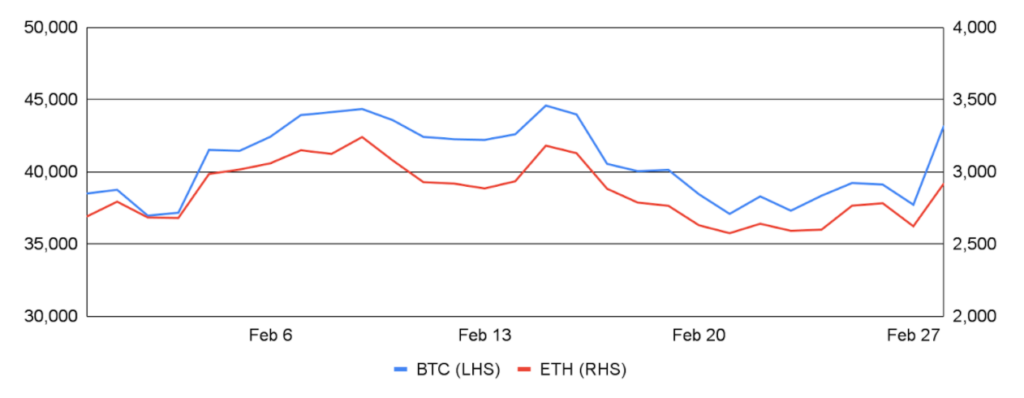

Bitcoin finally broke its streak of three consecutive down months, entering February around $38,500 and ending around $43,200 for a 12% increase. BTC displayed a high correlation with the stock market and was impacted by many of the same economic and geopolitical factors, such as rising inflation and the war in Ukraine, discussed below. It was really the last day of the month where Russian demand for a non-sovereign currency in the wake of monetary restrictions and a falling ruble, and more generally, the strengthening narrative of war making the case for decentralized currencies that BTC rallied 14% and finally decoupled from the stock market. Outside of the macro, positives during the month included a record network hash rate, daily active bitcoin addresses hitting 1m for the first time in 10 weeks, an upcoming iPhone feature that will enable bitcoin tap-to-pay transactions, Cash App integrating the Lightning Network, and KPMG Canada adding an undisclosed amount of BTC to its balance sheet. The news wasn’t all positive, however, with Lightning Network growth measured by BTC locked plateauing to start the year, bitcoin ATM installation growth slowing year-over-year for the first time in history, and a JPMorgan report pegging BTC’s fair value at $38,000 based on its volatility compared to that of gold.

Ethereum similarly turned in a solid month, gaining 9% and exiting February around $2,900 after having fallen a combined 42% over the prior two months. Ethereum was impacted by the same macroeconomic and geopolitical items that bitcoin was, and despite the price gain, had a relatively subdued month. Indeed, Ethereum’s average and median transaction fee slipped to the lowest in six months, Ethereum’s burn rate fell significantly as NFT activity declined, over $320m of wrapped ETH on Solana was temporarily unbacked after the Wormhole bridge was exploited, and Morgan Stanley warned in new research that Ethereum’s dominance may dwindle as competitors emerge. Positively, however, Twitter added an ether tipping capability, ether investment product inflows turned positive for the first time in 10 weeks, and scaling solutions continued to progress with StarkNet opening dapp deployment on Ethereum mainnet and zkSync releasing the test network of its EVM-compatible zero-knowledge rollup well ahead of schedule.

BTC and ETH

Source: Sansheets, GSR

War in Ukraine

From a macro perspective, investors initially focused their attention during the beginning of the month on the rising inflation around the world and pondered whether it would lead to expedited central bank policy tightening. The US CPI, for example, rose in January at its fastest pace since the early 80s, causing the 10-year treasury to break 2% for the first time since 2019. Later in the month, however, attention was focused solely on Russia-Ukraine tensions, which all started when Russia began increasing troops near the Ukraine border mid-month. With many fearing an attack could be imminent, Russian President Putin decided not to meet with US President Biden for peace talks and then recognized the independence of separatist-held parts of Eastern Ukraine before invading the country. Western countries announced sanctions in response, including the expulsion of several Russian banks from SWIFT. Subsequent peace talks seemingly yielded few results, and Russia continued to attack Ukraine, for example going after Ukraine’s second-largest city Kharkiv and sending a 40-mile long convoy to Kyiv. As mentioned above, the uncertainty was initially negative for crypto, though later proved to increase crypto demand in sanctioned regions and pointed to the utility of non-sovereign money.

