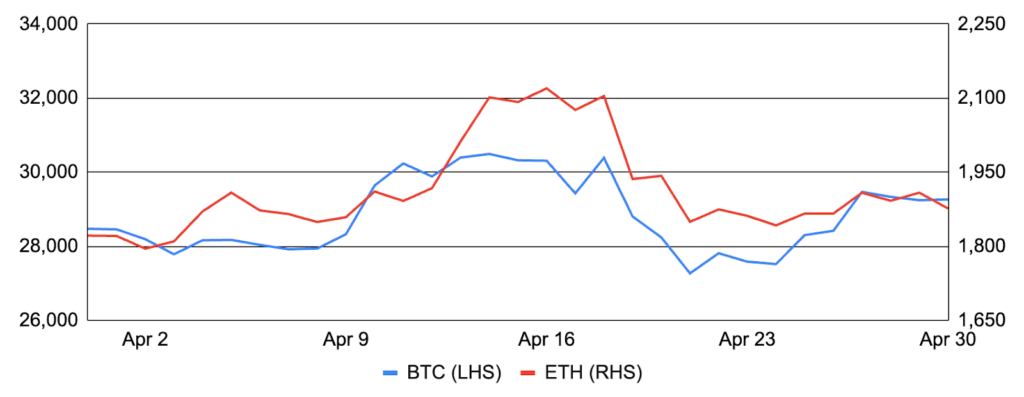

Bitcoin and Ethereum

Bitcoin delivered its fourth consecutive month of positive returns, increasing 3% after entering April at ~$28,500 and finishing at ~$29,300. Performance was solid through mid-month when gains were pared by nearly $550m of long crypto liquidations that arose between the 18th and 20th. The upward trend was reestablished later in the month as cracks in First Republic began to appear, somewhat resembling the price dynamics exhibited during the collapses of SVB and Signature. Gains were once again short-lived as a wave of long liquidations occurred, with the move falsely attributed to Mt. Gox and U.S. government selling initially. Beyond market movements, a growing number of Ordinal Inscriptions helped Bitcoin reach a new daily transaction record. Indeed, transactions in BRC-20 tokens, a fungible token standard experiment using text-based inscriptions, comprised more than half of all Bitcoin transactions on April 30th. Elsewhere, David Marcus’s Lightspark is seeking to bolster Bitcoin usage amongst institutions with the launch of its Lightspark Platform serving as the entrance to the Lightning Network for enterprises. Lastly, several presumably lost, inactive whale wallets sent hundreds of bitcoin in their first transaction in over a decade. The high level of activity led to vast speculation about the origin of the transfers, including claims that early wallet generation tools may have been cracked.

Ethereum also returned ~3% in April after entering the month at ~$1,825 and finishing above $1,875. Onchain activity continued to accelerate, and the total ETH supply decreased by more than 52,000, breaking the monthly supply reduction record for the fourth consecutive month. On the development side, the successful rollout of the Shapella upgrade enabling staked ETH withdrawals was the headline and is detailed more below. With Shapella now in the rearview, the next upgrade, dubbed Cancun, took center stage at last week’s All Core Devs Execution call. While the full scope of Cancun is still up for debate, scaling is the clear focus as Protodanksharding (PDS; EIP-4844) was confirmed as the headline EIP alongside several smaller additions. Ethereum’s layer 2 throughput is expected to increase tenfold once PDS is implemented with Cancun later this year. It was also a big month for ecosystem developments beyond the core Ethereum protocol, particularly in the MEV space. Flashbots introduced a beta version of its MEV-Share protocol within Flashbots Protect, entitling users of its RPC endpoint to share a portion of the MEV profits generated from their transactions. Another competing MEV protection RPC endpoint called MEV Blocker was also launched during the month and similarly provides frontrunning/sandwich protection while returning at least 90% of MEV profits to users. Lastly, an exciting partnership named Operation Solo Staker emerged to directly incentivize the geographic diversity of solo stakers. The program will pay accepted applicants in underrepresented regions to run an Ethereum validator, providing them with the required ETH capital, hardware, and software, all with operational risks minimized by Obol’s distributed validator technology.

