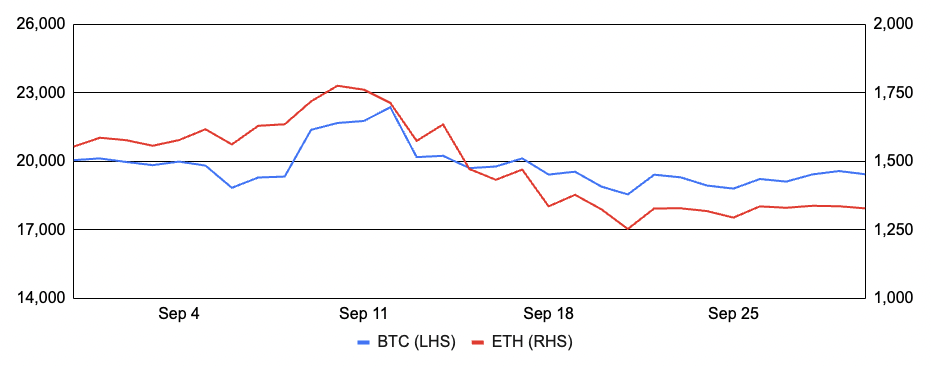

Bitcoin was largely range-bound in September, falling about 3% after entering the month at ~$20,000 and ending around $19,400. Bitcoin moved higher towards the beginning of the month until a worse-than-expected U.S. CPI print on September 13th and increased central bank hawkishness led to a challenging second half of the month. Outside of macroeconomic news, Lightning Labs released a test version of its Taproot-powered Taro protocol, which allows developers to create new assets like stablecoins for inexpensive transfers over the Lightning Network. Additionally, a new Microstrategy job listing indicated the company’s interest in offering Lightning Network-based services to clients. The company also filed to sell an additional $500m of stock during the month, which will be at least partially used to acquire more bitcoin. Elsewhere, CF Benchmarks introduced a bitcoin interest rate curve index, and an analysis of old domain name data indicated that Satoshi Nakamoto was choosing between the name Bitcoin and Netcoin in late 2008.

Ethereum was not immune from the market jitters, and it underperformed bitcoin during the month, falling ~15% after entering September at ~$1,550 and finishing around $1,350. Ethereum’s successful Merge was the key event of the month and is covered more below, but the event sparked a clear sell-the-news response from market participants, and ETH decoupled from other cryptoassets with increased liquidations in the following days. Notably, ETH outperformed most other crypto assets substantially heading into The Merge, gaining over 100% from its June low to its August peak, and it appears many reduced their exposure and monetized gains heading into the event. Additionally, many traders had bought spot and sold futures to remain market neutral while claiming the expected ETHW fork, which resulted in a temporary period of extremely negative funding costs before quickly reverting (See our OTC Trading Commentary for more on trading dynamics). Chandler Guo delivered his promise to create a new proof-of-work fork of Ethereum (ETHW), but the new token saw minimal interest and quickly fell to less than 1% of ETH’s price. Miners leaving the network upon the successful transition caused hordes of compute to chase smaller PoW opportunities such as Ethereum Classic, Ravencoin, Ergo, and Ethereum PoW, which all saw their network hashrate increase by multiples during the month. Reports indicate GPU prices in China have already cratered ~40% as the economics of mining these alternative tokens quickly deteriorated with the rise in hashrate. Ethereum miners like HIVE are still evaluating other PoW currencies to mine, while others like Hut 8 have pivoted their GPUs to other artificial intelligence and machine learning uses. Elsewhere, Stanford researchers proposed a token standard for reversible transactions on Ethereum, a white hat hacker found a critical bug in the Ethereum-Arbitrum bridge, the discount of Lido’s stETH and Rocket Pool’s rETH have largely evaporated, and censorship resistance continues to be in focus as Flashbots’ MEV-Boost has produced nearly ~40% of post-Merge Ethereum blocks.

BTC and ETH

Source: Sansheets, GSR

We Merged

The month’s highlight was a successful Merge on Ethereum, which was arguably the most important upgrade in crypto history. Indeed, Ethereum breached its terminal total difficulty level at block #15537393 on September 15th at approximately 2:43 am EST, triggering The Merge and the transition to proof-of-stake consensus for all future blocks. The execution of The Merge was as smooth as any test before it, and Ethereum seamlessly finalized its first checkpoint before 3:00 am EST. For background context, the Beacon Chain requires attestations from two-thirds of the stake to finalize, so any client bugs or node misconfigurations that result in more than one-third of the validator set going offline would impede finality. Comparing the last pre-Merge epoch (146874) to the first complete post-Merge epoch (146876), the voting participation of validators only decreased from 99.7% to 96.0%. The result was an overwhelming success, and participation is back above 99.0% today as offline validators worked through their issues.

