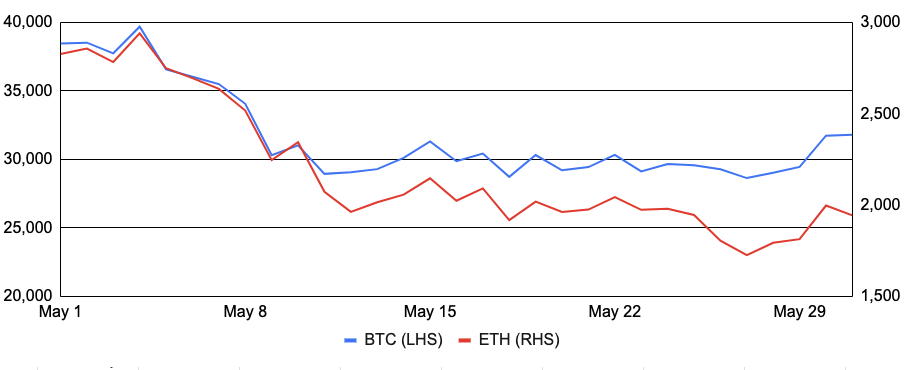

Bitcoin continued in its trend downwards in May, falling ~16% after entering the month around $37,700 and finishing at $31,800. The majority of losses came during the first third of the month as bitcoin fell for several reasons. First, there was a tough backdrop for risk markets amidst worse than expected inflation and continued worries around central bank tightening. Second, the collapse of Terra (LUNA) and its UST stablecoin undoubtedly weighed on crypto more generally. While losses moderated in the later part of the month, performance was unable to reverse and bitcoin set a record losing streak of nine consecutive down weeks through Sunday the 29th. Nevertheless, many companies remained active in expanding their bitcoin-related capabilities. David Marcus, the co-creator of Facebook’s Diem project, unveiled Lightspark, a new company established to extend Bitcoin’s capabilities with an initial focus on the Lightning Network. In addition, luxury fitness club Equinox and Emirates airline both revealed plans to accept bitcoin payments, Stripe partnered with OpenNode to give merchant customers the ability to automatically convert incoming fiat-payments to bitcoin, and LGT Group and Nubank allowed clients to begin trading BTC and ETH during the month. On the mining front, CoinMetrics data indicated miner flows to exchanges reached a four-month high, while new data from the Cambridge Centre for Alternative Finance indicated that Chinese miners still make up ~21% of the Bitcoin network’s hashrate. Other notable bitcoin-related news during the month included: the Luna Foundation Guard liquidated more than 80k bitcoin in an attempt to defend the UST peg, El Salvador bought the dip and hosted a 44-nation meeting to discuss Bitcoin, the Financial Accounting Standards Board (FASB) unanimously voted to review the accounting procedures for digital assets, Nubank invested 1% of its cash in bitcoin, Blockstream introduced a new multisig standard, and Valkyrie received SEC approval for a Bitcoin futures ETF while Ark and 21Shares re-filed their application for a spot Bitcoin ETF.

Ethereum performed worse than bitcoin during the month, declining ~29% after entering May around $2,750 and ending around $1,950. The highlight of the month was the continued progress towards Proof-of-Stake, as Ethereum co-founder Vitalik Buterin confirmed mainnet’s merge would occur in August if no unforeseen issues develop. The launch of the Beacon Chain on the Ropsten testnet, Ethereum’s longest-running Proof-of-Work testnet, was a step in this direction. By closely resembling the Ethereum mainnet, the Ropsten testnet merge, which is expected to commence around June 8th, is considered a key test. Additionally, Ethereum layer 2s continued to be a big theme throughout May. For example, Optimism executed its airdrop and its OP token went live. Optimism further announced its Bedrock upgrade, which is expected to speed up transactions and lower fees, and Binance announced its integration with Optimism, allowing exchange users to directly deposit ETH to the L2 network. Hop Protocol, an Ethereum layer 2 and sidechain bridging solution, followed in Optimism’s footsteps and announced the launch of a governance token and corresponding airdrop. StarkWare also made headlines in the month as it raised a new $100m funding round at an $8b valuation. Other notable headlines included: Cloudflare revealed plans to run ETH2 validator nodes, Lido increased stETH liquidity incentives as it began trading at a discount, Buterin proposed soulbound tokens (SBTs) as the web3 credentials of the future, Ethereum analytics platform Nansen acquired the DeFi portfolio tracker Ape Board, and a seven-block reorg occurred on the Beacon Chain as some validators failed to update their client software.

