Ethereum’s Shapella (Shanghai + Capella1) upgrade is scheduled to activate on mainnet on April 12th, enabling validators to withdraw staked ETH positions for the first time since the Beacon Chain’s launch in December 2020. This report dives into the implications of the forthcoming liquidity event and surmises what may transpire.

The following report dives into the mechanics of Ethereum withdrawals, including account balance structure and queuing mechanisms, before diving into the practical implications and takeaways from Shapella. Please see our previous coverage of Ethereum staking or our past coverage of the Beacon Chain for more information.

tldr

- Withdrawals will be smoothed over a period of weeks to months due to Ethereum’s queuing mechanisms, in addition to the various lags that Ethereum staking service providers require to integrate support for withdrawals.

- We don’t agree with the frequently cited bearish narrative that Shapella will catalyze material ETH selling pressure as liquidity is already available for the majority of Ethereum stakers, and the largest demographic of stakers without liquidity is the ETH-aligned cohort of solo stakers that are the least likely to exit. Additionally, concerned validators could enter the exit queue now by simply forgoing ~$10 of rewards, but that has yet to happen.

- Shapella is a material de-risking event for ETH stakers as natively staked ETH is able to be withdrawn from the protocol. Even if there is a temporary dip in staked ETH, such de-risking should cause the percentage of ETH that is staked to grow over the mid-to-long term.

Overview

Ethereum nodes seeking to participate in the network’s proof-of-stake consensus must deposit (stake) 32 ETH on the Beacon Chain to become a validator that proposes and attests to Ethereum blocks. Since the Beacon Chain’s launch in December 2020, this initial 32 ETH stake plus the rewards generated from actively validating the chain have sat in each validators’ account balance, unable to be withdrawn or transferred. This will change shortly, however, as developers recently announced that the Shapella upgrade enabling staked ETH withdrawals is scheduled on mainnet at slot 6,209,536, occuring at approximately 10:27 pm UTC on April 12th, 2023. Still, once withdrawals are enabled, the Ethereum protocol limits the number of validator entries and exits per epoch, and the exit queue is expected to take weeks to months to clear depending on the amount of stake that attempts to exit. Lastly, exiting stake is not necessarily indicative of ETH sell pressure as there are several reasons a validator may exit without selling. We dig into the implications of Shapella below, detailing important context and considerations ahead of the liquidity-enabling upgrade.

Validator Account Balances

To understand the changing liquidity dynamics for ETH, some background information is needed on the accrual of staking rewards. Prior to The Merge, all Ethereum staking rewards came from the consensus layer (e.g., block proposals, attestations, sync committee participation), and these rewards were entirely illiquid and accrued to the validator’s account balance alongside their initial 32 ETH deposit. After The Merge, however, validators started earning additional rewards from the execution layer as block proposers began to receive transaction priority fees, as well as MEV payments if they opted-in to MEV-Boost. These execution layer rewards do not suffer from the same illiquidity headwinds as they accrue to a designated Ethereum address and don’t interact with the validator’s account balance. Shapella focuses on validator account balances (e.g., staked ETH deposits and consensus layer rewards), enabling these balances to be withdrawn to an Ethereum address. With an average validator account balance of ~34 ETH across the ~564k validators on the network today, there is about 19.2m ETH that will become withdrawable in the near future subject to various queuing mechanisms and other impediments covered shortly.

Additionally, one common misconception is that a validator’s voting power scales proportionally with their stake (i.e., validator account balance). This is a slight oversimplification on Ethereum as a validator’s voting power, as well as their rewards and penalties, are scaled by an optimized account balance known as their effective balance. Sparing all the details, the key takeaway for withdrawals is that every validator’s effective balance has a hard cap at 32 ETH. Consensus layer rewards continue to accrue to the validator’s actual account balance above 32 ETH, but their voting power and share of rewards does not compound due to the cap on their effective balance2. After Shapella, the unproductive stake or the excess stake in a validator’s account balance (i.e., the stake above 32 ETH) will be automatically withdrawn at regular intervals.