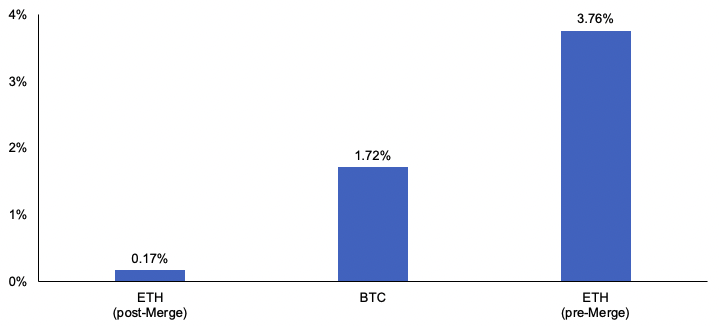

The successful completion of The Merge brought about many positive benefits to Ethereum. It replaced proof-of-work miners with energy-efficient proof-of-stake validators and reduced Ethereum’s electricity usage by an estimated ~99.9%. Block times decreased from a ~13.3-second average to a constant 12 seconds (assuming no empty slots), and the network now offers stronger economic finality guarantees underpinned by slashing and other validator penalties. From an economic perspective, new ETH issuance has fallen by more than ~95% as the block rewards paid to miners under the old security model ceased. And finally, staking yields have risen meaningfully as transaction priority fees now accrue to validators, and validators have new opportunities to capture MEV returns as well.

For those interested in staking ETH, our latest report offers applied coverage to ETH staking, evaluating the tradeoffs among various approaches and service providers.

Annualized New Token Issuance Since The Merge

Source: Ultrasound.money, GSR. Note: Ethereum’s supply growth is variable, and this graphic shows an annualized extrapolation of the supply growth based on the realized changes in ETH supply between The Merge and September 30th. Bitcoin and pre-Merge ETH inflation are shown for comparative purposes.

L1 Upgrades

While The Merge attracted the majority of attention in September, Ethereum wasn’t the only L1 to successfully implement an upgrade during the month. Algorand announced a significant protocol upgrade, releasing Algorand 3.9, which improved cross-chain communication, transaction throughput, and developer tooling by introducing on-chain randomness. The upgrade introduced State Proofs to enable trustless, quantum-secure cross-chain communication. State Proofs are cryptographic proofs of Algorand’s state that permit dapps on distinct blockchains to trustlessly verify Algorand transactions. The upgrade also increased Algorand block sizes, improving throughput from 1,200 to 6,000 transactions per second, with block latency and finality of less than four seconds.

Tezos similarly implemented a successful upgrade with Kathmandu, its 11th mainnet upgrade since the network’s launch in 2018. The upgrade addresses scalability by streamlining block validation and propagation via its pipelining project. It also will add testnet support for smart contract optimistic rollups, adding the potential to support generalized off-chain computation in the future. This addition follows Tezos’ previous upgrade that introduced less-generalized transaction optimistic rollups as a stepping stone. Kathmandu also improves randomness by introducing verifiable delay functions (VDFs), among other items.

Cardano’s Vasil upgrade went live and introduced a second version of Cardano’s native smart contract scripting language, Plutus v2. The upgrade extends its Bitcoin-based UTXO model to better facilitate smart contracts. The upgrade also introduced an improvement known as diffusion pipelining that enables faster block propagation, allowing for higher throughput.

