With a decade passed since the filing of the first spot Bitcoin ETF application, we evaluate the latest developments driving renewed optimism around a spot Bitcoin ETF.

Overview

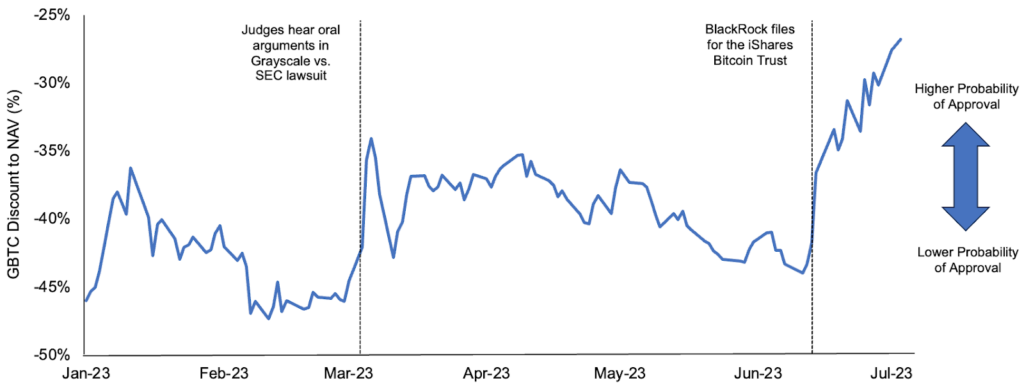

The path to a US-listed spot Bitcoin ETF has been a long and arduous one, with the SEC rejecting all 33 applications across more than a dozen filers since the Winklevoss twins first sought approval a decade ago. And while the road ahead remains uncertain, major developments like Grayscale’s lawsuit against the SEC and BlackRock’s recent filing to launch a spot Bitcoin ETF have both increased the odds of a spot Bitcoin ETF approval in the eyes of many. Given the importance of these two events, we dive into Grayscale’s bid to convert its bitcoin trust into an ETF and examine BlackRock’s ETF filing. In short, while this is the most optimistic the market has been in some time, as evidenced by the sharp improvement in GBTC’s discount to NAV, the magnitude of the discount still implies a high degree of uncertainty over the near term.

GBTC’s Discount to NAV Has Narrowed YTD

Source: GSR, Grayscale. Data as of July 5, 2023. Note: the first major discount narrowing event in early January was more related to the entanglement between Grayscale affiliates DCG & Genesis and Gemini/other creditors; the move was distinct from ETF filing dynamics.

Grayscale vs. the SEC

Grayscale’s Bitcoin Trust (GBTC) was launched in 2013 as one of the first securities providing exposure to spot bitcoin, but unlike ETFs registered under the Securities Act of 1933 (“1933 Act”), the offering was exempt from registration by Rule 506(c) of Regulation D as shares were only sold to accredited investors via private placement. After investors maintain the shares for the required holding period under Rule 144, they are able to resell them on the secondary market, and shares of GBTC have been quoted over-the-counter and traded on the OTCQX market since 2015.1 Any secondary market participants can freely buy or sell shares without any of the complexities previously mentioned, one simply needs a brokerage account that supports OTC markets. And as a sufficiently large number of private investors sold shares in the secondary market, the supply of unrestricted shares in the secondary market grew, and liquidity developed. Note, however, that this structure has several shortcomings relative to an ETF; most prominently, the price of its shares may materially deviate from the value of the underlying assets (i.e., its Net Asset Value, or NAV, the value of bitcoin it holds per share) as there isn’t a creation or redemption mechanism tethering the share price to its NAV.2 As a result, GBTC shares routinely traded at a material premium early in its history as retail demand for the only publicly-traded Bitcoin fund exceeded the supply of unrestricted shares available in the secondary market. In fact, despite its shortcomings, GBTC found tremendous success as an early mover and grew to be the world’s largest bitcoin fund, controlling ~3.2% of the outstanding supply today. Over the last several years, however, demand for GBTC dissipated, and shares moved to a substantial discount as competition increased behind the launch of other private funds and publicly-listed trusts, Bitcoin Futures ETFs, and easier direct bitcoin access through an ecosystem of increasingly reliable exchanges and custody providers.