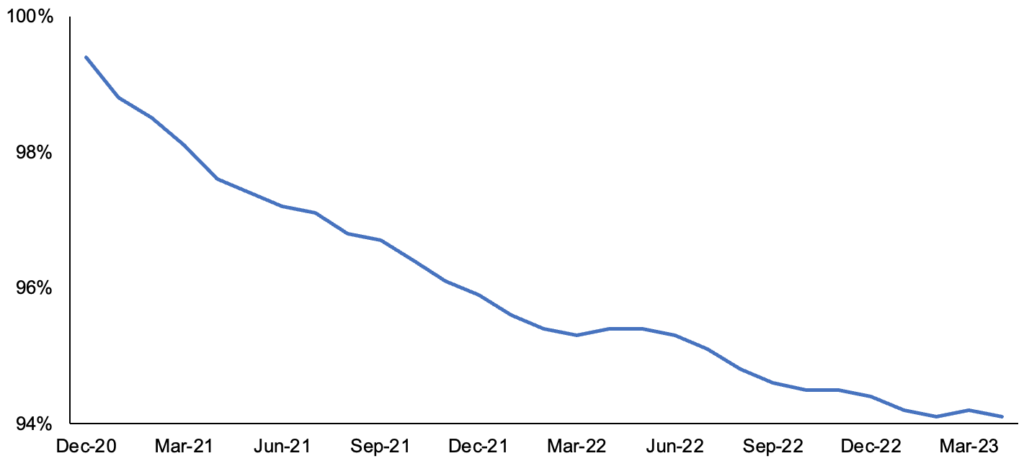

Stake Effectiveness (Effective Balances / Actual Balances)

Source: beaconcha.in, GSR. Note: Validator account balances have become less productive through time as gains could not be compounded historically. Additionally, there are examples of validators making double deposits (64 ETH) which halved their APYs (and reduced the effective stake) as a result.

Withdrawal Mechanics

Shapella will introduce a new system-level operation that will push Beacon Chain validator account balances into the Ethereum Virtual Machine (EVM). Notably, withdrawals won’t create a new transaction on the execution layer, but balance updates will occur behind the scenes similar to proof-of-work issuance historically. Simply put, the processing of withdrawals is akin to a burn and mint mechanism, where the validator account balance is burned from the Beacon Chain and subsequently minted to the designated Ethereum address. EIP-4895 details several drivers underpinning this design choice, but one notable feature is that withdrawals are gasless and will enable even small amounts of excess stake to be cost-efficiently withdrawn shortly after accrual.

There will be two types of withdrawals once Shapella is introduced: partial withdrawals (skimming) and full withdrawals. Partial withdrawals will occur on a routine basis, automatically withdrawing each validator’s excess stake to the specified withdrawal address. Full withdrawals, on the other hand, require the validator to signal a voluntary exit (or get slashed) and wait through the exit queue before going through the withdrawal queue.

The exit queue is used to rate-limit validator entries and exits, preserving certain finality properties by ensuring the validator set doesn’t change too quickly. Unbeknownst to most, validators have been able to exit this entire time, but not many have chosen to do so as they would stop receiving rewards and would still be unable to withdraw their stake. After completing the exit queue, validators have ‘exited’ and can stop performing their historical responsibilities without penalty, but they cannot withdraw their account balance until subsequently going through the withdrawal queue. Additionally, there is a minimum 256 epoch (~27 hour) validator withdrawal delay designed as a waiting period after the exit queue so that any slashable activity can be detected and reported before a withdrawal occurs3.