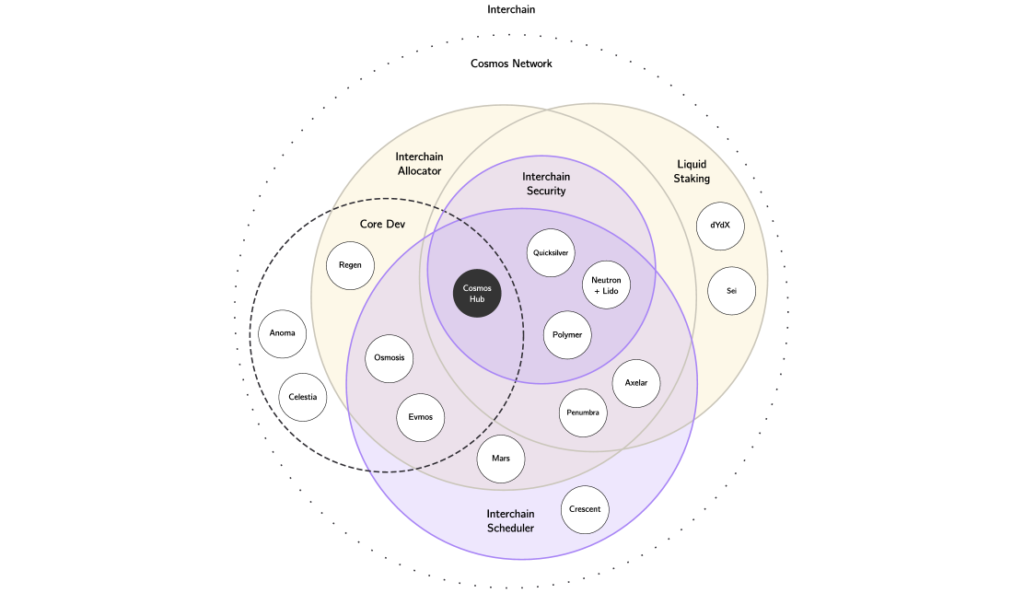

Beyond the upgrades implemented in the month, there were also several upgrade announcements. Helium revealed it would migrate from its own L1 to become an application on Solana. Cosmos unveiled a new white paper proposing changes to the utility of the Cosmos Hub and the utility and tokenomics of the ATOM token. Further, Polkadot released an updated roadmap. And finally, Chainlink announced the launch of its long-awaited staking program.

Cosmos’ Proposal Illustrated

Source: The Cosmos Hub White Paper, GSR

Bitcoin Mining’s Declining Profitability

Bitcoin miners are facing the most challenging backdrop in years as the price of bitcoin and transaction fees remain depressed, while energy costs and the network hashrate have risen significantly. Numerous headlines evidence this, including Bitdeer delaying its SPAC again, Bitmain discounting its already depressed rig prices, mining pool operator Poolin freezing withdrawals, hosting service provider Compute North filing for Chapter 11 bankruptcy, Celsius Mining suing its hosting provider Core Scientific for attempting to pass through power costs allegedly in violation of its agreement, and the CEOs of Citi, Bank of America, and Wells Fargo admitted they have no intent to provide miner financing in a recent congressional hearing. Moreover, another sizable upward difficulty adjustment is expected in the coming days to normalize faster than targeted block times. Despite this, many in positions of strength are looking to capitalize on the current situation, which may include the most efficient, least leveraged miners as well as outside parties, such as Maple Finance, which launched a $300m lending pool for mining firms, and Bitmain founder Jihan Wu, who announced a $250m fund to invest in distressed mining assets.

Bitcoin Hashprice Index

Source: Luxor, GSR. Hashprice measures dollar revenue per day for 1 TH/s of hashing power. Hashprice is impacted by bitcoin’s price, block rewards, transaction fees, and Bitcoin network hashrate / difficulty.

Regulators and Enforcement

September featured many interesting cases on the regulatory front. One particularly notable example is the CFTC’s case against Ooki DAO. As background, bZeroX, LLC operated a trading protocol providing margined and leveraged retail trading services. In August 2021, the founders of bZeroX transferred control of the protocol to Ooki DAO, an unincorporated decentralized autonomous organization. Fast forwarding to September 2022, the CFTC announced it had filed and settled charges against bZeroX LLC and its founders for violating the Commodity Exchange Act and CFTC Regulations. Additionally, the CFTC filed a civil enforcement action against Ooki DAO, alleging it violated the same laws as the founders by operating the same software protocol. In the enforcement action, the CFTC defines Ooki DAO as holders of the Ooki token that have voted on governance proposals, casting a wide net for determining personal liability. Indeed, CFTC Commissioner Mersinger’s dissenting statement called the approach for determining personal liability “arbitrary” and “unfair.” Given the unique nature of this case, the CFTC filed a motion to serve DAO members via a post on the Ooki DAO forums and a message to the website’s chatbot, which a federal judge subsequently approved in early October. The case is still ongoing, but we expect the criteria for determining personal liability to be argued heavily in the future.

