Bitcoin and Ethereum

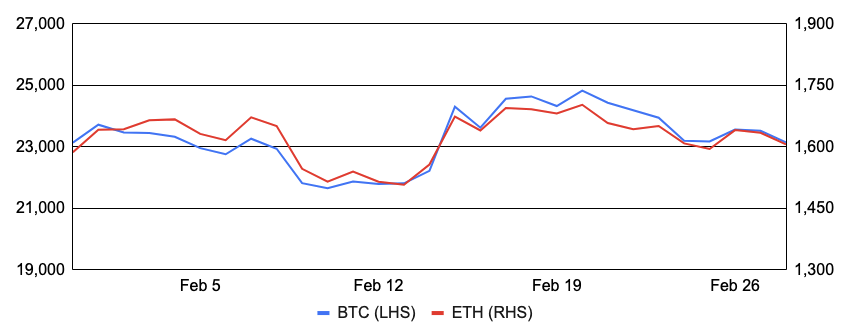

Despite significant price movements throughout the month, bitcoin ended February almost precisely where it began at ~$23,150, eking out a minuscule 0.03% gain. Risk assets started the month positively as the Fed hiked interest rates by a decreased 25 bp amount on February 1. While the hike was widely expected, markets surged as the accompanying commentary was interpreted as relatively dovish. A sharp selloff on Feb 9 quickly overshadowed earlier gains as the market grappled with an increasingly hostile regulatory backdrop for crypto in the U.S., discussed more below. Gains were recovered shortly thereafter on February 15 as reports of a warming regulatory environment in Hong Kong and China temporarily restored the bullish narrative. Additional reports that Mt. Gox’s two largest creditors elected to receive their recovery distributions in-kind also helped to calm fears that mass sell pressure would arise from the distributions. In addition, there was renewed excitement for building on Bitcoin, likely stemming from the success of Ordinals, and projects like Stacks, which aim to extend smart contract functionality to Bitcoin, more than tripled during the month. Elsewhere, the peer-to-peer Bitcoin exchange LocalBitcoins shut down after operating for more than a decade, and El Salvador announced plans to open a Bitcoin embassy in the U.S.

Ethereum’s performance was similarly muted in February, gaining just ~1% as it failed to generate meaningful dispersion from bitcoin during the month. Despite the lackluster price appreciation, onchain activity continued to accelerate, and the total ETH supply decreased by nearly 35,000, more than tripling the previous monthly record set in January. Beyond market dynamics, it was a busy month for testing staked ETH withdrawals as developers rolled out the Shapella1 upgrade on the Zhejiang and Sepolia testnets. Developers will implement Shapella on Goerli on March 14th as their final test before an expected deployment on mainnet in the first half of April. It was also a notable month for Ethereum layer 2 (L2) development as Coinbase announced the launch of its new L2 rollup, and many other L2 incumbents detailed new roadmaps and/or updated launch timelines, detailed more thoroughly below. There was additionally a suite of prominent announcements from Ethereum middleware providers during the month. EigenLayer unveiled its whitepaper proposing restaking on Ethereum that will allow non-protocol-native services (e.g., oracles, bridges, etc.) to leverage Ethereum’s economic security via a network of re-stakers opting in to validate these additional services and their corresponding slashing conditions. Obol Labs announced that it has successfully run a distributed validator on Ethereum mainnet for two months. Flashbots announced MEV-Share, an early step in the SUAVE roadmap that allows Ethereum transactors to privately bargain with searchers for the MEV they create. Elsewhere in Ethereum news, the percentage of OFAC-compliant blocks continued to dwindle from its Q4 peak and reached a five-month low. And developers announced that a new testnet called Holli will replace Goerli later this year, addressing the challenges associated with the Goerli ETH shortage that have caused the purportedly value-less testnet ETH token to trade above zero.

BTC and ETH

Source: Santiment, GSR

The U.S. Clamps Down on Crypto

U.S. regulators were particularly active during the month, with perhaps the biggest development being SEC Chair Gary Gensler’s statement in a New York Magazine interview that all cryptocurrencies aside from bitcoin are securities and fall under the SEC’s remit. Gensler supported his assertion by stating that “tokens are securities because there’s a group in the middle and the public is anticipating profits based on that group.” Industry lawyers have pushed back saying Gensler’s claims are merely his opinion and the issue of whether certain tokens are securities must be adjudicated in court.

