Bitcoin and Ethereum

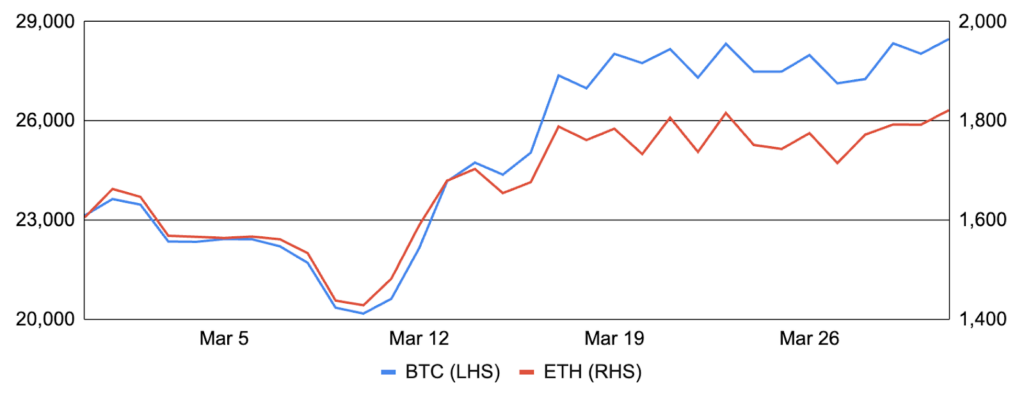

Following flattish price action in February, Bitcoin resumed its upward trend in March, rising ~23% after entering the month at ~$23,150 and finishing at ~$28,500. Amidst turmoil in the banking system, bitcoin benefited from its status as a non-sovereign digital reserve currency and from the rapid decline in interest rates / expectations of easing monetary conditions. In fact, many pointed to the Fed’s new Bank Term Funding Program as a stealth form of quantitative easing that similarly benefitted core Bitcoin narratives. Bitcoin meaningfully decoupled from equities, and its one month correlation to the S&P 500 fell to its lowest level since August 2021 at just 0.09. Outside of macro dynamics, it was also a prominent month for Bitcoin ecosystem developments. The ZeroSync Association was formed during the month to develop production-grade zero-knowledge proofs for Bitcoin. StarkWare sponsored the development, and the first planned application intends to broadcast chain proofs via Blockstream Satellite to allow full nodes to instantly sync even in the absence of an internet connection. In other Bitcoin-related news, the US government sold 9,861 bitcoin out of the more than 50,000 bitcoin it seized last November, and revealed plans to sell its remaining bitcoin in four tranches over the rest of the year. MicroStrategy acquired 6,455 more bitcoin, and it repaid its loan to Silvergate, recovering 34,619 bitcoin posted as collateral. And former Coinbase Chief Technology Officer Balaji Srinivasan bet $1 million that, spurred by the US banking crisis and resulting hyperinflation, the price of bitcoin would hit $1 million within 90 days (by June 17th).

While Ethereum underperformed bitcoin in March, it gained ~13% after entering the month at ~$1,600 and finishing above $1,800. Onchain activity remained elevated, and the total ETH supply decreased by nearly 35,000, breaking the monthly supply reduction record for the third consecutive month. MEV opportunities were abundant as USDC depegged, and a record ~5,100 ETH of MEV revenue was generated on March 11th alone. In addition, it was another big month for Ethereum ecosystem developments, highlighted by the deployment of the Shapella upgrade on the Goerli testnet, the final test before executing the upgrade on mainnet. Shapella will enable staked ETH withdrawals and developers further announced the mainnet deployment will commence on April 12th during epoch 194,048. Developers also deployed the official EntryPoint contract on mainnet as a key step in enabling Account Abstraction, the upgrade that’s expected to usher in the next wave of user experience improvements. In addition, Layer 2 developments were once again high, with Arbitrum’s airdrop occurring on March 23rd and its Foundation controversially selling 10m ARB tokens as the protocol transitions to a DAO. Additionally, zkSync launched the first zkEVM on Ethereum mainnet on March 24th, while Polygon launched a beta version of its zkEVM on mainnet just three days later. In other Layer 2 developments, ConsenSys launched its zkEVM public testnet and renamed it Linea, Taiko released its zkEVM Alpha-2 testnet, Starknet kicked off its DAO with its first governance vote, Conduit launched a managed rollup service leveraging the OP Stack, and Vitalik left an easter egg in the input data of the first Polygon zkEVM transaction (Select ‘Click to See More’, then View Input as UTF-8).