BTC and ETH

Source: Sansheets, GSR

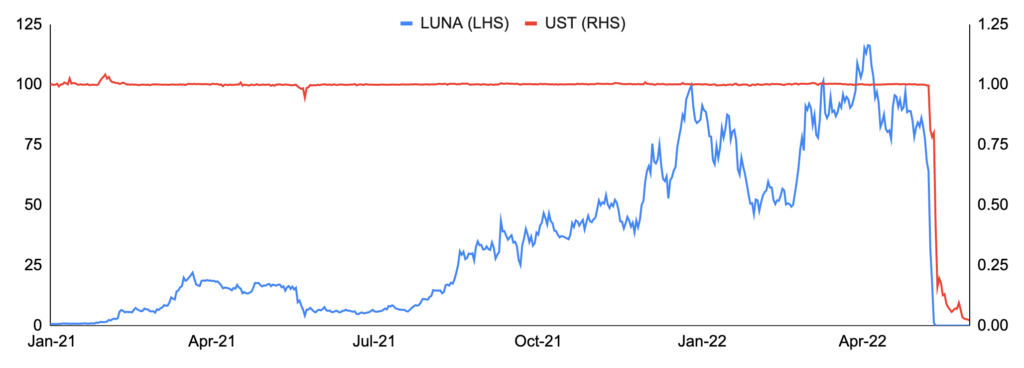

Terra’s Death Spiral

The month’s big news was the collapse of Terra, a smart contract blockchain with the second-highest TVL at the start of the month, and its integrated algorithmic stablecoin UST. The turmoil started on May 7th as UST came under modest pressure before sharply breaking downward on May 9th, falling below $0.70. While the exact reason for the sell pressure is unclear, it appears to have started after $2b of UST was withdrawn from Anchor, a savings protocol on Terra, and several hundred million dollars worth of UST sales occurred on stable swaps protocol Curve, as well as on centralized venues such as Binance. As UST remained depegged for longer and longer periods of time, investors ran for the exit, creating a falling price spiral for both LUNA and UST. In fact, redemptions of UST for LUNA hyperinflated the supply of LUNA from about ~345 million to ~6.5 trillion in a single week. During the crisis, Terra co-founder Do Kwon attempted to raise external financing to backstop the peg, but his efforts were unsuccessful as faith in the ecosystem collapsed. By the end of the month, LUNA was worth a fraction of a penny and UST was trading at ~$0.02.

While many speculated Terra’s collapse was the result of a malicious attack, there has not been any definitive evidence of this to date. Further, the community approved a governance proposal bringing back the Terra blockchain without the algorithmic stablecoin component, with the new chain denoted as Terra (LUNA) and the existing chain known as Terra Classic (LUNC). In the end, the collapse destroyed over $40b in value in LUNA and UST alone, and caused many altcoins to fall in sympathy. For more information on Terra’s collapse, please see our detailed report as well as our overview of algorithmic stablecoins.

LUNA & UST Price Chart

Source: Santiment, GSR

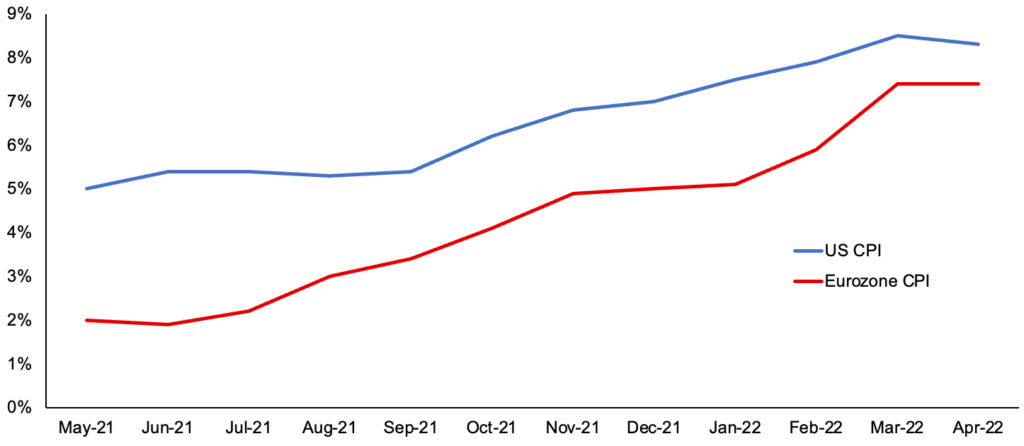

Rate Hikes Accelerate

The Fed hiked interest rates by 50 bps during the month, its first hike of this magnitude in more than 20 years, as it attempted to curb inflation that remains above 8%. The BoE followed suit, raising rates another 25 bps for its fourth consecutive hike. While these hikes were inline with market expectations, markets sold off dramatically as investors grappled with recessionary fears amidst tighter monetary policy. The US and UK were not alone, as central banks in Australia, Iceland, India, Brazil, Czech Republic, Poland, and Chile also tightened monetary policy.

