MACRO + CRYPTO SUMMARY

The CPI on January 12th was in line with expectations and caused market participants to expect a smaller hike at the Fed’s next meeting (the probability of a 25 bp hike increased at the expense of a 50 bp hike). A mild risk-on mode ensued and added support to risk assets in particular. Crypto markets performed extremely well with BTC up 30% and ETH up 20%, though there were no clear smoking guns as to the exact cause. The odds of a smaller Fed hike now appears priced in, and the market is clearly hoping for a dovish Fed. The Bank of Canada hiked rates and explicitly signaled it will hold rates here, a policy pivot that is often well-coordinated between central banks.

RATES, FUNDING AND BASIS

The rally in crypto markets over the last two weeks has left its mark on the perp funding markets, with funding rates in BTC and ETH seeing sharp moves higher across venues. Funding rates arguably should not move deeply positive in efficient markets, as arbitrageurs with a lower cost of USD capital come in to take advantage. One effect of the collapse of FTX, however, has been a greater awareness of exchange credit risk, which may make such funding rate biases much more persistent.

OTC lending markets continue to slowly pick up, with survivors recalibrating their risk models and new players carefully treading the waters. There is an indisputable demand for unsecured capital in the market, and a need for yield among holders of that capital – the market just needs to find the right balance to start operating again.

DERIVATIVES

BTC Derivatives

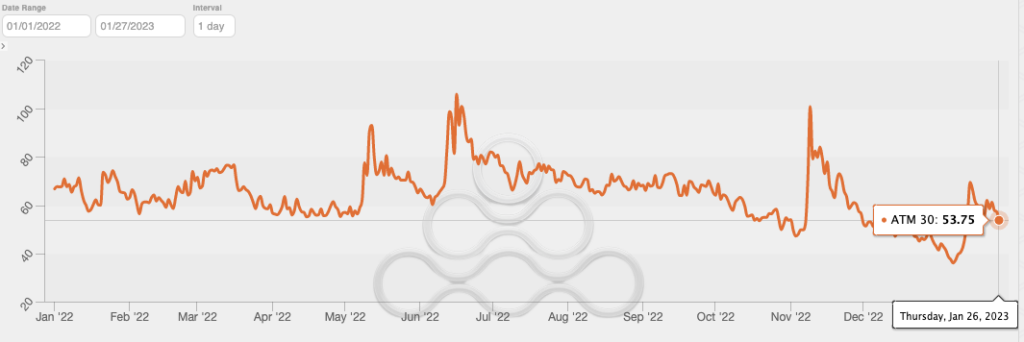

30-day BTC volatility is currently 54% after having ranged from 36% to 70% this year and currently shows a tight correlation with the market direction (volatility firms as prices rally). 30 day realized vol is 40% after an exceptionally quiet December where daily realized was ~28%.

BTC ATM Implied Volatility (30 Day)

Source: Amberdata, GSR

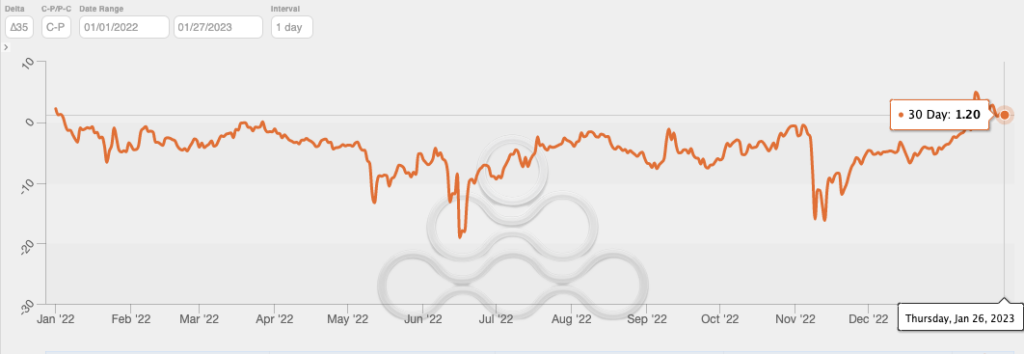

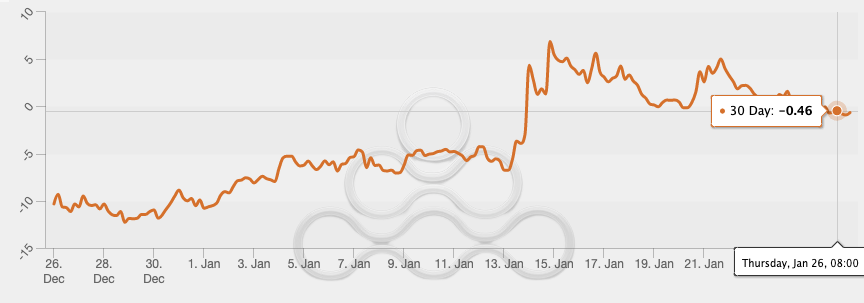

30 day BTC call skew is 1.20 (calls are now over puts), signaling continued bullish sentiment. While this is off the highs of 5.0, it is still above average.

