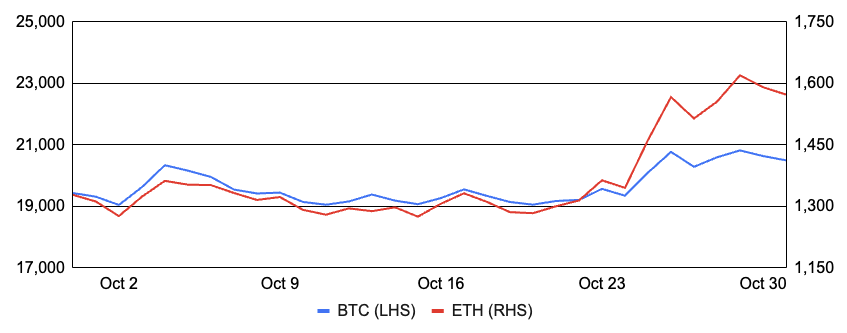

Bitcoin increased 5% in October and reversed its two-month downtrend after entering the month around $19,400 and finishing near $20,500. BTC moved higher at the beginning of the month alongside a broader relief rally in risk assets as investors speculated about a Fed pivot caused by a lower-than-expected rate hike out of Australia and a UN warning for the Fed to slow its pace of tightening. Optimism for a Fed pivot was short-lived, however, and BTC was range-bound for most of the month before rallying due to a short squeeze that liquidated more than $750m. Beyond macro, notable Bitcoin-related news included: A long-form research report funded by The Human Rights Foundation concluded that validity rollups could be implemented on Bitcoin to improve transaction throughput by 100x without forgoing custody or losing Bitcoin’s security properties; NYDIG’s parent company Stone Ridge unveiled a new accelerator program for projects building on Lightning and Taro; Cash App added the ability for users to send and receive bitcoin via The Lightning Network; McDonald’s began accepting bitcoin at its locations in Switzerland’s pro-crypto city of Lugano; and, Lugano also signed an agreement with El Salvador aimed at boosting the adoption of bitcoin domestically and in neighboring countries.

Ethereum similarly reversed its recent downtrend, rising ~18% during the month and outperforming bitcoin after entering October at ~$1,350 and finishing around $1,550. ETH traded similarly to bitcoin for most of the month but notably diverged to the upside in the latter part of the month as more than $850m of ETH shorts were liquidated. Additionally, on-chain Ethereum activity picked up as projects like XEN and Art Gobblers pushed up gas prices, which correspondingly increased the amount of ETH burned under EIP-1559. As a result, Ethereum realized its first deflationary calendar month, and the total outstanding supply of ETH fell by ~6,700 over the period. In other Ethereum-related news: Frax launched a liquid staking derivative for ETH to compete with Lido’s stETH and Rocket Pool’s rETH; Lido’s stETH expanded to Optimism and Arbitrum; Offchain Labs, the firm behind Arbitrum, acquired Prysmatic Labs, the engineering team behind Ethereum’s most popular consensus layer client, Prsym; a shortage of Goerli testnet ETH resulted in the testnet currency commanding a real dollar value despite intentions of it being worthless; Ripple began testing a new EVM-compatible XRP-Ledger sidechain; and, in recent days, ~65% of all Ethereum blocks and ~90% of relayed blocks are censoring transactions in compliance with OFAC.

BTC and ETH

Source: Sansheets, GSR.