BTC and ETH

Source: Santiment, GSR

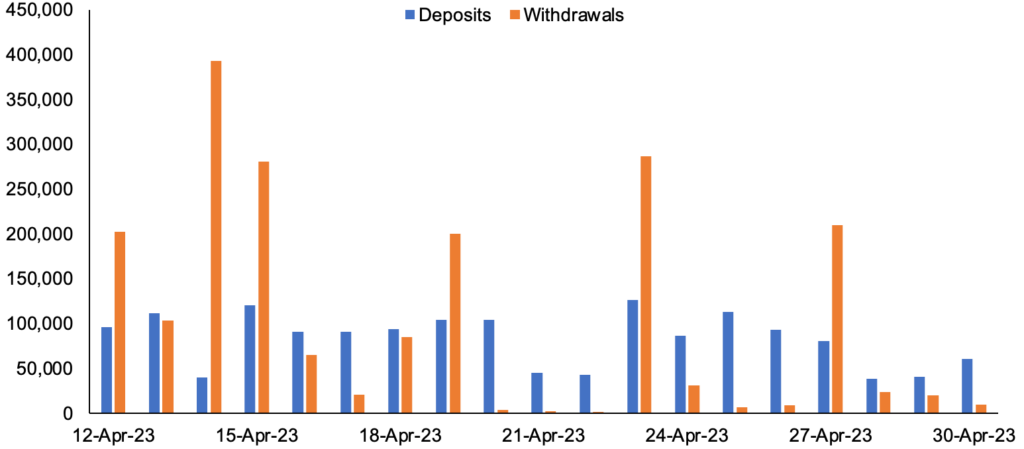

Recapping Withdrawals: Shapella

It was a historic month for Ethereum as developers implemented the Shapella upgrade on April 12th, enabling ETH staked in validator account balances to be pushed to a designated Ethereum address, providing direct (non-secondary) liquidity for staked ETH for the first time since the Beacon Chain’s launch in December 2020. Shapella completed the life cycle of Ethereum’s transition to proof-of-stake by introducing a two-sided market enabling staker entrants and exits, significantly reducing the risk of ETH staking as a result.

While a set of stakers using outsourced staking providers still do not have access to withdrawals as they wait for their providers to add support for Shapella, most large staking providers have already enabled withdrawals, with Lido the most prominent exception. Additionally, with Lido stakers having access to the deepest onchain liquidity and the ability to exit at virtually zero discount today, the total deposit and withdrawal data so far is seemingly representative of overall demand. By all accounts, Shapella did not manifest the ETH firesale that some anticipated as users gained liquidity on their stake. In fact, new ETH staking deposits already outpace withdrawals on most days, and the queue to begin staking ETH is more than twice as long as the queue to exit. Lastly, ~40% of all validator exits so far have come from Kraken’s legally compelled exit as a result of its settlement with the SEC. See our latest report on Shapella for deeper coverage of the upgrade.

Daily Validator Deposits and Withdrawals Since Shapella (ETH)

Source: beaconcha.in, GSR. Note: This doesn’t include queued entrances and exits, which would sum to a ~275k ETH deposit on a net basis if facilitated immediately.