Due to the various shortcomings inherent in GBTC’s structure, Grayscale has long been committed to converting GBTC into an ETF, first seeking approval in 2017. Grayscale’s application, like the others before it, was denied on the grounds that the risk of fraud and manipulation in the unregulated spot market caused the listing exchange to fall short of its burden under the Securities Exchange Act of 1934 (“1934 Act”) that require it to be “designed to prevent fraudulent and manipulative acts.”3,4,5 While progress was stymied for several years, a shift in the SEC’s positioning led to the approval of Bitcoin Futures ETFs in October 2021, a move that catalyzed Grayscale’s second filing for a spot Bitcoin ETF. Importantly, since the price of CME Bitcoin Futures settle based on an index derived from the spot price of bitcoin across several exchanges, some argued that it made little sense to treat spot and futures-based ETF proposals differently from the perspective of preventing fraudulent and manipulative acts, particularly given that many of the spot filings proposed striking their NAV off an index resembling the one used in the settlement of CME Bitcoin Futures.6 Nevertheless, Grayscale’s prospects quickly turned bleak as a similar spot Bitcoin ETF filing from Van Eck was rejected in November, weeks after futures ETFs were listed, illustrating the divergence in the SEC’s treatment of spot and futures-based ETF proposals.7,8

Grayscale quickly went on the offensive, aiming to convince the SEC of its filing’s merits ahead of the July 2022 decision deadline. First was a publicly-filed memo from Davis Polk on Grayscale’s behalf arguing that rejection on similar grounds as the Van Eck denial, in light of the Commission’s recent clearance of Bitcoin Futures ETFs, would “unfairly discriminate between issuers” in violation of the 1934 Act and “would constitute arbitrary and capricious action” under the Administrative Procedure Act.9 Adding to its aggressive posture in early 2022, Grayscale launched a public advocacy campaign spurring investors to write to the SEC in support of its conversion, culminating in the SEC’s receipt of more than 11,500 pro-Grayscale letters. The company’s forward posturing continued into the SEC’s decision deadline, with Grayscale routinely threatening legal action before publicly bolstering its legal team in early June, retaining the former Solicitor General, Donald B. Verrilli, Jr., to argue its case in court if necessary.

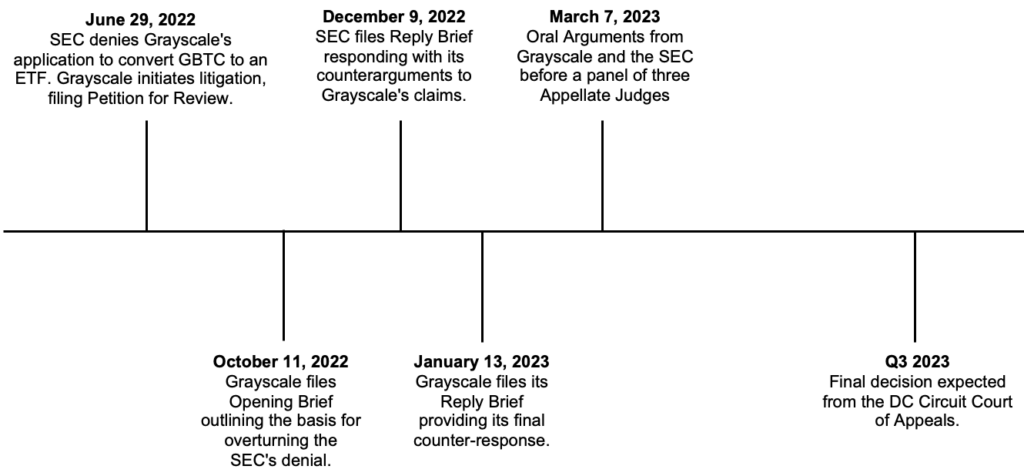

Despite Grayscale’s efforts, its filing was denied in June 2022, and Grayscale immediately initiated a lawsuit by filing a Petition for Review with the Court of Appeals for the D.C. Circuit.10 Grayscale filed its opening brief outlining why the SEC’s decision should be overturned, the SEC responded with its counterarguments, and Grayscale submitted its final counter-response, but it wasn’t until the oral arguments later in March 2023 that sentiment around Grayscale’s chances shifted as the panel of judges appeared sympathetic towards Grayscale’s case, pressing the SEC on several of the perceived inconsistencies in previous orders. In fact, Bloomberg’s Senior Litigation Analyst, Elliott Stein, believes Grayscale’s odds of victory rose from about 40% to 70% over the course of the arguments.