Another interesting case is that between the SEC and Ian Balina, where the SEC alleges the defendant failed to disclose promotion incentives linked to the Sparkster ICO (SPRK) and that he subsequently sold unregistered securities. Regarding the latter charges, Balina had formed an investment pool that permitted investors to deposit ETH in exchange for a share of the SPRK tokens Balina would receive under his Simple Agreement for Future Tokens (SAFT) terms. The case notes that some investors were U.S.-based, with their transactions originating within the country, and these “contributions were validated by a network of nodes on the Ethereum blockchain, which are clustered more densely in the United States than in any other country. As a result, those transactions took place in the United States.” It remains unclear if such a jurisdictional claim will hold up in court, but Australian lawyer Aaron Lane noted that geographic node density is a largely irrelevant point to jurisdiction in this case, given the U.S.-based defendant, the U.S.-based plaintiff, and a transaction emanating from the U.S. However, it’s still a unique argument for the SEC to raise, given its other avenues for establishing jurisdiction.

In other regulatory and enforcement-related news: the U.S. Treasury Department released an FAQ on the Tornado Cash sanctions, clarifying the scope for U.S. persons, the implications of dusting transactions, and more; the IRS obtained a court order providing it access to crypto prime broker sFOX’s customer records to investigate potential tax evasion; and, Interpol issued a red notice for Terra co-founder Do Kwon that requests law enforcement agencies worldwide to locate and provisionally arrest him.

A Snippet of CFTC Commissioner Mersinger’s Dissent

Source: CFTC, GSR. Full dissenting statement here.

Fighting Inflation and Interest Rate Differentials

Monetary tightening continues to be the trend among developed economies battling material inflation. The Fed issued its third consecutive 75-basis-point rate hike in response to a worse-than-expected August CPI print. The target Fed Funds range is now 3.00-3.25%, notably higher than most developed market peers and one commonly cited driver for the U.S. Dollar’s recent strength. Additionally, the newest dot plot illustrated the Fed’s increased hawkishness, with the median year-end Fed Funds rate projection increasing from 3.4% to 4.4%.

Most other developed market economies followed suit, with the Bank of Canada, the European Central Bank, and the Swiss National Bank each hiking by 75 bps, while the Reserve Bank of Australia and the Bank of England hiked by 50 bps each. It was an eventful month for the BoE in particular, which found the newly elected PM’s stimulative fiscal policy stance offside with the BoE’s path of tightening monetary conditions. After assuming office on September 6th, PM Truss quickly unveiled plans for fiscal stimulus via tax cuts funded by government borrowing. The announcement promptly raised inflationary concerns that sparked a quick and large selloff in U.K. Gilts and the GBP that forced the BoE to try and stabilize the market by purchasing long-dated bonds. Shortly after the month ended, PM Truss scrapped her controversial tax plans that initially sparked the turmoil, helping to support the GBP somewhat.

The Bank of Japan bucked the trend and kept interest rates constant at -10 bps, becoming the last major country to maintain negative interest rates after Switzerland’s rate hike. In response, the yen fell to a multi-decade low versus the dollar, which sparked the Japanese government’s first FX market intervention to prop up the yen since the Asian financial crisis in 1998. Japan sold nearly $20b to buy back yen, draining nearly ~15% of its readily available funds. It remains to be seen if the Japanese government will continue to intervene directly in currency markets or if the BoJ will alter its path of loose monetary conditions as rising rate differentials continue to strain the price of the yen.

U.S. Dollar Performance vs. Other Developed Currencies

Source: GSR, finance.yahoo

GSR in the Media

- Bloomberg – DeFi Projects Look to Replenish Treasuries After Crypto Collapse

- Blockworks – In Nod to Multichain Future, Startup Layer-1 Eyes Solana Scaling Solution

- Blockworks –Hashflow Raises $25M From Jump Crypto, Wintermute and GSR

- Cointelegraph – Magpie secures $3M in funding to enable seamless cross-chain swaps

- Decrypt – Decentralized Exchange Krypton Raises $7M From Framework Ventures, Samsung Next

- The Defiant – Bitcoin Surges 10% As Crypto Rallies Into The Weekend

Authors:

Matt Kunke, Junior Strategist | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Telegram, LinkedIn

View September 2022 Market Update

Disclaimers:

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.