BTC 35 Delta Call Skew (30 Day)

Source: Amberdata, GSR

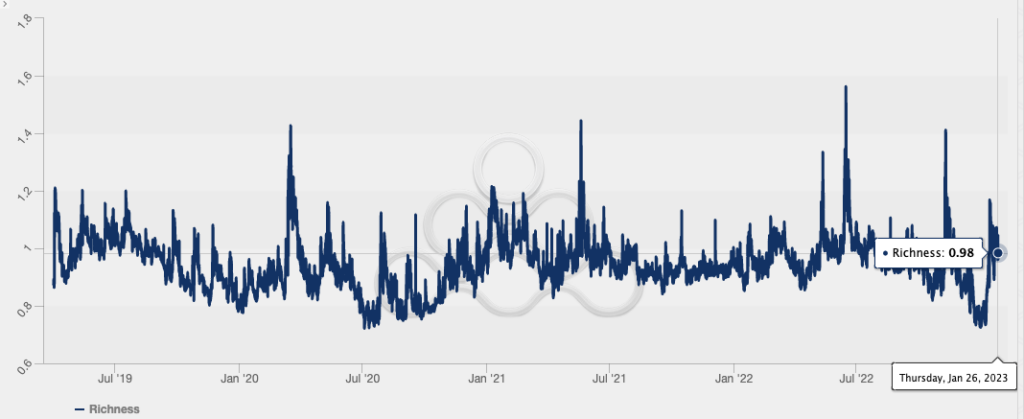

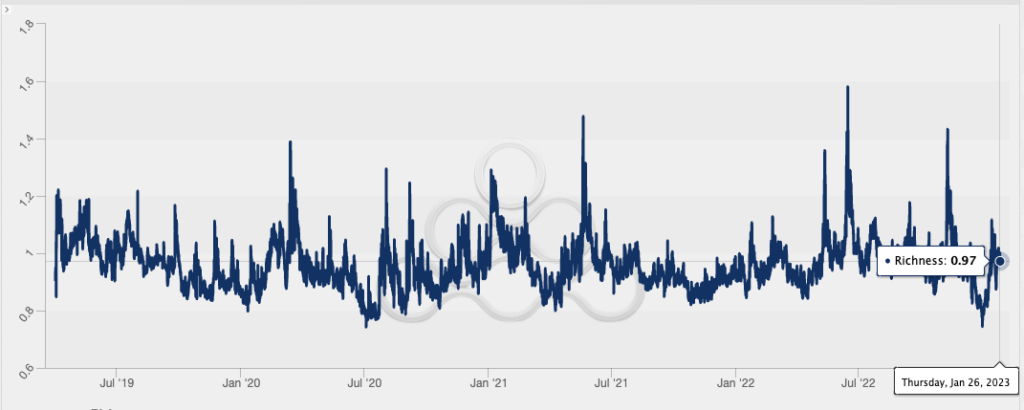

The term structure is currently flat at 0.98, reflecting recent gamma performance and the upcoming FOMC meeting that concludes on February 1st.

BTC Term Structure Richness

Source: Amberdata, GSR

ETH Derivatives

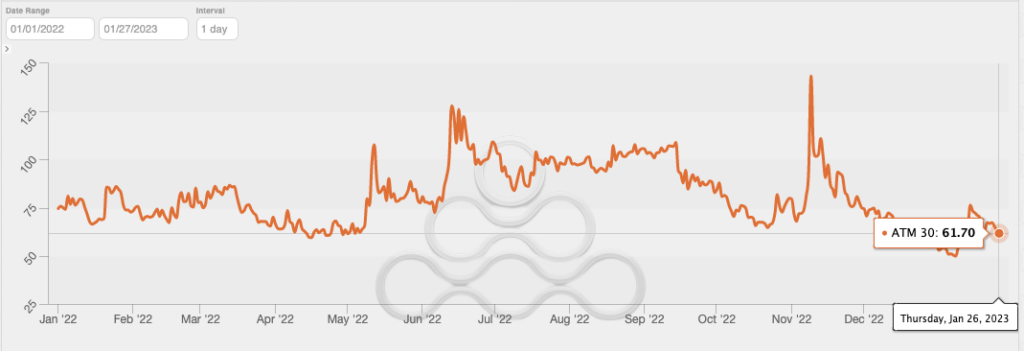

30 day ETH vol is currently 62% after having ranged from 50% to 76% and is also historically low. However, 30 day realized vol is still only 46%.