While the odds of Grayscale winning its lawsuit against the SEC appear to have increased, there are still a number of outcomes that may emerge as a decision in Grayscale’s favor simply dismisses the SEC’s disapproval order but does not imply approval or that an ETF conversion will be feasible. Don Verrilli outlined three paths the SEC could take under these circumstances: it could approve Grayscale’s application for a spot Bitcoin ETF, it could deny the application on newly introduced grounds as to why spot and futures ETFs should be treated differently, or it could renege on its approval of Bitcoin Futures ETFs entirely. While still highly uncertain, the last option seems the least likely as the first 2x Leveraged Bitcoin Futures ETF was approved in June 2023 after the oral arguments occurred, setting a new precedent that hadn’t been allowed historically. Lastly, despite anticipating a decision in Q3, any decision is not necessarily final, as either party could appeal the decision to the Supreme Court.

Grayscale vs. SEC Lawsuit Timeline

Source: GSR, Grayscale.

BlackRock Files for the iShares Bitcoin Trust

Optimism around the prospects of a US-listed spot Bitcoin ETF rose to its highest level in years after BlackRock, the world’s largest asset manager, unexpectedly filed for a spot Bitcoin ETF on June 15th, 2023. Perhaps encouraged by the progress in Grayscale’s lawsuit or due to its ability to maneuver through the politicized regulatory environment, the catalyst for BlackRock’s foray into the Bitcoin ETF arena remains unknown. Regardless, BlackRock is not known for filing long-shot applications, leading many to theorize that BlackRock has some informational edge versus competitors or simply has the political pull to gain approval. Moreover, SEC Chair Gensler has publicly stated his belief that all cryptocurrencies except bitcoin are securities, and as some have accused the SEC of overstepping its boundaries, some hypothesize that approving a spot bitcoin ETF would be a way for the SEC to concede some room while maintaining its current regulatory posture. Conversely, other industry pundits believe the optics and the perception of undue influence on the SEC may be too challenging of a headwind to overcome. Nevertheless, the filing has sparked a direct collision course between BlackRock’s astonishing 575-1 track record of getting its ETF applications through the SEC and the SEC’s 33-0 track record of denying spot Bitcoin ETFs.

While BlackRock’s submission mostly resembles previous filings from Grayscale and various others, the addition of a new surveillance sharing agreement (SSA) is the most notable distinction adding to hopes for an approval. As previously mentioned, all past spot Bitcoin ETF denials have argued that the risks of fraud and manipulation in the unregulated spot market prevent the listing exchange from meeting the 1934 Act requirement to be “designed to prevent fraudulent and manipulative acts.” And while we leave much of the legal minutiae for the footnotes, the SEC has routinely stated that one approach to satisfying this requirement would be entering into a surveillance sharing agreement with a “regulated market of significant size” to give the listing exchange “the ability to obtain information necessary to detect, investigate, and deter fraud and market manipulation.” Historically, most filers have argued that an SSA with the CME sufficiently meets this criteria for spot bitcoin, but the SEC has previously rejected this claim, arguing such an agreement is only sufficient to meet this criteria for Bitcoin Futures (which is a cornerstone of Grayscale’s lawsuit).11 BlackRock’s filing notably goes a step beyond prior attempts, however, adding an SSA with a large U.S.-based spot bitcoin trading platform, which it later clarified to be Coinbase, to enhance the Nasdaq’s surveillance capabilities, in addition to an SSA with the CME. While many have highlighted the SSA with Coinbase as the key to approval, the path ahead still remains incredibly uncertain as Coinbase would fail to meet the SEC’s criteria of a regulated market and is currently being sued on these grounds despite arguably meeting the significant size criteria. Nevertheless, other filers, like Ark 21Shares and many others, believe the spot market SSA could be helpful and have subsequently amended or refiled their 19b-4s to include similar language.