BTC and ETH

Source: Santiment, GSR

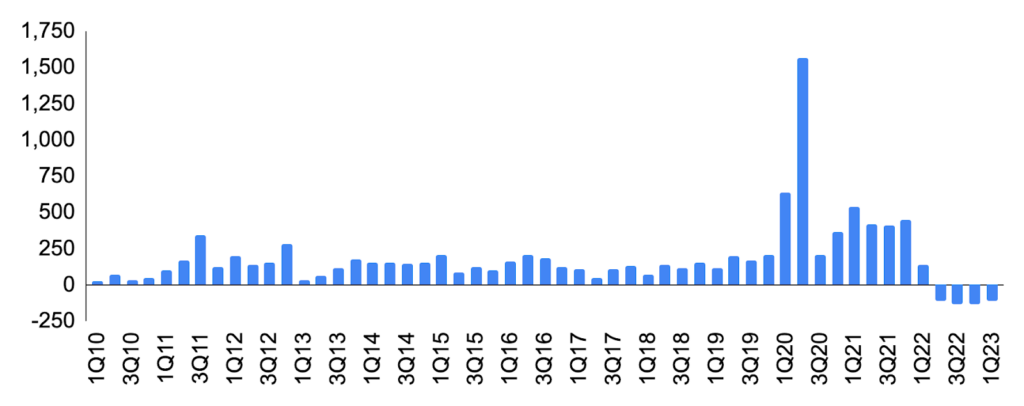

A Run on US Banks

Silvergate was a $16b bank based in La Jolla, California with a primary focus on serving digital asset customers. Its Silvergate Exchange Network (SEN), along with Signature Bank’s Signet, were key infrastructure for the digital asset industry, enabling clients to send and immediately settle US dollar transfers to others on the network 24/7/365, effectively tokenizing deposit accounts. Due to turmoil in the crypto industry and concerns around Silvergate’s activities with fraudulent crypto exchange FTX, the bank saw a massive 80% decline in total deposits in 4Q, requiring it to borrow $4.3b from the FHLB and liquidate $5.2b of securities to meet the withdrawal requests. Moreover, given the rise in interest rates, the securities were sold at a significant loss, contributing to a $1.0b loss in the quarter. While the bank survived this initial depositor drawdown, it filed with the SEC on March 1st to delay its annual report and additionally stated in the filing that it was evaluating its ability to continue as a going concern. This revelation sparked widespread panic and further withdrawals that culminated in the bank’s March 3rd announcement that it would close the SEN and its March 8th announcement that it intended to wind down operations and voluntarily liquidate the bank.

Banking troubles unfortunately did not stop there, with Silicon Valley Bank, a $212b asset bank based in Santa Clara, California focusing on tech startups and venture capital firms, next finding itself in the crosshairs. It all started after management announced the sale of $21b of securities at a $2b loss to reposition the balance sheet and increase forward earnings that when combined with large unrealized losses in its remaining securities portfolio and an expected moderate decline in deposits over the coming year, caused depositors to panic and run on the bank. Silicon Valley Bank saw $42b of withdrawals on March 9th alone, and regulators shut down the bank the very next day. On March 12th, state regulators seized Signature Bank ($110b in assets; New York, NY), purportedly on similar mass deposit withdrawals, though some, including Signature board member and former congressman Barney Frank, questioned whether Signature’s seizure was necessary. Regardless, Silicon Valley Bank and Signature Bank rank as the second and third largest bank failures in US history, and combined with Silvergate’s wind down, are a material setback for the digital asset and startup industries in the US.

Shortly after these bank failures, the Treasury, FDIC, and Federal Reserve issued a joint statement saying that all depositors of Silicon Valley and Signature will be made whole, and the Federal Reserve further introduced a new Bank Term Funding Program allowing banks to borrow cash using approved Treasury and mortgage backed securities collateral as an additional means for banks to generate liquidity without needing to sell securities during times of stress. While banking worries seamed to have calmed more recently, some US regional banks remain in the spotlight and such fears proved to be the final straw for Credit Suisse, which had been suffering from several unrelated issues beginning in 2021 and was ultimately acquired by its Swiss rival UBS for $3.2b on March 19th. For its part, the US government has stated it will increase bank support should the crisis worsen, but prefers to use targeted programs such as the BTFP rather than a blanket guarantee of all deposits or blunt tools like Fed Funds. For personal views on the cause of the bank runs, please see here for more information.

Quarterly Change in US Bank Deposits, $b

Source: Federal Reserve, GSR. Note: Uses all domestically chartered commercial banks and seasonally adjusted data. 1Q23 is through February.