Elsewhere, the SEC charged crypto exchange Kraken with offering unregistered securities via its staking-as-a-service offering. The SEC alleged that investors would transfer crypto assets to Kraken in exchange for advertised annual investment returns of as much as 21% that “derive from Kraken’s efforts on behalf of investors, including… strategies to obtain regular investment returns and payouts.” To settle the charges, Kraken immediately ceased its U.S. staking-as-a-service program and paid a $30m fine.

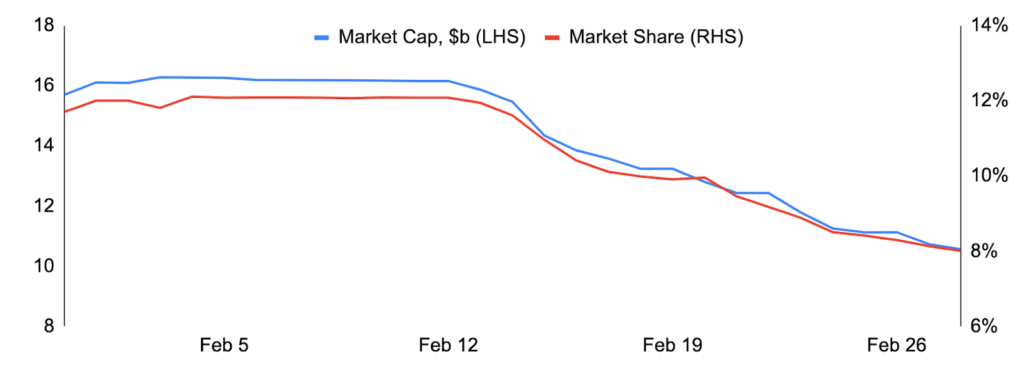

The SEC continued its busy month by issuing a Wells Notice to blockchain infrastructure platform Paxos, notifying the firm of an impending lawsuit alleging the branded USD-pegged stablecoin Binance USD (BUSD) it issues is an unregistered security. Shortly after, the New York Department of Financial Services (NYDFS) directed Paxos to cease issuance of BUSD for not administering BUSD in a safe and sound manner, and Paxos additionally announced that it will end its relationship with Binance for BUSD. While all BUSD will continue to be fully backed by U.S. dollar-denominated reserves and redeemable through at least February 2024, its market cap will only decline going forward. Binance responded by stating that BUSD is wholly owned and managed by Paxos and that the exchange will continue to support BUSD for the foreseeable future but sees users migrating to other stablecoins over time. BUSD had the seventh largest market cap at $16b when news broke of the SEC’s Wells Notice on Feb 12, but fell to the 11th largest by the end of the month with its market cap falling below $11b.

While not all occurring during the month, the notion of U.S. regulators and other parties trying to restrict crypto industry access to the banking system continued to gain steam in what some are calling Operation Choke Point 2.0. The main pushback appears to have come from the three U.S. federal banking regulators – the Federal Reserve, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency – which issued a joint statement in early January highlighting a number of key risks associated with crypto-assets and crypto-asset sector participants that banking organizations should be aware of. Other notable participants have chimed in, including the National Economic Council, the Department of Justice, and various congressional leaders, which saw Signature Bank announce a planned reduction in its digital assets business, Metropolitan Commercial Bank shutting down its crypto business, Custodia Bank having its application to the Fed denied, and Silvergate shuttering its Silvergate Exchange Network on Friday after continued deposit withdrawals. Bank regulators were quick to pushback on the notion of Chokepoint 2.0 in a more recent joint statement on liquidity risks from crypto-asset market vulnerabilities, stating “banking organizations are neither prohibited nor discouraged from providing banking services to customers of any specific class or type, as permitted by law or regulation.” However, it does appear that regulators and other government agencies are quite focused on risk inherent in banking crypto companies at the very least.

Elsewhere, other notable U.S. regulatory developments during the month include: Coinbase revealed it has outstanding subpoenas from the SEC; Robinhood disclosed its receipt of an SEC subpoena in December related to its custody and listing of crypto assets; the SEC proposed amending federal custody rules by requiring custodial crypto assets to be held by a ‘qualified custodian’; the SEC sued Do Kwon and Terraform Labs for fraud; the SEC, NYDFS, and NY AG objected to Binance.US’s amended plan to acquire Voyager; the FTC launched an investigation into Voyager’s allegedly deceptive marketing tactics; and, Binance revealed its expecting to settle monetary fines with U.S. regulators for past misconduct.

BUSD Market Cap & Market Share

Source: Santiment, CoinGecko, GSR.