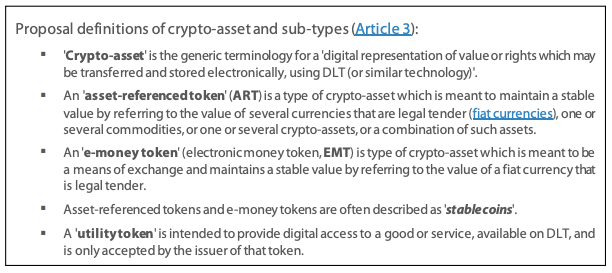

MiCA Passed by European Parliament

The European Parliament passed the EU’s landmark cryptocurrency regulatory framework, the Markets in Crypto-Assets (MiCA) on April 20, giving much-needed clarity across the 27-country bloc to token issuers, trading platforms, and other cryptoasset service providers. Specifically, MiCA defines three sub-categories of cryptoassets in e-money tokens, asset-referenced tokens, and other cryptoassets, and outlines the obligations of cryptoasset issuers and cryptoasset service providers (CASPs). The new rules apply to wallet providers, exchanges, and stablecoin issuers, though notably MiCA generally doesn’t cover lending and staking, decentralized finance, or NFTs and does not apply to cryptoassets already regulated by existing EU frameworks. Though some have expressed concerns for a heightened administrative burden on small firms, the response to MiCA has been quite positive, with the legislation anticipated to both protect consumers and spur adoption and innovation. The European Council is widely expected to approve MiCA on May 16 in the final administrative step before it comes into force around July, with major provisions kicking in 12-18 months later.

MiCA’s passage by the European Parliament wasn’t the only positive regulatory development during the month. Hong Kong is expected to launch its crypto licensing regime this month and give access to retail traders in June. In addition, the UAE approved a licensing regime for crypto service providers, and South Korea passed a first phase review of proposed digital asset regulations. The UK Treasury is reviving its Asset Management Taskforce. And several exchanges made progress, with Bybit establishing its global headquarters in Dubai, Kraken registering in Ireland, and Bitfinex receiving the first digital asset service provider license from El Salvador.

MiCA Cryptoasset Definitions

Source: Europa.eu, GSR

Coinbase Fights Back

After receiving a Wells Notice from the SEC in March for allegedly violating federal securities laws around its token listing process and staking services, Coinbase spent much of April defending itself. For one, Coinbase issued a written response to the Wells Notice, warning that it would be a “well-resourced adversary” and will “exhaust all avenues” if sued. Further, Coinbase filed a lawsuit in a federal court seeking to compel the SEC to respond to Coinbase’s July 2022 petition asking for more clear crypto regulations, as outlined in this blog post. Coinbase further received its first off-shore license from the Bermuda Monetary Authority, and Coinbase launched its international exchange subsequent to month-end, allowing non-US institutional users in approved jurisdictions to trade perpetual futures. Finally, at a recent conference in the UK, CEO Brian Armstrong hinted that Coinbase could leave the US, saying that “anything is on the table” if regulatory clarity doesn’t occur within the US within a reasonable timeline.

Coinbase wasn’t the only recipient of the harsh regulatory environment in the US. Binance.US, for example, abandoned its proposed $1b acquisition of Voyager, citing a “hostile” regulatory climate, while a CFTC commissioner stated there was no “immediate path forward” with Binance after the agency sued the exchange last month. The SEC also sued Bittrex alleging the crypto exchange sold unregistered securities and failed to register as a broker, exchange, and clearing agency (Bittrex subsequently announced its US exit). The SEC further reopened a proposal from last year, expanding the definition of an exchange that would require DEXs to register. In addition, the NYDFS will start charging crypto companies for supervision, Binance.US is reportedly unable to find bank partners in the US, and SEC head Gary Gensler refused to directly answer whether ETH is a security.

