in weekly sales.

- Entertainment: Deadmau5 and PTM are hoping their “This is Fine” NFT single will be the first platinum NFT single and Start-Up NFT Studios intends to make the first feature film solely funded by selling NFTs.

- Financial Services: Defiance launched the first NFT-focused ETF, Bitwise launched an NFT-tracking index fund for accredited investors, and Nexo launched NFT-backed lending.

- Gaming: Ubisoft became the first major gaming company to launch in-game NFTs, BAYC revealed plans to launch a play-to-earn NFT game, and the Blockchain Gaming Alliance said that NFT gaming generated $2.3b in revenue in 3Q.

- Traditional Companies: Instagram is actively exploring NFTs, Nike acquired digital wearables and collectibles company RTFKT, and multiple companies are building offices in the metaverse such as PwC.

- Notable NFT Sales: Notable sales included Pak’s $92m in sales of “mass” tokens for his experimental Merge NFT project, Adidas’s drop bringing in $23m in sales, CryptoPunk #4156 selling for $10.3m, and celebrities piling into Bored Apes, causing its floor price to briefly pass that of CryptoPunks.

Google Trends: Searches for ‘NFT’ vs. ‘Crypto’

Source: Google, GSR

Smart Contract Blockchain Performance

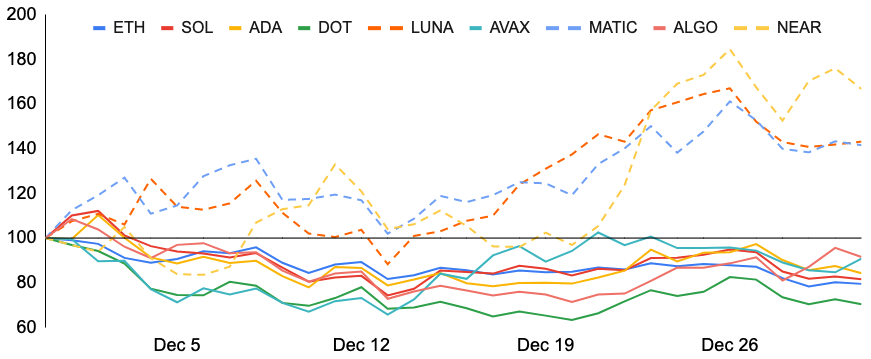

The performance of smart contract blockchains was fairly mixed, with the vast majority falling similar to BTC and ETH, but a few breaking out. These include NEAR, Terra, and Polygon, which saw their NEAR, LUNA, and MATIC tokens increase 67%, 43%, and 42%, respectively, during the month.

NEAR benefited from the launch of its Nightshade Sharding, the integration of Terra’s UST stablecoin, the creation of a new validator program to further decentralize the network, partnerships with Endless and Aurora/ConsenSys, the launch of decentralized oracle Flux on NEAR, the deadmau5 NFT single launch on Mintbase/NEAR, and Moonpay adding NEAR purchases to its platform.

Terra and its LUNA token benefitted from the rapid growth of the UST stablecoin, the issuance of which requires LUNA to be burned, reducing its supply. During the month, the market cap of UST grew from $7.5b to over $10b, and UST flipped DAI to become the fourth largest stablecoin. Additionally, Terra saw its TVL expand significantly, and it overtook BSC to become the second largest DeFi blockchain by TVL. Savings protocol Anchor, liquid staking protocol Lido, and new decentralized exchange Astroport all saw large increases in TVL. Additionally, Anyswap partnered with Terra to bridge UST between Terra and Fantom, the Terra Naming Service is airdropping TNS tokens, and the highly anticipated borrow lend protocol Mars continues to get closer to launch.

MATIC rose during the month as Polygon acquired ZK rollup-based Mir, launched new scaling solution Polygon Nightfall on testnet, revealed plans to bring EIP-1559 to Polygon to introduce MATIC burning, announced partnerships with Wanchain, Metaworld, and Opera, initiated a $200m social media web3 fund with Seven Seven Six, is reportedly in talks with VCs to raise $50-150m, saw 21Shares list Europe’s first Polygon ETP, and had several notable projects launch on Polygon including Uniswap v3, Vesper Finance, and Popsicle Finance.