Base Joins the Superchain

Layer 2 scaling providers had a busy month, with nearly all of the top incumbents announcing key updates. Still, none were more prominent than Coinbase announcing a new EVM-equivalent Optimistic Rollup called Base, its most substantial onchain endeavor to date. A live testnet is already running, and the mainnet is expected to arrive in the coming months.

Base is envisioned as an open ecosystem that combines the low fees and strong security properties of rollups, but with the added benefit of integrations with Coinbase’s existing onchain products like Coinbase Wallet and cbETH, and more importantly, access to its 110m verified users holding $80b in platform assets. With Base, Coinbase aims to offer a safe, inexpensive, and user-friendly way for its offchain users to enter the onchain crypto economy without sacrificing on decentralization in the long run. While Base will introduce new trust and security assumptions beyond those of Ethereum initially, similar to other rollups today, it has announced a path for progressive decentralization with a corresponding timeline to remove its training wheels2. This commitment to decentralization is evident in many design choices released so far. For example, Coinbase opts for a rollup over an alternative L1 and uses ETH as its native gas token.

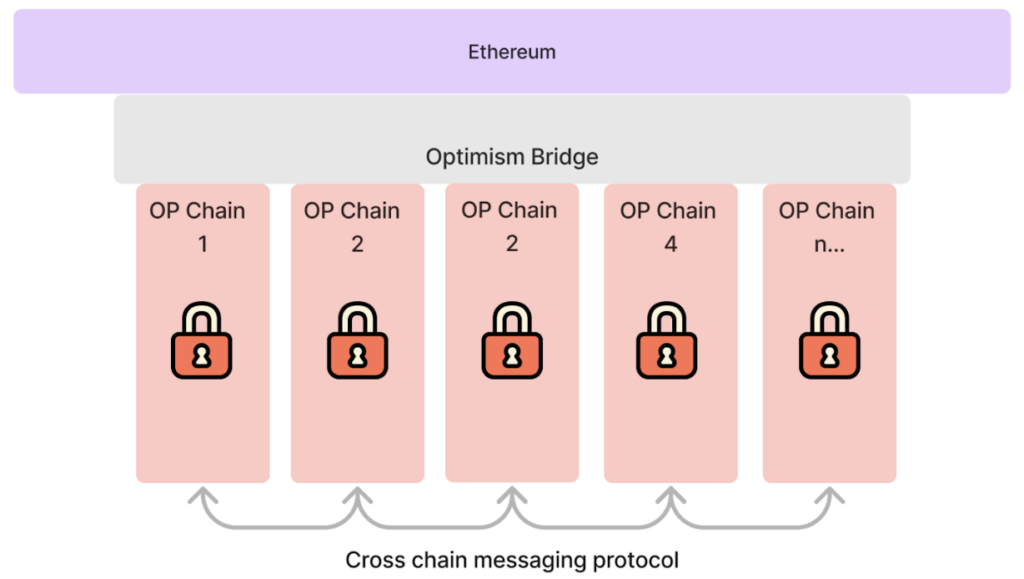

Perhaps even more indicative of Coinbase’s intent was its decision to build Base leveraging the OP Stack, an open-source development toolkit that powers Optimisms’ mainnet and can be used to permissionlessly deploy new rollups. In fact, alongside Coinbase’s announcement of Base, Optimism unveiled its grand vision for the Superchain, a proposed network of L2 chains that share key infrastructure (e.g., bridging, sequencing, messaging, governance, etc.) and are built on the OP Stack. While security challenges have historically hindered many cross-chain designs largely due to each chain’s independent security model, the Superchain’s multi-rollup vision mitigates this shortcoming by relying on the security of Ethereum as the shared settlement layer. Additionally, since each rollup leverages a shared sequencer set for block production, it achieves atomic cross-rollup composability, somewhat abstracting away the individual chains to appear as a singular network. In short, the Superchain thesis aims to scale Ethereum via a network of composable L2 rollups that share core infrastructure and are built on a shared standard. Coinbase has seemingly bought into this vision as well. While it could have adversarially forked Optimism and approached its rollup launch alone, it has prioritized open-source collaboration, committing developer resources to join Optimism as the second core developer on the OP Stack. Base will additionally employ an onchain mechanism to allocate a portion of its transaction fee revenue back to the Optimism Collective, furthering the expansion of retroactive public goods funding.