ETH ATM Implied Volatility (30 Day)

Source: Amberdata, GSR

30 day ETH call skew is rich at -0.4 (calls are slightly under puts), reflecting the BTC dominant rally.

ETH 35 Delta Call Skew (30 Day)

Source: Amberdata, GSR

ETH term structure is relatively flat at 0.97.

ETH Term Structure Richness

Source: Amberdata, GSR

FLOWS AND LIQUIDATIONS

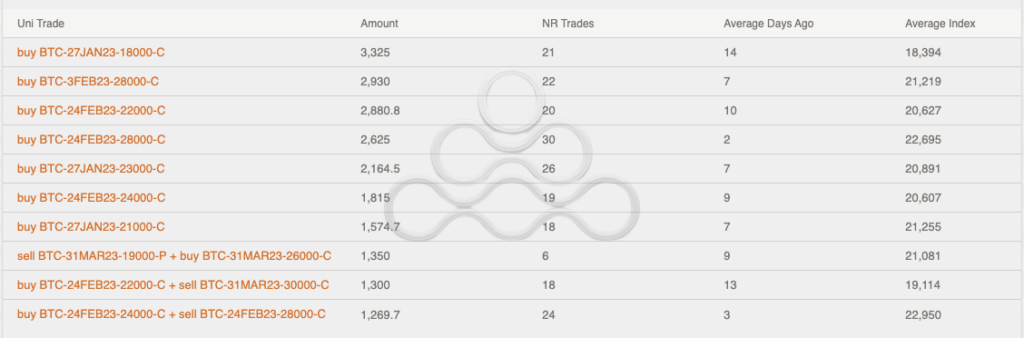

Some of the most interesting flow over the past two weeks has been the demand shown in the 27JAN23 18K calls. There is a lot of upside buying happening through block trades on Deribit, mainly targeting the short-dated side.

Deribit BTC Block Trades, Last Two Weeks

Source: Amberdata, GSR

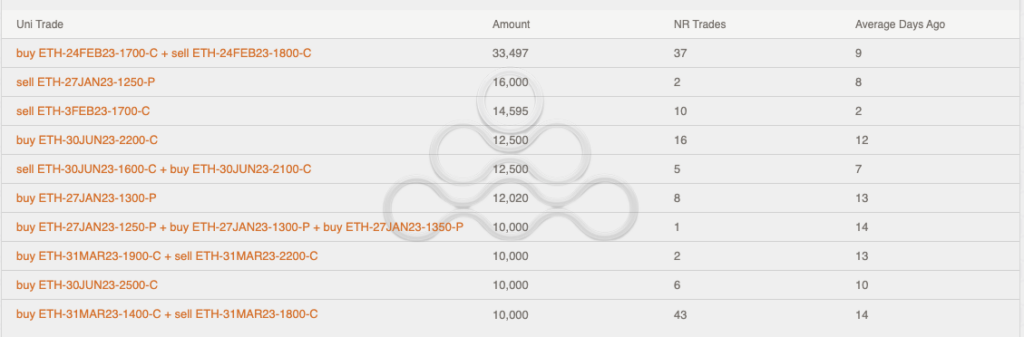

There isn’t an obvious narrative occurring in ETH, and sentiment in the options market paints a picture of indecisiveness. This can be seen across a variety of activity/strategies, including longer-dated call purchases, debit and credit call spreads opened, short-term put selling, short-term call selling, etc. Perhaps traders in ETH are focusing mainly on dislocations and opportunities in skew and term structure, while in BTC there is a very clear directional narrative playing out.

Deribit ETH Block Trades, Last Two Weeks

Source: Amberdata, GSR

Bitcoin liquidations have been relatively sporadic over the past few weeks, as we’ve seen some after-hours moves driven by liquidations into illiquid environments. Some noticeable pickups have been spotted, often on Friday’s but also more recently yesterday as we wicked up to $23,800.

BTC Liquidations

Source: Conalyze, GSR

In ETH, a similar picture has emerged, although some of the liquidations in ETH have caused noticeably larger moves percentage-wise than in BTC.

ETH Liquidations

Source: Coinalyze, GSR

Authors

Mike Pozarzycki – Macro & Crypto Summary

Ruchir Gupta – Rates, Funding and Basis

John Cole – Derivatives

Christopher Newhouse – Flows and Liquidations

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.