MACRO + CRYPTO SUMMARY

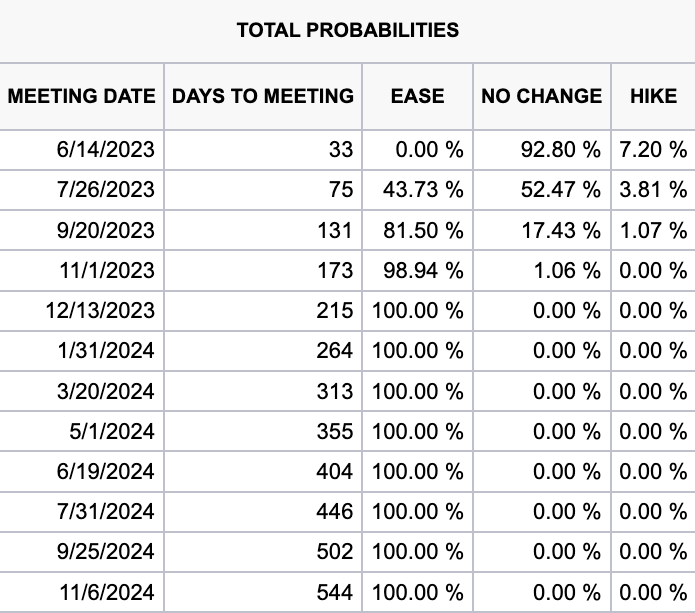

The Fed hiked rates another 25 bps last week to 5.00-5.25%, in line with market expectations. Although futures are pricing in 2-3 rate cuts by the end of the year, some may argue that the Fed will hold current rates for longer, with CPI remaining elevated (+4.9% year-over-year in April) and nonfarm payrolls growth remaining solid (+253,000).

The banking situation in the US remains fragile, with a number of regional banks still holding large unrealized securities losses and depositors making a run on the bank as a result. Case in point is First Republic, which was recently seized by the California banking regulator after experiencing significant deposit outflows, and its assets were subsequently sold to JP Morgan. Given continued banking worries, the SPDR S&P Regional Banking ETF fell 15% over the past month. With respect to crypto, many US banks appear tentative to bank digital asset clients, though several non-US banks are increasing their efforts to gain market share.

Fed Funds Probabilities

Source: CME, GSR

RATES, FUNDING AND BASIS

Fed Funds Rates in the US have touched 5%. The divergence between traditional “risk free” rates compared to onchain yields offered by the likes of Aave and Compound continues to grow. When combined with the increased risks associated with transacting onchain, many market participants appear to favor deploying excess capital into traditional markets, at least for now.

Limited access to fiat rails, in conjunction with increased regulatory scrutiny and tax considerations, continue to pose a challenging environment for many crypto institutions. Although we’ve seen an increasing number of market participants try to offer solutions to bridge this gap, either via fund or SPV solutions, there continues to be a sizable growth opportunity in the space.

DERIVATIVES

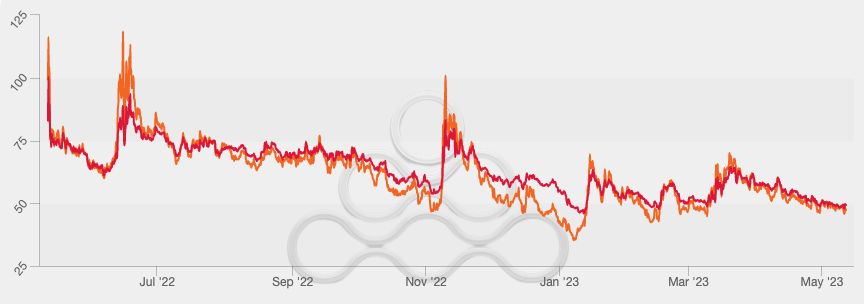

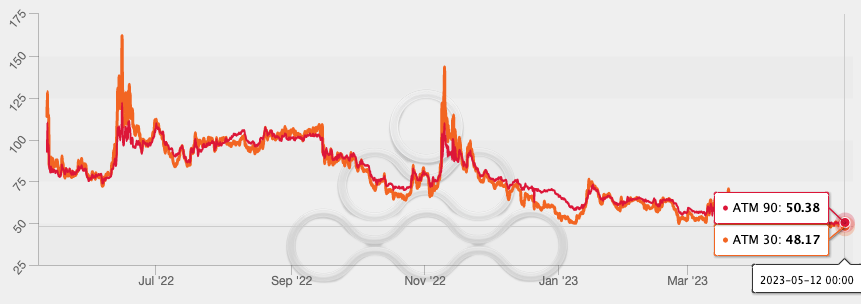

Both BTC and ETH implied vols have compressed considerably over the past few months from the elevated levels at the start of the year and in March.

BTC’s rolling 30 day ATM implied vol hovers around 48% (11th percentile over a one-year lookback), with realized vols around 43%.