In other L2 news, daily transactions on Arbitrum surpassed Ethereum mainnet for the first time. Polygon set a beta launch date of March 27th for its zkEVM mainnet. zkSync open-sourced its recently rebranded zkSync 2.0 code, now known as zkSync Era, and it also announced that pre-registered developers could deploy apps on zkSync Era before a full launch in the months ahead. Scroll launched its zkEVM on the Goerli testnet. ConsenSys announced it would open its zkEVM to a public testnet on March 28th. StarkWare announced plans to open source its proprietary Starknet Prover. Optimism announced its second airdrop, and the vote for its highly anticipated Bedrock upgrade, which aims to reduce fees by nearly 50%, reduce deposit times, and improve proof modularity to enable a choice between fault and validity proof schemes, was delayed likely until late March.

The Superchain Illustrated

Source: Optimism.io, GSR

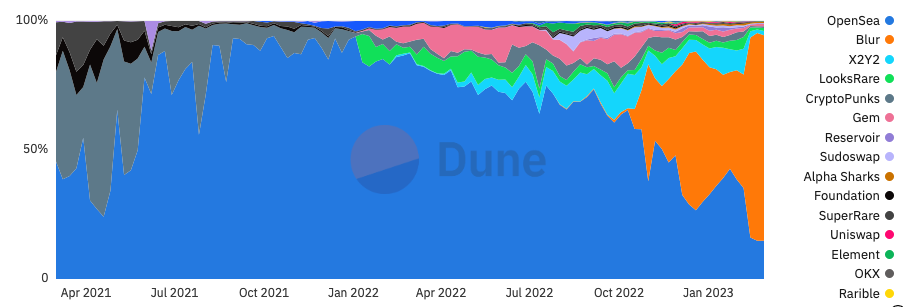

OpenSea’s Blurred Outlook

The biggest NFT-related news of the month was the $BLUR airdrop and its large increase in NFT trading volumes. Blur is a leading NFT marketplace/aggregator launched in October 2022 offering zero marketplace fees, optional royalty payments, and the fastest sweeps and swipes of any NFT platform. In addition, the Blur airdrop rewards Blur users for loyalty and liquidity rather than volume which results in wash trading. Given an exceptional user experience and the airdrop, Blur has seen large uptake particularly from professional traders, and it now boasts a commanding NFT trading market share, though OpenSea still boasts the largest number of unique users.

One particularly interesting component of Blur’s rise has been competitive dynamics with other marketplaces, most notably with OpenSea. OpenSea had been the dominant NFT marketplace from 2019 through 2022, and historically charged a 2.5% marketplace fee and full creator royalties, the latter of which are fees earned by a project’s creator when an NFT changes hands and are not enforceable by the project itself. However, a debate around creator royalties emerged after royalty-free NFT AMM Sudoswap gained market share after its July 2022 launch, prompting other marketplaces like X2Y2 to eliminate royalties or make them optional and for Blur to launch in October with optional royalties. Due to the launch of new competitors offering reduced fees/royalties and token rewards, OpenSea’s market share fell from 95% to 50%, and it responded by introducing a new Operator Filter Registry tool in November that enforces full royalties for new collections if the collection blocks all marketplaces that don’t enforce full royalties (including Blur). OpenSea opted for this solution as it believes onchain royalty enforcement is best, and the move was both applauded for its support of creators and criticized for its negative impact on decentralization. Blur then added its own filter registry, began imposing a 0.5% minimum royalty, and in early February implemented a loophole in OpenSea’s Operator Filter Registry tool by integrating OpenSea’s decentralized open sourced Seaport protocol, effectively allowing it to bypass OpenSea’s royalty enforcement mechanism. The $BLUR airdrop went live on February 14th when its “care packages” became claimable, catalyzing a large spike in trading volume on the exchange. One day later, Blur released guidelines for creators promising to enforce full royalties on collections that blocked OpenSea that when combined with the $BLUR airdrop, made doing so the optimal option for many creators and further catalyzed volumes. Two days later, OpenSea for the first time in its history cut its marketplace fee to 0% for a limited time and made royalties optional with a 0.5% minimum. It remains to be seen whether Blur can sustain its momentum, though Season 2 of the $BLUR airdrop is ongoing and it believes NFT market inefficiencies and the professional liquidity providers it has garnered will allow it to maintain its newfound dominance long after its airdrops stop.

In other NFT news, ordinal activity continues to grow, recently crossing the 300,000 inscription mark. In addition, Bored Ape Yacht Club creator Yuga Labs announced its own Bitcoin-based digital artifact collection called TwelveFold, mining pool operator Luxor bought bitcoin NFT marketplace OrdinalHub, and the Litecoin network adopted ordinal inscriptions after forking the Ordinals protocol. Outside of Ordinals, Cosmos announced an incentivized testnet for interchain NFTs, and a U.S. judge denied Dapper Labs’ request to dismiss a lawsuit alleging that NBA Top Shot moments are unregistered securities.