Gobblers, Goo, and Other NFTs Too

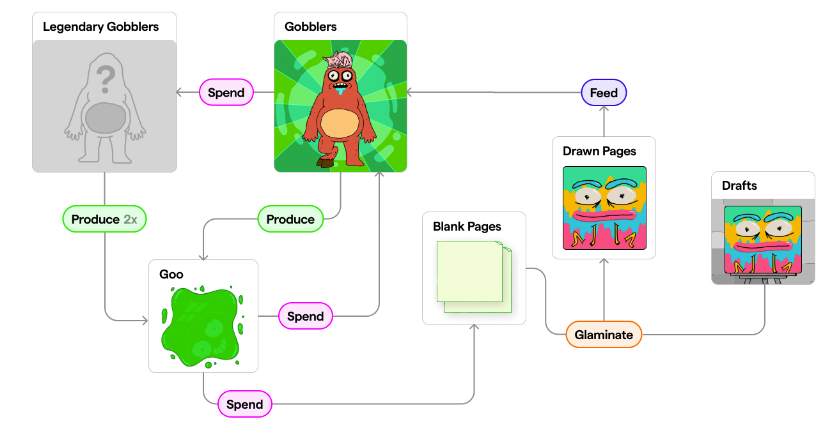

It was a big month for NFTs, headlined by the Art Gobblers mint on the last day of the month. The initial mint featured 2,000 Art Gobblers, 1,700 of which were freely mintable by whitelisted addresses, with the remaining 300 reserved for the creators. Another 8,000 Art Gobblers will be minted over the next decade, leveraging the project’s unique minting mechanism. Following the reveal, the collection’s floor price reached 25 ETH before settling closer to ~9 ETH this morning.

In more detail, Art Gobblers is an ambitious NFT project built by the team at Paradigm in partnership with Rick and Morty creator Justin Roiland. The Art Gobblers experiment is designed to be a self-sustaining, decentralized art ecosystem that is complete at the time of mint, with no roadmap or future involvement from the creators. The project combines many distinct token mechanisms, like Art Gobblers, Goo, and Pages, in an attempt to build this self-sustaining ecosystem. Artists create Blank Pages by spending the ecosystem’s in-game currency, Goo. Once Blank Pages are acquired, artists can use the project’s draw tool to create artwork, turning them into 1/1 NFTs that can be transferred or sold. As the name implies, Art Gobblers are animated NFTs that consume art via Pages. As a Page is fed to an Art Gobbler, it becomes a permanent part of that Art Gobbler, appearing in its belly and viewable via the Art Gobblers app. Gobblers and consumed Pages are inextricably linked, and any transfer of an Art Gobbler will necessarily include all of its previously gobbled artworks. In addition to ingesting art, Art Gobblers generate Goo at a constantly increasing rate, giving the owners of Art Gobblers control over the generation of new Blank Pages and, effectively, the curation of art generated in the ecosystem. Additionally, since the supply of Goo is constantly increasing, Art Gobbler and Blank Pages cannot be sustainably priced per unit of Goo. To solve this challenge, the project implements a Variable Rate Gradual Dutch Auction (VRGDA), adjusting prices as sales move ahead or behind the targeted schedule. For a more detailed overview and parameterization of these mechanisms, please see the original Paradigm report, as we simplified and omitted details, including Legendary Gobblers, issuance of Goo and Pages, and others.

NFT royalty fees have also garnered much attention of late. The issue first came to the fore after Sudoswap launched the first decentralized AMM protocol for permissionless NFT trading in July. The project gained traction behind significantly reduced trading fees and, more controversially, bypassed creator royalties that had been traditionally enforced by centralized NFT marketplaces. Subsequently, exchanges like X2Y2 followed suit, and October saw this trend accelerate. Solana’s top NFT project DeGods and affiliated t00bs and y00ts collections announced their transition to a zero royalty model, implementing this trend at the collection level. Following the DeGods announcement, Solana’s leading NFT marketplace Magic Eden announced that royalties would be optional on the platform before LooksRare quickly followed suit and Blur launched with royalties being optional. Notably, OpenSea has stood its ground so far and still enforces creator royalties.

In other NFT-related news: Azuki designed a physically backed token (PBT) standard featuring a scannable chip that connects a physical object to a digital token; Azuki raised ~$2.5m auctioning off eight NFTs backed by gold-plated skateboards using its new PBT standard; Damien Hirst completed his social experiment that forced NFT holders to choose between a physical artwork or a corresponding NFT, and live-streamed the burning of the physical copies for those that chose the NFT; OpenSea expanded to Avalanche; Mythical Games announced a foundation, DAO, and token; Moonbirds announced plans to launch a DAO in 2023 with seed funding provided in crypto and NFTs by Kevin Rose; Yuga Labs unveiled a BAYC community council to help shape future initiatives; it was revealed that the SEC is investigating Yuga Labs to determine if any of its NFT offerings violated securities laws; the liquidators of Three Arrows Capital took possession of its Starry Night NFT wallet; and, VeeFriends inked a deal to sell physical toys in Macy’s and Toys’R’Us stores.

Art Gobblers Mechanism Design

Source: Paradigm, GSR.

