MACRO + CRYPTO SUMMARY

Most markets are relatively unchanged compared to where they were two weeks ago, with the exception perhaps being precious metals tracking a bit higher. Despite this, it was a journey to get here. First, we went through roughly a week and a half of Fed pivot hopes, with all the accompanying correlated moves: rates lower, stocks and crypto higher, dollar subdued, and so on. This positive sentiment, however, peaked a couple days before the U.S. employment report last Friday, and once the relatively solid payroll number and the unexpected tumble in the unemployment rate came out, the reversal started to pick up pace. This past weekend saw an escalation in war in Ukraine with the Crimea bridge explosion, as well as a cut in oil output by OPEC, both of which likely further pressure energy and inflation. Hopes for a Fed pivot are now essentially gone, and near-term, market participants will likely focus on the FOMC minutes on Wednesday and the U.S. CPI print on Thursday.

RATES, FUNDING & BASIS

Rates in the fiat world continue to be on an upwards trajectory, as central banks try to keep pace with inflationary pressures. In the crypto space, however, we haven’t seen any significant moves in rates in the bilateral lending markets.

In the perps market, BTC and ETH funding rates continue to hover in the -5% to -10% territory, highlighting the general trending market. Altcoin funding rates have been relatively range bound in the -20% to -10% range. There tends to be systematic downward pressure on altcoin perps, driven by the general selling of forwards in the market (via covered calls) as well as selling pressure ahead of token unlocks, which may argue for rates to stay in this range in the current market conditions.

7-Day Rolling Average on Perp Funding Rates

Source: FTX, GSR

DERIVATIVES

BTC Derivatives

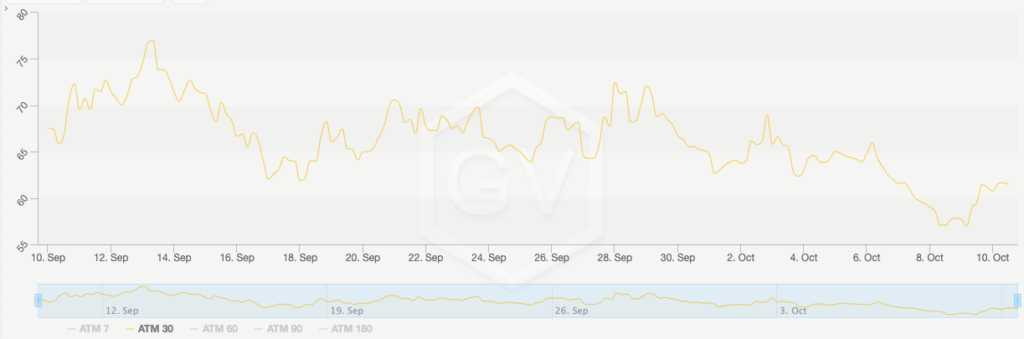

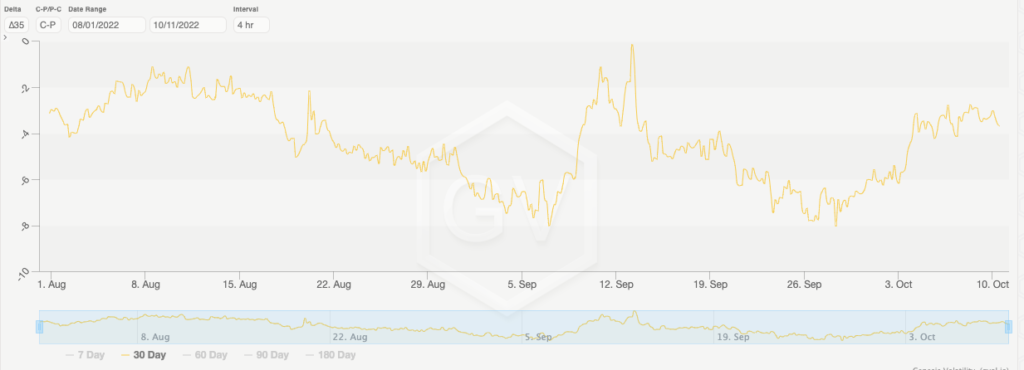

30 day implied volatility is at a one-month low at 62%, which is still a significant premium to realized volatility, where 10 day realized vol is at 34%. Vol term structure has softened significantly and more noticeably, which is to be expected on the shorter-dated options. 35 Delta Risk Reversal is trading in the middle of its ~two-month range, with calls 4% under puts (the chart below is priced in terms of the call).