BTC ATM Implied Volatility (30 and 90 Day)

Source: Amberdata, GSR

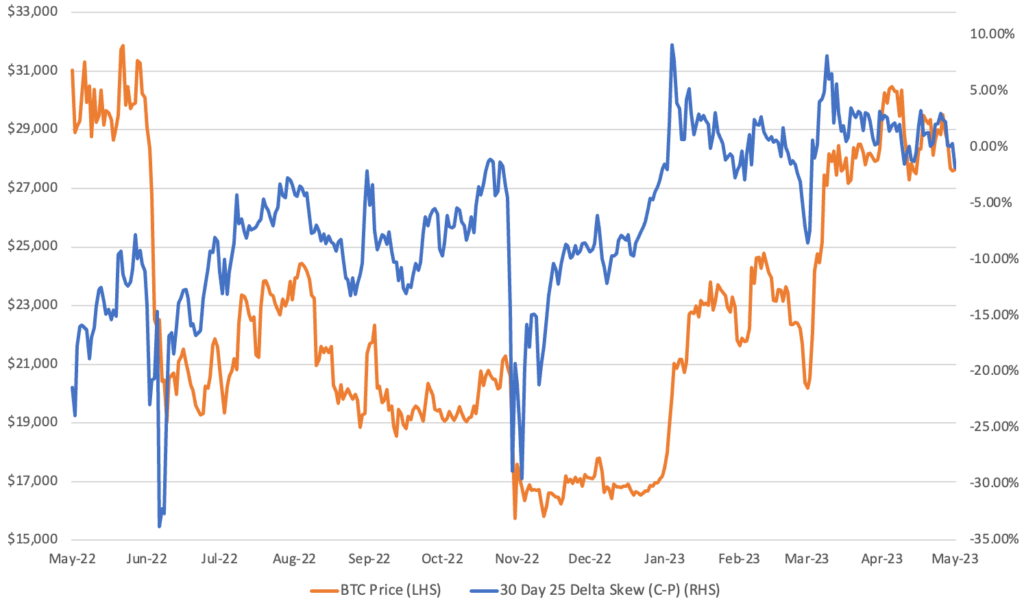

Although less pronounced when compared to the start of the year, we continue to observe positive spot-vol correlation in BTC, with 30 day 25D skew hovering around -2% (69th percentile over a one-year lookback) with calls trading under puts.

BTC Price vs 30 Day 25D Skew (C-P)

Source: Amberdata, GSR

The market is pricing the 30 day ATM implied vol difference between the majors around historic lows (1st percentile over a one-year lookback).

ETH ATM Implied Volatility (30 and 90 Day)

Source: Amberdata, GSR

ETH 30 day risk reversals remain relatively elevated compared to earlier in the year at -1.79.

ETH – BTC ATM Implied Volatility Diff (30 Day)

Source: Amberdata, GSR

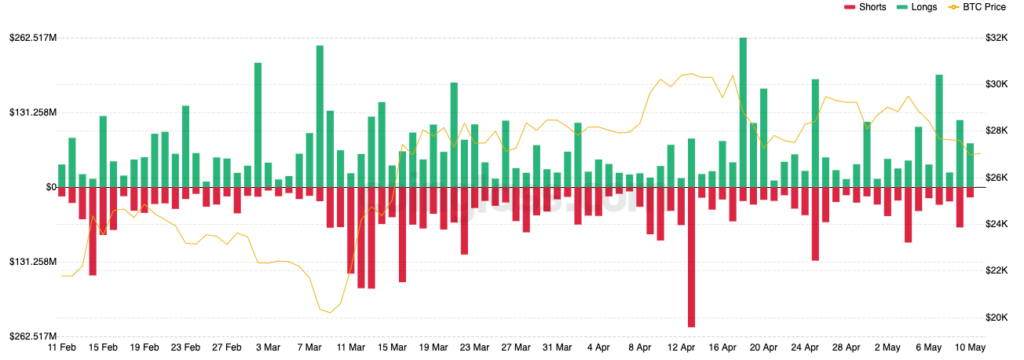

LIQUIDATIONS

Longs have continued to feel the brunt of the liquidations over the last two weeks, especially with yesterday’s sudden selloff. Despite this, the broader market has been relatively range bound and Bitcoin and Ethereum futures open interest has remained relatively stable.

Total Liquidations

Source: Coinglass, GSR

Altcoin Vol

Outside of some memecoins such as PEPE, volumes and volatility have been lower among most alts, as ETH and BTC continue to trade in the $27k- 30k range. Altcoin vols have followed the significant ETH vol selloff (60% to 50%) in the past month, a trend often seen when the market trades flat to down small as retail loses interest in alts and there are fewer random movements. The PEPE rally demonstrates that there is still fomo and greed in the market, but it seems to be targeting memecoins more so than other projects. This likely indicates that we are going to need a more significant rally in the majors before alts begin to gain substantial interest again.

DeFi

Memecoin mania continues to be the focus, with the number of wallets swapping on Uniswap close to an all-time-high. And it is not just ERC-20 tokens that are the rage, as traders have launched memecoins on the Bitcoin blockchain using Ordinals. Bitcoin network fees have soared as a result, with some blocks even seeing fees surpass the 6.25 BTC block reward for the first time since 2017.

Authors

Simran Singh – Macro & Crypto Summary

Ruchir Gupta – Rates, Funding and Basis

Simran Singh – Derivatives

Embert Lin – Liquidations

Mitch Galer – Altcoin Vol

Calvin Goh – DeFi

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.