Memecoins

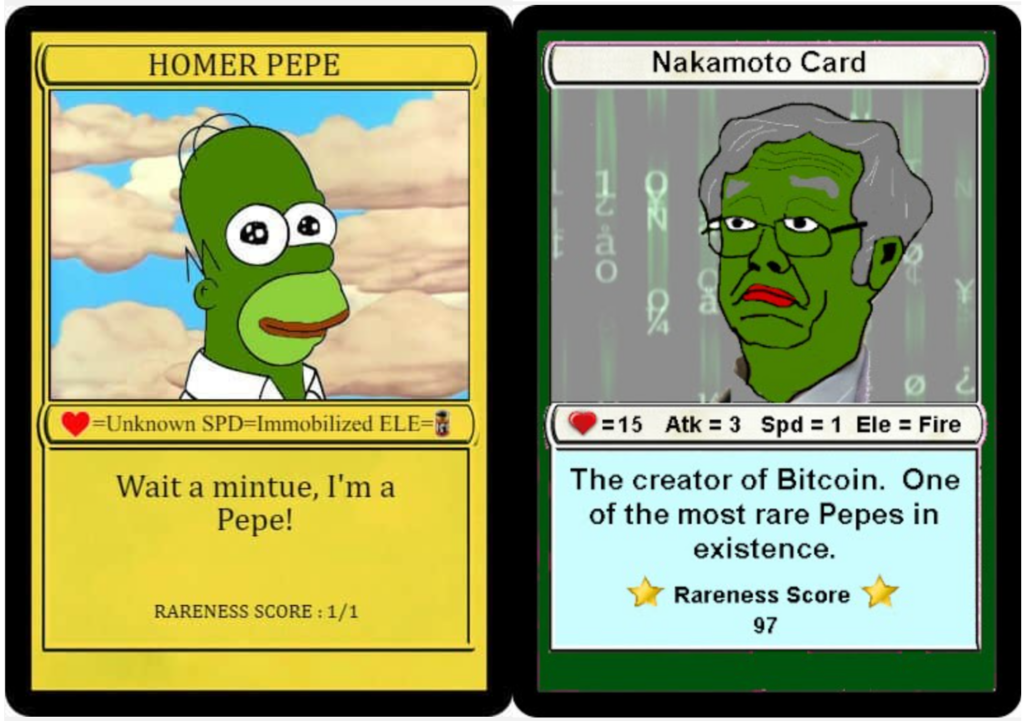

Several memecoin’s skyrocketed in value last month, bringing back memories of 2021. The frenzy was kickstarted on April 3 by Twitter, which changed its bird icon to Dogecoin’s shiba inu logo, causing DOGE to spike by as much as 32% before giving it all back over the following days. But the real frenzy started after the launch of PEPE, a Pepe the frog-themed memecoin, on April 14. First depicted in Matt Furie’s Boys Club comic, Pepe the Frog evolved into one of the internet’s most iconic memes due to its versatility in a wide set of situations. Moreover, Pepe’s prominence is especially notable in crypto due to Rare Pepe’s, one of the earliest NFT success stories where more than 1,700 community contributed Rare Pepe memes were tokenized and traded on the Bitcoin-based CounterParty platform. With such a rich history in crypto culture and a relatively fair deployment (contract ownership renounced and ~93% of the fixed supply LP’d alongside 2 ETH), PEPE quickly gained momentum. By the end of the month, PEPE’s market cap grew to ~$325m, a more than 70,000x increase from its initial deployment value, and stories of newly-minted millionaires became somewhat common. Soon, other memecoins took off, such as WOJACK and CHAD. While certainly entertaining, gains have been hard to monetize given the poor liquidity, and MEV bots such as jaredfromsubway.eth have been notoriously sandwiching memecoin traders (jaredfromsubway.eth used nearly 8% of all Ethereum gas over a 24 hour period largely due to this).

The Rarest of Pepes

Source: GSR

GSR in the News

- Coindesk TV – Bitcoin Seesaws Wildly Before Settling Above $29K

- Bloomberg – Bitcoin Whipsaws Traders After Failing to Hold $30,000 Again

- Fortune – Bitcoin is up 72% in 2023. Is Crypto Winter finally over?

- The Block – Bitcoin hurtles toward $30,000, wiping out millions in short positions

- Fortune – Decentralized exchange Vertex launches on Arbitrum with backing from Jane Street and Hudson River Trading

- Cointelegraph – Bitcoin reaches $30K — Is this the start of the next bull run?

- Yahoo! Finance – Cryptocurrencies continue rebound as some say crypto is ‘through the bear market’

- CoinDesk – Bitcoin Volatility Index’s Correlation With Price Flips Positive, Boosts Appeal of Bullish Call Options

Authors:

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Disclaimers

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.