MACRO + CRYPTO SUMMARY

There is growing perception that the unrealized losses in bank held-to-maturity securities portfolios (which sparked runs on Silicon Valley Bank and others) will stop the Federal Reserve from raising rates in the future to fight inflation. Since the second week of March, year-end Fed Funds rate expectations have come down 100 bps (at one point dropping as many as 200 bps). After a knee-jerk reaction lower on initial banking fears, BTC has rallied nearly 50% to $28,200 as the market implies that the banking crisis is due at least partly to the higher interest rates and the only way out is for the Fed to lower them. Bitcoin is many things to many people, sometimes demonstrating a strong correlation to more speculative assets like NASDAQ growth stocks and at other times acting more like a store of value similar to gold. It appears that this latter narrative has taken hold. If the Fed is forced to table its inflation-fighting mandate to prevent a wider systemic banking crisis, BTC seems like a pretty good place to park capital to maintain purchasing power.

RATES, FUNDING AND BASIS

The banking crisis and the overall macroeconomic situation over the past couple of weeks has led to a significant repricing in USD rates, with expectations for front-end rates implied by the futures markets down by more than a percentage point. Funding rates across venues have continued to be stable and biased slightly positive, in-line with the bullish sentiment that seems to be driving crypto markets at the moment. The bilateral lending market continues to be fairly muted, with a spectrum of lenders of different kinds looking to build back the market, but progress has been slow.

DERIVATIVES

BTC Derivatives

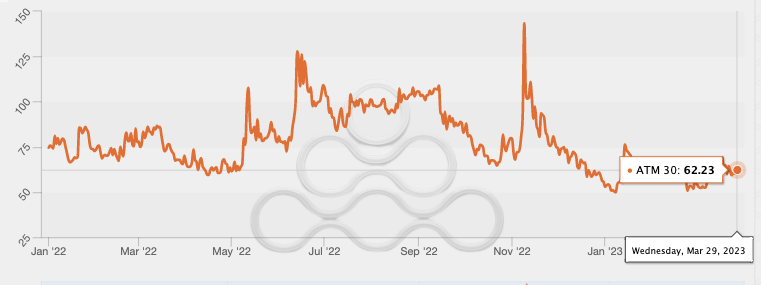

BTC 30 day implied volatility is back to long-term fair value around 60%, and is displaying a high positive correlation with price. As such, implied vol may pick up significantly if BTC breaks above $29,000. For comparison, 30-day implied vol was 55% on Tuesday when BTC was at $27,000. In addition, 30 day realized vol is currently 66%.

BTC ATM Implied Volatility (30 Day)

Source: Amberdata, GSR

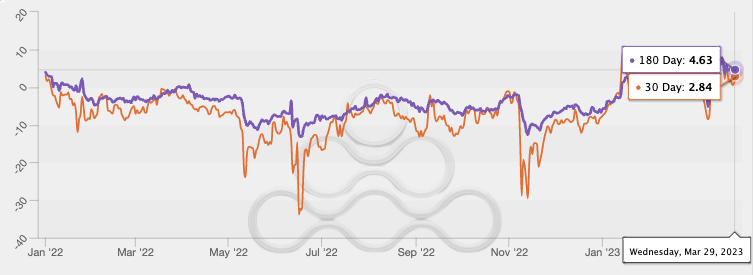

BTC 25d risk reversals (call over) continues to remain strong (having rallied from the earlier lows), while still retaining further upside given the previously mentioned positive spot-vol correlation in the context of the current market sentiment.

BTC 25 Delta Call Skew (30 Day & 180 Day)