Terra Outperformance

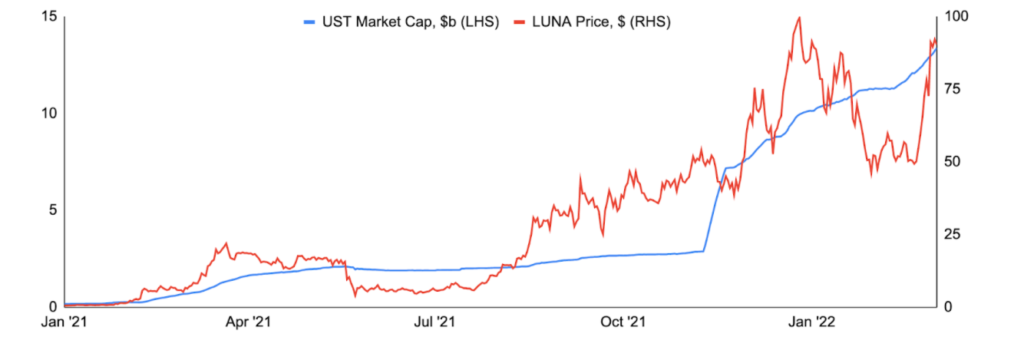

One bright spot during February was Terra, which saw its LUNA token rally 74% during the month and overtake peer layer ones such as Cardano and Polkadot to become the seventh-largest cryptocurrency by market cap. There were various positive items during the month contributing to the rise.

One positive item for Terra was the increased demand for its popular dollar-pegged UST stablecoin, as LUNA holders capture value as UST demand grows. This is because Terra’s native LUNA token is used as part of the stabilization mechanism for UST, as discussed in more depth here. More specifically, Terra allows anyone to mint one UST by burning $1.00 worth of LUNA (or conversely, minting $1.00 worth of LUNA by burning one UST). As such, the greater the demand for UST, the more LUNA is burned. And UST demand was strong during the month, with the stablecoin’s market cap increasing by over $1.6b or ~15%. This helped LUNA’s circulating supply fall by ~24m during the month, per smartstake.io.

While UST is used across many Terra-based protocols, one particularly large source of UST demand is Anchor Protocol, Terra’s flagship savings product that offers a stable ~20% yield on UST deposits. Whether due to increased stable farming during a tougher market period or the $450m replenishment of Anchor’s yield reserve allowing it to continue to pay out one of the best stablecoin yields in all of DeFi, UST deposits on Anchor grew $2.8b or 56% during the month, adding to UST demand and ultimately helping LUNA’s price.

Another large event during the month was The Luna Foundation Guard’s $1b raise to create a bitcoin reserve that will act as a release value during volatile markets for UST. This adds another mechanism to help UST maintain its dollar peg and inspires greater confidence for its users. Additionally, Terra signed a sponsorship deal with Major League Baseball’s Washington Nationals, which is additionally exploring in-stadium payments using UST. Lastly, new and innovative dapps continue to be developed on Terra, while many existing, leading dapps saw significant TVL gains during the month, including Lido, Astroport, and Stader.

LUNA Price vs. UST Market Cap

Source: Santiment, GSR

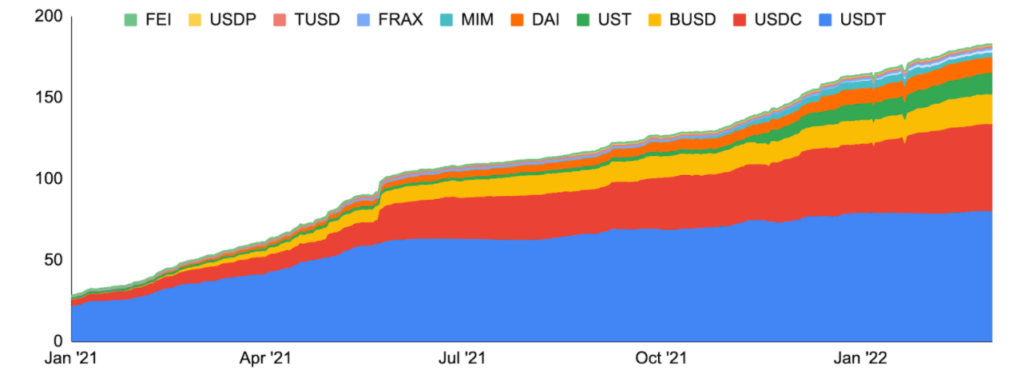

Stablecoin Growth Continues

It was an active month for stablecoins beyond just UST. On the regulatory front, both the US Senate and House of Representatives held stablecoin-dedicated hearings, where congress agreed that issuers need to make disclosures and face audits, but generally rejected the idea that all stablecoin issuers need to be regulated as banks. Additionally, a US lawmaker released a draft federal stablecoin regulation bill aimed at defining a “qualified stablecoin”, while a bill seeking to establish government-backed stablecoin insurance was also introduced. Additionally, Wyoming proposed a new law that would pave the way for the state to launch its own dollar-pegged stablecoin, while the Fed released multiple stablecoin studies, examining, for example, the risks and potential of stablecoins as well as the impact on bank lending under various stablecoin regulatory regimes.