Additionally, BlackRock’s filing incited a host of previous filers to refile and enter the SEC’s review queue. Prior to BlackRock’s filing, the Ark 21Shares Bitcoin ETF was the only outstanding application awaiting SEC review, but Bitwise, VanEck, WisdomTree, Invesco, Valkyrie, and Fidelity have since refiled in the aftermath of BlackRock’s filing, and we anticipate more could soon follow. Unlike BlackRock though, none of these follow-on applicants are new filers, and they have all applied and been denied historically. Moreover, we agree with Bloomberg ETF Analyst Eric Balchunas’ conclusion that the additional filings do not impact the probability of approval but are simply applicants re-entering the review queue under the guise that BlackRock may have a path to approval.

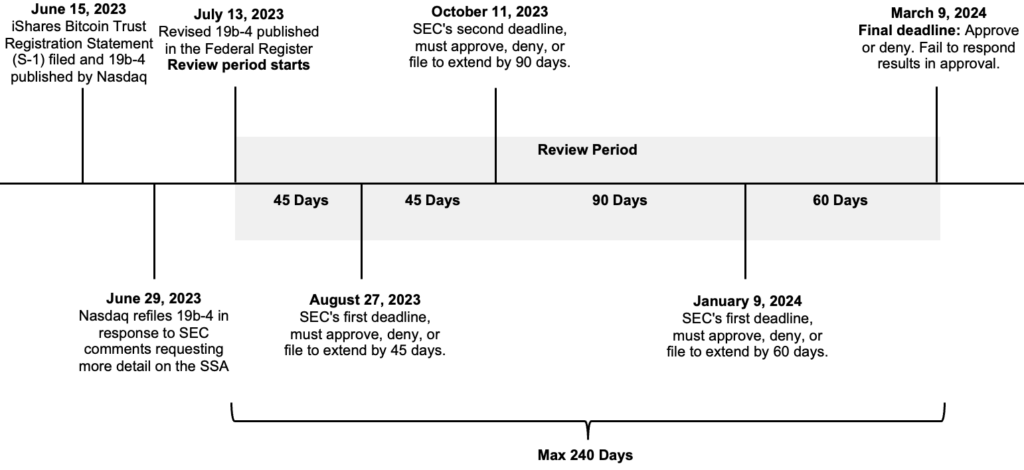

Looking ahead, we can gain a sense of each applicant’s position in the SEC’s review queue based on the agency’s response deadlines. After an exchange files a 19b-4 seeking approval to list shares of a new ETF, the SEC conducts an initial review of the filing before publishing it in the Federal Register. The timeline for the initial review can vary, but it’s typically in the realm of one or two weeks, and the formal review window only begins after the 19b-4 is published in the Federal Register. Once published and the review window begins, the SEC has at most four decision points, with the ability to approve, deny, or extend the review period at each point except for the last decision point, where the review period can no longer be extended. The deadlines are at days 45, 90, 180, and 240, and if the SEC fails to respond after 240 days, the filing is deemed approved. The Ark 21Shares’ filing is at the front of the queue after being posted to the Federal Register on May 15, 2023. Every other filing is still in the initial review period, and while there is a few days of dispersion between the initial filing dates, it remains to be seen if they will be posted to the Federal Register on the same day or if certain filings will be posted earlier and gain advantageous positioning in the queue. Lastly, given the SEC retains the flexibility to act ahead of these deadlines, in addition to the incremental uncertainty from Grayscale’s court case, the actual response dates cannot be pinpointed, but only the latest potential response dates can be determined. For example, the SEC could attempt to enable a fair launch, approving all viable products simultaneously ahead of the earliest review deadline (i.e., irrespective of queue positioning). However, the SEC did not take this approach with the launch of Bitcoin Futures ETFs, and ProShares’ Bitcoin Futures ETF raised ~$1b more than any competitor as a result of being first to market, so the importance of queue positioning cannot be understated given the recent history (i.e., the SEC may wait for each product’s individual response deadline).

iShares Bitcoin Trust SEC Response Deadlines

Source: GSR, Pear Protocol, U.S.C. 78s(b)(2)(B)(ii). Estimated timeline as of July 5th. Note: The SEC’s clock only starts after the 19b-4 is published into the Federal Register, and since the time between filing and publishing into the Federal Register varies, we built this timeline relying on the assumption that it would take two weeks. The review period timeline should be updated based on the date the 19b-4 is actually posted to the Federal Register. Additionally, note that this is the estimated timeline for BlackRock’s filing and the SEC could act before these deadlines. Lastly, Ark 21 Shares is currently first in the queue, with its filing submitted to the Federal Register on May 15, 2023. Ark 21Shares’ respective deadlines can be determined by adding 45, 45, 90, and 60 days to the May 15, 2023 starting point; its next deadline is August 13, 2023 and its final deadline is January 10, 2024.