Additional notable protocol news during the month included:

- Borderless Capital launched a $500m fund to support projects building on Algorand

- DEX aggregator 1Inch raised a $175m funding round

- PlanetWatch’s decentralized IoT network technology will be used by Miami to monitor air quality

- Bitcoin DeFi protocol Badger DAO suffered an exploit

- Smart contract blockchain Cardano reached 1m wallets staking ADA

- The Cardano ERC-20 converter went live on testnet

- Decentralized exchange dYdX went down for nine hours due to a major outage that hit Amazon Web Services

- SushiSwap CTO Joseph Delong resigned

- ConstitutionDAO’s PEOPLE token rose 86% in December despite its failed auction bid to buy a rare copy of the US constitution

- Five Polkadot parachains went live: Acala, Astar, Clover, Moonbeam, and Parallel Finance

- Zero knowledge rollup-based scaling solution provider Starkware revealed plans to launch Layer 3 chains built on top of StarkNet for hyperscalability

- Open interest rate protocol Rari Capital and algorithmic stablecoin protocol Fei are merging in one of the largest DAO mergers in DeFi history

- BNB officially announced the implementation of a new auto-burn mechanism

- Elon Musk announced that Tesla will accept DOGE as payment for merchandise

- Dogecoin has released a “trail map” detailing its plans going forward

- Swiss digital asset bank SEBA published a governance proposal requesting to be whitelisted for borrow lend protocol Aave’s institutional lending platform Arc

- Aave partnered with decentralized operating system Centrifuge to launch its Real World Assets market

Select Layer One Performance, December 2021, Nov 30 = 100

Source: Santiment, GSR

Regulatory Update

There were several notable regulatory / legislative updates during the month. Perhaps most encouraging was a hearing in the US Congress on digital assets that saw executives from Circle, FTX, Bitfury, Paxos, Stellar, and Coinbase discuss a bevy of crypto-related topics. The executives urged for a clear regulatory framework and greater regulatory harmonization, and argued that stablecoins may support the global dominance of the US dollar, can help the unbanked, and have safe reserves. Notably, members of Congress adopted a constructive tone towards crypto, acknowledging cryptocurrencies’ potential benefits and conveying a desire to both protect investors and not stifle innovation. Other news from the US included FSOC stating it would look to mitigate stablecoin risk if Congress fails to act, crypto-friendly Senator Lummis revealing plans to introduce legislation creating a new crypto regulatory body, Biden nominee to lead the OCC and crypto-critic Saule Omarova withdrawing her consideration for the position, the NCUA allowing credit unions to partner with crypto providers, and Senate Aide Frayer joining the SEC as a crypto policy Senior Advisor.

India was in the news frequently last month, with media reports flip flopping between reports that crypto will be banned in the country and that cryptocurrencies will have sensible regulation. The most recent articles suggest that PM Modi will make the final decision, but that final rules could be delayed until May as the government refines its thinking. Similar news also surrounded Russia, with the country reportedly deciding between a blanket crypto ban and legalizing crypto exchanges. Russia did share plans to create a working group to further study the issue. Elsewhere, Gibraltar announced a pilot program for blockchain-based digital identities, though other countries introduced more restrictive measures or maintained a conservative stance, including Thailand (prohibiting banks from offering crypto trading), Singapore (low crypto licensing from MAS), South Korea (removing play-to-earn games from app stores), and Iceland and Iran (both capping crypto mining energy usage amidst power shortages). We also got news of likely forthcoming regulations from Australia, Paraguay, and Turkey. And lastly in international news, the IMF called for establishing a global crypto regulatory framework, the BIS issued a warning on DeFi as a broader financial risk, and ISDA is working to develop common standards for crypto assets.

Author: Brian Rudick, Senior Strategist

Download the full report here.

GSR in the Media

CoinDesk – Fireblocks ‘Whitelists’ 30 Trading Firms for Aave’s Institutional DeFi Debut

Cointelegraph – Happy Birthday, Bitcoin! Industry players share a few words

Reuters – Asian VCs, crypto funds to invest $100 mln to bolster new Assembly blockchain

eFinancialCareers – Ex-Goldman Sachs, JPMorgan traders hiring hundreds in crypto

The Block – Crypto derivatives platform Paradigm nabs $400 million valuation in funding round

GSR has partnered with The Block to publish the 2022 Digital Asset Outlook report focusing on the key sector highlights of 2021 and the trends to lookout for in 2022.

In what has been an incredible year across the crypto industry, the 160-page report covers 8 different sectors:

1. The state of the market

2. Investment trends

3. Institutional custody

4. Layer-1 and Layer-2 platforms

5. Decentralized finance (DeFi)

6. Web3

7. NFT/Blockchain gaming

8. Macroeconomics

Download the report here.

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report. This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.