Weekly NFT Volume by Marketplace

Source: Hildobby’s NFT Market Overview, GSR

Exploiting the Exploiter

One year after exploiting the cross-chain bridging protocol Wormhole for 120k wETH, the still-unknown attacker has become the exploited, losing an ETH-equivalent value of ~137.6k ETH across two common liquid staking derivatives (LSDs), ~120.7k wstETH and ~3.2k rETH. Onchain evidence indicates market maker Jump likely facilitated the counter exploit, with two Jump-tagged wallets involved, including one that funded the $80m of DAI required to execute the counter exploit. As a reminder, Jump assumed the loss from last year’s Wormhole exploit, filling the 120k ETH void to backstop the protocol after the attack. In what follows, we outline what took place and the questions it raises for the broader DeFi ecosystem.

The Wormhole Exploiter used the Oasis protocol, a front-end user interface for Maker DAO (also Aave) that spun out of the Maker Foundation, to generate leverage by opening wstETH and rETH vaults, enabling DAI to be minted against their ETH LSD collateral. However, Oasis’s interface additionally offers automation services unrelated to Maker that the exploiter fatefully opted-in to. These automation services allow the user to define rules to automatically manage the collateralization ratio in their Oasis vaults, but this necessarily requires giving an automation contract access to the vault so it can help avoid liquidations or help generate more leverage against a growing collateral value, for example. Unfortunately for the Wormhole exploiter, Oasis’s automation contract was an upgradable contract, and a signature from the Oasis team’s multisig could change its logic. After this information became known by a party interested in retrieving the stolen funds, Oasis confirmed that it had “received an order from the High Court of England and Wales to take all necessary steps that would result in the retrieval of certain assets involved with the wallet address associated with the Wormhole Exploit.” Oasis further noted the counter exploit “was carried out in accordance with the requirements of the court order, as required by law, using the Oasis Multisig and a court authorised third party,” and “the assets were immediately passed onto a wallet controlled by the authorised third party, as required by the court order.” For those interested in a deeper dive into the facilitation of the counter exploit itself, we’d highly recommend Blockworks’s report.

While many applauded the ability of a victim to recover stolen assets, others criticized that the mechanism in which it was achieved poses threats to crypto’s core tenets of decentralization and immutability. Interacting with upgradable contracts inherently requires trust that the code will not be maliciously changed to the user’s detriment. And as some jurisdictions increase their hostility towards crypto, it’s not hard to imagine a hostile jurisdiction using a similar approach to seize assets that did not have a similarly nefarious origin. As the Maker DAO founder articulates in the following exhibit, this is an omnipresent risk for contracts with centralized upgradability.

The Founder of MakerDAO on the Centralization Inherent in Upgradable Contracts

Source: Twitter, GSR.

Footnotes:

- Shanghai is being more commonly referred to as Shapella now. Ethereum upgrades as most commonly think of them (i.e., The Merge, Withdrawals, etc.) actually consist of two distinct upgrades, one on the execution layer and one on the consensus layer. Shanghai is the name of the execution layer upgrade, while Capella is the name of the consensus layer upgrade. Ethereum developers have begun referring to the holistic upgrade of ‘Withdrawals’ more regularly now as Shapella (Shanghai + Capella) instead of just Shanghai. We previously covered this dual upgrade concept in the first paragraph of ‘The Merge Implementation Process’ section here.

- Leveraging Vitalik’s proposed framework for evaluating the stages of rollup decentralization, Base intends to be a Stage 0 rollup at launch, reaching Stage 1 later in 2023 and Stage 2 in 2024.

GSR in the News

- Business Wire – GSR Launches Foundation with $10m Pledge Celebrating 10 years of Business

- The Block – GSR pledges $10 million to its philanthropic social impact foundation

- UK Fundraising – GSR launches foundation with $10mn pledge

- Bloomberg – Bitcoin (BTC) Traders Eye $30,000 Even as Momentum Wanes – Bloomberg

- Bloomberg – DeFi Champions Pivot From Crypto Intangibles Toward Treasuries, Hard Assets

- Yahoo! Finance – Crypto market cap falls below $1 trillion after BUSD halt, ahead of inflation data

- BSC News – Believe: A Crypto Thesis by GSR

- TechCrunch – Binance-backed web3 gaming startup Unagi gets funding to expand fantasy sports platform

Authors:

Matt Kunke, Junior Strategist | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

View February 2023 Market Update

Disclaimers

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.