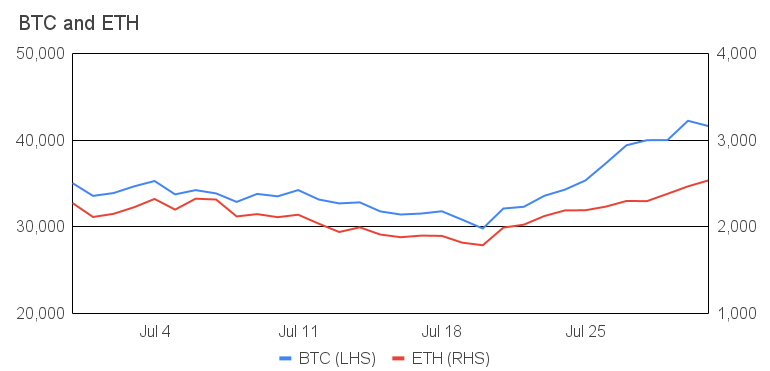

After three consecutive monthly declines, Bitcoin came roaring back in July, increasing 19% for the month. Bitcoin entered July around $35,000, generally trended down for the first 20 days of the month to breach the $30,000 level before coming back with a vengeance to finish around $42,000.

Ethereum exhibited a similar trend, entering the month around $2,275, generally trending down during the first part of the month to $1,775 before finishing at $2,500 for a 12% gain.

Bitcoin and Ethereum price action ($)

Source: Sansheets, GSR

Regulatory Pressure

The decline in crypto prices during the first part of the month was caused at least in part due to continued regulatory pressure as governments around the world decide how they want to regulate crypto. Action in Europe centered around KYC/AML rules, with European Commission officials proposing expanded information collection and monitoring of crypto money transfers. US regulatory activity was a bit more wide-ranging, from a new Digital Asset Market Structure and Investor Protection Act bill that would create a far-reaching regulatory framework for digital assets to SEC hints that certain tokens may be securities to concerns that the crypto “pay-for” in the bi-partisan infrastructure deal could place undue compliance burdens on much of the digital asset industry. Other countries seemed to focus on crypto exchange registration and compliance, with South Korea and Mexico prime examples.

But perhaps the most consistent regulatory theme during the month was the continued onslaught against Binance. Countries such as Thailand, Italy, Poland, and Malaysia either warned against the exchange or accused it of operating in their country illegally. Amid the pressure, corporate partners altered or outright ceased dealings with Binance, including Barclays, Santander, Natwest, and Clear Junction. This resulted in material action from Binance, which during the month suspended euro bank transfers, ceased stock token sales, delisted EUR, GBP, and AUD margin trading pairs, limited leverage to 20x, reduced withdrawal limits for low-verification customers, suspended derivatives trading in Europe, and even started searching for a replacement CEO with a regulatory background.

On a positive note, despite their tightened focus, governments around the world continued to push forth CBDC efforts, including those in Nigeria, India, Ukraine, China, South Korea, UAE, France, Singapore, Jamaica, and New Zealand. The ECB announced it is moving into the “investigation phase” of its digital Euro project, while US Fed Chair Powell stated he is “legitimately undecided” on a US CBDC but did tee up a Fed research paper on the subject to be released in early September. Overall, we view a tougher regulatory environment as a near-term negative, but do believe clear regulatory guidelines, so long as they aren’t so overburdensome to stifle innovation, will be a long-term positive.

Late-Month Momentum

Positive news began to percolate, particularly later in the month. Corporate and institutional participation in the space continued to ramp up, with news of increasing crypto efforts during the month from the likes of Mastercard, Visa, PayPal, Twitter, State Street, BNY Mellon, UBS, JP Morgan, Bank of America, and Fidelity. But perhaps the biggest of them all was rumors that Amazon would begin supporting crypto payments later this year. While Amazon would go on to deny those rumors – despite a job posting for a Digital Currency and Blockchain Product Lead – we do believe they were a reminder of this large potential catalyst, whether it is coming to fruition immediately or not. We also got past the large GBTC unlocks mid-month that had caused quite a lot of consternation. The limited effect on price and the fact that future unlocks are relatively small were additional positives for the space.