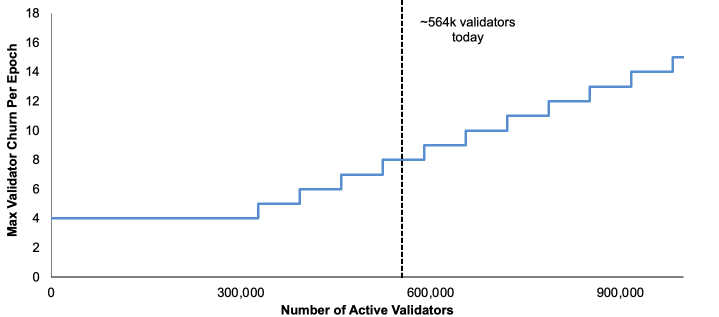

The exit queue parameterization specifies that a minimum of four validators can exit every epoch (6.4 minute), but the actual per epoch validator churn allowed by the protocol grows as the size of the active validator set grows4. With ~564k active validators today, a maximum of eight validators can exit per epoch, but the protocol-allowed churn decreases as validators exit and the set becomes smaller. The exit queue’s rate-limiting parameterization may lead to congestion, and the exit queue is expected to be the overwhelming factor determining how long withdrawals will take in aggregate directly after Shapella’s implementation. While many note that withdrawals may take weeks or months due to the exit queue, it’s important to remember that this is a queue and not a cliff. All else equal, the queue will dissipate with a subset of validators exiting each day, so references to the length of an exit refer to an incremental exit, not when everybody will exit.

Validator Exits Allowed Per Epoch by Validator Set Size

Source: Upgrading Ethereum, GSR. Note: While beyond today’s scope, the formula is as follows: MAX(MIN_PER_EPOCH_CHURN_LIMIT, n / CHURN_LIMIT_QUOTIENT); where n is the number of active validators.

The withdrawal queue is akin to a round-robin-style sweep that cycles through the full validator set. Unlike the exit queue, validators are automatically placed in the withdrawal queue, and no opt-in is necessary unless the validator has old withdrawal credentials. As background, all validators have a withdrawal credential with a 0x00 or 0x01 prefix depending on when and how their initial deposit was made. Validators with a 0x00 prefix must execute a one-time migration to the newer 0x01 prefix after Shapella is implemented to become eligible for withdrawal5,6.

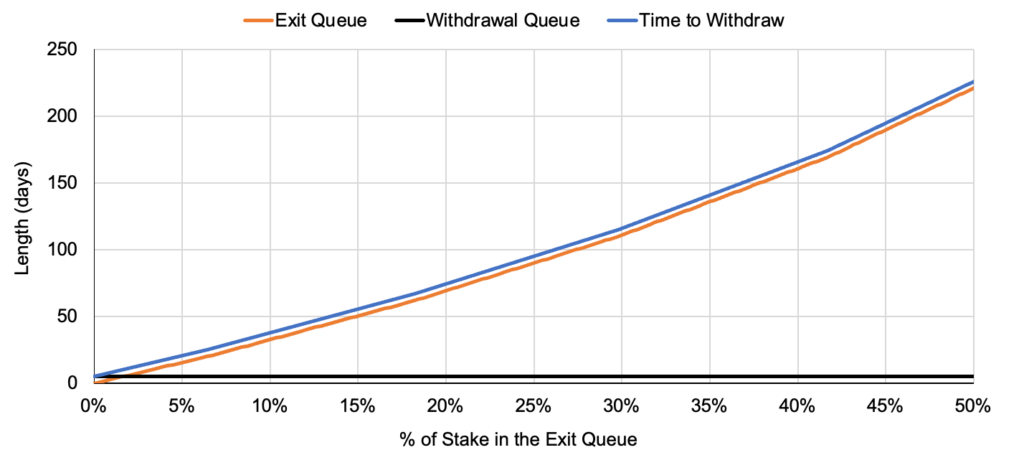

In a hypothetical where all validators have 0x01 credentials, the withdrawal pool functions as a round-robin sweep starting from the oldest validator and incrementing by age (i.e., the validator index number). As a validator reaches the front of the withdrawal queue, the protocol checks if they’ve gone through the exit queue and if the minimum withdrawal delay (~27 hours) has since passed, if so, the validator’s full stake is withdrawn, if not, a partial withdrawal occurs and the excess stake is withdrawn. The withdrawal queue is indifferent between partial or full withdrawals, and it sweeps through the validator set processing 16 withdrawals per block. As a result, partial withdrawals will occur about every ~5 days7, but full withdrawals will take much longer if a large portion of validators try to exit simultaneously given the more constrained exit capacity. Leveraging the per epoch validator churn formula from the previous exhibit, we can estimate the number of days it will take to withdraw depending on one’s estimates for the amount of exiting stake. For example, if 10% of validators try to exit simultaneously, the exit queue will balloon to about 33 days, and it will take closer to 38 days for a staker in the back of the queue to withdraw in full8.