Conclusion

Despite a decade-long path riddled with rejection, optimism for a US-listed spot Bitcoin ETF has returned in the wake of several prominent developments, most notably Grayscale’s lawsuit versus the SEC and the announcement of BlackRock’s spot ETF filing. The improvement in sentiment is palpable and can be proxied by observing the discount on Grayscale’s GBTC shares, which narrowed by 6.4% and 5.1% during the one-day periods encompassing these events. Additionally, the discount continued to narrow in the days after BlackRock’s announcement after other asset managers quickly followed suit, including Bitwise, who had stated that there was “no path forward” just a few months earlier. Lastly, sentiment was further bolstered by the recent approval of a leveraged Bitcoin Futures ETF that highlights the SEC’s growing comfort with Bitcoin-based products. While optimism has clearly returned alongside a real improvement in the prospect of approval, the path ahead remains uncertain. Even the most optimistic ETF analysts peg the chance of approval at just ~50% by year-end. And with GBTC’s discount still at ~27%, the market is far more skeptical about GBTC’s near-term chances of approval. Nevertheless, this year’s developments certainly add credence to the view that a US-listed spot Bitcoin ETF is only a matter of time.

Footnotes:

- The required holding period for GBTC was initially one year, but it was reduced to six months beginning in 2020 after GBTC became an SEC reporting company, with its shares registered pursuant to Section 12(g) of the 1934 Act.

- There was a creation mechanism historically via the private placement, but it operated on a delay given the holding period requirements before the private shares could be exchanged on the secondary market. Imagine there’s a substantial amount of demand for shares but no ability to create more shares in real-time, then the shares begin to trade at a higher price (premium) relative to the value of bitcoin they represent (NAV). Conversely, if demand dissipates and everybody wants to exit, everyone is fighting for secondary market liquidity without the ability to redeem the shares for the underlying assets, so the shares begin to trade at a lower price (discount) than the value of the bitcoin they represent. Enabling a redemption mechanism would allow the billions of dollars in value trapped in the discount to be unlocked in an environment like today.

- An application for a spot Bitcoin ETF is actually two filings: 1) An S-1 registration statement registering the shares for sale under The Securities Act of 1933 (“1933 Act”) that provides information about the fund, investment strategy, risks, fees, etc. and 2) a 19b-4 submitted by the listing exchange (e.g., NASDAQ, NYSE, CBOE) proposing a rule change that would enable the shares to be listed on a national securities exchange, which the SEC evaluates to ensure consistency with the requirements of the 1934 Act. The word “approval” is commonly used colloquially to indicate that the SEC allowed shares to be sold to investors and listed on an exchange. However, the SEC technically does not “approve” any registration statements but would declare them “effective” to “ legally offered to the public if they’ve met the legal requirements. In the case of a 19b-4, the SEC may grant “approval of a rule change,” but this again isn’t an approval or endorsement of the security but an approval of the proposed rule change enabling the shares to be listed.

- Grayscale’s first application was technically not denied but withdrawn. This is a technicality and simply means that the proposed listing exchange withdrew the 19b-4 after it became clear that the application would be denied. In this case, two 19b-4 filings of competitors were denied, and thus NYSE withdrew the application.

- See The Crypto Conundrum for a deeper dive into the legal and political history of Bitcoin ETFs in the US. The summarized argument is that each application “failed to demonstrate that the proposal was consistent with the requirements of Section 6(b)(5) of the 1934 Act and, in particular, the requirement that the rules of a national securities exchange be designed to prevent fraudulent and manipulative acts.” The SEC determined this requirement may be satisfied by entering into a surveillance sharing agreement (SSA) with a “regulated market of significant size” in order for the listing exchange to have “the ability to obtain information necessary to detect, investigate, and deter fraud and market manipulation.” The SEC defines “significant size” by a two-pronged definition: 1) a market in which there is a reasonable likelihood that anyone attempting to manipulate the ETP would need to trade on this market, and 2) it is unlikely that trading in the ETP would be the predominant influencer on price discovery in this market. Spot Bitcoin ETFs have continued to be denied for failing to establish a “surveillance-sharing agreement with a regulated market of significant size related to bitcoin.” Bitcoin Futures ETFs were first denied in 2018, and the SEC argued that insufficient evidence was provided to illustrate that the CME Bitcoin Futures market was of “significant size,” but it has since stated that the CME is a market of “significant size” relative to the CME Bitcoin Futures market, clearing the path for Bitcoin Futures ETFs.