During the month USDC surpassed the $50b market cap mark, and its issuer Circle also entered into a new agreement with the Concord Acquisition Corp SPAC, doubling its valuation from $4.5b to $9b. Circle will now go public on the NYSE and is expected to trade under the ticker CRCL. Circle also launched a new business-centric Circle Account product that allows enterprise clients to deposit, withdraw, receive and store cryptocurrencies with all payments settled in USDC.

Tether was also in the news during the month, releasing another reserves attestation that showed its allocation to commercial paper fell by over 20% and teasing an announcement regarding a partnership with the Swiss city of Lugano that would later see Lugano recognize BTC, USDT, and its own LVGA Points token as “de facto” legal tender.

Elsewhere, the total category market cap surpassed $175b, trading giant Mitsui revealed plans to create a new gold-based stablecoin, Mitsubishi UFJ announced plans to launch a yen-pegged stablecoin to be used for digital securities clearing and settlement, custody tech provider Fireblocks acquired stablecoin payments platform First Digital, 1inch rolled out new liquidity pools optimized for stablecoin swaps, and Frax Finance took a snapshot for its CPI-linked Frax Price Index stablecoin airdrop.

Top Stablecoin Market Caps, $b

Source: Santiment, GSR

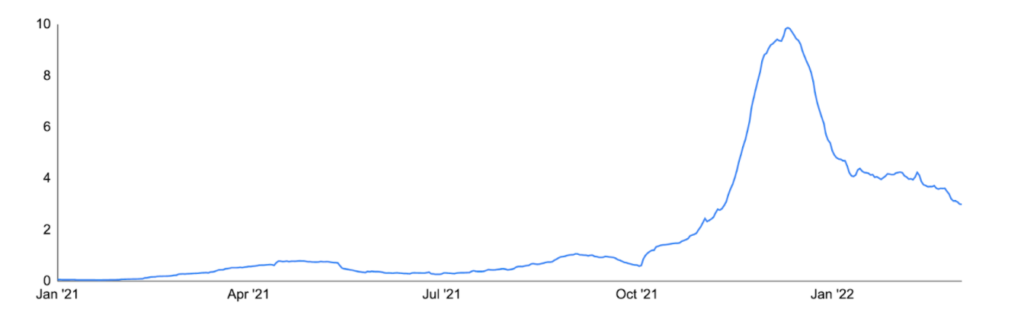

Metaverse News

The metaverse continued to be top of mind during the month, perhaps not with metaverse NFT sales, but certainly with studies pointing to its potential and with companies continuing to dive in. Gartner, for example, released a study concluding that 25% of people will spend at least an hour per day in the metaverse by 2026, and JP Morgan released a report calling the metaverse a $1 trillion opportunity. JP Morgan additionally became the first large bank in the metaverse after opening a virtual lounge in Decentraland, while fashion brand Gucci bought virtual land in The Sandbox. Corporations also continued to file for metaverse-related patents and/or trademarks, including McDonald’s, the NYSE, and Monster Energy to name a few. And they continued to create new metaverse-related teams and products, such as Disney, which called the metaverse a “new storytelling frontier,” Bandai Namco, which is investing $130m in its metaverse operations, Death Row Records, which plans to be the first major record label in the metaverse, and South Korea, which is investing in a new national metaverse ecosystem. Even Shiba Inu got into the act, announcing plans for a doggy version of the metaverse.

Metaverse NFT Sales, 30-Day Average, $m

Source: NonFungible.com, GSR

Author: Brian Rudick, Senior Strategist

GSR in the News

- eFinancialcareers: Goldman Sachs, Citi, Credit Suisse staff jump to crypto firms

- CoinDesk: Web 3 Infrastructure Startup Aligned Exits Stealth With $34M in Funding

- Investing.com: Bitcoin Miners’ Revenue Rose 206% In 2021

- PYMNTS: Aiming for Market Integrity, New Crypto Association is Formed

- Reuters: Crypto firms launch coalition to promote market integrity

- The Block: Luna Foundation Guard raises $1 billion to form bitcoin reserve for UST stablecoin

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.

This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.