Source: Amberdata, GSR

ETH Derivatives

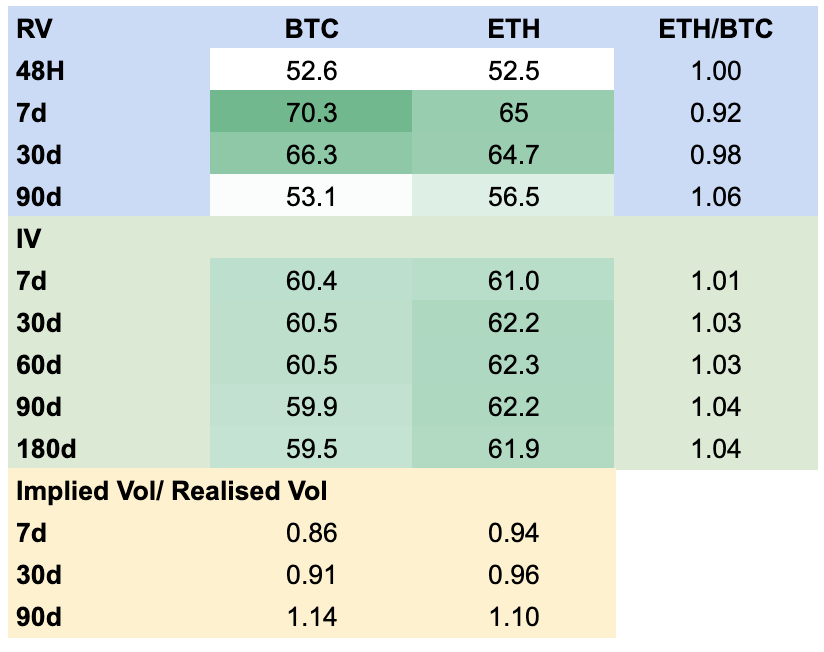

ETH 30 day implied volatility is currently 62%. This is just 3% above that for BTC, while the ETH / BTC implied volatility ratio has historically been around 25% over.

ETH ATM Implied Volatility (30 Day)

Source: Amberdata, GSR

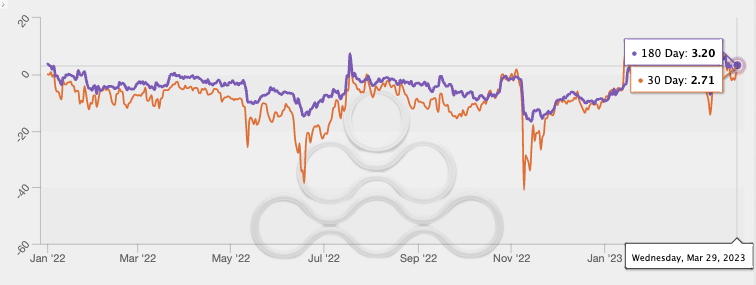

ETH risk reversal (call over) is also very firm, currently at a 15-month high.

ETH 25 Delta Call Skew (30 Day & 180 Day)

Source: Amberdata, GSR

BTC implied volatility is below realized volatility over shorter time periods, both absolutely and relative to that of ETH.

BTC and ETH Implied vs. Realized Vols

Source: Amberdata, TradingView, GSR

Altcoin Volatility

Over the past month, ETH realized volatility has rallied significantly, though this has not flowed to long-term ETH IV’s nor altcoin realized vols. This collapse in the ETH IV/ETH RV may potentially lead to slightly lower long-term vols for alts compared to a month ago. On the other hand, rallies more so than collapses have triggered extremely high vol periods lately. With the increase in spot vol correlation, call skew on alts, especially in the short-term, has risen significantly. This is similar to what occurred in the mid-2021 bull market; as soon as a token caught a bid, massive flows would generally overpower token holders cashing out at elevated prices. This is indicative of market sentiment turning a bit more positive.

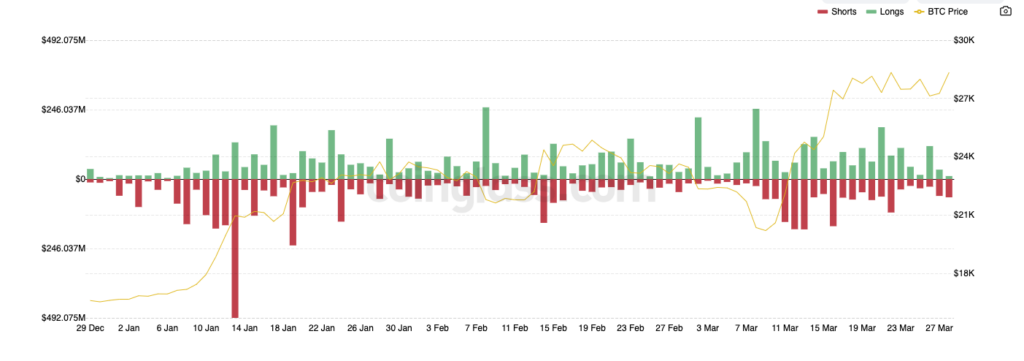

LIQUIDATIONS

Liquidations over the past few weeks have been elevated as price action has experienced increased volatility. Interestingly enough, liquidations haven’t been one-sided, as the indecisive, yet volatile price action has caused liquidations on both the short and long side of the spectrum. The most noticeable liquidations occurred after the USDC depegging event, with a large amount of longs liquidated on the move lower followed by late-to-enter shorts forced out of their positions on the subsequent rally. With recent consolidatory price action and a reversal of the downside move likely caused by the regulatory action taken against Binance, one can assume some shorts may be liquidated around the $30,000 price level, although it’s difficult to pinpoint liquidation points.

Total Liquidations

Source: Coinglass, GSR

Authors

Spencer Hallarn – Macro & Crypto Summary

Ruchir Gupta – Rates, Funding and Basis

John Cole – Derivatives

Mitch Galer – Altcoin Volatility

Christopher Newhouse – Liquidations

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.