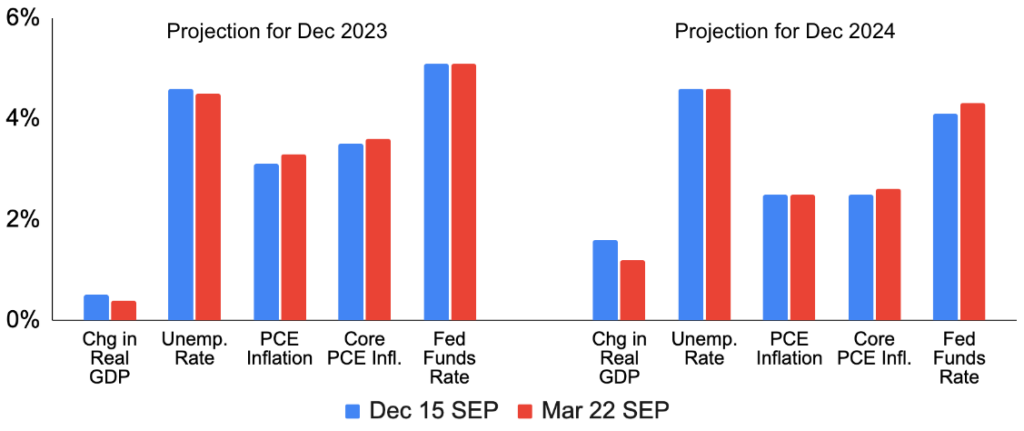

The Fed’s Conundrum

The banking crisis threw a monkey wrench into the Fed’s hiking plans, as the Fed finds itself needing to balance inflation and banking/economic worries. Indeed, inflation remains persistently high, with February’s CPI increasing 6.0% year-over-year and arguing for continued tightening. At the same time, however, many of the banking worries center around unrealized securities losses that have emanated from higher rates and there is also the real possibility that tighter bank credit causes a slowdown in the broader economy. As a result of this new consideration, market participants materially altered their expectations for the Fed, with implied probabilities for the recent March 21-22 FOMC meeting moving from considering a 50 bp hike coming into the month (76% chance of 25 bp hike & 24% chance of 50 bps hike) to contemplating a pause prior to the meeting (86% chance of 25 bp hike & 14% chance of a pause).

The Fed pulled off its balancing act, at least so far, hiking rates by 25 bps and providing even commentary in its post-meeting press conference. Powell stated that the banking system is sound and deposit flows have stabilized, but the impact of the banking crisis on the economy and inflation is unknown. Further, Powell stated that the Fed is committed to restoring price stability and that it is approaching the end of the current tightening cycle, but that the fight against inflation has a long way to go and rate cuts are not expected this year. For its part, the Fed’s updated dot plot showed the median forecast amongst Fed officials for the year-end 2023 Fed Funds rate was unchanged at 5.1%, while the same measure for year-end 2024 increased slightly to 4.3% from 4.1% previously.

Federal Reserve’s Summary of Economic Projections – Dec vs. Mar Meeting

Source: Federal Reserve, GSR

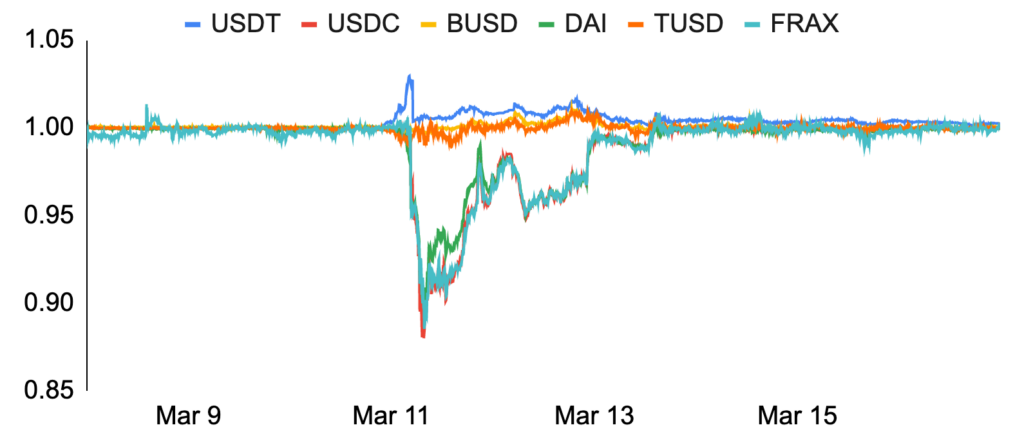

Stablecoins De-Peg

Another consequence of the banking crisis was the temporary de-pegging of USD Coin (USDC), a centralized USD-pegged stablecoin issued by CENTRE and the second largest stablecoin with $33b outstanding behind only Tether (USDT). USDC is 100% backed by cash and short-dated US treasuries and is redeemable 1:1 for US dollars. However, concerns started to mount after state regulators seized Silicon Valley Bank, as Circle’s most recent audit had revealed that $9b of USD reserves were held by six banks, including Silicon Valley. Circle quickly confirmed on March 10th that it had $3.3b of USDC cash reserves held at Silicon Valley, representing ~8% of USDC reserves. At the time, there was a question of whether depositors would be made whole on their uninsured deposits, and panic set in, causing USDC to trade as low as $0.878 on March 11th. Circle released a blog post later that day stating that it will cover in full any shortfall in reserves using corporate resources, which caused USDC to partially recover to $0.96, and USDC further recovered to $0.99 (and eventually to $1.00) on March 12th after the US government stated that all Silicon Valley Bank depositors will receive their deposits back in full.