Days to Withdraw Under Various Exiting Stake Assumptions

Source: GSR. Note: This simplistically assumes a constant five-day withdrawal queue (the average experience is likely closer to 2.5 days w/ five days being a max). The withdrawal queue may be slightly shorter than this in the short term depending on the percentage of 0x00 to 0x01 migrations. In the long run, the withdrawal queue will grow as a function of validator set growth. Additionally, due to ~3,600 validators exiting in advance (or being slashed) since the launch of the Beacon Chain, these validators have already gone through the exit queue; they would’ve added an additional two days to the exit queue at the current churn level of 1,800 validators per day if they hadn’t already exited.

The Impact – What Comes Next

With Ethereum’s withdrawal mechanics now understood, we consider the magnitude of near-term staked ETH withdrawals, other validator exit considerations, and contemplate the relationship between ETH withdrawals and subsequent sales of ETH.

Staked ETH Unlocks

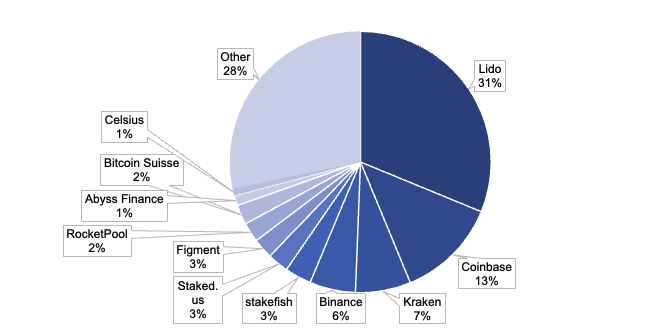

While the percentage of validators that will withdraw in full is difficult to estimate, one can estimate the upper bound on the ETH available due to partial withdrawals. Assuming all validators have 0x01 prefixes for simplicity9, there are ~564k validators with an average account balance of ~34 ETH, meaning ~1.13m of excess ETH staked will be skimmed on a continuous basis over the course of the roughly five days beginning immediately after Shapella. Additionally, ~3,600 validators have already gone through the exit queue and exited as of two days before Shapella, so a small subset of validators in the withdrawal queue will be immediately withdrawing their full stake instead of their excess stake during the first sweep through the withdrawal queue. This adds another ~115k ETH of exit pressure from full withdrawals to the first sweep, but this number will grow as more validators exit10. With validator churn capped at 1,800 validators per day for at least the first three weeks of withdrawals, an incremental ~58k ETH of withdrawals could potentially be added to the total each day (ignoring the de minimis incremental skimming rewards generated between the first sweep and subsequent sweeps). Lastly, just to reiterate, this is simply a model for thinking about the withdrawal parameterization in a tangible way, but it’s certainly an upper-bound estimate. Many validators will need to change their withdrawal credential prefixes to be able to withdraw, and staking service providers complicate matters further as end users may not immediately have access to the withdrawable ETH depending on the service provider’s setup. For example, Lido controls ~31% of all stake, but it will not support withdrawals until some point in May.

ETH Staked by Entity

Source: Hildobby ETH Staking Dashboard, GSR.

Validator Exit Considerations

Determining the number and timing of validator exits is a challenging and imprecise task. There are myriad reasons that one may exit their staked ETH position, so it is hard to generalize but there are some telling details that can help inform a lower bound. Kraken and Celsius are the two most notable examples of ‘known withdrawals.’ Kraken, the third largest staker of ETH, will need to withdraw and return all of its stake attributed to U.S. clients as a result of its recent settlement with the SEC. While Kraken’s U.S. vs. international client split isn’t known, we estimate at least 50% of its stake is U.S.-based and will be withdrawn (21Shares assumes 70%). Celsius, on the other hand, will withdraw all of its staked ETH due to its bankruptcy. If these withdrawals were signaled at the same time, they would single handedly clog the exit queue for ~14 days.