- Credible arguments have been made by Nasdaq, Davis Polk, and various others that spot Bitcoin ETFs constrained to in-kind creations/redemptions are even less manipulation prone than futures-based constructions. Since Bitcoin Futures ETFs are cash-settled to an index price, they are exposed to any manipulation of that index price to the extent manipulation is possible. Conversely, spot Bitcoin ETFs could remove the impact of price manipulation entirely by removing support for cash creations/redemptions and only allowing in-kind creations/redemptions. Since the Trust represents fractional ownership of the underlying bitcoin, and since shares are only created or redeemed in-kind, authorized participants could source bitcoin from any venue of their selection, and there is no need for an external bitcoin price to determine the value that shareholders are owed. See page 23 for a further explanation.

- The SEC aimed to justify its disparate treatment of the two ETF construction approaches on the grounds that Bitcoin Futures trade on the CME, a distinct CFTC-regulated venue that shares market surveillance information with the ETF’s listing exchange, making the CME “a ‘significant market’ related to CME bitcoin futures contracts” (a tautology). Conversely, the Commission has argued that spot filers have not established that the CME Bitcoin Futures market is of “significant size” with respect to the bitcoin spot market. Many industry participants would argue this is an arbitrary difference as it pertains to protection from fraudulent and manipulative acts, given the same pricing sources (spot) dictates the price of spot and futures markets. In fact, the SEC acknowledges the connection between spot and futures explicitly in the Teucrium approval order, where the SEC states, “the Commission is not persuaded that the market for CME bitcoin . futures contracts ‘stands alone;’ ‘has a lack of connection’ with, and is ‘not specifically materially influenced’ by, other bitcoin markets; nor that it is ‘the primary, if not the lone determinant, of its valuation.’” The same order also states, “the CME’s surveillance can reasonably be relied upon to capture the effects on the CME bitcoin futures market caused by a person attempting to manipulate the proposed futures ETP by manipulating the price of CME bitcoin futures contracts, whether that attempt is made by directly trading on the CME bitcoin futures market or indirectly by trading outside of the CME bitcoin futures market.” This latter SEC quote comes with a seemingly arbitrary accompanying footnote stating, “this reasoning, however, does not extend to spot bitcoin ETPs.” The logic of this footnote was questioned by Judge Rao during the oral arguments and was highlighted as clearly being a reservation ahead of the agency’s deadline to respond to upcoming spot filings

- SEC Commissioner Pierce has issued multiple dissents (here, here, and here) arguing that other commodity ETFs would be in peril if the SEC historically held them to the same standard as bitcoin. She was joined by Commissioner Uyeda in the latest Van Eck dissent in 2023, stating that the inconsistent process applied to spot Bitcoin ETPs versus other commodity-based ETFs is “arbitrary and capricious” given the lack of evidence or reason for changing the standard.

- David Polk filed a second memo in April 2022 reiterating its earlier claims and doubling down on them with added evidence after the SEC approved Teucrium’s Bitcoin Futures Fund, which like the proposed spot ETFs, is not registered under the Investment Company Act of 1940 (“1940 Act”).

- Note that the SEC does not need to respond on the day of its deadline; Grayscale’s filing was denied seven days before the SEC’s actual deadline.

- See footnote 5 for a review of the historical context.

Authors:

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Sources:

The Crypto Conundrum, GBTC Lawsuit – Grayscale, GBTC SEC Lawsuit Q&A – Grayscale, Davis Polk Letter, Grayscale Opening Brief, Grayscale Oral Arguments Transcript, Craig Salm – Grayscale CLO, James Seyffart – Bloomberg ETF Analyst, Eric Balchunas – Bloomberg ETF Analyst

Additional sources include every SEC application and denial hyperlinked herein.

Required Disclosures

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.