CPI, Year-Over-Year Percent Change

Source: Bureau of Labor Statistics, GSR

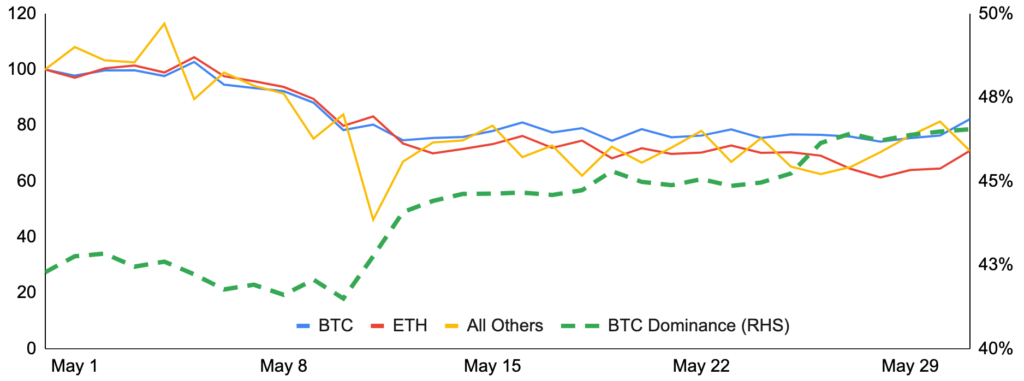

Altcoins Lead to the Downside

Perhaps unsurprisingly, bitcoin dominance rose throughout the month as altcoins offered a higher beta exposure to falling crypto prices. The collapse of Terra was a large contributor as well as the second-order contagion it created in the market for other altcoins. Avalanche, which was becoming more integrated with Terra and had its AVAX token as part of the Luna Foundation Guard’s (LFG) reserve, was a notable loser during the month, falling ~55%. Conversely, despite Terra’s large bitcoin reserve and LFG selling ~33k bitcoin on May 10th in a last-ditch effort to defend UST’s peg, bitcoin’s performance was surprisingly resilient, while the price of altcoins dwindled.

Crypto Market Cap, May

Source: Bureau of Labor Statistics, GSR

TRON Bucks the Trend

One cryptocurrency that bucked the trend of poor altcoin performance was TRON, a delegated Proof-of-Stake smart contract blockchain founded by Justin Sun. While allowing for the creation of all types of dapps, TRON has historically had an entertainment and content-sharing focus, as exemplified by its 2018 acquisition of BitTorrent.

One reason for the outperformance was the launch of TRON’s algorithmic stablecoin USDD. Notably, USDD is nearly a carbon copy of Terra’s UST, as it uses a mint/burn stability mechanism involving the chain’s native token to absorb the stablecoin’s volatility and also revealed plans to raise a $10b cryptocurrency reserve to further support its peg. Despite these similarities, USDD launched on May 5th and quickly grew its market cap to $600m, perhaps due to the 30-40% yield offered via protocols such as JustLend. Such growth helped push TRON’s TVL to flip that of Solana and Avalanche. Note that more recently, Justin Sun has pledged that USDD will always be overcollateralized, though questions remain surrounding the calculation and reflexivity given the inclusion of TRX in the reserve.

TRON TVL as Percentage of Total Crypto Market TVL

Source: Defi Llama, GSR

Authors: Matt Kunke, Junior Strategist, Brian Rudick, Senior Strategist

GSR in the Media

Barron’s –How TerraUSD, a Digital Token Designed to be Stable, Fueled a Crypto Crash

Bloomberg –Bitcoin Traders Move to Perpetual Contracts as Risk-Free Return Ends

Bloomberg –Terra’s Luna 2.0 Saw Wild Swings Post Crypto Token Airdrop

The Block – Saga raises $6.5 million to build scalable ‘chainlets’ for web3 developers

CoinDesk – After Week of UST Turmoil, Are Rest of Crypto Markets Stabilizing?

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report. This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.”