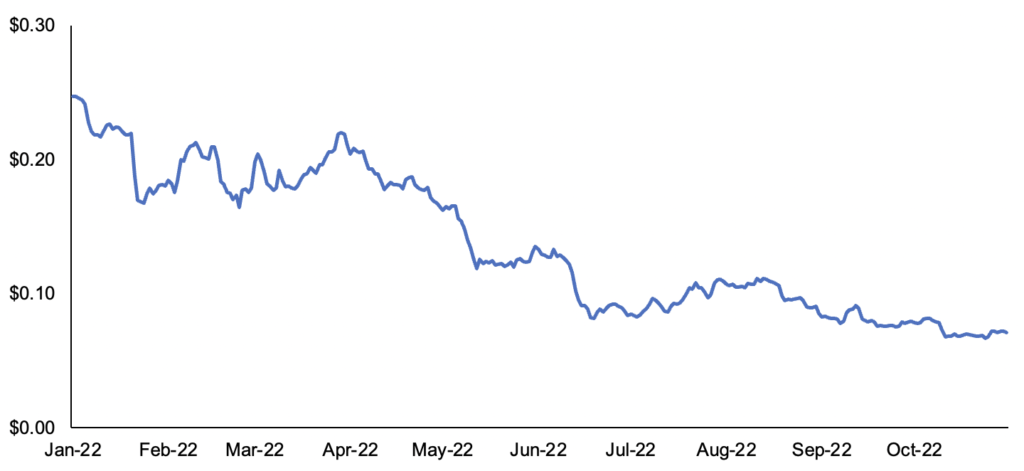

Bitcoin Mining Headwinds Continue

Bitcoin miners continue to operate in what’s arguably the most challenging environment for the industry on record. Depressed bitcoin prices, historically low transaction fees, and a rising network hashrate continue to dampen revenue, and have culminated in a record-low hashprice, which measures the expected value of 1 TH/s of hashing power per day. Pressure is being felt on the expense side of the equation as well with rising electricity prices, especially for those without solid Power Purchase Agreements as power represents the largest marginal cost for a miner. Moreover, several miners appear to have gotten overextended, with cash outlays for debt expense, rig deliveries, or infrastructure buildout outweighing cash being generated. While we’ve covered miner headwinds in recent months (September and June), October has illustrated the most significant challenges so far.

Several large public miners announced negative news during the month. Core Scientific, the largest Bitcoin miner in the world by hashrate, filed an 8-K acknowledging that the company will miss upcoming payments in late October and early November and is weighing a restructuring or bankruptcy. The stock fell ~80% after the filing and ~85% for the full month. Argo Blockchain announced that it no longer believes it will be able to raise the $27m in financing previously signed under a non-binding letter of intent, and warned that it will “need to curtail or cease operations” soon should it fail to secure other financing. Argo’s stock has fallen over 75% since the announcement. Lastly, Greenidge’s CEO abruptly resigned and the company announced it expected a net loss of ~$21m in the quarter, while Iris Energy published an update shortly after month end that it’s on the verge of defaulting on equipment financing agreements.

Despite the readily apparent challenges, many continue to support and invest in the mining ecosystem. Binance launched a new $500m lending pool for miners, further announcing its entrance into the cloud mining sector. Grayscale announced a new private investment vehicle providing co-investments in depressed mining hardware. And CleanSpark continued to opportunistically acquire ASICs at depressed prices and raised its year-end hashrate guidance by 10%. In other mining-related news: flare gas Bitcoin miner Crusoe Energy acquired competing flare gas miner Great American Mining; Bitcoin ASIC manufacturer Canaan introduced its new A13 series rigs; TeraWulf raised $17m to ramp up its infrastructure build; Stronghold ended its hosting deal with Northern Data to improve operational control; Compass Mining inked a new 27 MW hosting deal with Aspen Creek Digital; Moldova banned crypto mining amidst its energy crisis; and, Luxor introduced a new derivative contract with payoffs tied to its hashprice index.

Bitcoin Hashprice Index

Source: Luxor, GSR. Hashprice measures dollar revenue per day for 1 TH/s of hashing power. Hashprice is impacted by bitcoin’s price, block rewards, transaction fees, and Bitcoin network hashrate / difficulty.