BTC 30 Day ATM Implied Volatility

Source: Genesis Volatility, GSR

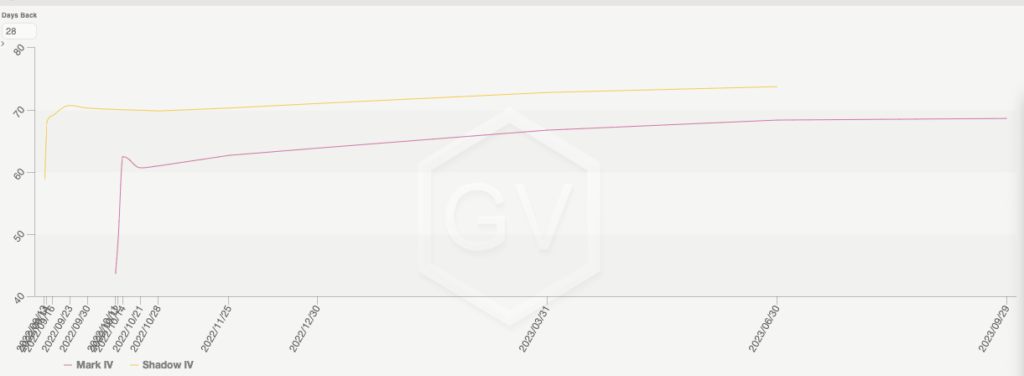

BTC Term Structure vs. 28 Days Prior

Source: Genesis Volatility, GSR

BTC 30 Day 35 Delta Call Skew

Source: Genesis Volatility, GSR

ETH Derivatives

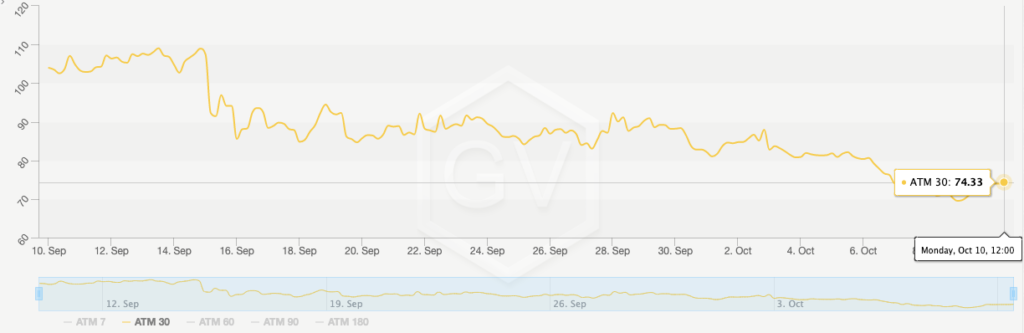

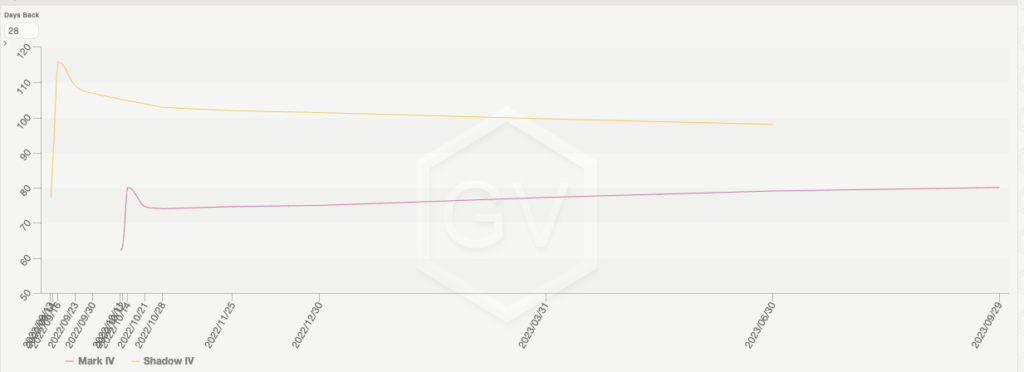

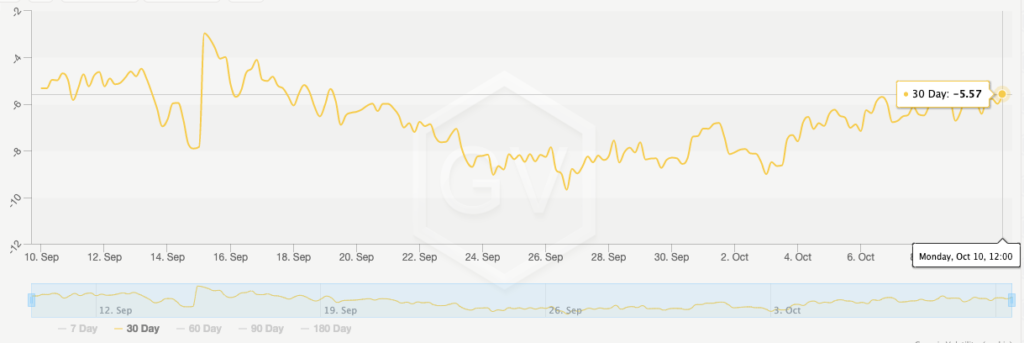

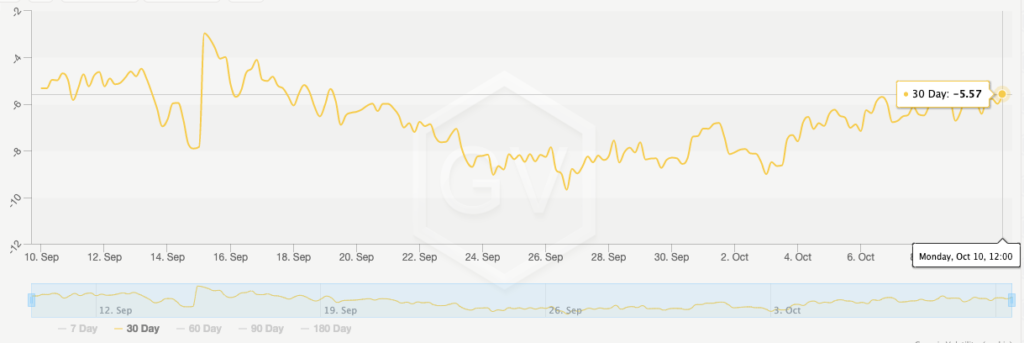

Implied vol continues to trend lower after The Merge, now at 74% compared to the recent high of 110%. Realized volatility is currently 36% and is nearly the same as BTC, despite the fact that ETH realized vol is typically 20% higher than that of BTC. Call skew is relatively fair at 5.5% under puts.

ETH 30 Day ATM Implied Volatility

Source: Genesis Volatility, GSR

ETH Term Structure vs. 28 Days Prior

Source: Genesis Volatility, GSR

ETH 30 Day 35 Delta Call Skew

Source: Genesis Volatility, GSR

FLOWS AND LIQUIDATIONS

Liquidations over the past two weeks have been relatively muted compared to August and September, with the largest amount of long liquidations occurring on October 1st and 6th with $59m and $63m of longs liquidated, respectively. Short liquidations have been relatively calm over the past two weeks without much action on that end.