While noting the large degree of uncertainty, our base view is that the peak length of the exit queue is more likely weeks than months, particularly due to the level of stake outsourced to staking service providers that will add support for withdrawals at differing times. Coinbase intends to begin processing withdrawal requests about 24 hours after Shapella, Binance will follow suite “within one week,” Rocket Pool’s withdrawal-enabling Atlas upgrade will occur on April 18th, and Lido will follow later in May11. In addition, it’s important to note that validators concerned about the future length of the exit queue could signal to exit now. At the time of writing, two days before Shapella, the exit queue is empty and any validator could sign a voluntary exit at the expense of forgoing ~$10 of staking rewards. This implies to us that most validators do not have an immediate need for liquidity.

Outside of the ability to withdraw staked ETH, increased competition in the ETH staking ecosystem may be the next largest implication of Shapella. While most stakers have had access to liquidity in one form or another, most commonly via decentralized exchanges or the centralized exchange they used to outsource the management of their stake, direct redeemability is a game changer for the competitive landscape. The largest and most trusted liquid staking derivatives should see their secondary market discounts evaporate after withdrawals are introduced and congestion in the exit queue dissipates12. Resultantly, secondary market discounts no longer must be considered in choosing one’s preferred solution, leading to more flexibility for stakers and potentially eroding a degree of service provider entrenchment. Several examples immediately come to mind: 1) centralized exchange stakers who have increased their onchain participation may want to transition to a lower-fee provider, like Lido, 2) early solo stakers who value yield maximization may prefer the increased returns enabled by Rocket Pool’s capital efficiencies, and 3) early Lido stakers valuing decentralization may prefer to allocate their stake to another provider to better distribute the network’s stake. Certainly there are many other examples, but the point remains the same, Shapella removes barriers to competition and presents the best opportunity for the redistribution of stake thus far.

Relationship Between ETH Withdrawals and ETH Sales

While Shapella has been commonly viewed as a bearish event introducing sell pressure as staked ETH becomes withdrawable for the first time, we believe that most withdrawal pressure will result in a reallocation rather than a sale in aggregate. As previously mentioned, most stakers have had access to liquidity at a slight discount if it was truly needed for financial reasons. In addition, the largest demographic of ETH stakers without any liquidity are solo stakers, but they are the most ETH-aligned cohort of stakers that, all else equal, are the least likely to exit in full. Unlike outsourced stakers that rely on third-party service providers, solo stakers have gone through the non-trivial hurdles to help secure Ethereum directly, investing financial resources in hardware, as well as their time to ensure their validator remains up-to-date and performant.

In our view, taxes will be the most likely driver of incremental ETH sales. Without opining on the tax implications of ETH staking, many stakers believe their accrued rewards only become taxable once control is gained over them, leading to the view that rewards are not taxable until a liquidity event like Shapella occurs (not tax advice). As a result, solo ETH stakers may sell a fraction of their staking income to finance these tax expenses.

Conclusion

Overall, we don’t agree with the frequently cited bearish narrative that Shapella will catalyze large scale exits from Ethereum. Queueing mechanism will constrain how quickly withdrawals can be facilitated, and the various staking service providers will integrate support for withdrawals on different lags, so staked ETH withdrawals will be smoothed over several weeks to months. Moreover, with liquidity already widely available through many popular staking service providers, we don’t foresee Shapella introducing material new sell pressure, particularly given it’s largely the ETH-aligned demographic of solo stakers without liquidity today. We believe the current exit queue, or lack thereof, lends itself to this point as nervous stakers could front run the exit queue right now for the de minimis cost of forgoing ~$10 of staked ETH rewards. While some withdrawals will certainly lead to sales, particularly for tax implications, we believe withdrawals will lead to most stakers reinvesting their excess/unproductive ETH or swapping out their existing service providers with the increased flexibility of direct redemptions. Lastly, as the percentage of staked ETH (~15%) continues to sit well below that of competing smart contract blockchains, and with Shapella representing a material de-risking event for stakers, we envision that the growth of the ETH staking populace will be the most meaningful outcome of the upgrade in the mid-to-long term.