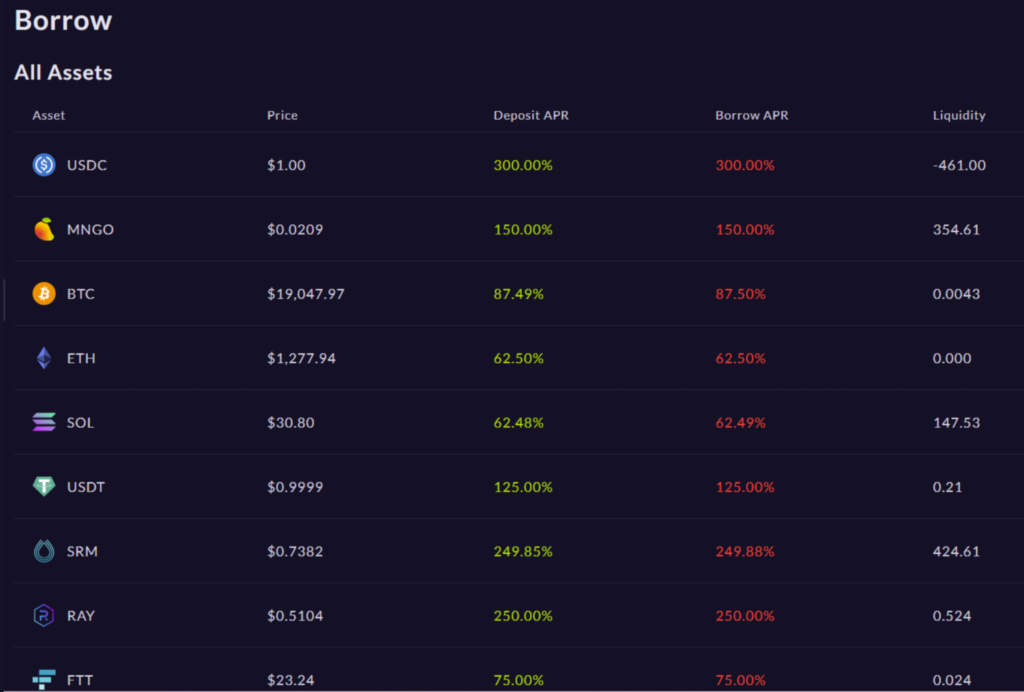

Mango and Other Exploits

October was the biggest month of the year for crypto hacks and exploits as measured by dollar value stolen, pushing the year on track to surpass the record set in 2021. The exploit of DeFi platform Mango Markets was perhaps the most prominent, given its size, doxxed identity of the exploiter, and public interactions with the DAO’s open governance process, though unfortunately, there were other high-profile exploits as well.

As an overview, Mango Markets is a Solana-based decentralized application for lending, borrowing, swapping, and leveraged trading of cryptoassets. At a high level, Mango allowed relatively illiquid collateral to be posted as margin to establish leveraged positions, which allowed the exploiter to manipulate the price in the spot market at a lower cost than the likely profit generated on the derivatives exposure. Other lending protocols like Compound seemed to learn from Mango’s mistake, ceasing to credit margin for less liquid tokens that were previously marginable.

In more detail, the Mango attacker deposited $10m of USDC evenly split among two accounts. He used $5m of collateral in one account to offer ~483m units of MNGO perps (~$20m) on Mango’s order book. The attacker then used his second account to purchase these contracts, taking on both sides of the trade. Given the low liquidity of MNGO, the attacker deployed additional capital to the spot market and manipulated the spot price from less than $0.04 to $0.91, pushing his long account value to more than $400m. With the account inflated by unrealized gains, the attacker borrowed against it and withdrew the borrowed funds in the form of various legitimately priced assets. The price of MNGO quickly fell, but not before the attacker siphoned ~$116m out of the protocol and left it insolvent. In essence, the attacker extracted unrealized gains on one account while socializing the unrealized losses on the other.

In the aftermath of the exploit, investigative journalist Chris Brunet released a blog post with compelling circumstantial evidence of the exploiter’s identity. A few days later, the alleged exploiter, Avraham (Avi) Eisenberg, released a series of tweets announcing his involvement in “a highly profitable trading strategy last week” and that he believed all of the actions were legal as they used the protocol as designed. Avi then proposed a DAO vote that essentially suggested the DAO use its treasury funds in combination with ~$67m that he would return to pay off the protocol’s bad debt and make end users whole. Community members iterated on several proposals and ultimately approved one. Users were reimbursed for their losses, and Avi kept a sizable ~$47m ‘bug bounty’ with the voters agreeing not to “pursue any criminal investigations1.”