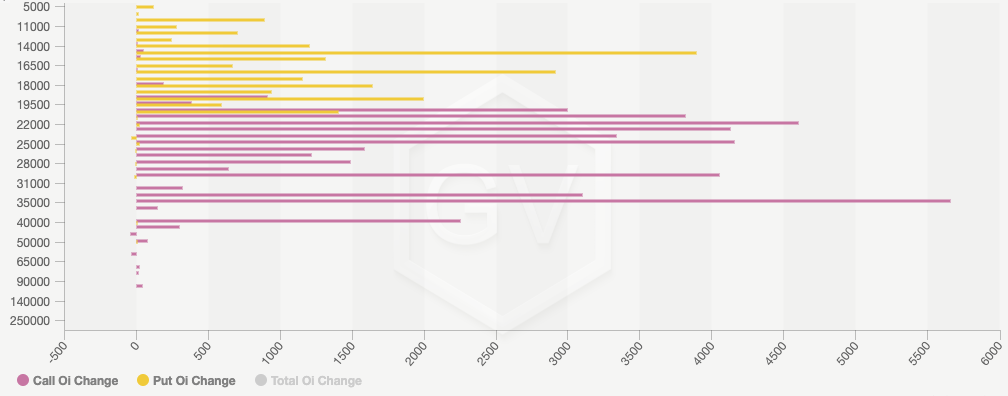

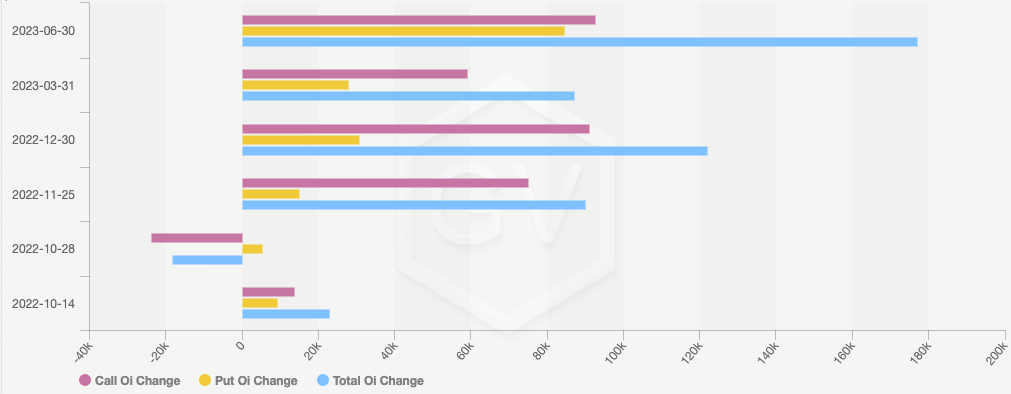

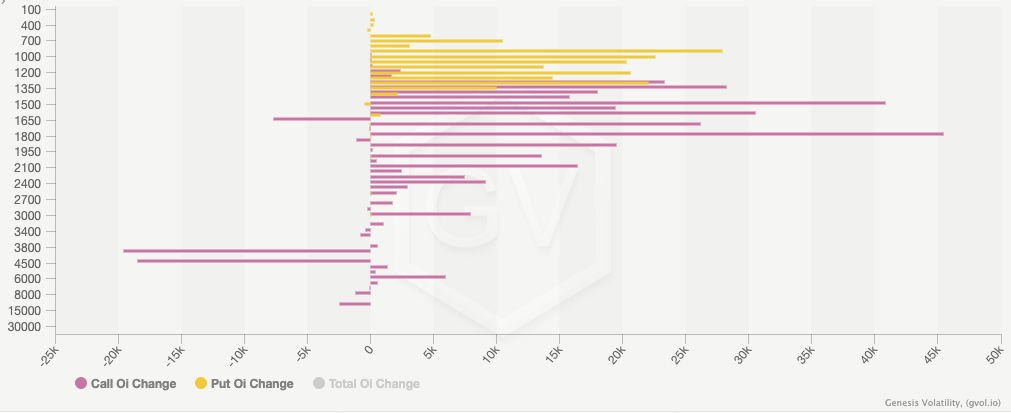

Bitcoin option flows by expiration over the past two weeks have seen concentrated demand in the March 31st 2023 and November 25th 2022 tenors, both showing large demand for calls compared to puts, while June 30th 2023 is the only expiry showing greater demand for puts over calls. With regards to flows by strike, the most popular strike for calls has been the $35k strike, with the most popular put strike being the $15k strike.

Historical BTC OI Change by Expiration

Source: Genesis Volatility, GSR

Historical BTC OI Change by Strike

Source: Genesis Volatility, GSR

Ethereum option flows by expiration show a large amount of October 28th 2022 calls being closed out, with a large amount of option interest building up in the June 30th 2023 tenor. Demand for calls overshadows demand for puts across each tenor, with an interesting decrease in open interest in the October 28th expiry. With regards to flows by strike, a large number of $4k and $4.5k strike calls have closed, most likely attributed to those playing The Merge with the September 28 expiry. Call open interest is concentrated in the $1.5k and $1.8k strikes, with put open interest spread out across the $900-$1.3k region.

Historical ETH OI Change by Expiration

Source: Genesis Volatility, GSR

Historical ETH OI Change by Strike

Source: Genesis Volatility, GSR

ALTCOIN VOL

Altcoin vols have continued downwards with ETH and BTC vol selling off. Larger alts are realizing some of the lowest vols that we have seen this year, and newly launched tokens are realizing significantly lower vols than they have in the past two years.

DeFi

Daily trading volumes fell below $1b for the first time since January 2021, a sign that the market is feeling the pinch. Eyes are on the Aptos and Sui launches this year for some potential respite from the on-chain slump. Given the number of big-name projects already building on Aptos, and the tremendous amount of VC funding for the new chain, there will likely be many opportunities for DeFi traders looking for yield.

Elsewhere, the BNB Chain was exploited, allowing a hacker to claim BNB from the bridge between the Beacon chain and Binance Smart Chain. In total, the hacker withdrew 2m BNB, worth roughly $560m, and started sending the BNB to other chains where he or she borrowed against these BNB. Validators acted fast and halted the BSC chain within hours, allowing the hacker to only get away with $89m, with the rest of the BNB locked on the BSC chain and the hacker address blacklisted.

WHAT WE’RE WATCHING

BTC one-month implied vol is historically low at 62%, however, realized vol has been underperforming recently at 30%.

Authors:

Mike Pozarzycki – Macro & Crypto Summary

Ruchir Gupta – Rates, Funding and Basis

John Cole – Derivatives

Christopher Newhouse – Flows and Liquidations

Mitch Galer – Altcoin Vol

Calvin Weixuan Goh – DeFi

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.