Footnotes:

- The upgrade that most community members know as Shanghai is more commonly known as Shapella now. Ethereum upgrades, as most commonly view them (e.g., The Merge, Withdrawals, etc.), actually consist of two distinct upgrades, one on the execution layer and one on the consensus layer. Implementing staked ETH withdrawals requires an upgrade to the execution layer and the consensus layer. Shanghai is the name of the execution layer upgrade, and Capella is the name of the consensus layer upgrade. Ethereum developers have begun naming the upgrade holistically as the name of the two upgrades merged together (Shanghai + Capella = Shapella). We previously covered this dual upgrade concept in the first paragraph of ‘The Merge Implementation Process’ section here.

- This is true in normal cases but doesn’t hold if a validator is first penalized. If a validator is penalized first and their effective balance falls below 32 ETH, their voting power and share of rewards would compound from that decreased level up until their effective balance returns to 32 ETH.

- This min withdrawal threshold would supersede the withdrawal queue if the time to get through the withdrawal queue is less than the minimum withdrawal threshold (e.g., you would never be able to withdraw less than ~27 hours after going through the exit queue under any circumstances). The withdrawability delay is also extended to 8,192 epochs (~36 days) for slashed validators.

- This same churn formula applies to validator entries as well. The formula was omitted to prioritize the practical implications of withdrawals, but interested readers should see MIN_PER_EPOCH_CHURN_LIMIT and CHURN_LIMIT_QUOTIENT here. It’s also detailed nicely here.

- This introduces a complicating factor in determining the duration of the withdrawal queue as ~322k validators will need to migrate their withdrawal credentials before being eligible for withdrawals. Additionally, there is no timeline in which validators are required to execute this migration. Rational actors may want to wait a few days to ensure the migration works smoothly, while also recognizing that their capital beyond 32 ETH is not being put to efficient use until they migrate. Conversely, if they believe there is a potential that their key may have been compromised they would act ASAP in attempt to assign the withdrawal credentials first. Practically speaking the withdrawal queue will almost certainly be overshadowed by the length of the exit queue, and the withdrawal queue is unlikely to be a material contributor to the total time it takes to execute a full withdrawal (i.e., go through the exit queue and then the withdrawal queue) immediately after Shapella. For further context, the difference in exit duration between a hypothetical scenario that assumes all ~322k validators already migrated and a scenario that assumes none of them migrate is a difference of less than 3 days.

- Details are beyond the practical scope of this report, but this transition is incredibly important for early stakers as the 0x00 prefix was the only withdrawal credential at the launch of the Beacon Chain. Migration details can be found here, and prefix explanations can be found in the ‘withdrawal prefixes’ section here.

- The withdrawal queue will take zero to five days depending on one’s place in the withdrawal queue. The math is: 16 withdrawals per slot, 32 slots per epoch, and 225 epochs per day implies ~115.2k withdrawals per day; there are currently 564k validators, so would take approximately five days at most to cycle through them.

- More precisely, this would be ~33 days, plus a ~27 hours withdrawal delay, plus an additional zero to five days (~2.5 avg) depending on one’s position in the withdrawal queue.

- This is overly conservative as only 16 withdrawal credential changes can occur per block, so it’s impossible for all validators to have 0x01 credentials immediately after Shapella. Forecasting this is difficult and this provides a safe upper bound for newly available ETH.

- Given we already assumed excess ETH skimming in our prior calculation determining newly liquid ETH, incremental calculations assume a 32 ETH balance for full withdrawals to avoid double counting the ETH rewards.

- We were unable to locate a clear implementation for timeline from Kraken, but we anticipate it will be hours or days given the centralized structure.

- There may be discounts on less battle-tested liquid staking derivatives due to smart contract risk, but those with little perceived contract risk should converge to a discount rate loosely-based on the exit queue and the risk-free rate by principals of no-arbitrage.

Authors:

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Sources:

Shapella Mainnet Announcement, Ethereum Validator FAQ, ETH Withdrawals FAQ, Rated.Network, Upgrading Ethereum – Ben Edgington, Shapella Upgrade – Etherworld, Onchain Insights – 21Shares, 100 Days After The Merge – Galaxy, ETH 2 Staking Dashboard – Hildobby, Marc Zeller – Twitter, Westie Capital – Twitter, Korpi – Twitter, Tim Beiko – Twitter, Lido – Twitter, Coinbase – Twitter, Rocket Pool – Twitter, Binance Announcement

Disclaimers

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.