Beyond Mango, the other prominent hack during the month was an attack on BNB Chain’s bridge, adding to the long and growing list of exploits targeting cross-chain bridges. In short, the bridge was drained for ~$566m as a bug allowed an attacker to forge withdrawal proofs and withdraw millions of BNB tokens erroneously. The exploiter attempted to move the funds to other chains, but only managed to move ~$110m to other networks before BNB Chain was temporarily halted, which prevented the movement of the remaining funds. Sam Sun dives into this exploit in more technical detail for the interested reader.

Mango Markets Liquidity Evaporated

Source: Joshua Lim’s Twitter, GSR.

Tech & TradFi Corporates

Despite the challenges of a crypto bear market, many large traditional finance and tech incumbents continued to launch crypto-related offerings or partner with crypto-native firms during the month. Google Cloud, for example, entered into a long-term strategic partnership with Coinbase to support the growing web3 ecosystem. The partnership is multi-faceted, but includes the ability for select Google Cloud customers to pay for services with cryptocurrency. Google Cloud subsequently announced the launch of its Blockchain Node Engine business that provides fully-managed Ethereum node hosting as a service. Beyond Google, Twitter unveiled a partnership with four NFT marketplaces, allowing users to buy and sell NFTs directly through tweets. BNY Mellon, the world’s largest custodian, added BTC and ETH to the list of assets it custodies. Fidelity also expanded its crypto solutions beyond bitcoin to offer ETH trading and custody services, and additionally announced plans to hire 100 new employees for crypto-related roles in the months ahead. Payment firms like PayPal, Visa, and Western Union also filed for crypto-related trademarks that provide insight into their potential future initiatives in the space.

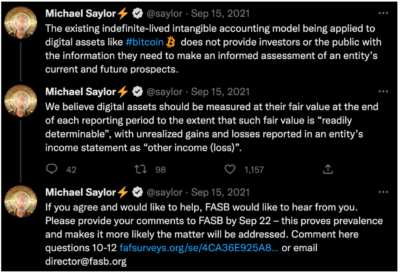

As traditional finance and technology corporations continue to interact with the crypto ecosystem in various ways, an accounting rule change may pave the way for more corporations to own cryptoassets directly. While many corporations such as MicroStrategy, Tesla, and Square hold bitcoin on their balance sheet, historical accounting rules were relatively unfavorable and may have disincentivized other companies from doing the same. The Financial Accounting Standards Board (FASB) historically required non-investment companies to treat digital assets as indefinite-lived intangible assets. This treatment required a corporation to book an impairment charge when the value of its crypto assets fell below cost basis, but prohibited marking up its fair market value when the assets moved higher. Following a unanimous vote in May 2022 to review the accounting rules for digital assets, the FASB has since recommended that fungible crypto assets be reported at fair value, allowing financial statements to more accurately reflect the fair value of assets like BTC and ETH. While this new recommendation still awaits implementation via a formal Accounting Standard Update, the newly recommended guidance may remove one impediment for corporate crypto investment during the next bull run.

Michael Saylor Advocating for the Proposed Accounting Change

Source: Twitter, GSR.

GSR in the Media

- CoinDesk – First Mover Asia: Will Bitcoin Remain in the Doldrums? Signals Are Mixed; Major Cryptos Are Mostly Flat

- CoinDesk TV – Justin Sun on About Capital’s Acquisition of Huobi Global; Bitcoin Clings to $19K Ahead of Inflation Data | First Mover Video | CoinDesk

- Markets Media – Cboe Digital Aims to Launch Margin-Based Crypto Futures – Markets Media

- CryptoMode – Delysium Raised $10 Million in a Strategic Round

- Blockchain Reporter – Web3 Infrastructure Puerto Rico-Based Startup Aligned Exits Stealth with $34M In Funding

Footnotes:

- We are simply quoting the proposal and not opining on any legal implications of this statement in the DAO proposal. There are numerous interesting legal takes on Twitter. Here’s one example.

Authors:

Matt Kunke, Junior Strategist | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Telegram, LinkedIn

View October 2022 Market Update

Disclaimers

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.