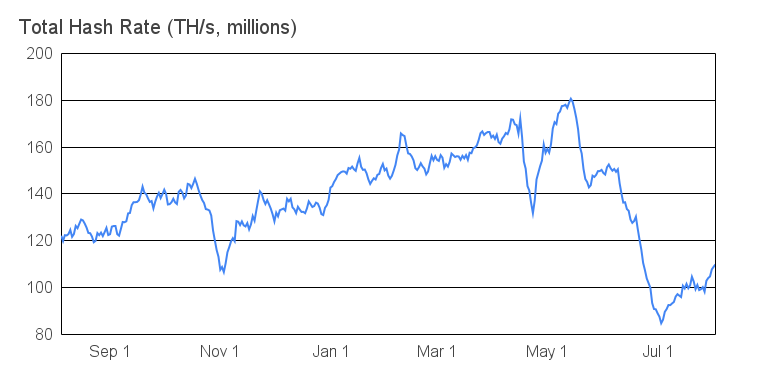

The mining industry also exhibited resilience in the wake of last month’s crackdown. And after the well-publicized decline in Bitcoin hash power as firms relocated from China, the total hash rate steadily increased throughout July as more miners came online. Moreover, a number of miners such as Stronghold, Core Scientific, and Iris Energy indicated plans to go public, while others such as Bit Mining, Greenidge, Hive, and Gryphon bought additional mining rigs, both positive signs in our opinion. All told, July saw total Bitcoin miner revenue increase 16% from June and the Bitcoin network difficulty increasing by 6% at the end of the month, the first such increase since mid-May.

Source: Blockchain.com, GSR

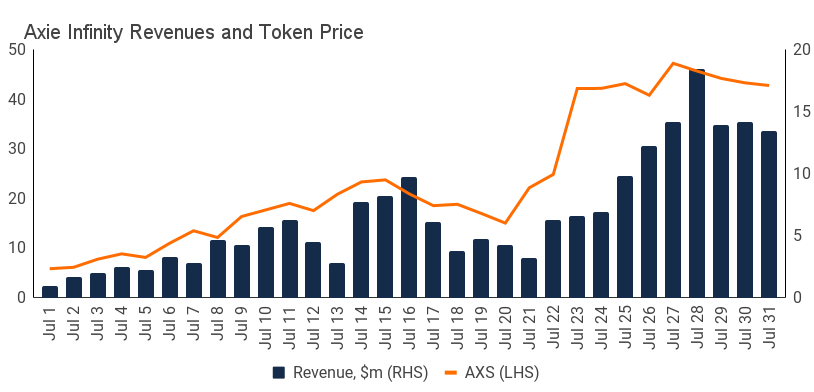

One final positive during the month was the breakout performance of blockchain-based games, with Axie Infinity leading the pack. As we covered in our Chart of the Week in much more detail, the blockchain-based, digital pet universe play-to-earn game has seen its revenues skyrocket by over 65x since moving onto the Ronin sidechain. Such a move caused the AXS token to increase ~8x during July, and caused many gaming and NFT tokens to move in sympathy as shown in our July Market Update below.

Chart of the week, source: tokenterminal, Santiment, GSR

GSR Update

We are pleased to welcome Michael Bressler to GSR as Global Head of Sales. Mr. Bressler will lead the firm’s ongoing expansion into the institutional market, developing trading, risk management, and capital strategies for the fast-growing client base it serves. Mr. Bressler joins GSR with over 20 years of experience in trading and institutional sales at top banks and hedge funds, most recently J.P. Morgan where he was a Managing Director and Head of Western Region Sales & Marketing.

Cristian Gil, Co-founder of GSR, said: “The trading needs of the institutional investor in digital assets are becoming more sophisticated. A core element of our business strategy for the next 12 months is to keep building out our quantitative trading and risk management capabilities and maintaining our leadership as one of the top trading firms in crypto. Michael will play an instrumental role in that effort, given his institutional expertise and strengths, and we’re looking forward to having his leadership on the team.”

Mr. Bressler added: “When it comes to investing in digital assets, Institutions have moved past curiosity and are looking into the practical implications, like execution quality, portfolio weightings, and risk management. This is exciting for people in traditional finance to make the leap and I was impressed with GSR’s reputation, leadership team, and technological strengths. I’m excited to help traditional institutions navigate their entry into the digital asset space, supported by market-leading capabilities.”

GSR in the Media

The Block Podcast: Bitcoin bear market? GSR’s Rich Rosenblum says crypto is in ‘a stasis’

CNBC: GSR’s Rich Rosenblum on the future of the cryptocurrency world

Coindesk: Co-Founder of GSR Rich Rosenblum talked to Coindesk TV about recent market price action and Amazon crypto rumours.

Crowdfund insider: GSR is excited to be backing Secured Finance a platform provider for cryptocurrency loans and derivatives.

The Block: “The actions of the Chinese government certainly resulted in some selling,”

GSR is backing Port Finance, a leading protocol built on Solana.

Coindesk Markets: “If USDT were to drop substantially, it is likely it would be a time when the crypto market, in general, is suffering substantial losses,”. “USDT put buyers should be wary of what the credit environment would look like if the puts pay out.”

TD Ameritrade: The recent press about bitcoin mining and the wider regulation of the market are healthy conversations that will move the industry forward. Trey Griggs of GSR spoke to the TD Ameritrade network about why crypto is an asset class that is here to stay.

GSR is hiring across Engineering, Defi, Trading, Operations, IT, Talent, and Marketing. Open positions: gsr.io/careers/

Disclaimers: This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report. This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.