USDC’s de-peg had implications across the stablecoin space. DAI, a stablecoin created by MakerDAO soft-pegged to the US dollar and backed by crypto assets locked in a vault, traded as low as $0.881 as over half of DAI collateral is composed of USDC. Maker’s Risk Core Unit Team quickly proposed and later passed an emergency proposal to reduce risk associated with USDC, such as steering peg stability module (PSM) activity towards the Pax Dollar (USDP) and away from USDC as well as closing vaults that accept LP tokens on USDC pools as collateral. FRAX and USDD similarly depegged amidst market jitters, while Curve, the dominant decentralized exchange for stablecoin swaps, saw its 3pool liquidity pool become imbalanced with USDT falling to below 7%. Additionally, stablecoin market share changed materially throughout the month, with significant redemptions at Circle causing USDC’s market share to fall from 32% at the beginning of the month to 25% by month end. Tether (USDT) was the main beneficiary, with its market share increasing from 54% to 62%, while LUSD and TUSD also benefited from the turmoil.

Mid-March Stablecoin Prices

Source: Santiment, GSR

More US Regulatory Action

After charging Kraken and issuing a Wells Notice to Paxos for offering unregistered securities in February, US regulators continued to be particularly active in March. The SEC was up first, issuing a Wells Notice to Coinbase, stating that it made a preliminary determination to recommend that the SEC file an enforcement action against Coinbase for violating federal securities laws tied to the crypto exchange’s spot market, Earn, Prime, and Wallet products, with Coinbase suggesting concerns center around its token listing process and staking services. Coinbase responded by stating that it has advocated for but not received reasonable digital asset rules and guidelines, that it worked with the SEC but was not given a path to registration, that the company and its business practices haven’t changed since the SEC reviewed them in depth and permitted Coinbase to go public in 2021, and that it is confident in the legality of its assets and services and welcomes the opportunity to get before a court to defend the rule of law.

Elsewhere, the CFTC sued Binance, its founder Changpeng Zhao (CZ), and its former compliance officer for alleged violations of the Commodity Exchange Act and CFTC regulations. The complaint alledges that Binance offered and executed commodity derivatives transactions on behalf of US persons knowingly in violation of the law, failed to register with the CFTC, operated a “sham” compliance program where employees and customers were directed to circumvent controls, and engaged in a calculated strategy of regulatory arbitrage, among other accusations. CZ called the complaint “unexpected and disappointing”, stated that it appeared to contain an incomplete recitation of facts, and disagreed with the characterization of many of the alleged issues. CZ further stated that Binance.com implements a stringent, mandatory KYC program and blocks US users by nationality and IP, employs over 750 people on its compliance teams, has 16 licenses/registrations, and does not trade for profit or manipulate markets under any circumstance.

In other US regulatory news, the SEC charged Tron-founder Justin Sun with fraud, and accused eight celebrities of illegally promoting cryptocurrencies; DeFi protocol Sushi and its leader were allegedly subpoenaed by the SEC; the NY Attorney General sued KuCoin for allegedly selling securities and commodities without registration and further claimed that ETH is a security; the trial between Grayscale and the SEC regarding GBTC’s conversion to an ETF started; and, the US Justice Department filed criminal charges against Terraform Labs founder Do Kwon.

The CFTC’s Complaint Against Binance, CZ, and Samuel Lim

Source: CFTC, GSR

GSR in the News

- Wall Street Journal – Banks Step Up to Serve Crypto Firms After Signature, Silvergate Blowups – WSJ

- CoinDesk TV – Bitcoin Erases Some Gains After Touching Intraday High of $28.8K | Video | CoinDesk

- Bloomberg BNN – Bitcoin Gains as Crypto Unbowed by Latest Regulatory Crackdown

- CoinDesk – First Mover Asia: Bitcoin Regains Momentum as Investors Shrug Off Banking, Fed Concerns

- Bloomberg – Surging Demand for Derivatives Is Fueling Bitcoin’s Resurgence

- CoinDesk – Fed Preview: Powell Likely to Raise Rates by 25 Basis Points Against Crypto Market’s Hope for Status Quo

- Bloomberg – Bitcoin Jumps the Most in Almost a Month After US Supports Banking Sector

- Bloomberg – Crypto Exhales as USDC Stablecoin Rebounds Toward Peg After Being Roiled by SVB Exposure

Authors:

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Disclaimers

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.